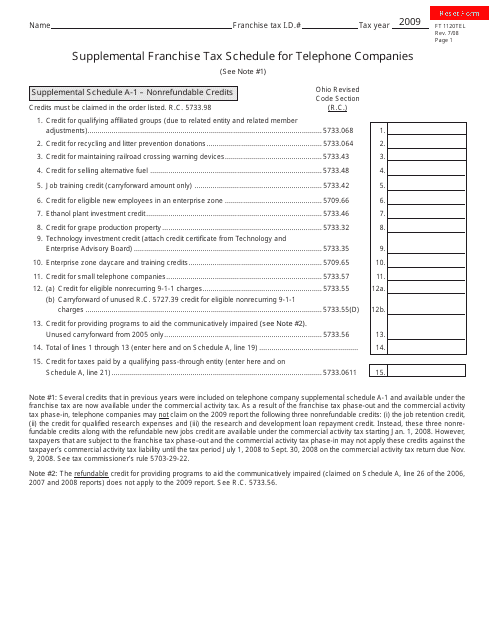

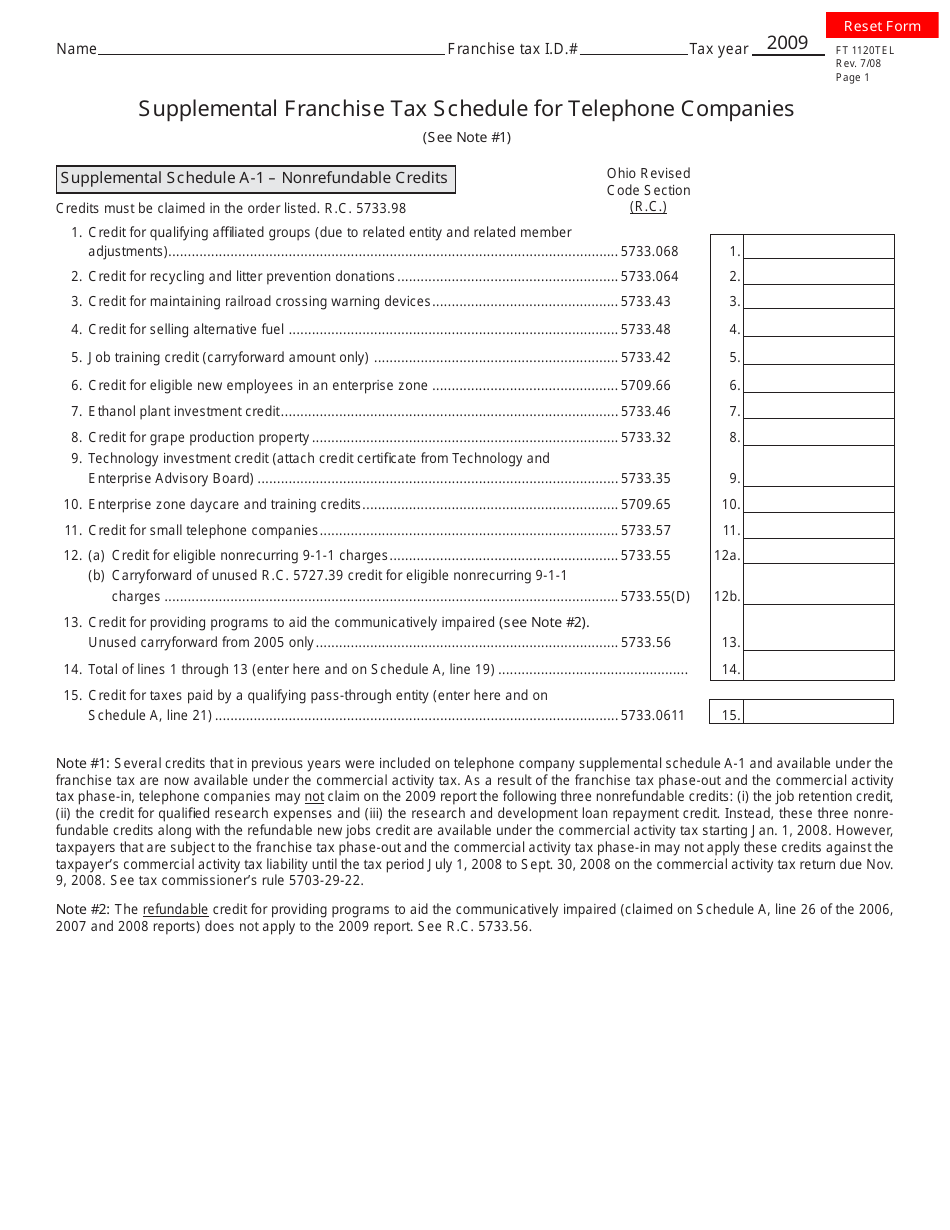

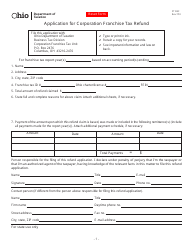

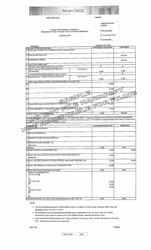

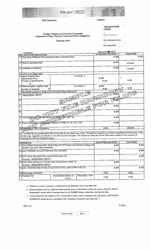

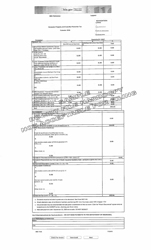

Form FT1120tel Supplemental Franchise Tax Schedule for Telephone Companies - Ohio

What Is Form FT1120tel?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT1120tel?

A: Form FT1120tel is the Supplemental Franchise Tax Schedule for Telephone Companies in Ohio.

Q: Who needs to file Form FT1120tel?

A: Telephone companies operating in Ohio need to file Form FT1120tel.

Q: What is the purpose of Form FT1120tel?

A: The purpose of Form FT1120tel is to calculate and report the supplemental franchise tax for telephone companies in Ohio.

Q: What is the due date for filing Form FT1120tel?

A: The due date for filing Form FT1120tel is the same as the due date for the Ohio corporation franchise tax return, which is generally on or before April 15th.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT1120tel by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.