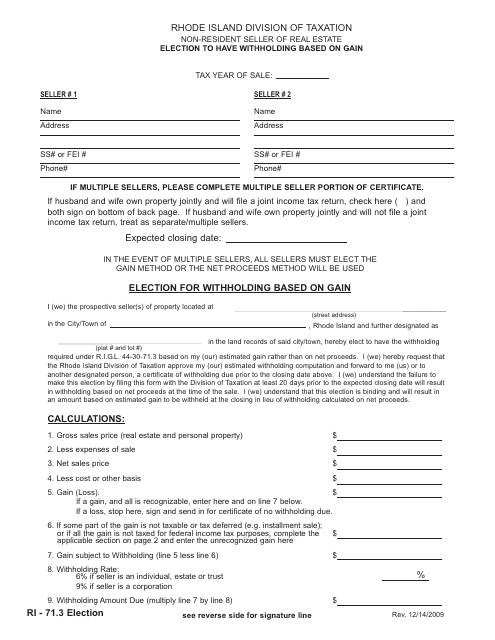

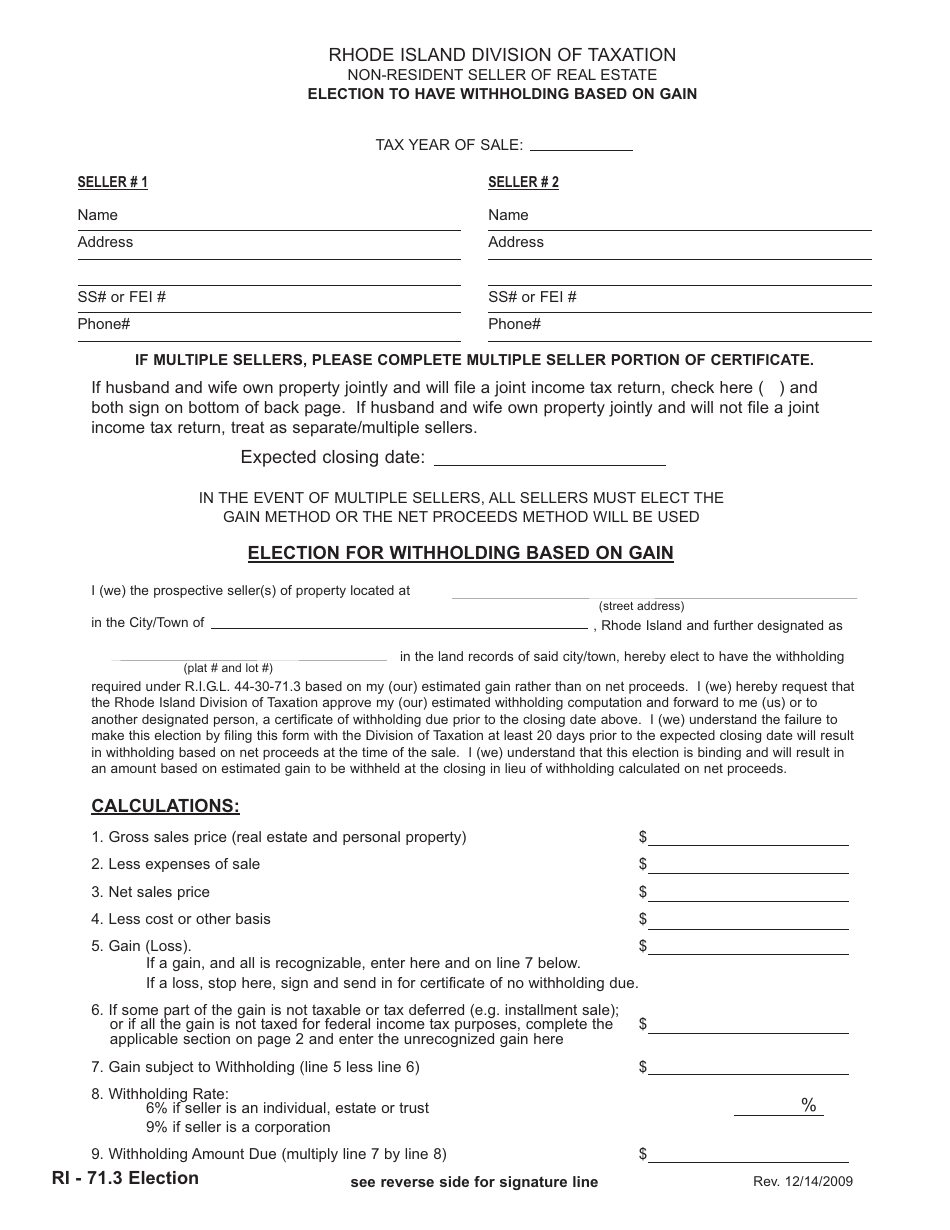

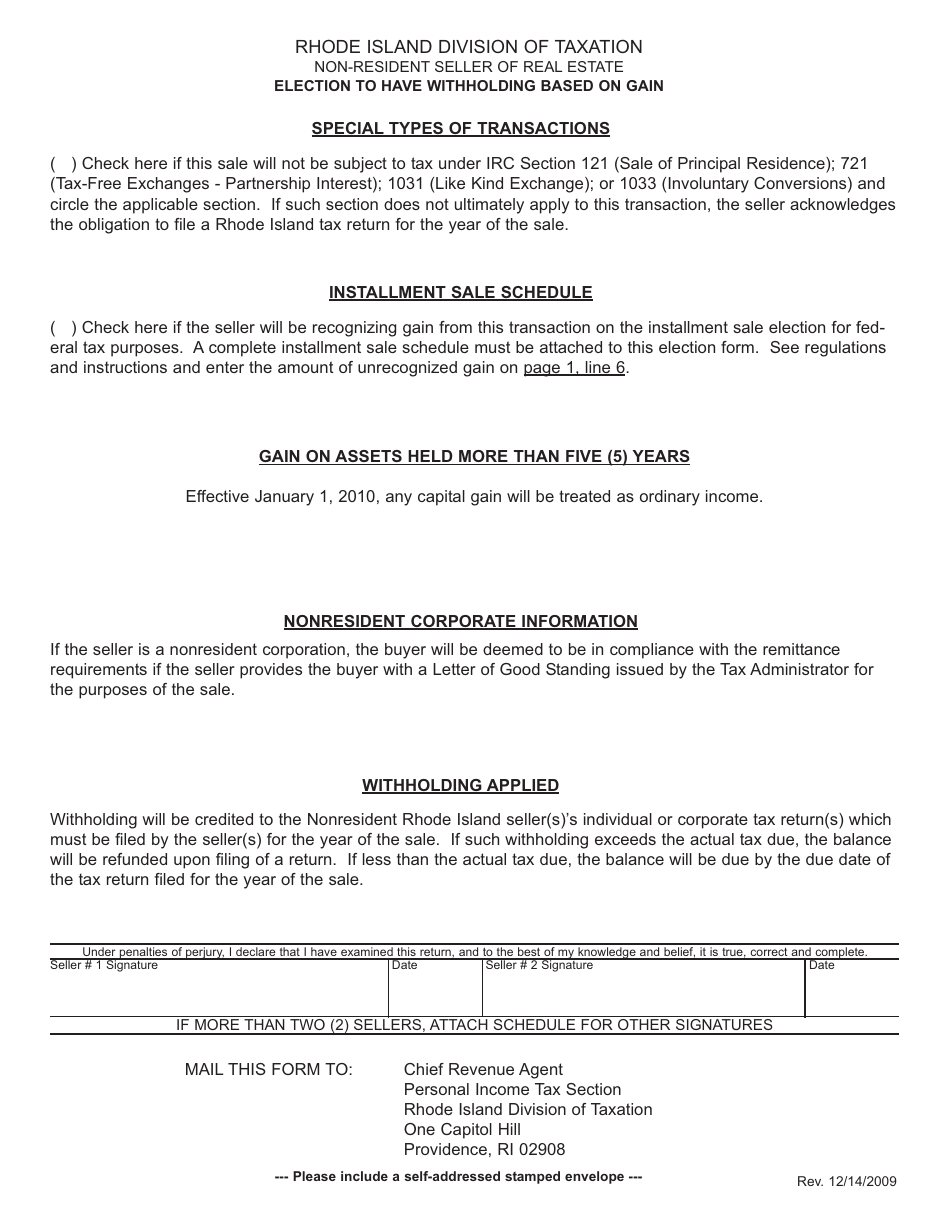

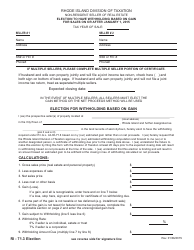

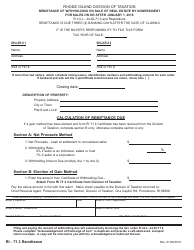

Form 71.3 Non-resident Seller of Real Estate - Election to Have Withholding Based on Gain - Rhode Island

What Is Form 71.3?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 71.3?

A: Form 71.3 is a tax form used by non-resident sellers of real estate in Rhode Island to elect withholding based on the gain from the sale.

Q: Who needs to file Form 71.3?

A: Non-residents who are selling real estate in Rhode Island and want to have withholding based on the gain from the sale need to file Form 71.3.

Q: What is the purpose of Form 71.3?

A: The purpose of Form 71.3 is to provide the Rhode Island Division of Taxation with information about the non-resident seller's election to have withholding based on the gain from the sale of real estate.

Q: When should Form 71.3 be filed?

A: Form 71.3 should be filed at least 15 days prior to the closing of the sale of the real estate.

Q: What information is required to complete Form 71.3?

A: To complete Form 71.3, the non-resident seller needs to provide their personal information, information about the property being sold, and details about the gain from the sale.

Form Details:

- Released on December 14, 2009;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 71.3 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.