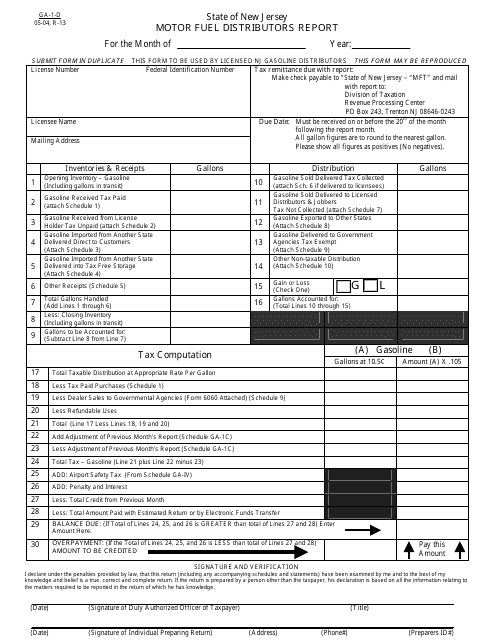

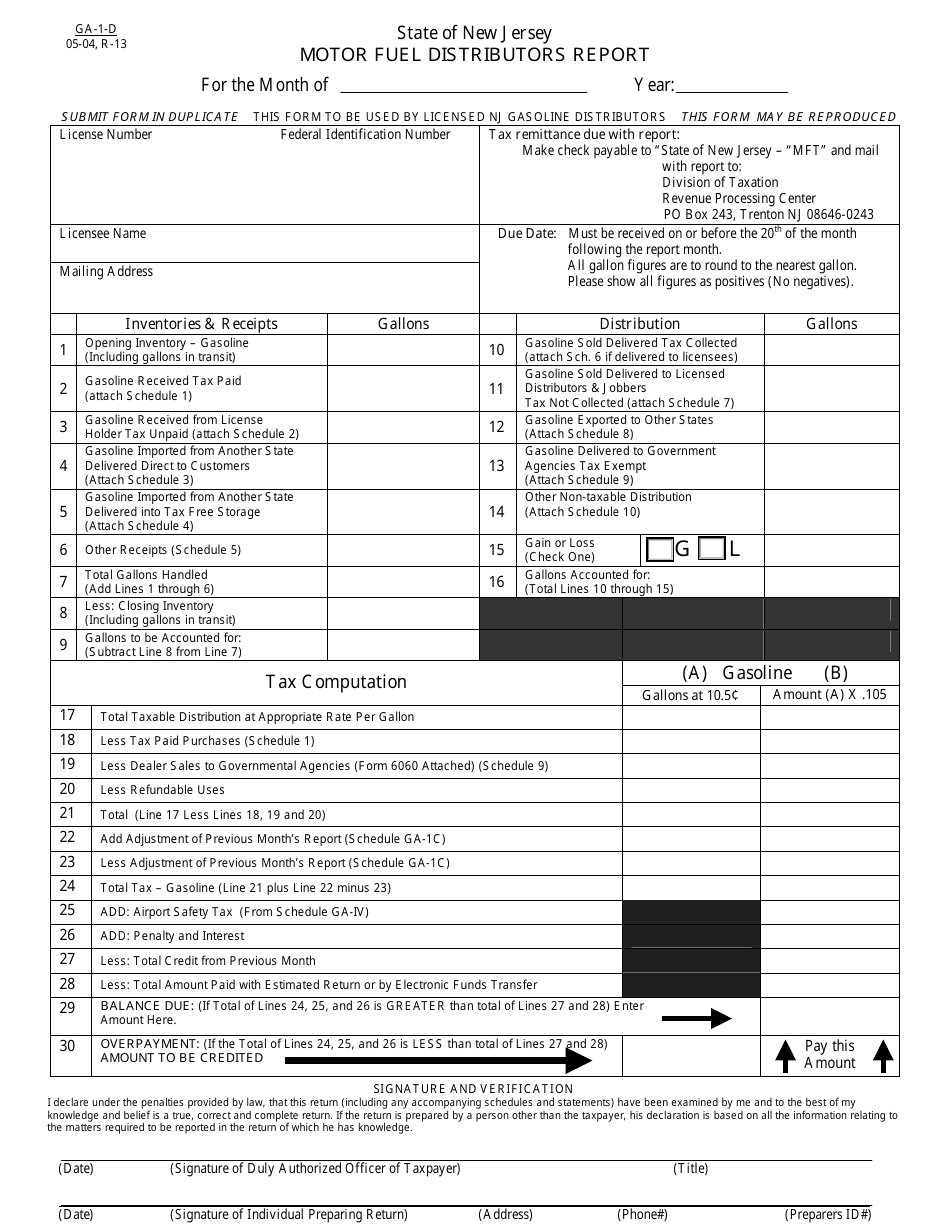

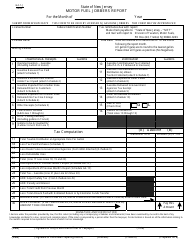

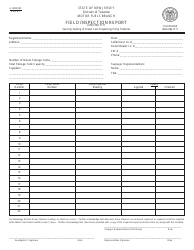

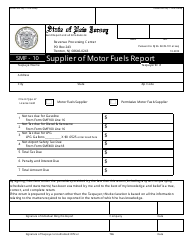

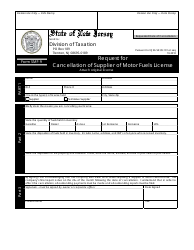

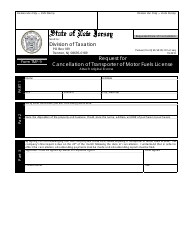

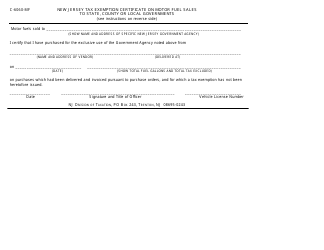

Form GA-1-D Motor Fuel Distributors Report - New Jersey

What Is Form GA-1-D?

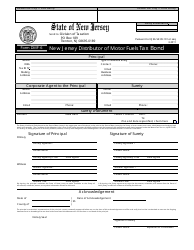

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GA-1-D?

A: Form GA-1-D is the Motor Fuel Distributors Report for New Jersey.

Q: Who needs to file Form GA-1-D?

A: Motor fuel distributors in New Jersey need to file Form GA-1-D.

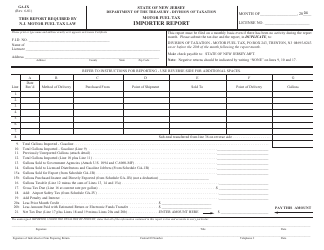

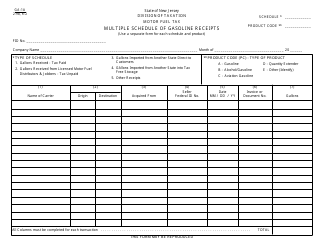

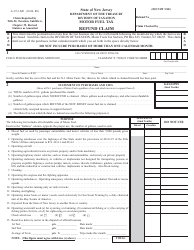

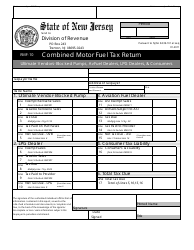

Q: What information is required on Form GA-1-D?

A: Form GA-1-D requires information regarding motor fuel transactions, sales, and use tax liabilities.

Q: When is Form GA-1-D due?

A: Form GA-1-D is due on the 22nd day of the month following the end of the reporting period.

Q: How can Form GA-1-D be filed?

A: Form GA-1-D can be filed electronically or by mail.

Q: Is there a penalty for late filing of Form GA-1-D?

A: Yes, there may be penalties for late filing or failure to file Form GA-1-D.

Form Details:

- Released on May 1, 2004;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-1-D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.