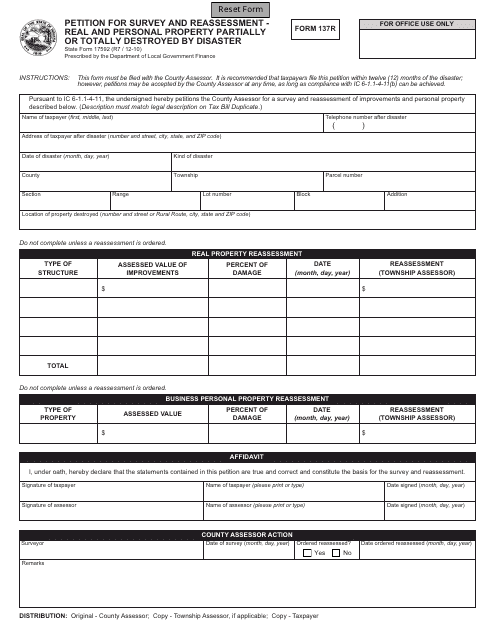

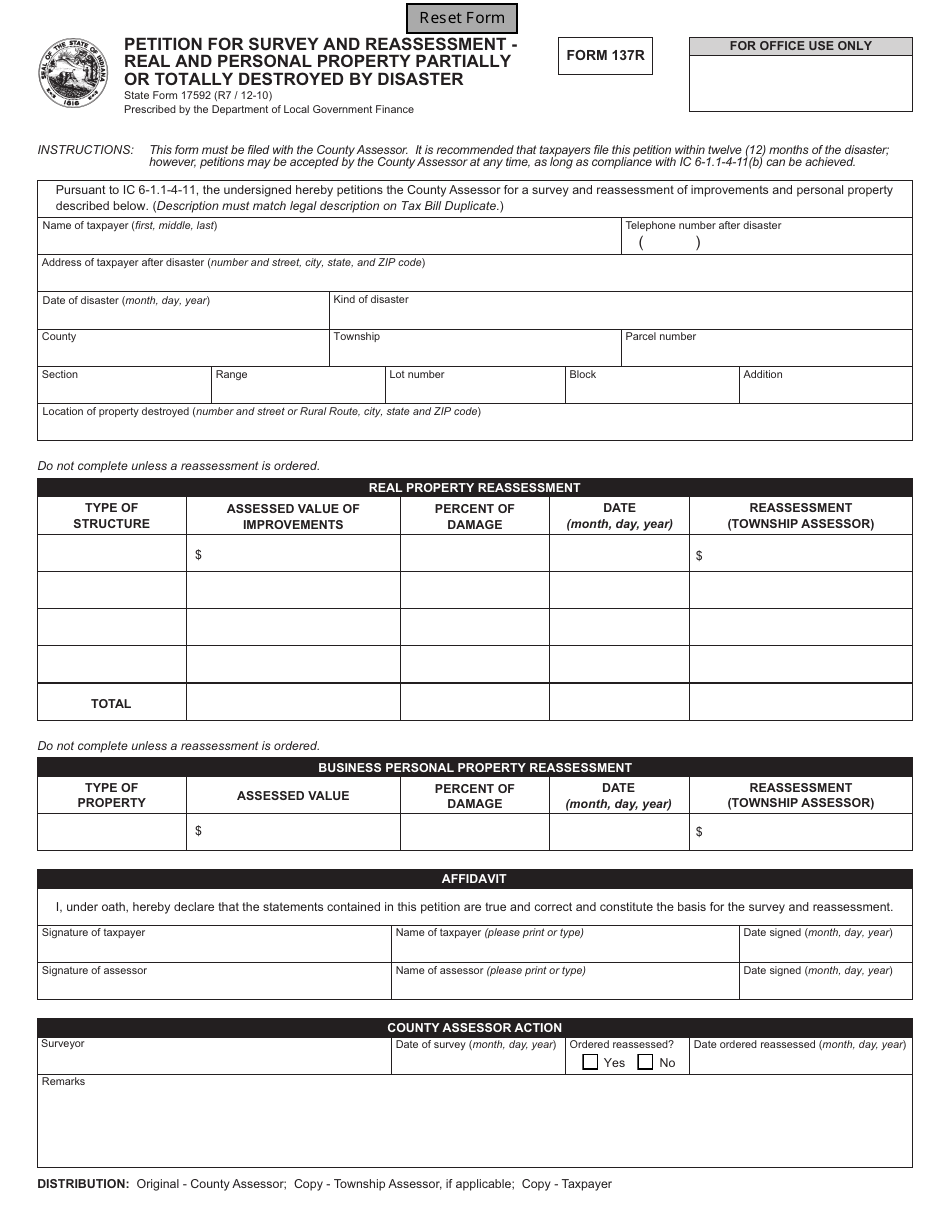

State Form 17592 (137R) Petition for Survey and Reassessment - Real and Personal Property Partially or Totally Destroyed by Disaster - Indiana

What Is State Form 17592 (137R)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 17592 (137R)?

A: Form 17592 (137R) is a petition for survey and reassessment for real and personal property that has been partially or totally destroyed by a disaster in Indiana.

Q: What is the purpose of Form 17592 (137R)?

A: The purpose of Form 17592 (137R) is to request a reassessment of the property's value after it has been damaged or destroyed by a disaster.

Q: Who should use Form 17592 (137R)?

A: Individuals or businesses in Indiana whose real or personal property has been partially or totally destroyed by a disaster should use Form 17592 (137R).

Q: What information is required on Form 17592 (137R)?

A: Form 17592 (137R) requires information about the property and details of the disaster, including the extent of the damage.

Q: Is there a deadline for submitting Form 17592 (137R)?

A: Yes, Form 17592 (137R) must be submitted within one year from the disaster date or by May 1st of the year following the disaster, whichever is later.

Q: Can I appeal the reassessment decision made based on Form 17592 (137R)?

A: Yes, you have the right to appeal the reassessment decision made based on Form 17592 (137R).

Q: Is there a fee for submitting Form 17592 (137R)?

A: There may be a fee associated with submitting Form 17592 (137R), depending on the county. Contact the county assessor's office for more information.

Q: Can I claim a deduction on my taxes for the damaged property?

A: Yes, you may be eligible to claim a deduction on your taxes for the damaged property. Consult with a tax professional for specific advice.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 17592 (137R) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.