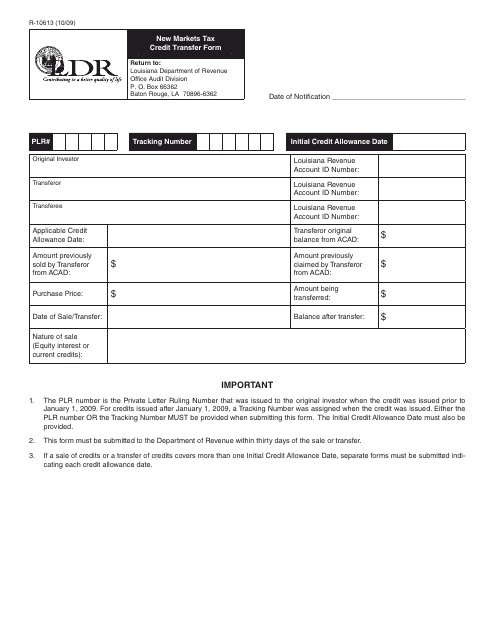

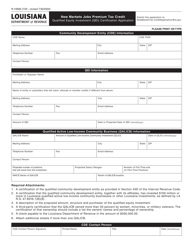

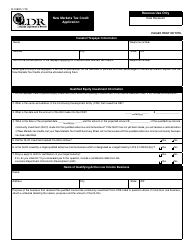

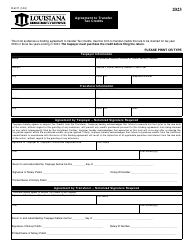

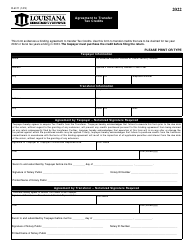

Form R-10613 New Markets Tax Credit Transfer Form - Louisiana

What Is Form R-10613?

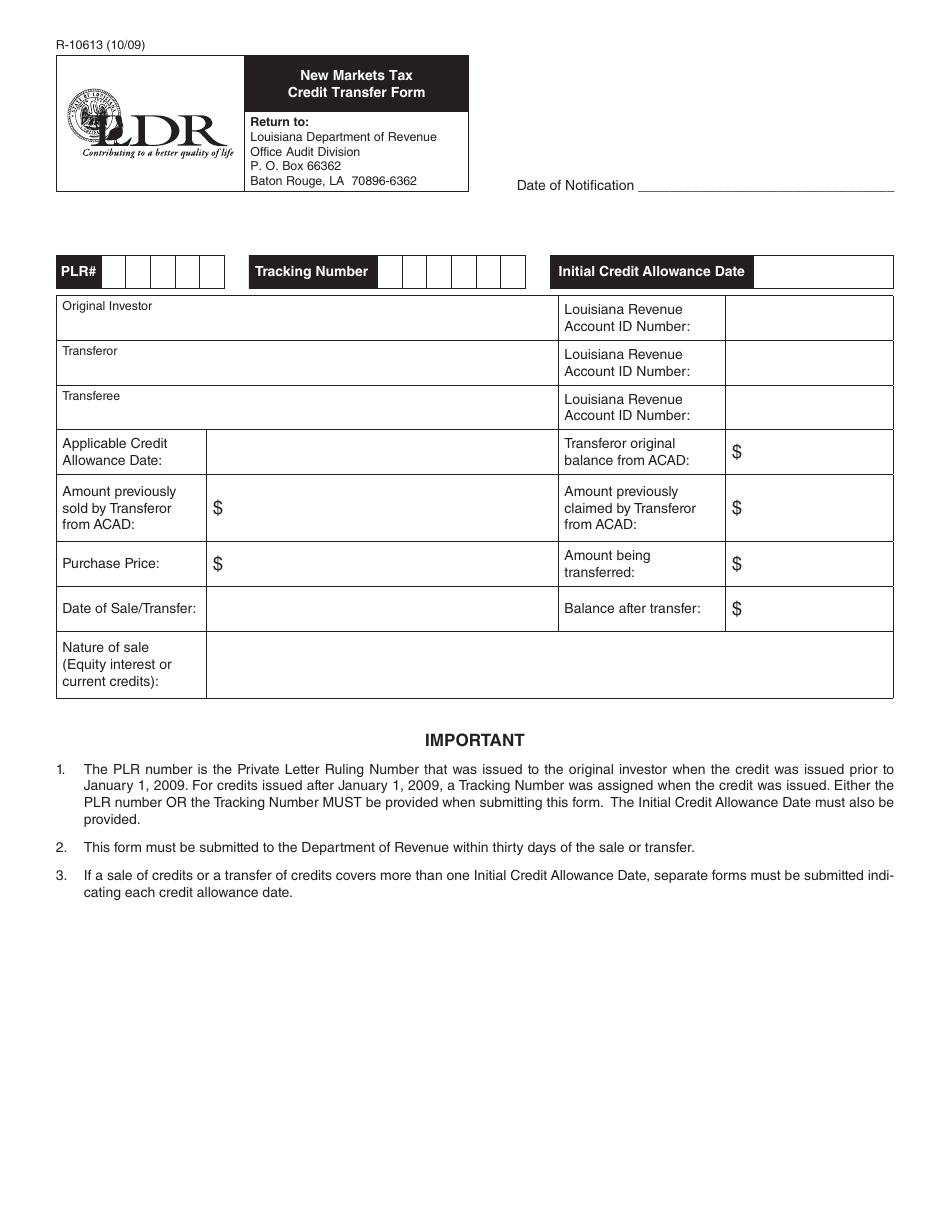

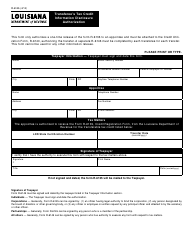

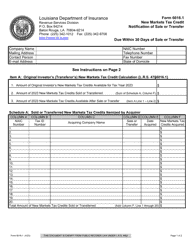

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-10613?

A: The Form R-10613 is the New MarketsTax Credit Transfer Form for Louisiana.

Q: What is the New Markets Tax Credit?

A: The New Markets Tax Credit is a federal program designed to spur investment in low-income communities.

Q: What is the purpose of the Form R-10613?

A: The Form R-10613 is used to transfer the New Markets Tax Credit from one taxpayer to another in Louisiana.

Q: Who can use the Form R-10613?

A: The Form R-10613 can be used by taxpayers in Louisiana who are eligible for the New Markets Tax Credit.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-10613 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.