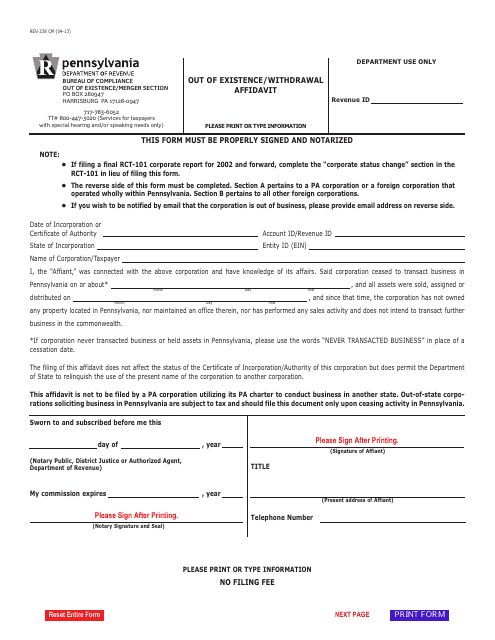

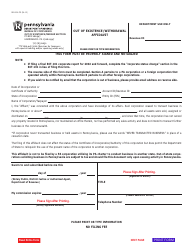

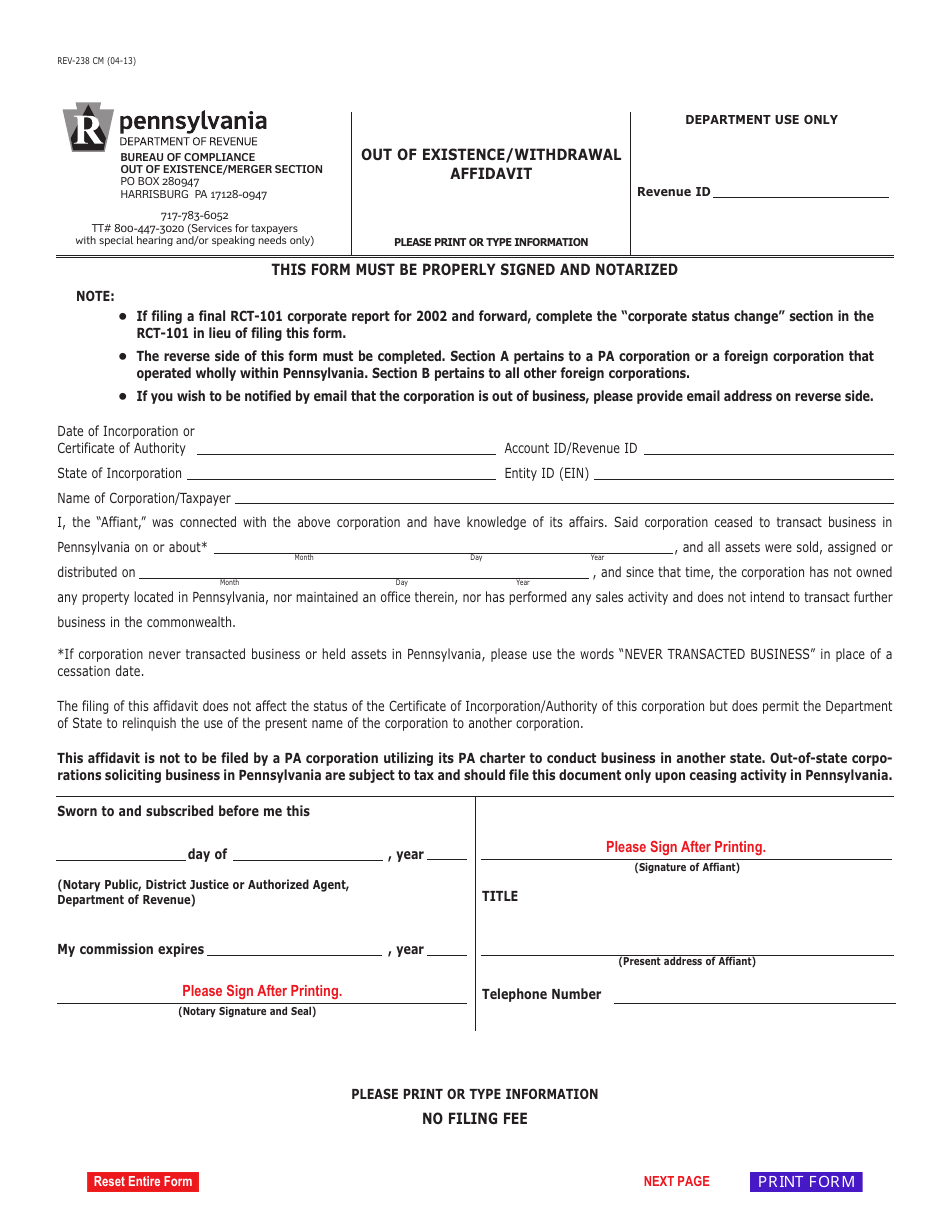

Form REV-238 CM Out of Existence / Withdrawal Affidavit - Pennsylvania

What Is Form REV-238 CM?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-238 CM?

A: Form REV-238 CM is the Out of Existence/Withdrawal Affidavit for businesses in Pennsylvania.

Q: What is the purpose of Form REV-238 CM?

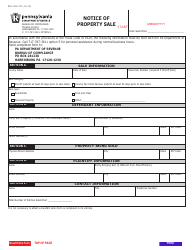

A: The purpose of Form REV-238 CM is to officially withdraw or dissolve a business entity in Pennsylvania.

Q: Who needs to file Form REV-238 CM?

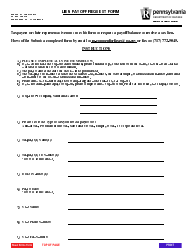

A: Business entities, such as corporations, limited liability companies (LLCs), partnerships, and associations, that wish to voluntarily cease operations in Pennsylvania need to file Form REV-238 CM.

Q: Are there any fees for filing Form REV-238 CM?

A: There are no fees for filing Form REV-238 CM.

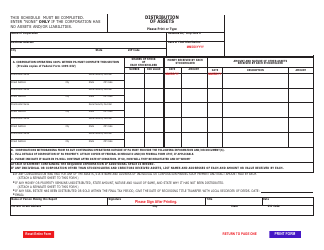

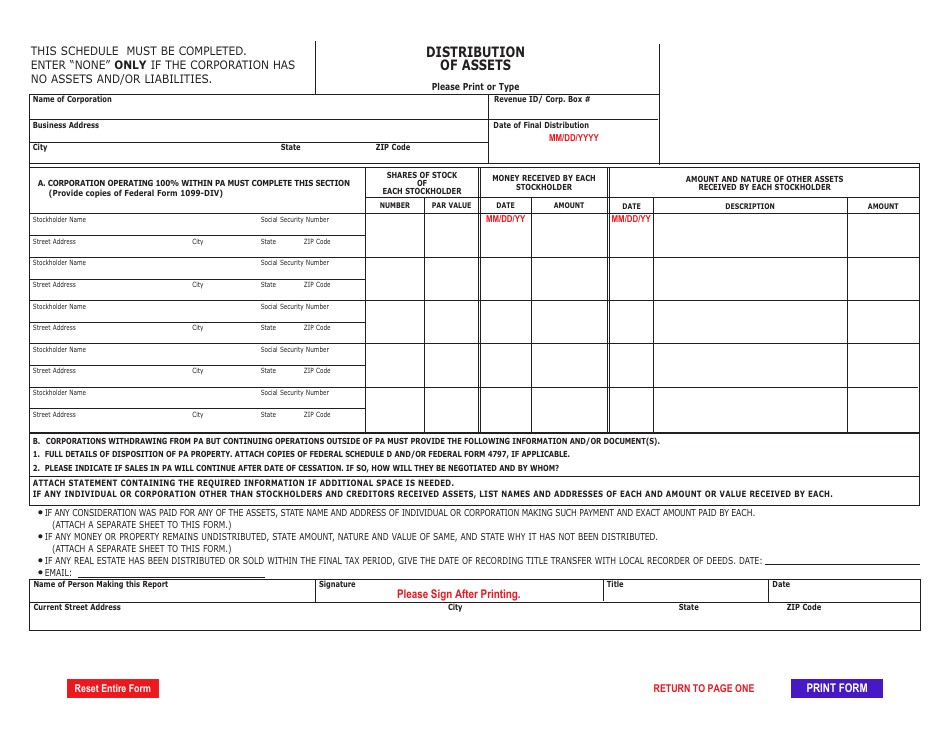

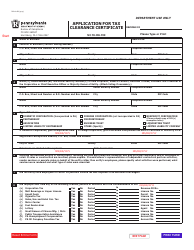

Q: What information do I need to provide on Form REV-238 CM?

A: You will need to provide your business entity's name, address, employer identification number (EIN) or social security number (SSN), and details about your business's dissolution or withdrawal.

Q: What happens after I file Form REV-238 CM?

A: After you file Form REV-238 CM, the Pennsylvania Department of Revenue will process your request and update their records to reflect the dissolution or withdrawal of your business entity.

Q: Is there a deadline for filing Form REV-238 CM?

A: There is no specific deadline for filing Form REV-238 CM, but it is recommended to submit the form as soon as possible after ceasing operations.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-238 CM by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.