This version of the form is not currently in use and is provided for reference only. Download this version of

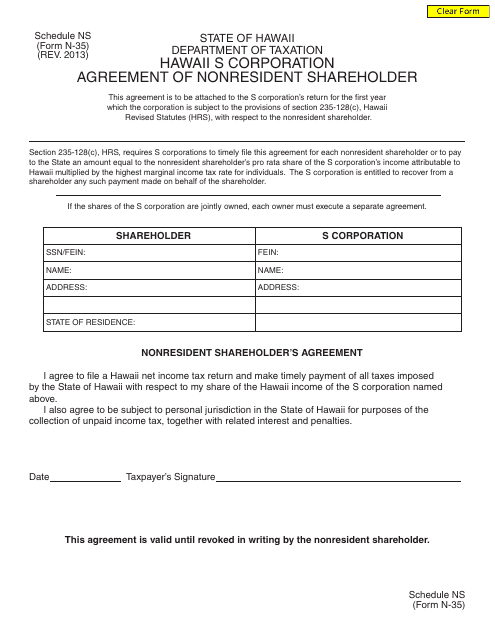

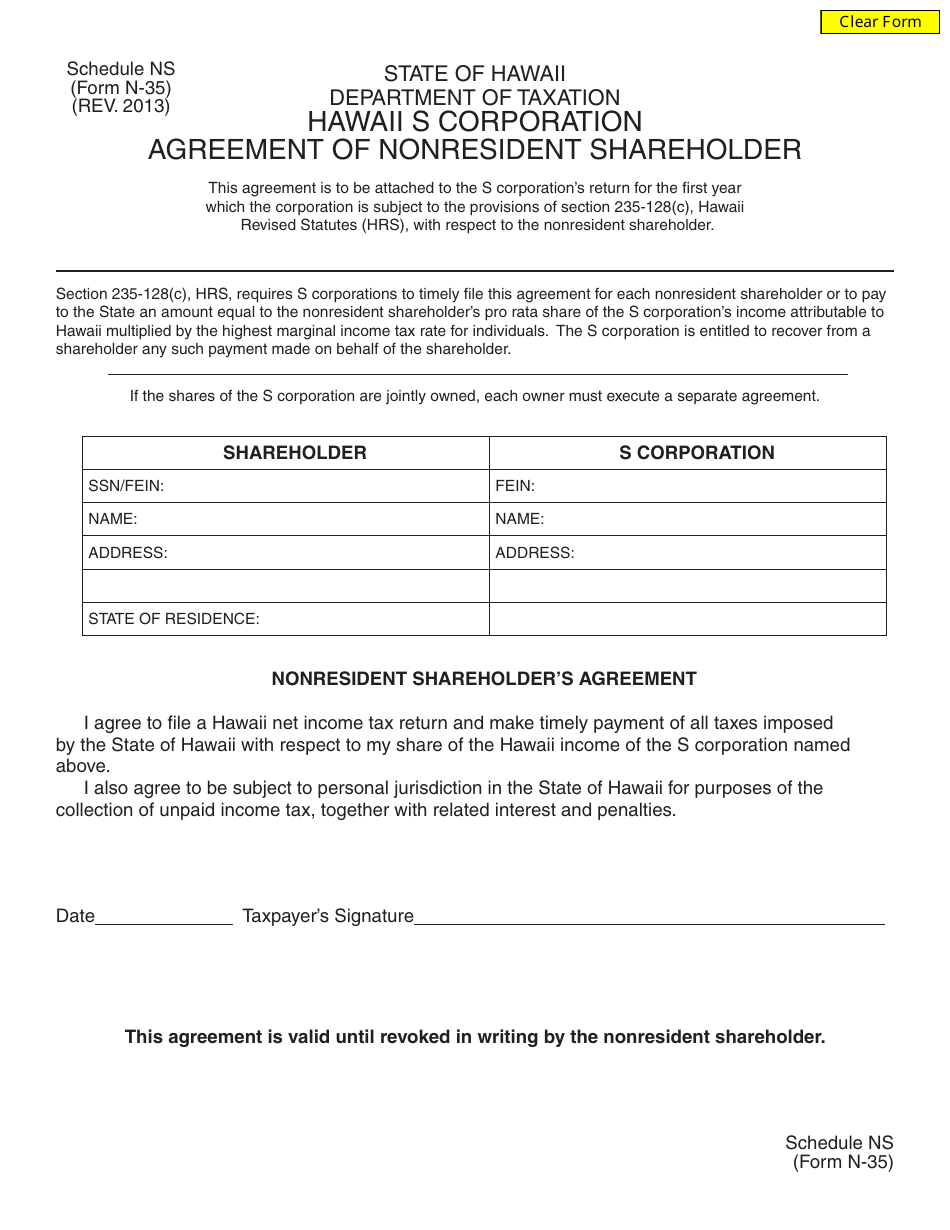

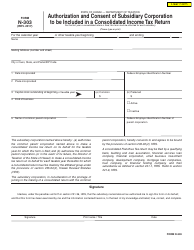

Form N-35 Schedule NS

for the current year.

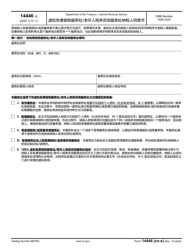

Form N-35 Schedule NS Hawaii S Corporation Agreement of Nonresident Shareholder - Hawaii

What Is Form N-35 Schedule NS?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-35 Schedule NS?

A: Form N-35 Schedule NS is an attachment to Form N-35, which is the tax return form for S corporations in Hawaii.

Q: What is a Hawaii S Corporation Agreement of Nonresident Shareholder?

A: A Hawaii S Corporation Agreement of Nonresident Shareholder is a document that outlines the terms and agreement between a nonresident shareholder and an S corporation in Hawaii.

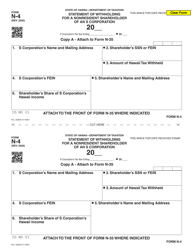

Q: Who needs to file Form N-35 Schedule NS?

A: Nonresident shareholders of S corporations in Hawaii are required to file Form N-35 Schedule NS.

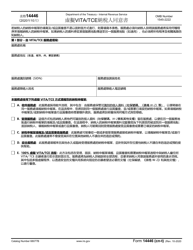

Q: What information is required on Form N-35 Schedule NS?

A: Form N-35 Schedule NS requires information about the nonresident shareholder's name, address, ownership percentage, and any deductions or credits.

Q: When is the deadline to file Form N-35 Schedule NS?

A: The deadline to file Form N-35 Schedule NS is the same as the deadline for filing Form N-35, which is generally the 20th day of the 4th month after the close of the tax year.

Q: What happens if I don't file Form N-35 Schedule NS?

A: Failure to file Form N-35 Schedule NS may result in penalties and interest imposed by the Hawaii Department of Taxation.

Q: Do I need to file Form N-35 Schedule NS if I am a resident shareholder?

A: No, Form N-35 Schedule NS is only required for nonresident shareholders.

Q: Is Form N-35 Schedule NS the only form I need to file for my S corporation in Hawaii?

A: No, you also need to file Form N-35, which is the tax return form for S corporations in Hawaii.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 Schedule NS by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.