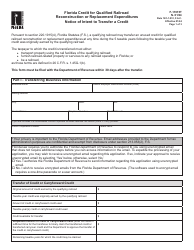

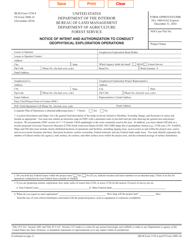

This version of the form is not currently in use and is provided for reference only. Download this version of

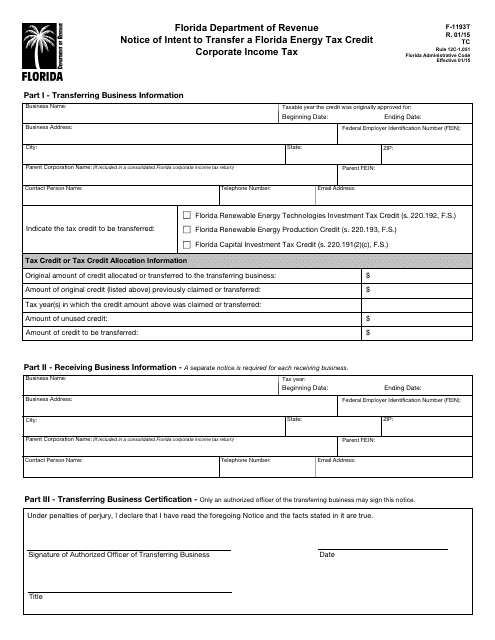

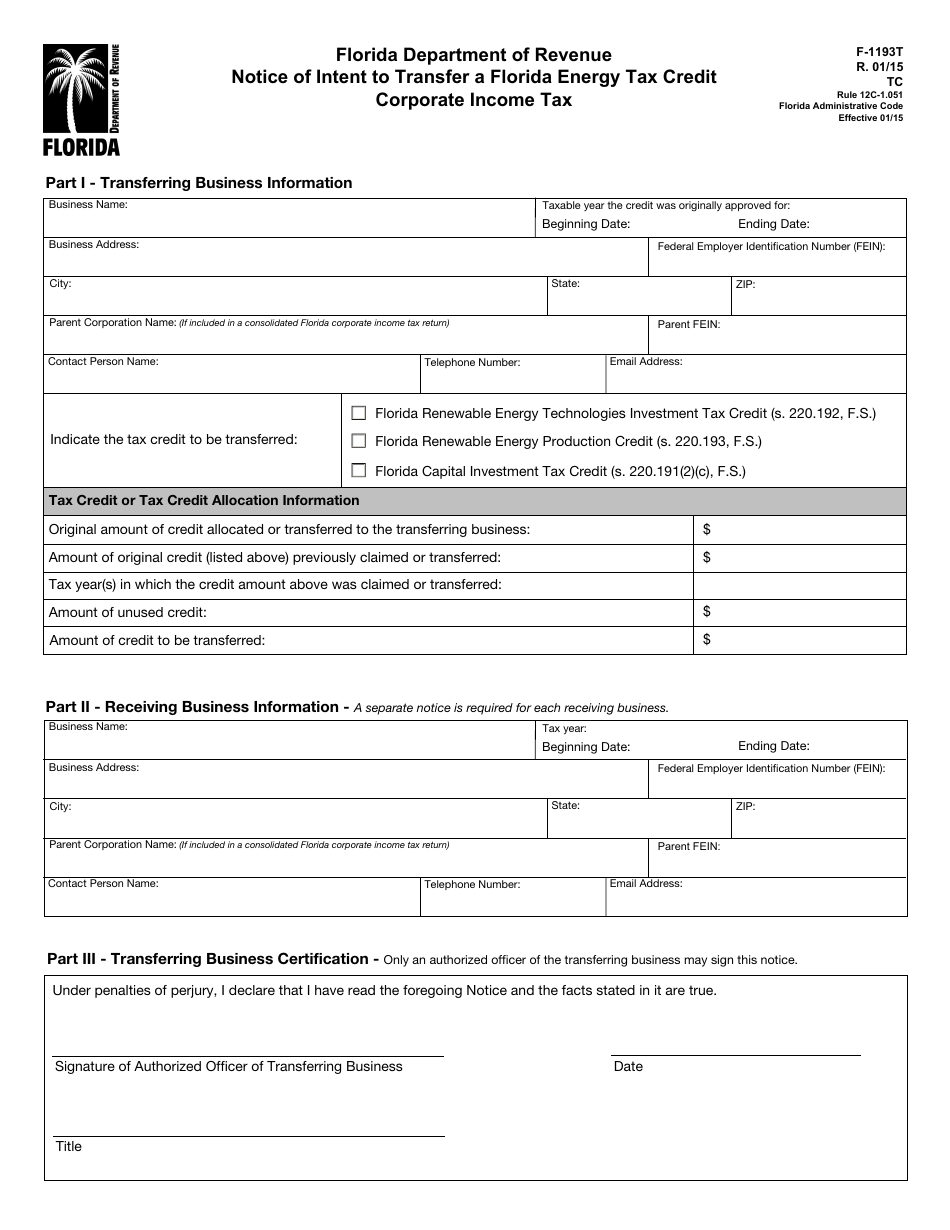

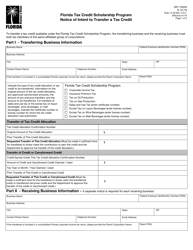

Form F-1193T

for the current year.

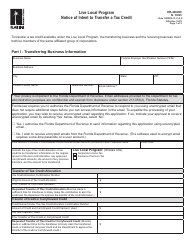

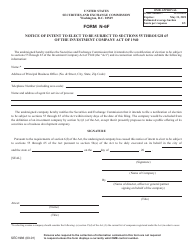

Form F-1193T Notice of Intent to Transfer a Florida Energy Tax Credit - Florida

What Is Form F-1193T?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

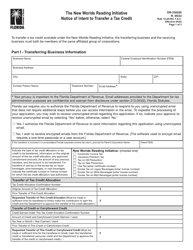

Q: What is Form F-1193T?

A: Form F-1193T is a Notice of Intent to Transfer a Florida Energy Tax Credit.

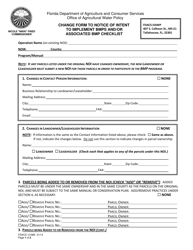

Q: What is a Florida Energy Tax Credit?

A: A Florida Energy Tax Credit is a credit that can be applied against certain taxes owed to the state of Florida.

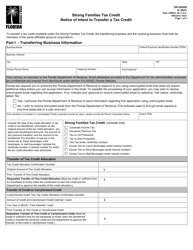

Q: Who needs to file Form F-1193T?

A: The party transferring the tax credit needs to file Form F-1193T.

Q: What is the purpose of filing Form F-1193T?

A: The purpose of filing Form F-1193T is to provide notice of the intent to transfer a Florida Energy Tax Credit to another taxpayer.

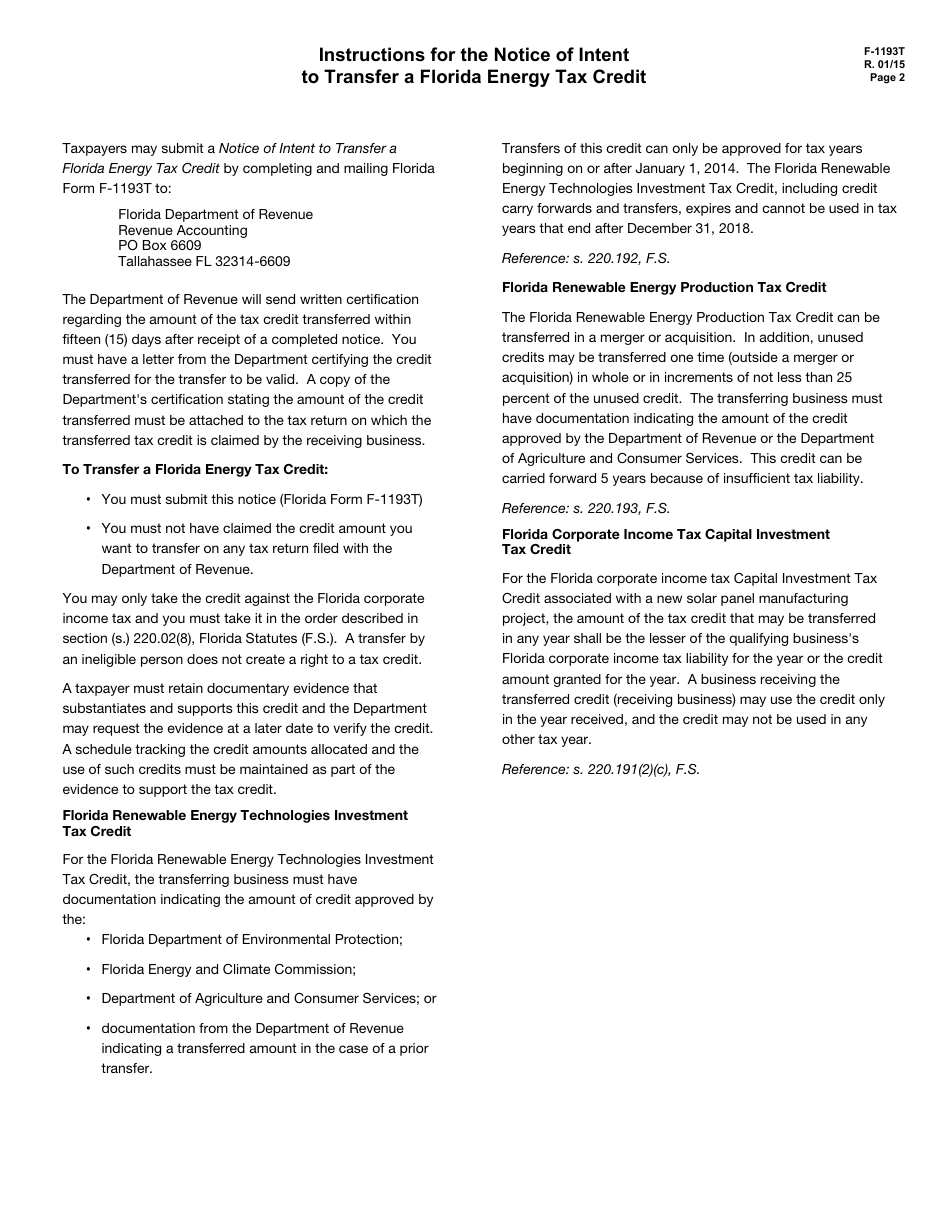

Q: What are the requirements for transferring a Florida Energy Tax Credit?

A: The transfer of the tax credit must meet certain requirements as specified by the Florida Department of Revenue.

Q: Are there any fees associated with filing Form F-1193T?

A: No, there are no fees associated with filing Form F-1193T.

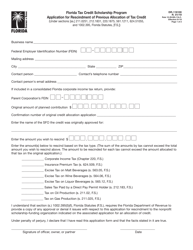

Q: What supporting documentation is required when filing Form F-1193T?

A: The filer must include the agreement or other document evidencing the transfer of the tax credit.

Q: When should Form F-1193T be filed?

A: Form F-1193T should be filed at least 10 days prior to the effective date of the transfer of the tax credit.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-1193T by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.