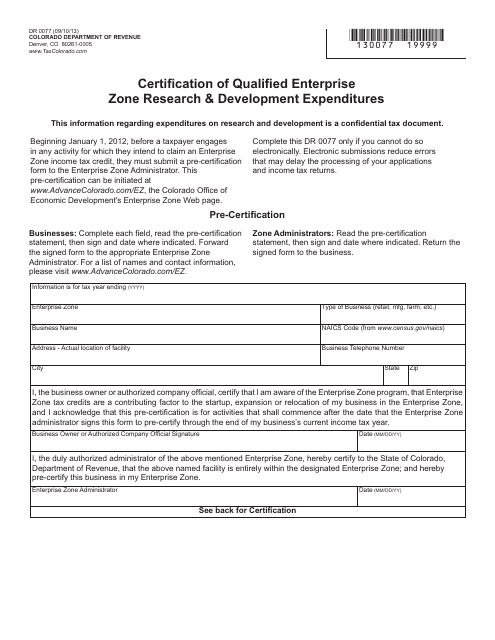

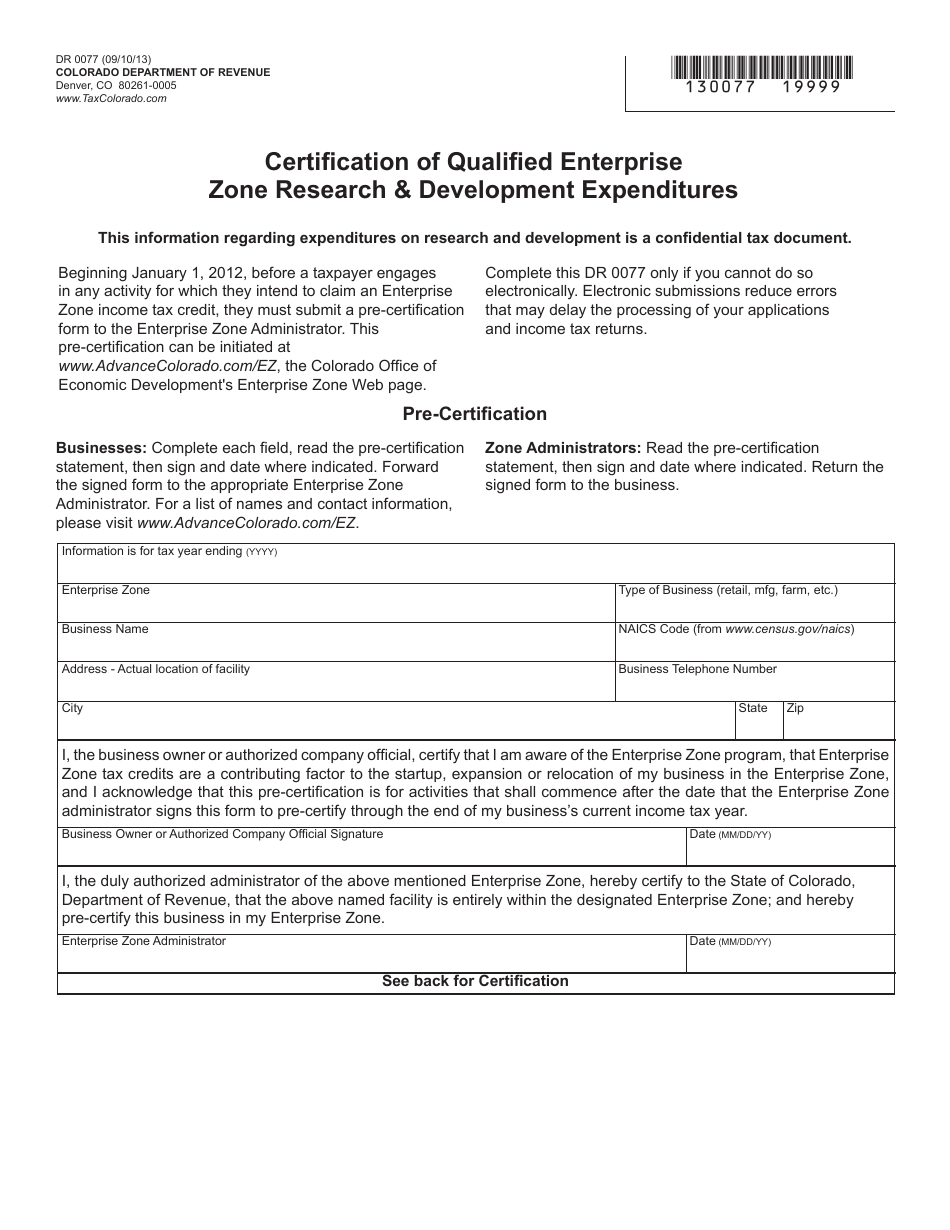

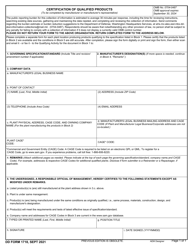

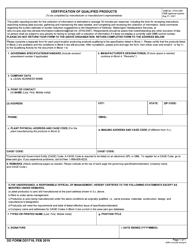

Form DR0077 Certification of Qualified Enterprise Zone Research & Development Expenditures - Colorado

What Is Form DR0077?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0077?

A: Form DR0077 is a certification form for Qualified Enterprise Zone Research & Development Expenditures in Colorado.

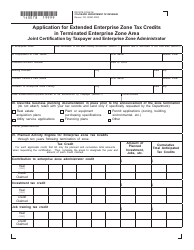

Q: What is a Qualified Enterprise Zone?

A: A Qualified Enterprise Zone is a designated area within Colorado that offers certain tax incentives to businesses.

Q: What are Research & Development Expenditures?

A: Research & Development Expenditures refer to expenses incurred by businesses in conducting qualified research activities.

Q: Who needs to file Form DR0077?

A: Businesses that have incurred qualified research and development expenditures in a designated Enterprise Zone in Colorado need to file Form DR0077.

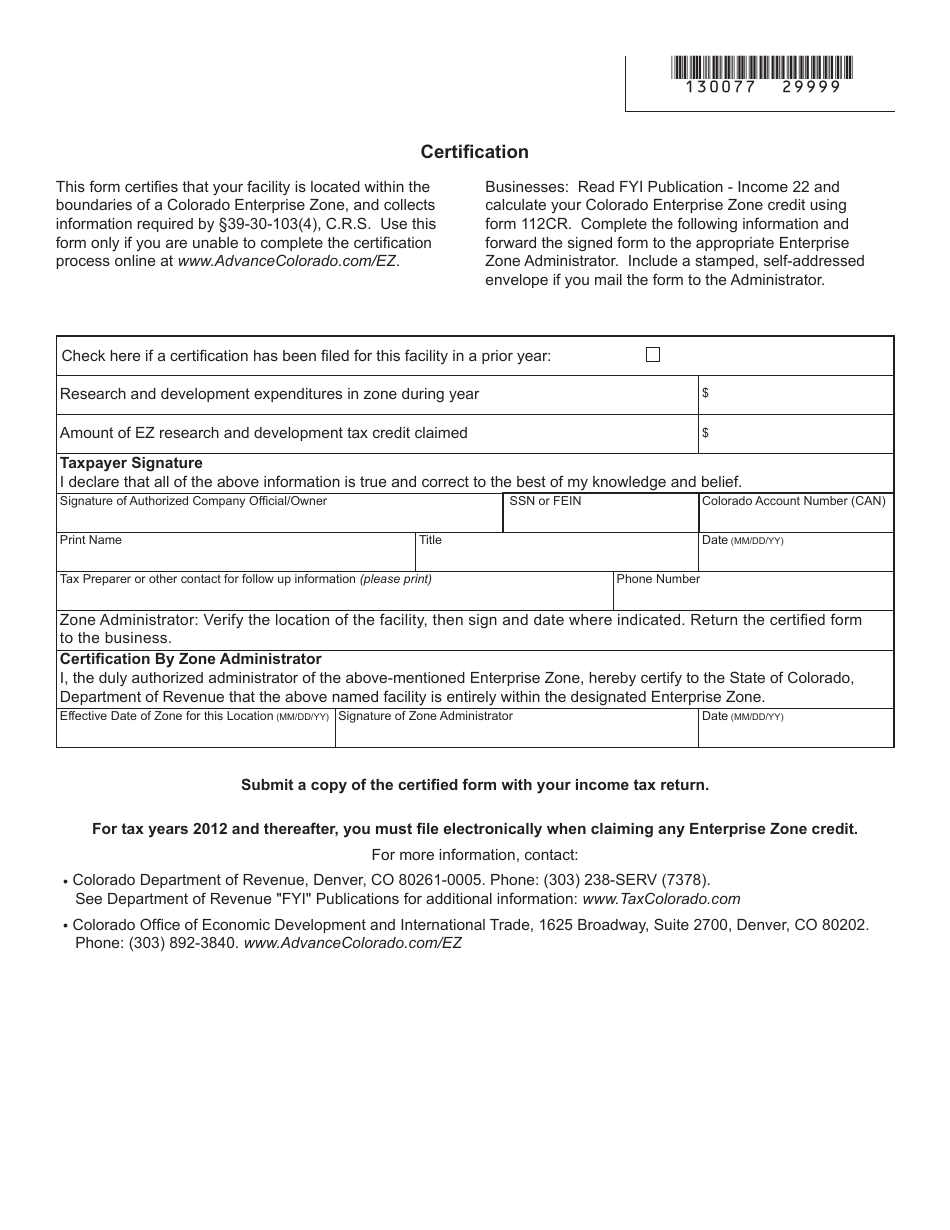

Q: What is the purpose of filing Form DR0077?

A: The purpose of filing Form DR0077 is to certify the amount of qualified research and development expenditures incurred by a business in a designated Enterprise Zone in order to claim certain tax credits.

Q: When is the deadline for filing Form DR0077?

A: The deadline for filing Form DR0077 is typically the same as the deadline for filing the business's annual tax return, which is generally April 15th of each year.

Q: Are there any penalties for not filing Form DR0077?

A: Yes, failure to file Form DR0077 or filing it late can result in the loss of certain tax credits and incentives for the business.

Q: Do I need to include supporting documentation with Form DR0077?

A: Yes, you may need to include supporting documentation such as receipts and records of the qualified research and development expenditures with Form DR0077.

Form Details:

- Released on September 10, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0077 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.