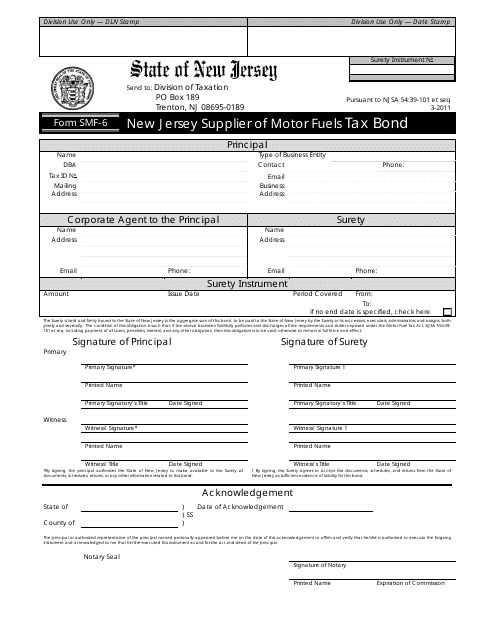

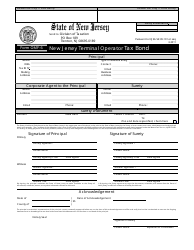

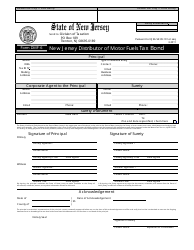

Form SMF-6 Tax Bond - New Jersey

What Is Form SMF-6?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

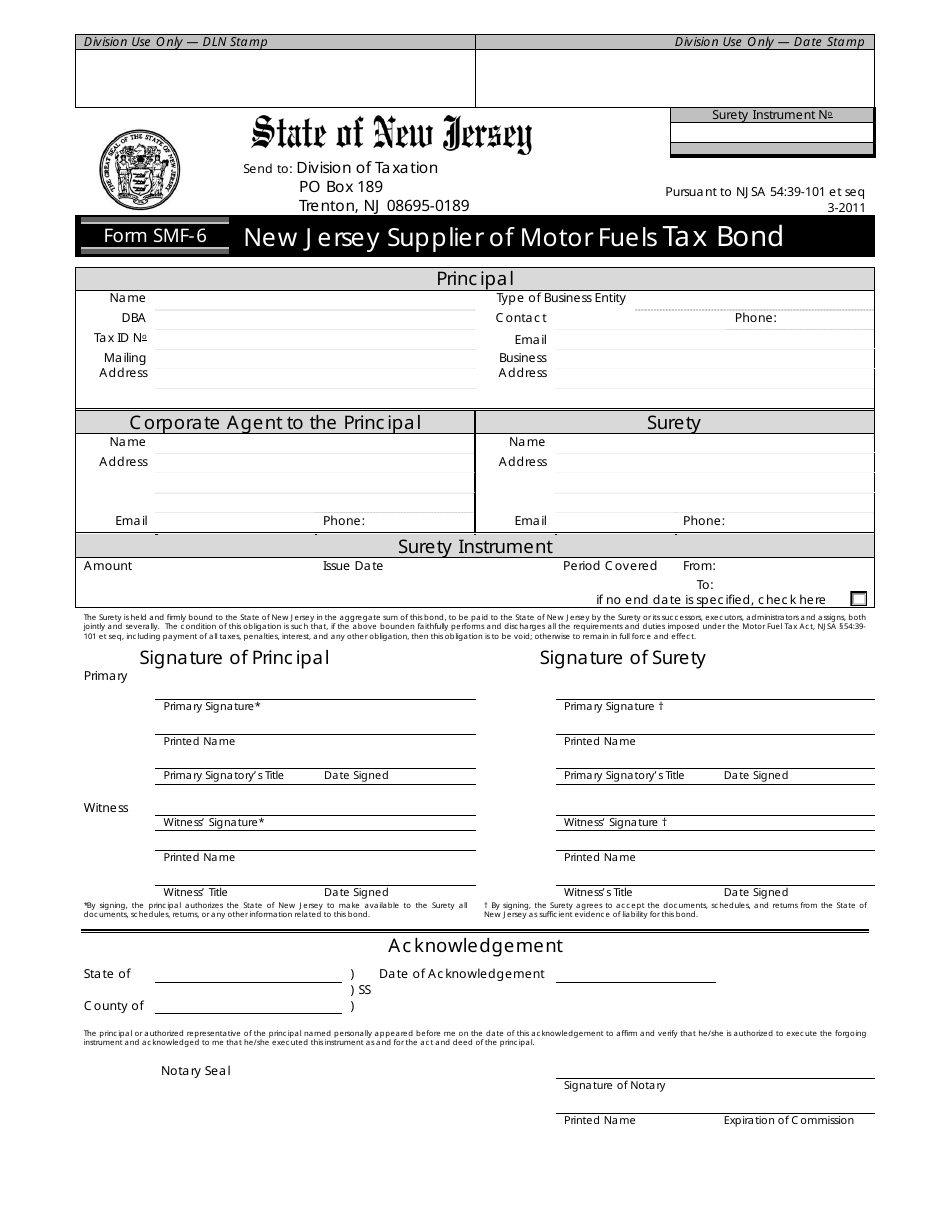

Q: What is the SMF-6 Tax Bond?

A: The SMF-6 Tax Bond is a bond required by the state of New Jersey for certain businesses to ensure compliance with tax obligations.

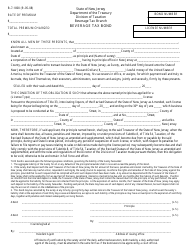

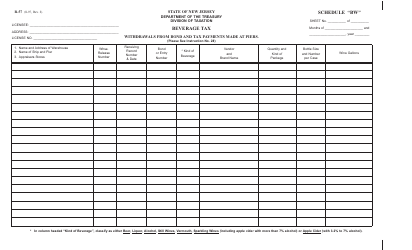

Q: Which businesses need to obtain the SMF-6 Tax Bond?

A: Various businesses in New Jersey, such as those in the fuel distribution or processing industry, may be required to obtain the SMF-6 Tax Bond.

Q: How does the SMF-6 Tax Bond work?

A: The SMF-6 Tax Bond serves as a financial guarantee that the bonded business will fulfill its tax obligations. If the business fails to do so, the bond may be used to compensate the state for any unpaid taxes.

Q: How can a business obtain the SMF-6 Tax Bond?

A: To obtain the SMF-6 Tax Bond, businesses can contact a surety bond company or an insurance agency that offers bonding services.

Q: What are the benefits of obtaining the SMF-6 Tax Bond?

A: Obtaining the SMF-6 Tax Bond allows businesses to comply with New Jersey's requirements and continue their operations. It also provides assurance to the state that the business will meet its tax obligations.

Q: How much does the SMF-6 Tax Bond cost?

A: The cost of the SMF-6 Tax Bond varies depending on factors such as the bonded amount and the business's financial stability. It is recommended to contact a surety bond company for a quote.

Q: How long is the SMF-6 Tax Bond valid for?

A: The validity period of the SMF-6 Tax Bond can vary. It is typically renewed annually or according to the time period specified by the state of New Jersey.

Q: What happens if a business fails to obtain the SMF-6 Tax Bond?

A: If a business that is required to have the SMF-6 Tax Bond fails to obtain it, they may face penalties, fines, or other consequences imposed by the state of New Jersey.

Q: Can the SMF-6 Tax Bond be canceled or terminated?

A: Yes, the SMF-6 Tax Bond can be canceled or terminated. However, it is important to follow the specific procedures outlined by the surety bond company or insurance agency that issued the bond.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SMF-6 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.