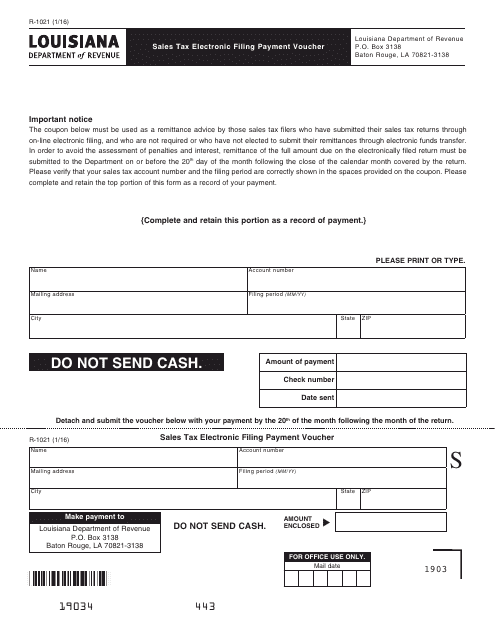

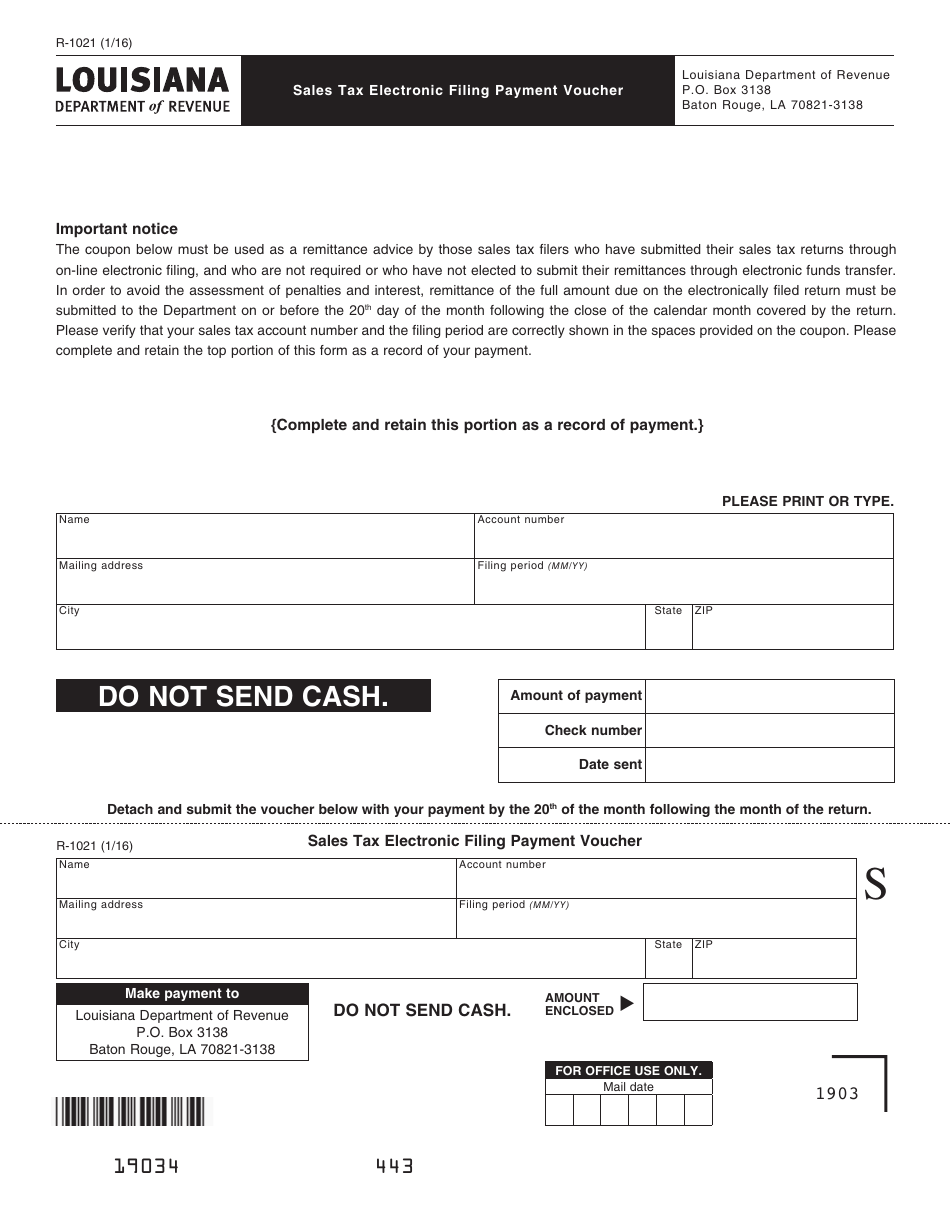

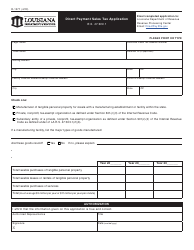

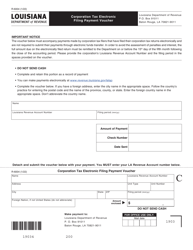

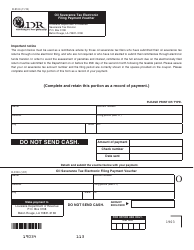

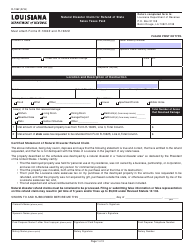

Form R-1021 Sales Tax Electronic Filing Payment Voucher - Louisiana

What Is Form R-1021?

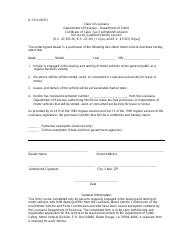

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1021?

A: Form R-1021 is the Sales Tax Electronic Filing Payment Voucher for the state of Louisiana.

Q: What is the purpose of Form R-1021?

A: The purpose of Form R-1021 is to make payments for sales tax electronically in Louisiana.

Q: How do I use Form R-1021?

A: You can use Form R-1021 to make electronic payments for sales tax in Louisiana.

Q: Do I need to file Form R-1021 if I don't owe any sales tax?

A: No, you do not need to file Form R-1021 if you do not owe any sales tax in Louisiana.

Q: What information do I need to include on Form R-1021?

A: You will need to provide your tax account number, the period covered by the payment, and the amount of the payment on Form R-1021.

Q: When is Form R-1021 due?

A: Form R-1021 is generally due on the 20th day of the month following the end of the tax period.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1021 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.