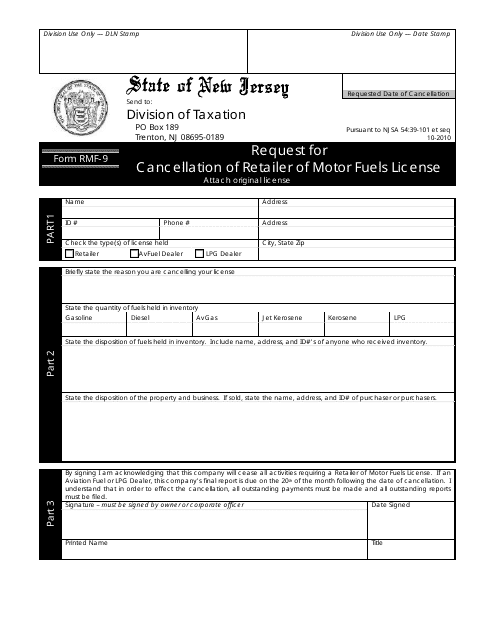

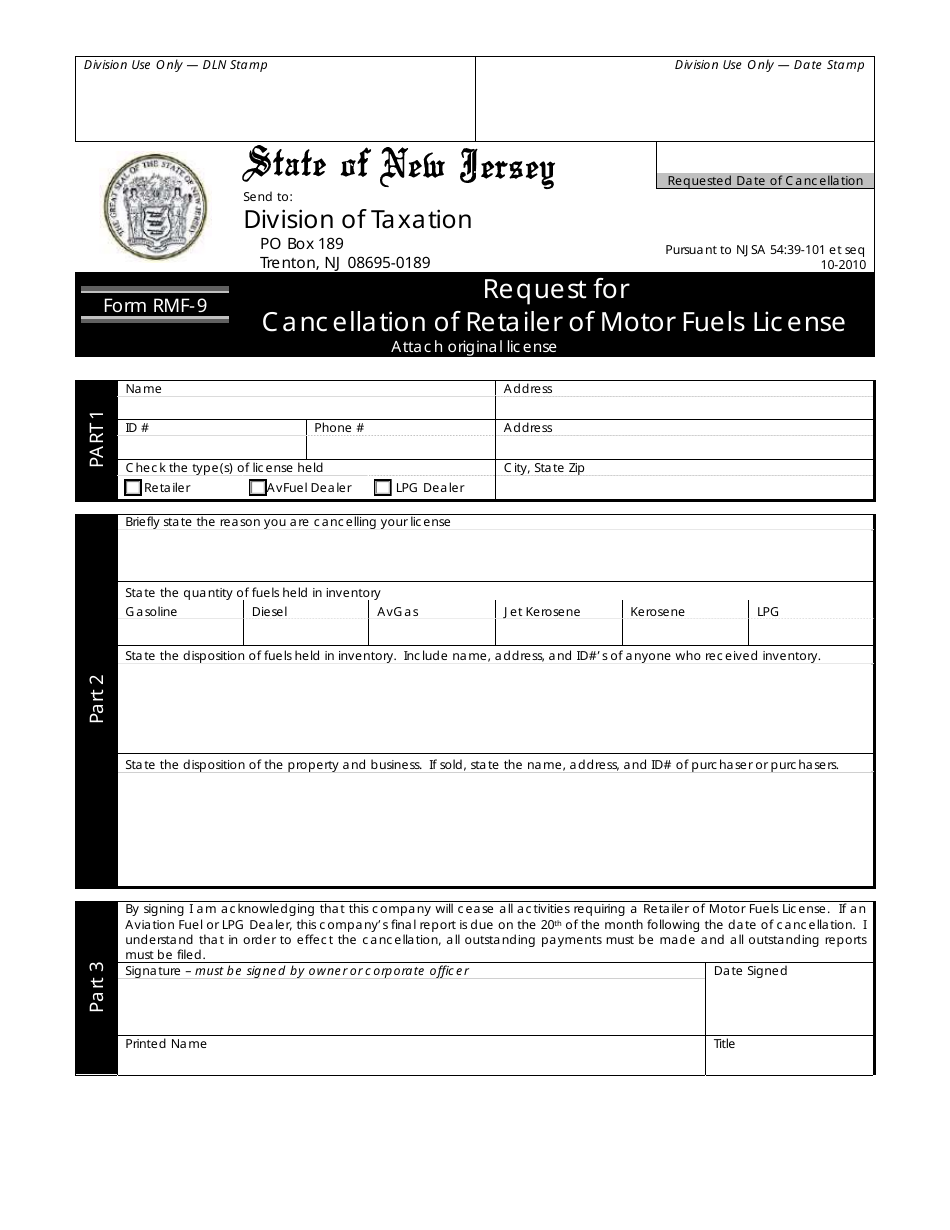

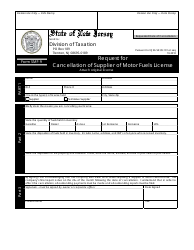

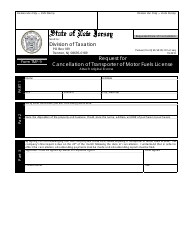

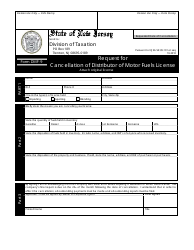

Form RMF-9 Cancellation of Retailer of Motor Fuels License - New Jersey

What Is Form RMF-9?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMF-9?

A: Form RMF-9 is a form used to cancel a retailer of motor fuels license in New Jersey.

Q: What does the RMF-9 form cancel?

A: The RMF-9 form cancels a retailer of motor fuels license in New Jersey.

Q: Who needs to use the RMF-9 form?

A: Anyone who wants to cancel their retailer of motor fuels license in New Jersey needs to use the RMF-9 form.

Q: Are there any fees associated with canceling a retailer of motor fuels license?

A: There may be fees associated with canceling a retailer of motor fuels license in New Jersey. You should contact the New Jersey Division of Taxation for more information.

Q: What information is required on the RMF-9 form?

A: The RMF-9 form requires information such as the licensee's name, address, tax identification number, and the reason for cancellation.

Q: How long does it take to process a RMF-9 form?

A: The processing time for a RMF-9 form may vary. You should contact the New Jersey Division of Taxation for more information on processing times.

Q: Do I need to notify any other agencies when canceling a retailer of motor fuels license?

A: You may need to notify other agencies such as the New Jersey Department of Environmental Protection. You should contact the New Jersey Division of Taxation for more information.

Q: Can I reinstate a canceled retailer of motor fuels license?

A: You may be able to reinstate a canceled retailer of motor fuels license in New Jersey. You should contact the New Jersey Division of Taxation for more information.

Q: What happens if I don't cancel my retailer of motor fuels license?

A: If you don't cancel your retailer of motor fuels license when appropriate, you may still be responsible for certain obligations and liabilities.

Q: Is there a deadline for submitting the RMF-9 form?

A: There may be a deadline for submitting the RMF-9 form. You should contact the New Jersey Division of Taxation for more information on deadlines.

Q: What if I made a mistake on the RMF-9 form?

A: If you made a mistake on the RMF-9 form, you should contact the New Jersey Division of Taxation to make the necessary corrections.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF-9 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.