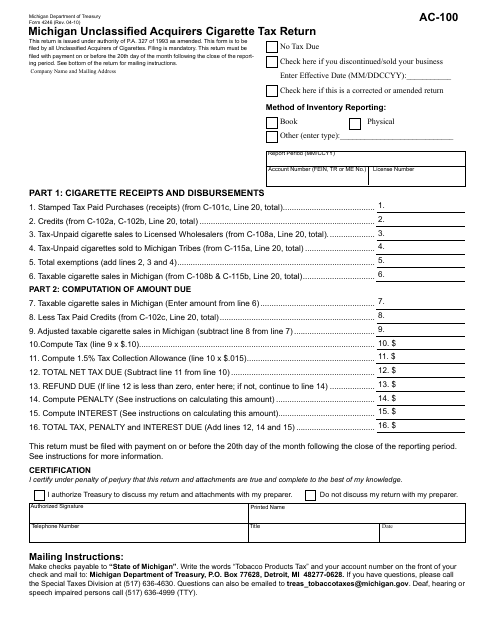

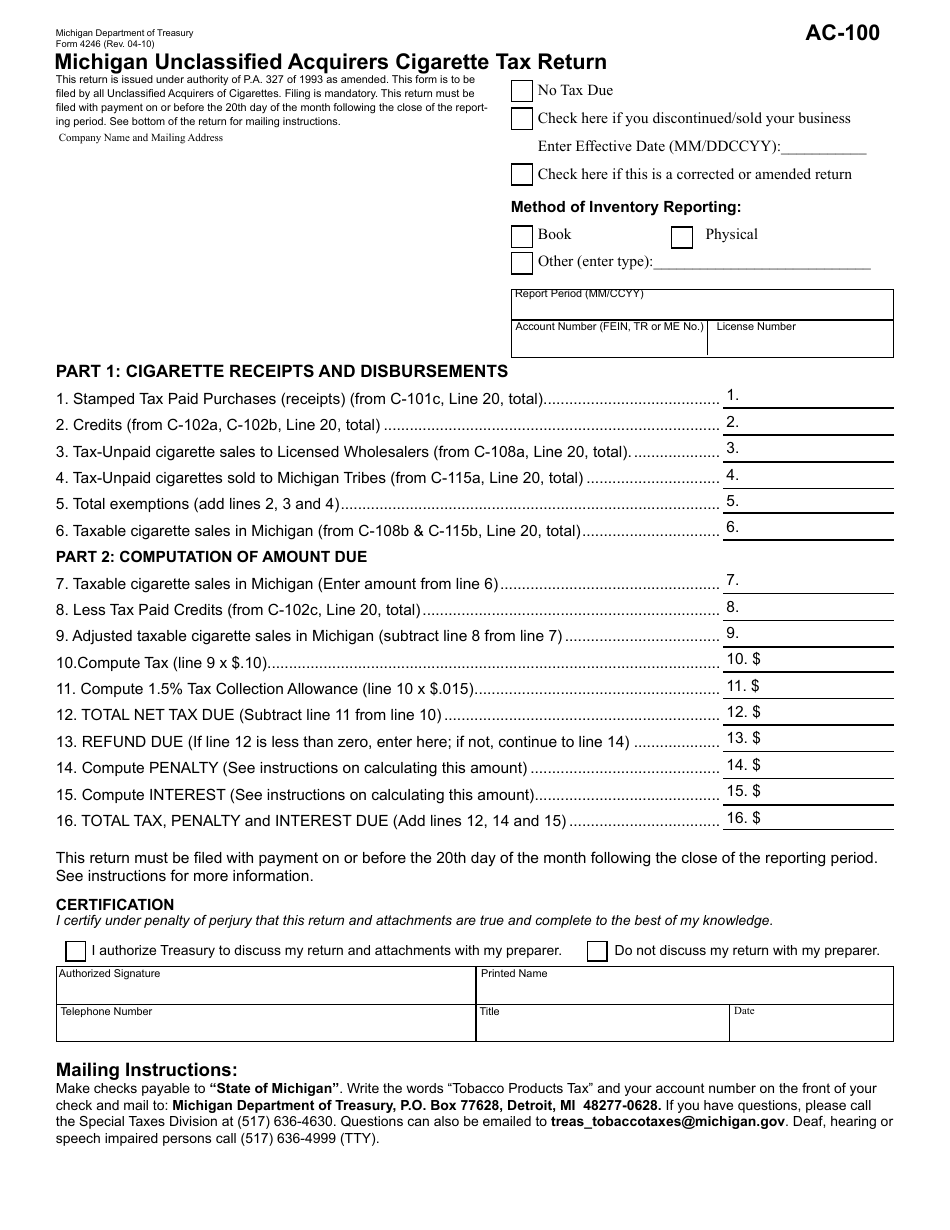

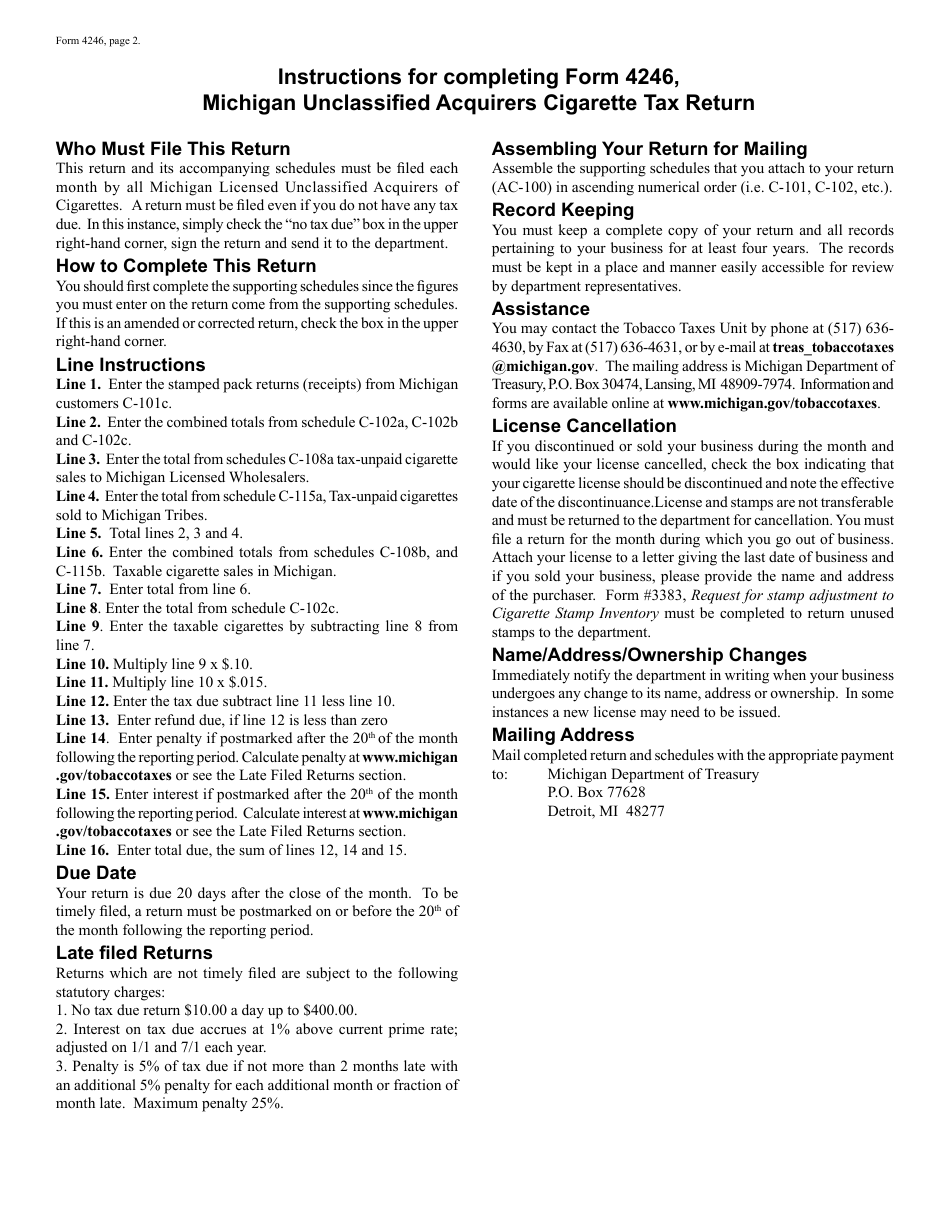

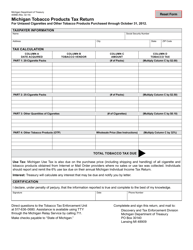

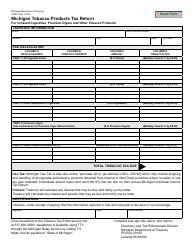

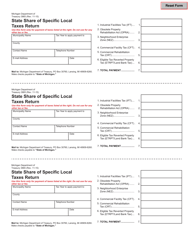

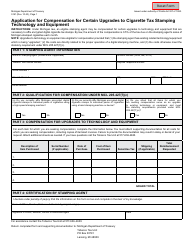

Form 4246 (AC-100) Michigan Unclassified Acquirers Cigarette Tax Return - Michigan

What Is Form 4246 (AC-100)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4246 (AC-100)?

A: Form 4246 (AC-100) is the Cigarette Tax Return used in Michigan by unclassified acquirers.

Q: Who needs to file Form 4246 (AC-100)?

A: Unclassified acquirers in Michigan who sell or distribute cigarettes need to file Form 4246 (AC-100).

Q: What is the purpose of Form 4246 (AC-100)?

A: The purpose of the form is to report and pay the cigarette tax owed by unclassified acquirers in Michigan.

Q: When is the deadline to file Form 4246 (AC-100)?

A: The deadline to file Form 4246 (AC-100) in Michigan is the 20th day of each month.

Q: Are there any penalties for not filing Form 4246 (AC-100) on time?

A: Yes, there are penalties for late filing and late payment of the cigarette tax. It is important to file and pay on time to avoid penalties.

Q: What should I do if I have questions about Form 4246 (AC-100)?

A: If you have questions about Form 4246 (AC-100), you can contact the Michigan Department of Treasury for assistance.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4246 (AC-100) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.