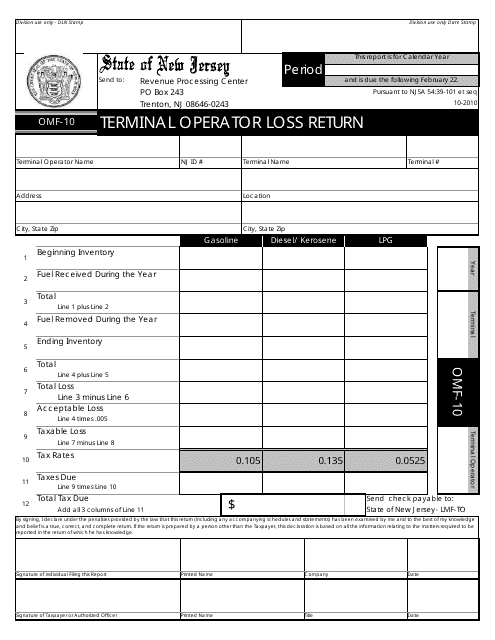

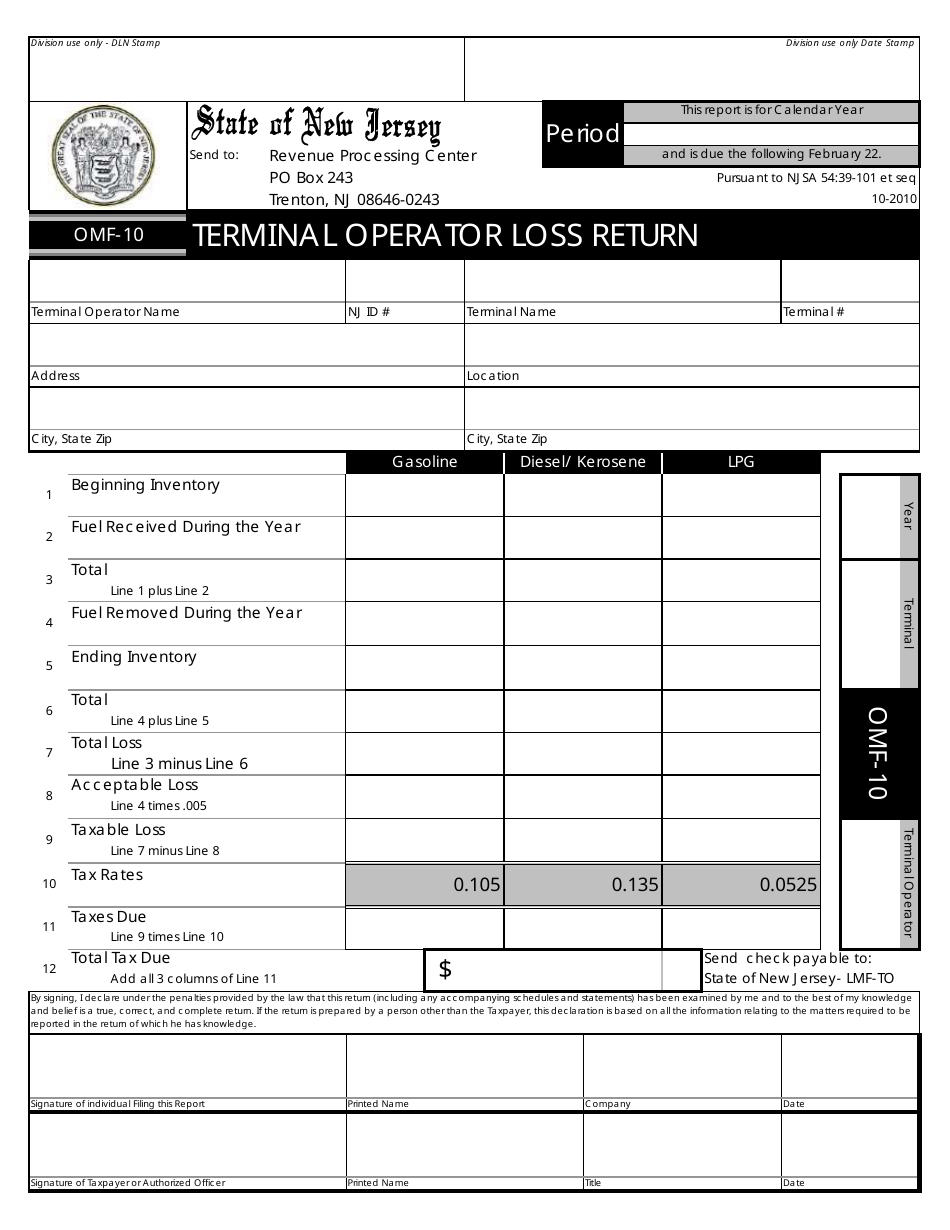

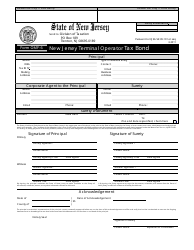

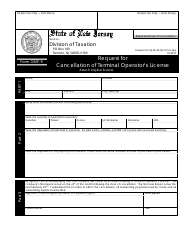

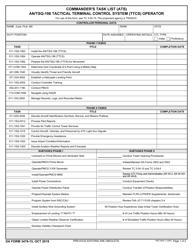

Form OMF-10 Terminal Operator Loss Return - New Jersey

What Is Form OMF-10?

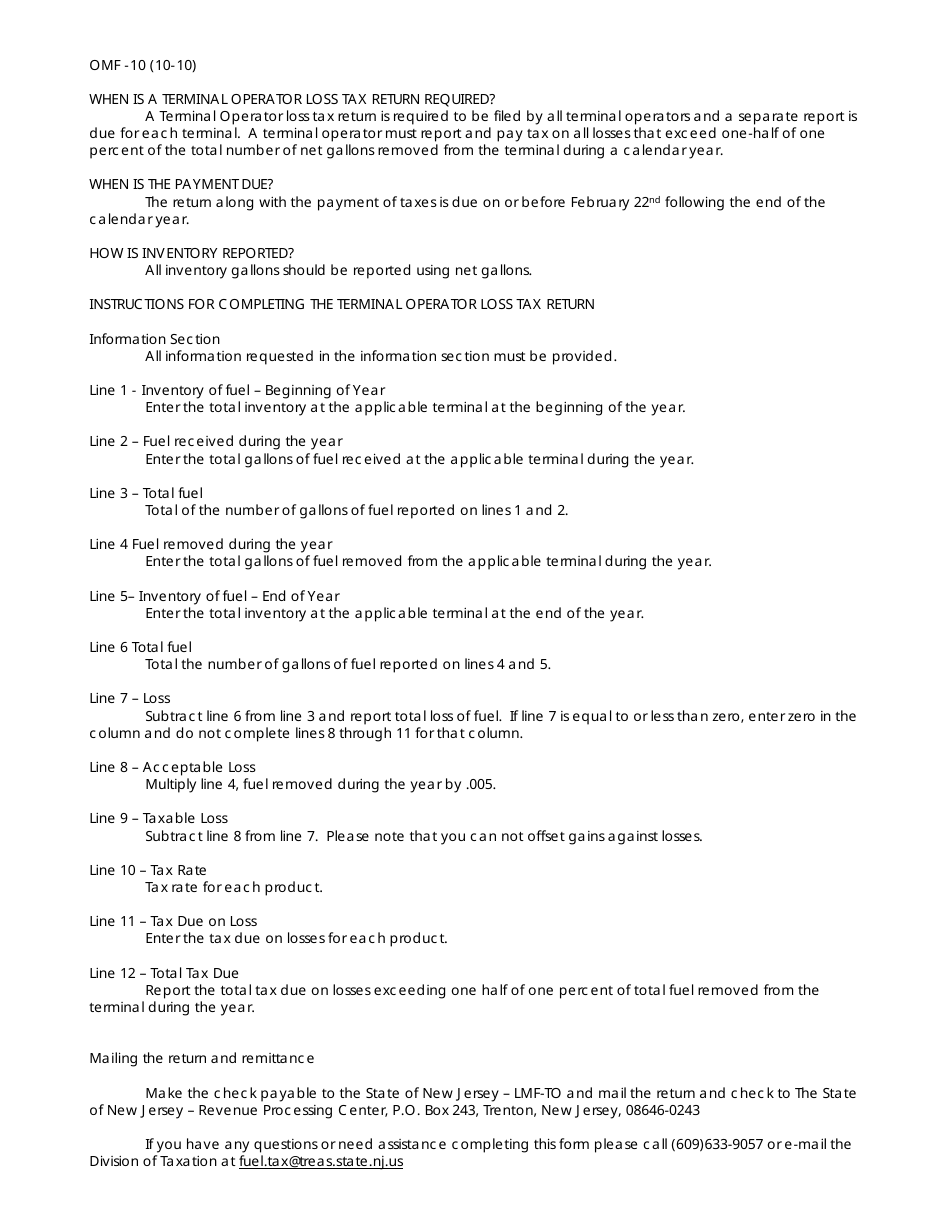

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

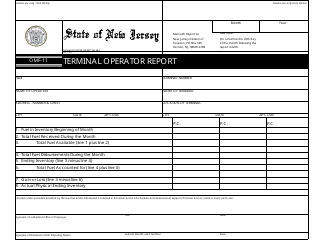

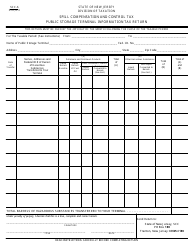

Q: What is Form OMF-10?

A: Form OMF-10 is the Terminal Operator Loss Return.

Q: Who needs to file Form OMF-10?

A: Terminal operators in New Jersey need to file Form OMF-10.

Q: What is the purpose of Form OMF-10?

A: Form OMF-10 is used to report terminal operator losses in New Jersey.

Q: When is the deadline to file Form OMF-10?

A: The deadline to file Form OMF-10 is determined by the New Jersey Department of Treasury.

Q: Are there any penalties for late filing of Form OMF-10?

A: Penalties may apply for late filing of Form OMF-10, as determined by the New Jersey Department of Treasury.

Q: Can I amend my Form OMF-10?

A: Yes, you can amend your Form OMF-10 if needed.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OMF-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.