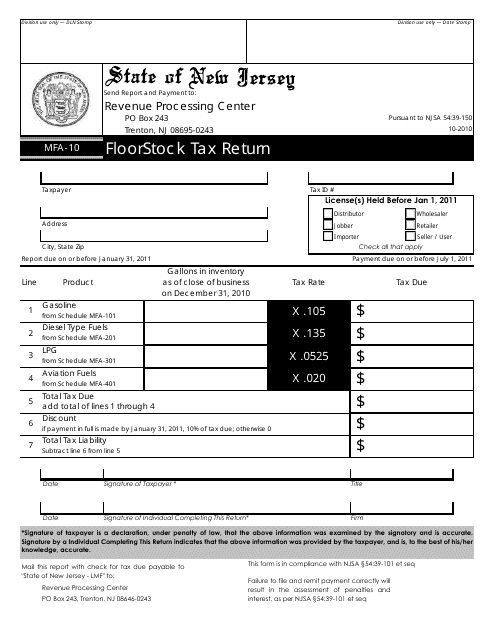

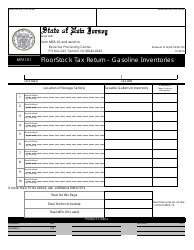

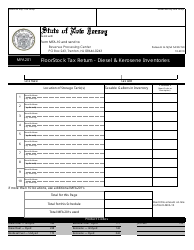

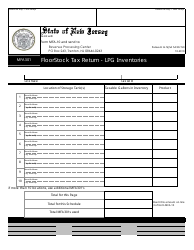

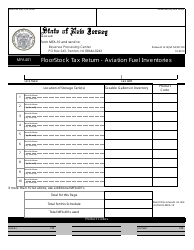

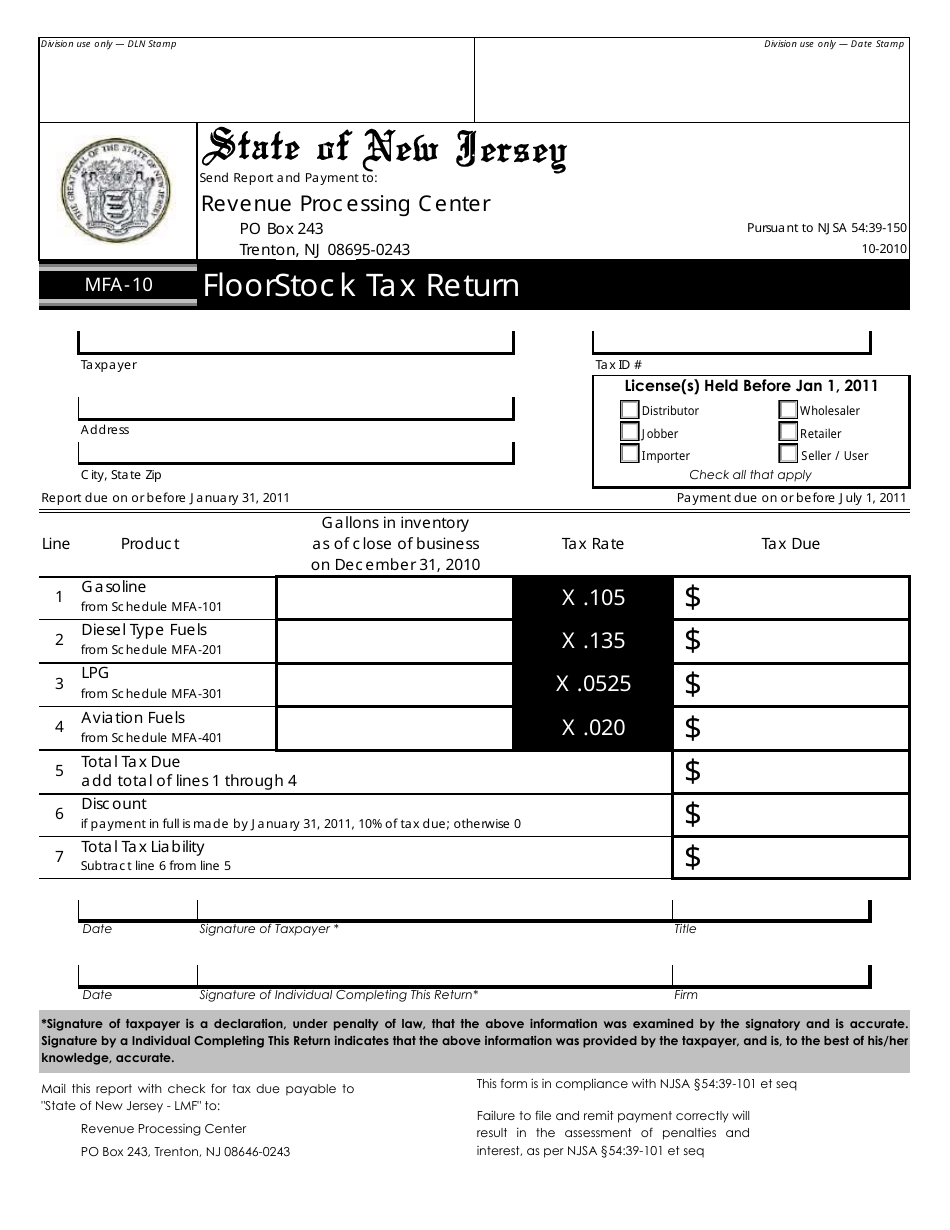

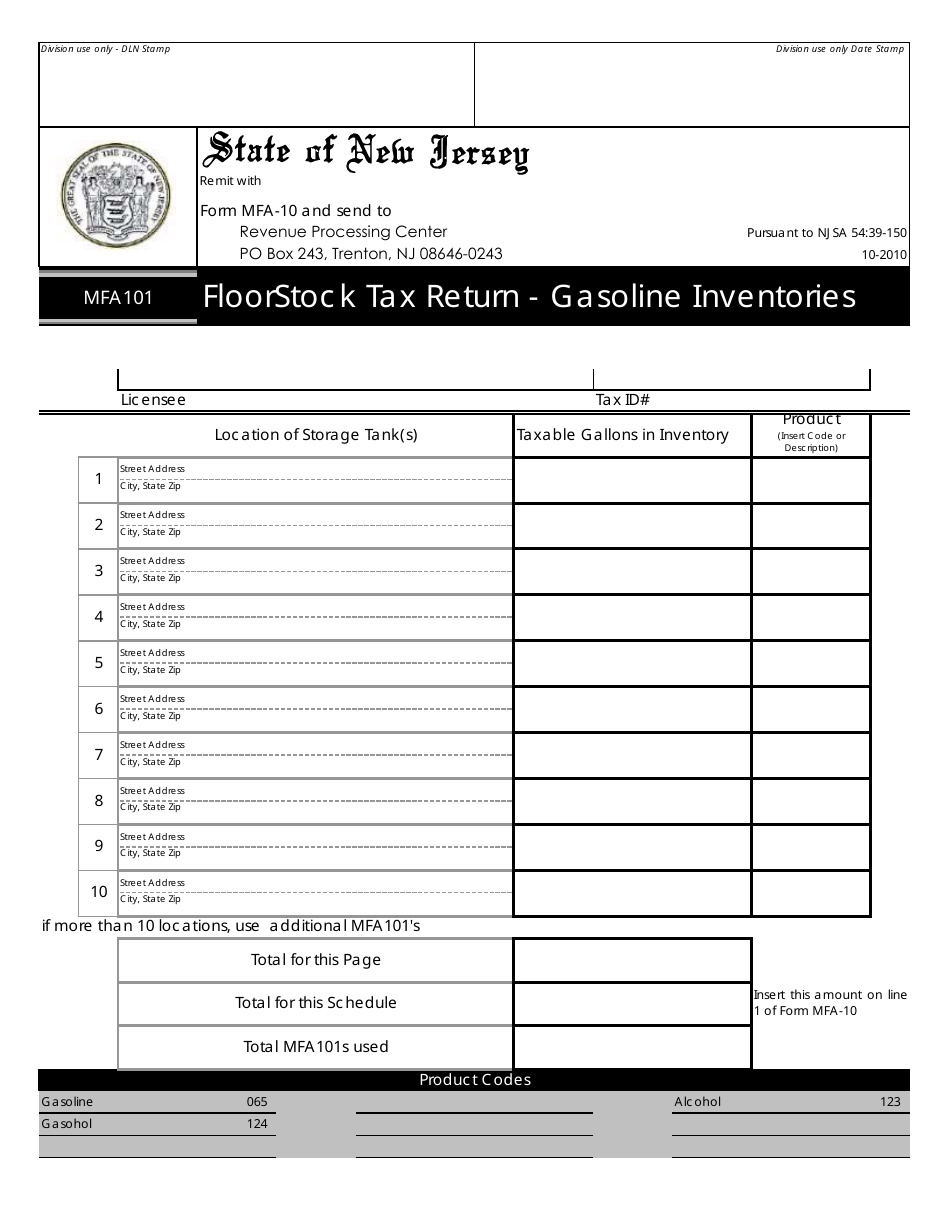

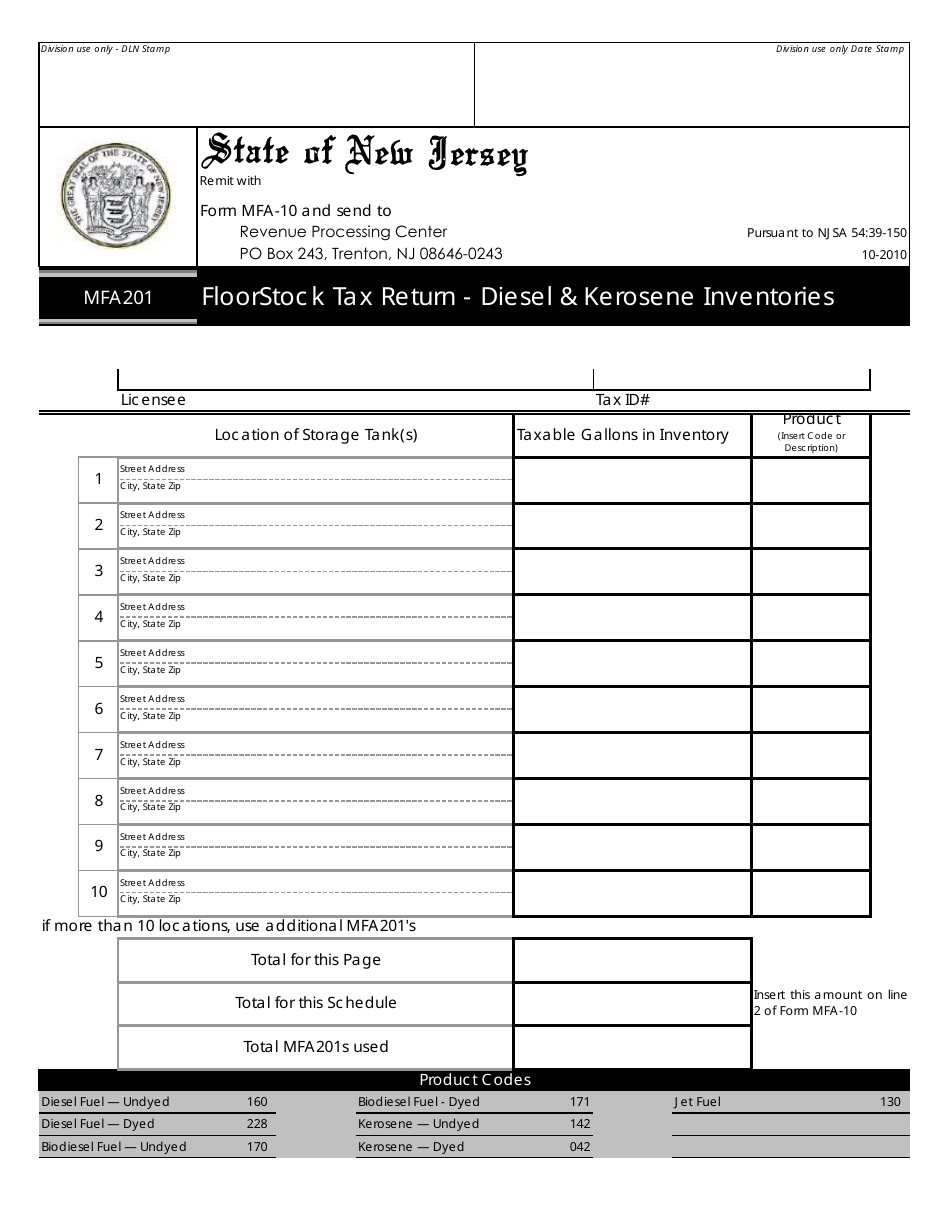

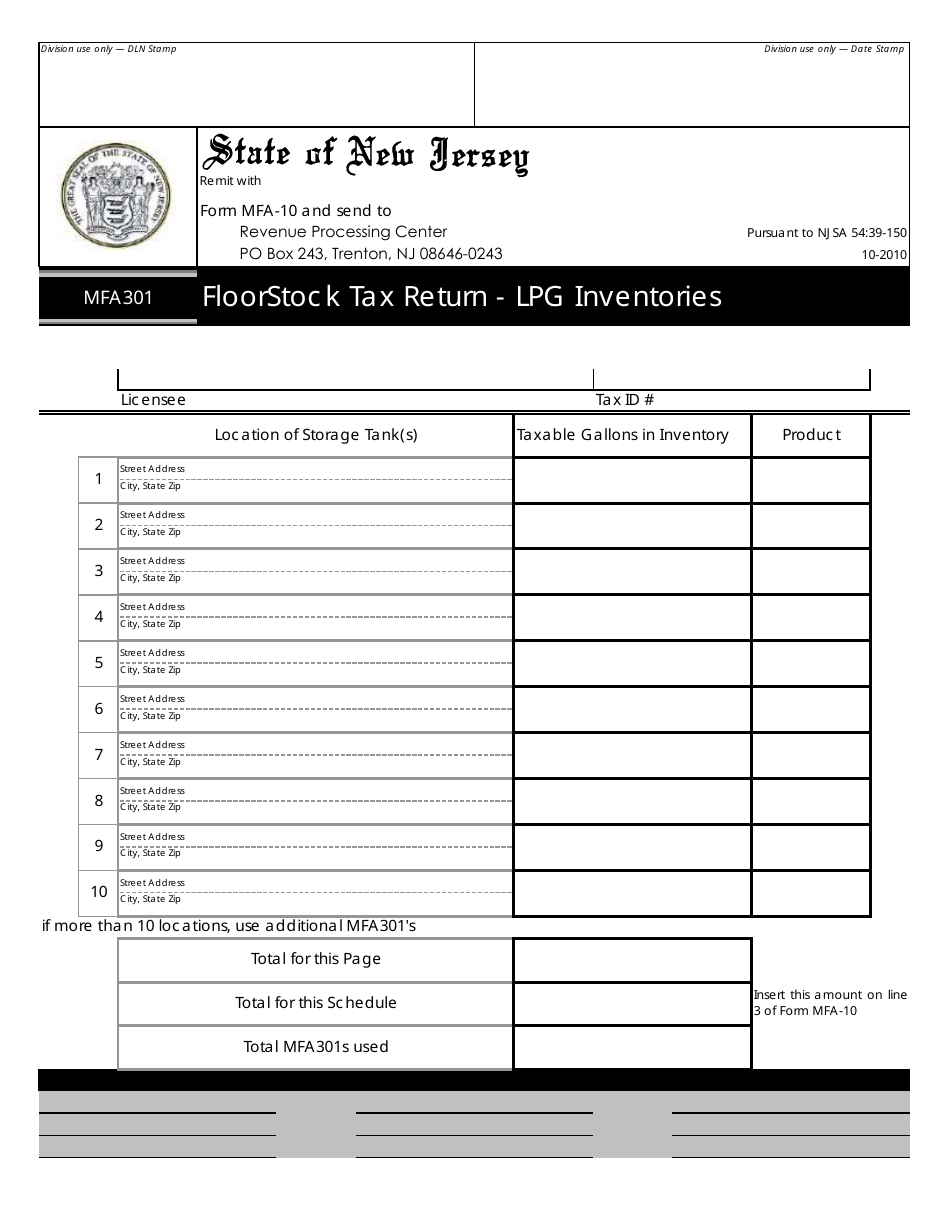

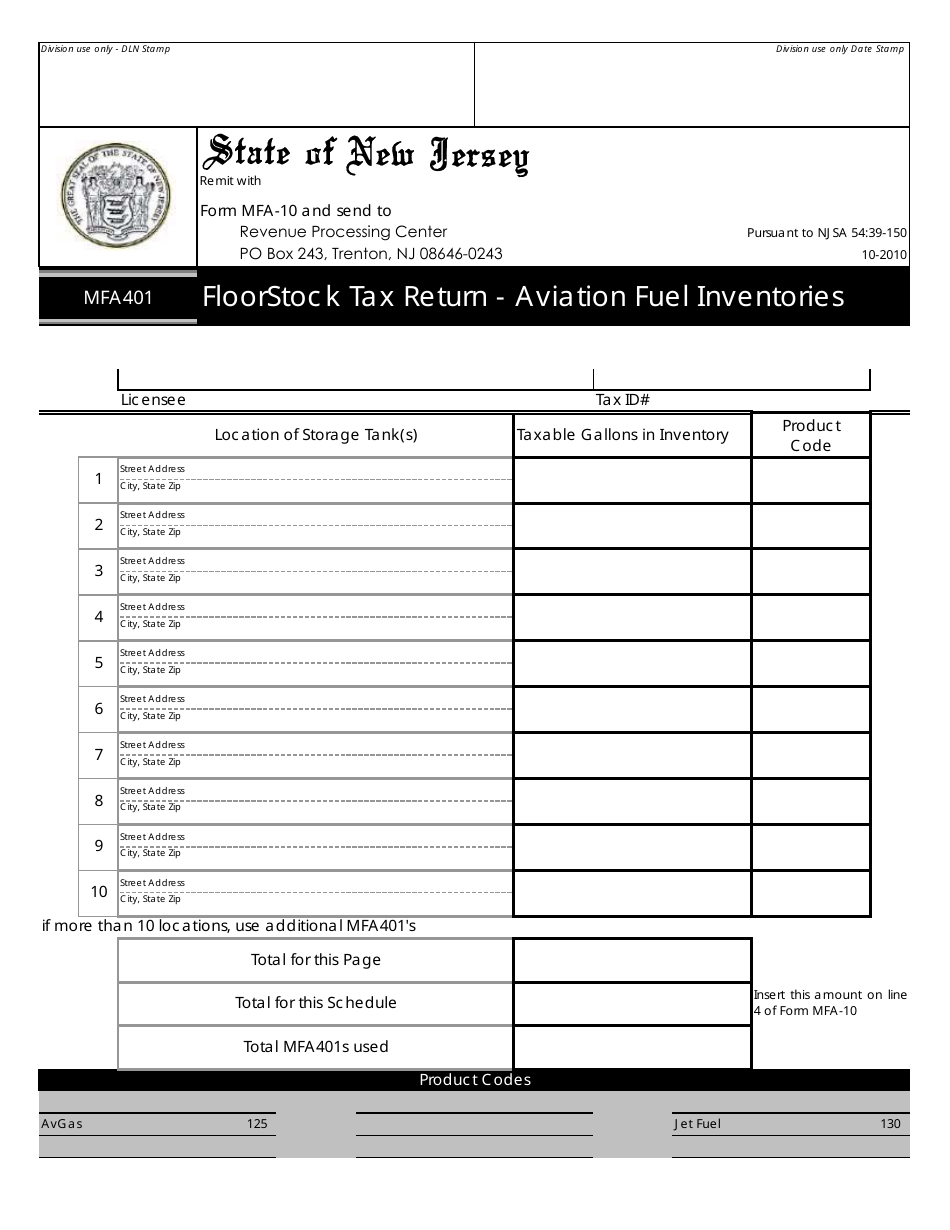

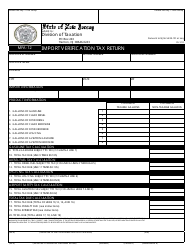

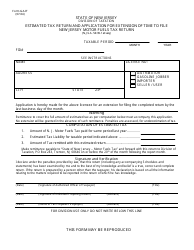

Form MFA-10 Floorstock Tax Return - New Jersey

What Is Form MFA-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MFA-10?

A: Form MFA-10 is the Floorstock Tax Return for New Jersey.

Q: What is the Floorstock Tax?

A: The Floorstock Tax is a tax imposed on certain merchandise held for sale on the effective date of a tax rate increase.

Q: Who needs to file Form MFA-10?

A: Businesses that hold taxable merchandise for sale on the effective date of a tax rate increase in New Jersey must file Form MFA-10.

Q: When is Form MFA-10 due?

A: Form MFA-10 is due within 30 days of the effective date of a tax rate increase.

Q: What information do I need to complete Form MFA-10?

A: You will need to provide information about your business, the taxable merchandise held on the effective date of the tax rate increase, and the amount of tax due.

Q: Is there a penalty for not filing Form MFA-10?

A: Yes, failure to file Form MFA-10 or pay the tax due can result in penalties and interest.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFA-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.