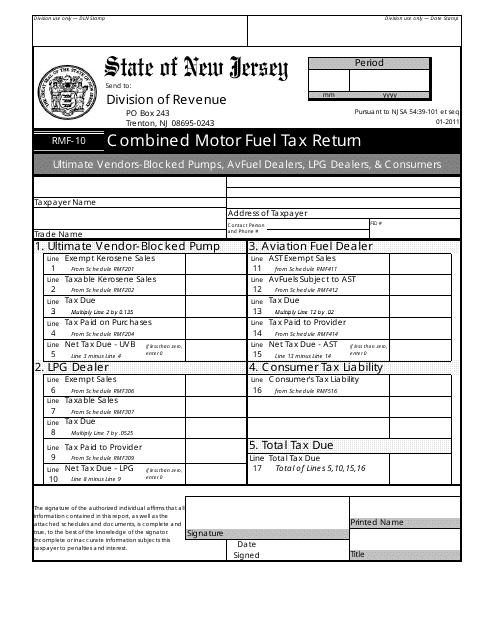

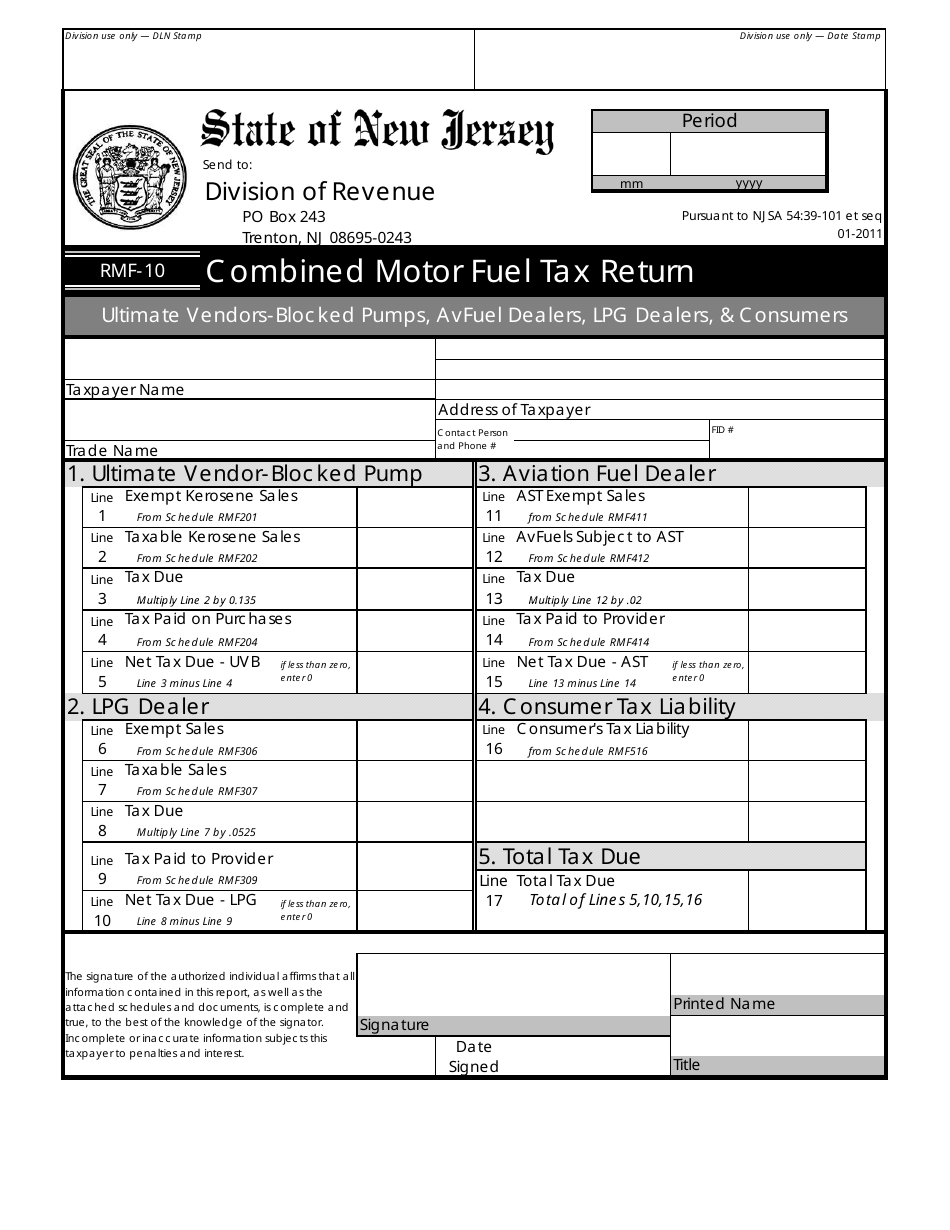

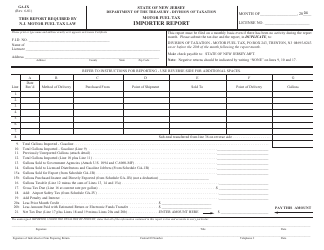

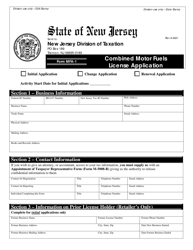

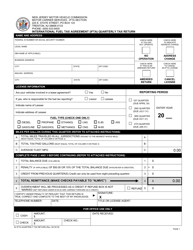

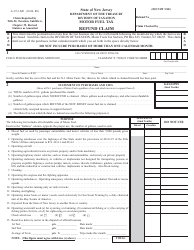

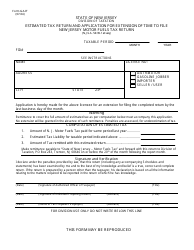

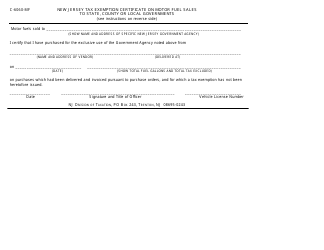

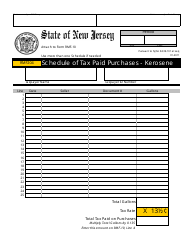

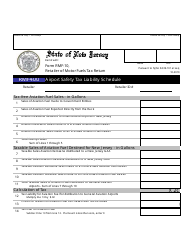

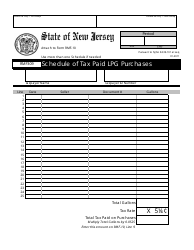

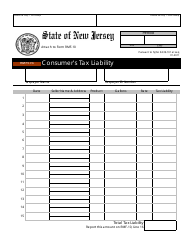

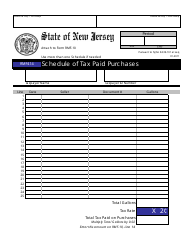

Form RMF-10 Combined Motor Fuel Tax Return - New Jersey

What Is Form RMF-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMF-10 Combined Motor Fuel Tax Return?

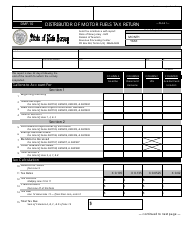

A: RMF-10 Combined Motor Fuel Tax Return is a form used in New Jersey to report and pay motor fuel taxes.

Q: Who needs to file RMF-10 Combined Motor Fuel Tax Return?

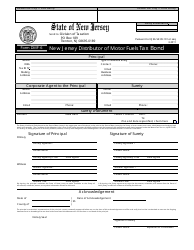

A: Anyone who sells or distributes motor fuel in New Jersey is required to file the RMF-10 Combined Motor Fuel Tax Return.

Q: How often do I need to file RMF-10 Combined Motor Fuel Tax Return?

A: The frequency of filing RMF-10 Combined Motor Fuel Tax Return depends on the volume of motor fuel sold or distributed. It can be filed monthly, quarterly, or annually.

Q: What information do I need to include in RMF-10 Combined Motor Fuel Tax Return?

A: You need to provide details of the motor fuel sold or distributed, including the type, quantity, and selling price. You also need to calculate and report the tax owed.

Q: Are there any penalties for late or incorrect filing of RMF-10 Combined Motor Fuel Tax Return?

A: Yes, there are penalties for late or incorrect filing of RMF-10 Combined Motor Fuel Tax Return, including interest charges and possible loss of license.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.