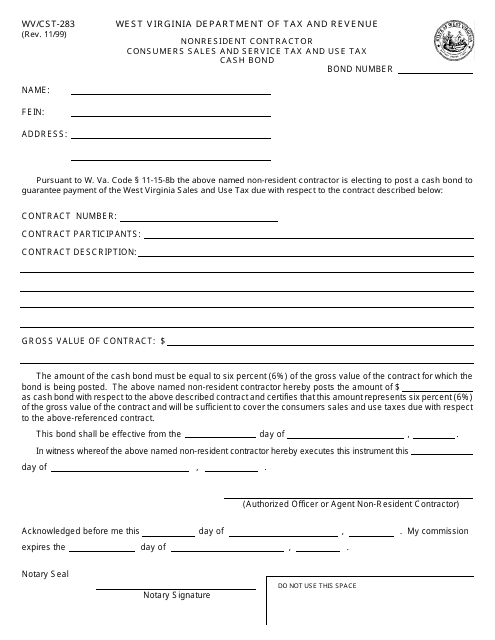

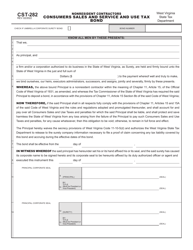

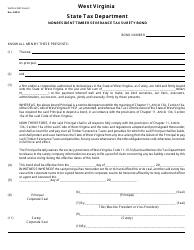

Form WV / CST-283 Nonresident Contractor Consumers Sales and Service Tax and Use Tax Cash Bond - West Virginia

What Is Form WV/CST-283?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/CST-283?

A: WV/CST-283 refers to the Nonresident Contractor Consumers Sales and Service Tax and Use Tax Cash Bond form in West Virginia.

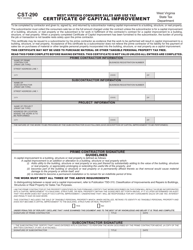

Q: Who needs to fill out WV/CST-283?

A: Nonresident contractors who are engaged in construction activities in West Virginia and are required to collect and pay sales and use tax.

Q: What is the purpose of WV/CST-283?

A: The purpose of WV/CST-283 is to provide a cash bond as security for the payment of sales and use tax by nonresident contractors to the State of West Virginia.

Q: How much is the cash bond for WV/CST-283?

A: The amount of the cash bond required for WV/CST-283 is determined by the West Virginia State Tax Department and will vary depending on the estimated sales and use tax liability of the nonresident contractor.

Q: How long is the cash bond required for WV/CST-283?

A: The cash bond is required for the duration of the nonresident contractor's construction activities in West Virginia.

Q: What happens if the nonresident contractor fails to pay the sales and use tax?

A: If the nonresident contractor fails to pay the sales and use tax, the cash bond may be forfeited and used to cover the unpaid tax liability.

Q: Can the cash bond be refunded?

A: Yes, the cash bond can be refunded once the nonresident contractor has fulfilled all of their sales and use tax obligations and has received a release from the West Virginia State Tax Department.

Q: Are there any exemptions from the cash bond requirement?

A: Yes, there are certain exemptions from the cash bond requirement. These exemptions are outlined in the instructions accompanying WV/CST-283.

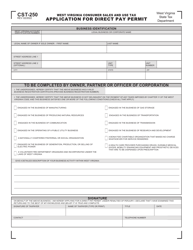

Q: What other documentation is required with WV/CST-283?

A: In addition to the cash bond, nonresident contractors must also submit a completed WV/CST-280 Tax Registration Application and copies of their contractor's license and liability insurance.

Form Details:

- Released on November 1, 1999;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-283 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.