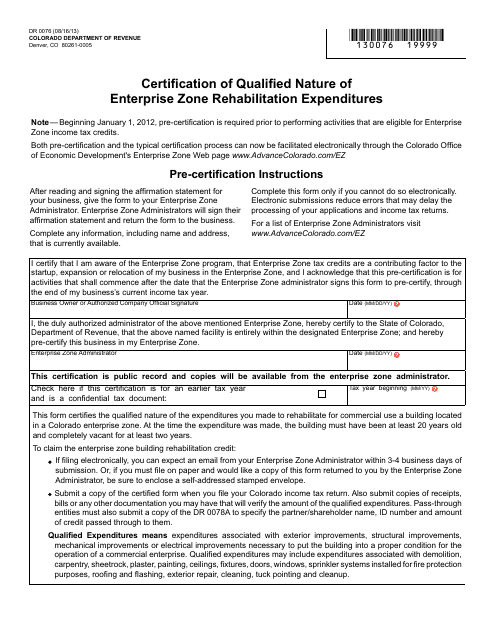

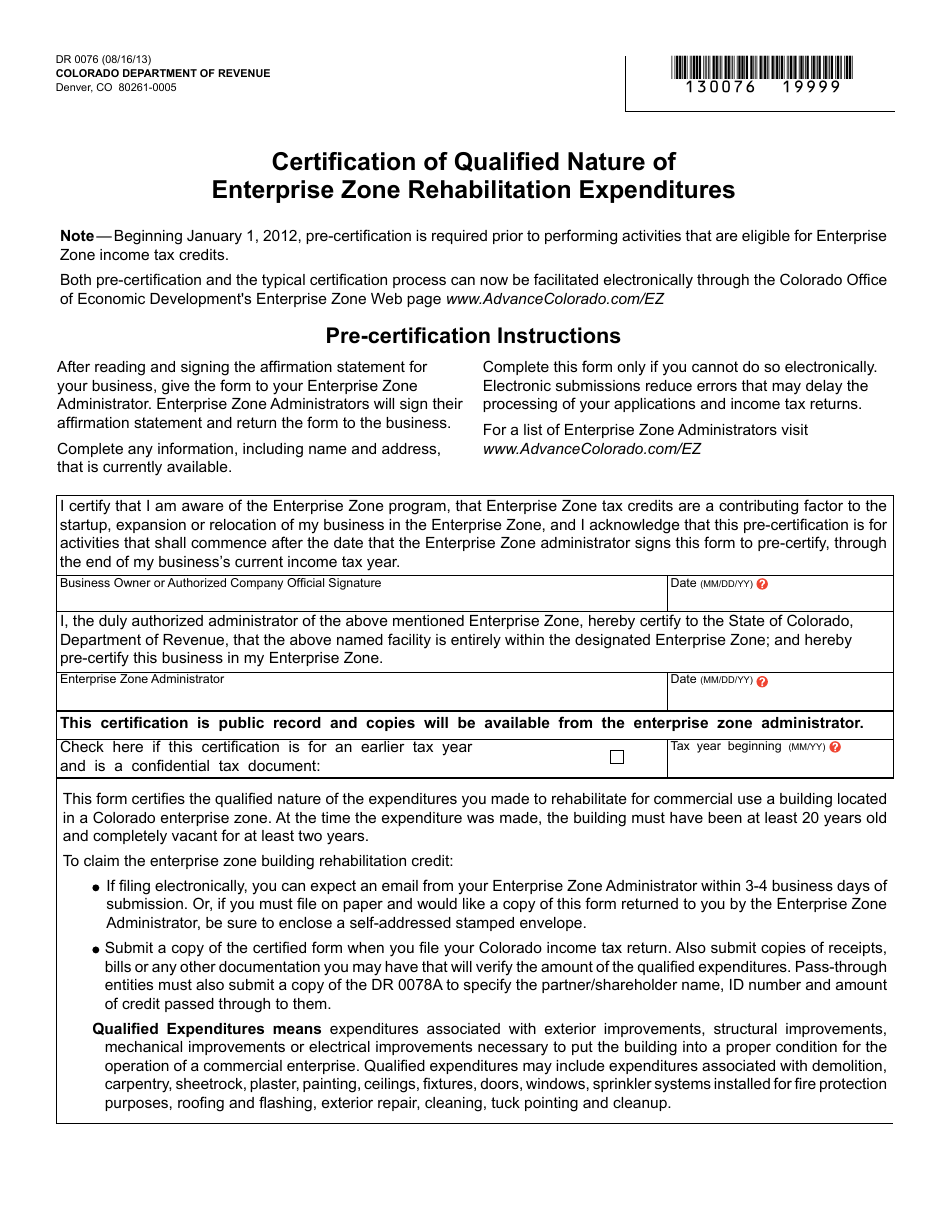

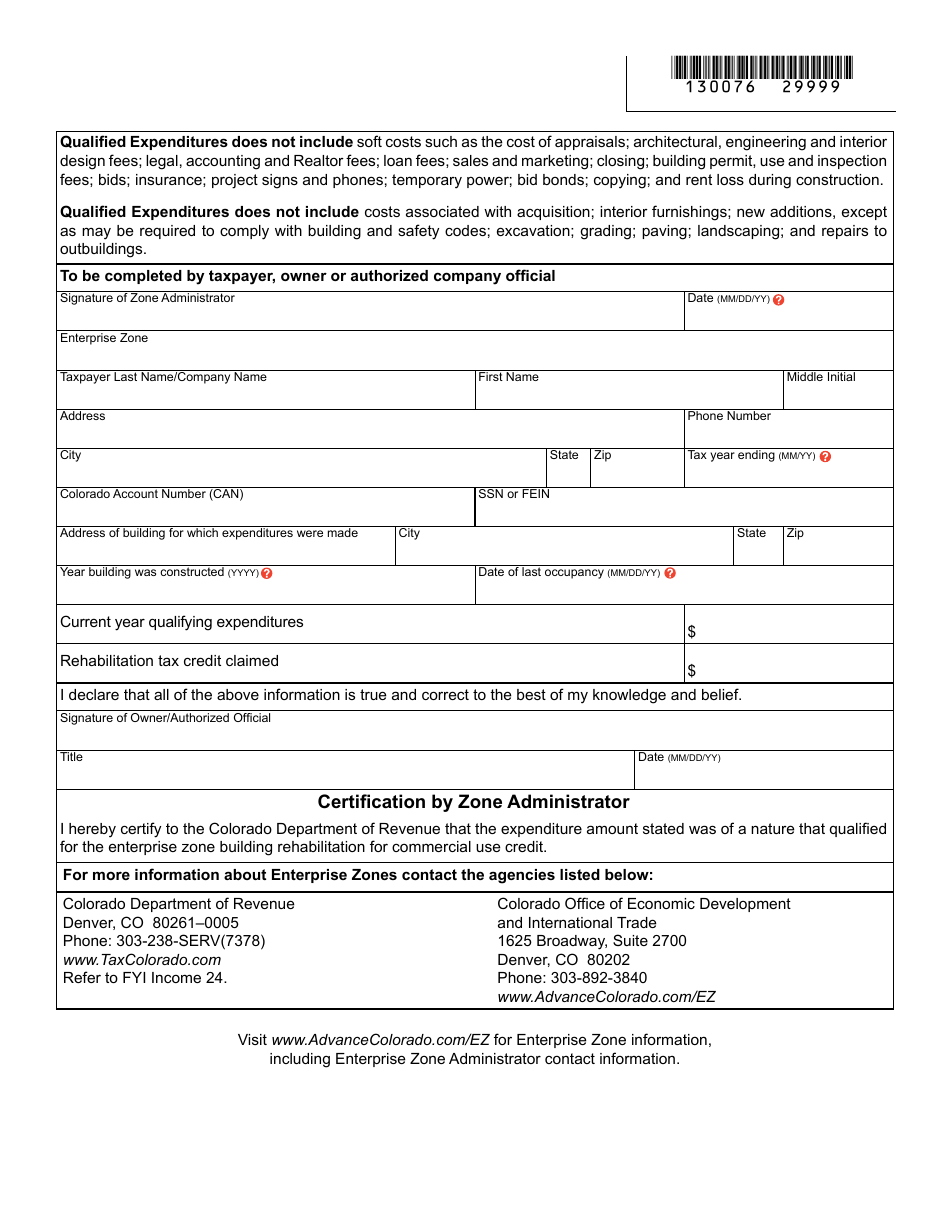

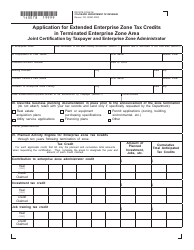

Form DR0076 Certification of Qualified Nature of Enterprise Zone Rehabilitation Expenditures - Colorado

What Is Form DR0076?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0076?

A: Form DR0076 is a certification form used in Colorado to verify the qualified nature of enterprise zone rehabilitation expenditures.

Q: What is the purpose of Form DR0076?

A: The purpose of Form DR0076 is to certify that the rehabilitation expenditures meet the criteria for qualification as enterprise zone rehabilitation expenditures.

Q: Who needs to fill out Form DR0076?

A: Any individual or organization claiming enterprise zone rehabilitation expenditures in Colorado needs to fill out Form DR0076.

Q: When should Form DR0076 be submitted?

A: Form DR0076 should be submitted with the taxpayer's income tax return for the tax year in which the rehabilitation expenditures were made.

Q: Are there any fees associated with filing Form DR0076?

A: There are no fees associated with filing Form DR0076.

Q: What supporting documentation is required with Form DR0076?

A: Supporting documentation, such as invoices and receipts, must be provided to substantiate the rehabilitation expenditures.

Q: Who can certify Form DR0076?

A: Form DR0076 must be certified by the appropriate zoning authority or a designated appointee.

Q: What happens after submitting Form DR0076?

A: After submitting Form DR0076, it will be reviewed by the Colorado Department of Revenue to determine if the rehabilitation expenditures qualify as enterprise zone rehabilitation expenditures.

Q: What if there is an error on Form DR0076?

A: If there is an error on Form DR0076, a corrected form should be filed as soon as possible to avoid any potential penalties or delays in processing the claim.

Form Details:

- Released on August 16, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0076 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.