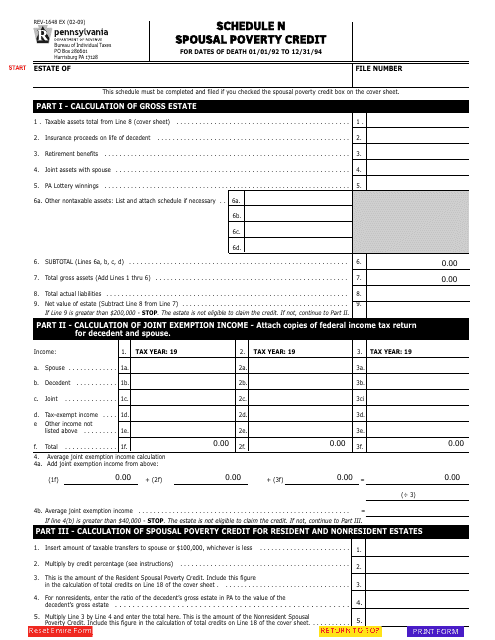

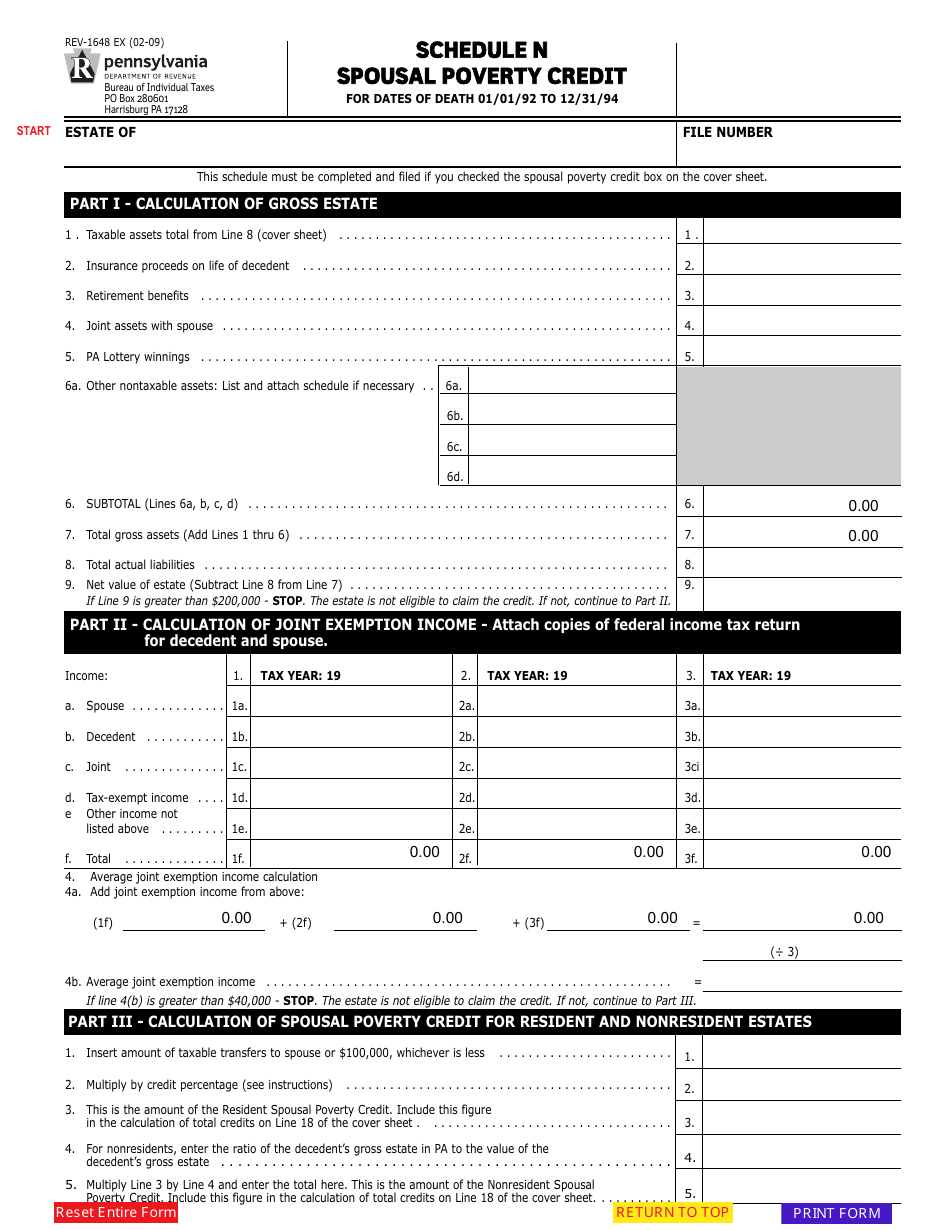

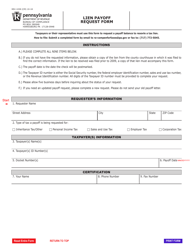

Form REV-1648 Schedule N Spousal Poverty Credit - Pennsylvania

What Is Form REV-1648 Schedule N?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1648 Schedule N?

A: Form REV-1648 Schedule N is a form used to claim the Spousal Poverty Credit in Pennsylvania.

Q: What is the Spousal Poverty Credit?

A: The Spousal Poverty Credit is a tax credit in Pennsylvania specifically for low-income married couples.

Q: Who is eligible for the Spousal Poverty Credit?

A: Married couples who meet certain income requirements in Pennsylvania may be eligible for the Spousal Poverty Credit.

Q: How do I claim the Spousal Poverty Credit?

A: To claim the Spousal Poverty Credit, you need to fill out Form REV-1648 Schedule N and include it with your Pennsylvania state tax return.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1648 Schedule N by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.