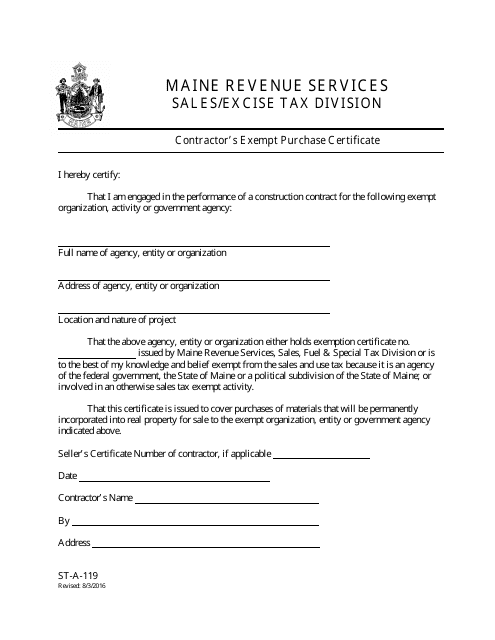

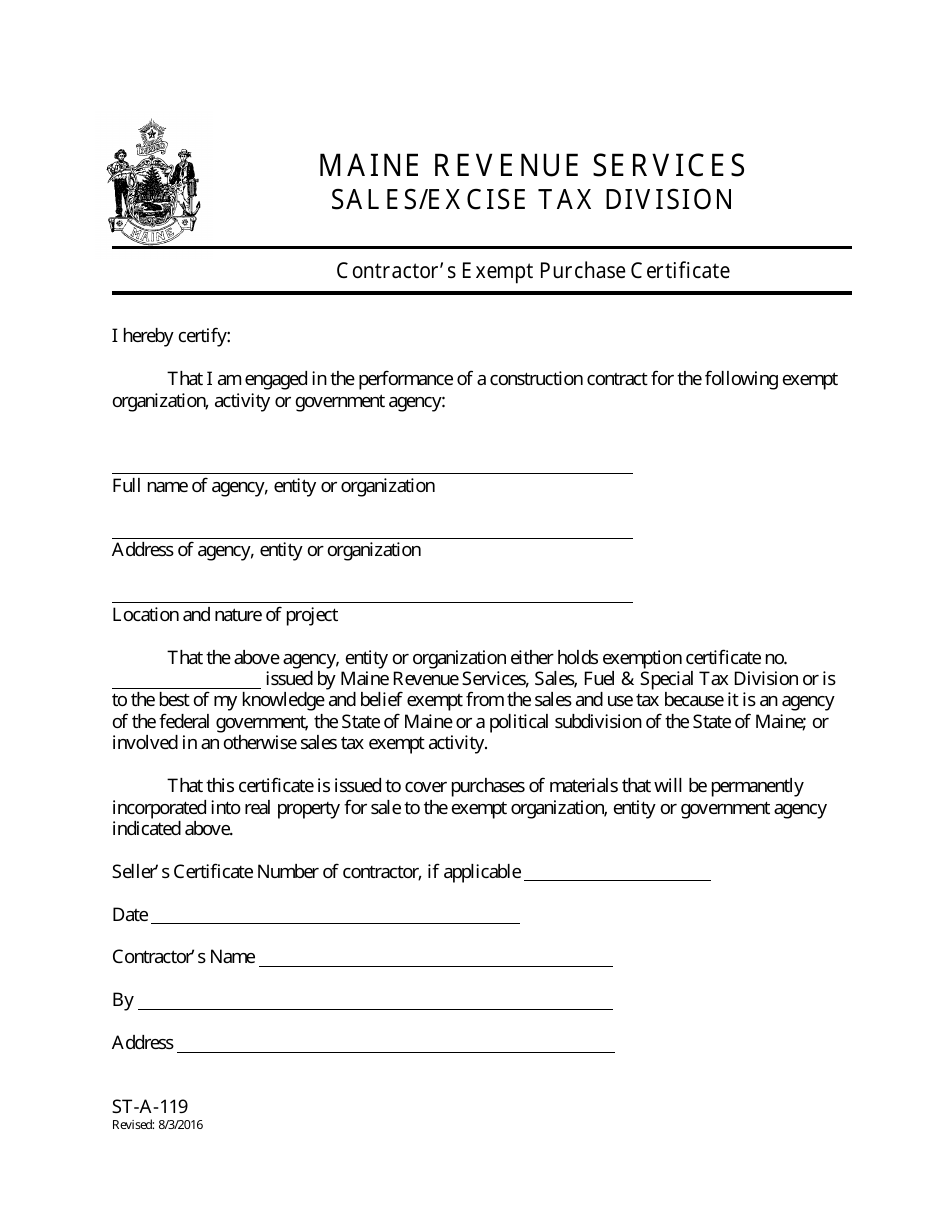

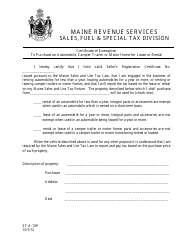

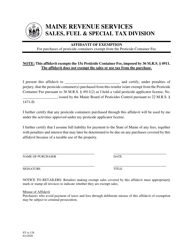

Form ST-A-119 Contractor's Exempt Purchase Certificate - Maine

What Is Form ST-A-119?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-A-119?

A: Form ST-A-119 is a Contractor's Exempt Purchase Certificate.

Q: Who uses Form ST-A-119?

A: Contractors in Maine use Form ST-A-119.

Q: What is the purpose of Form ST-A-119?

A: The purpose of Form ST-A-119 is to claim exemption from sales tax on purchases made by contractors for use in certain construction projects.

Q: Do I need to fill out Form ST-A-119 for every purchase?

A: Yes, you need to fill out Form ST-A-119 for each purchase that qualifies for exemption.

Q: What information do I need to provide on Form ST-A-119?

A: You need to provide your name, address, contractor registration number, description of the project, and details of the purchase.

Q: How long does it take to process Form ST-A-119?

A: It may take up to 30 days to process Form ST-A-119.

Q: Can I use Form ST-A-119 for all types of construction projects?

A: No, Form ST-A-119 is only for certain construction projects as specified by the Maine Revenue Services.

Form Details:

- Released on August 3, 2016;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-A-119 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.