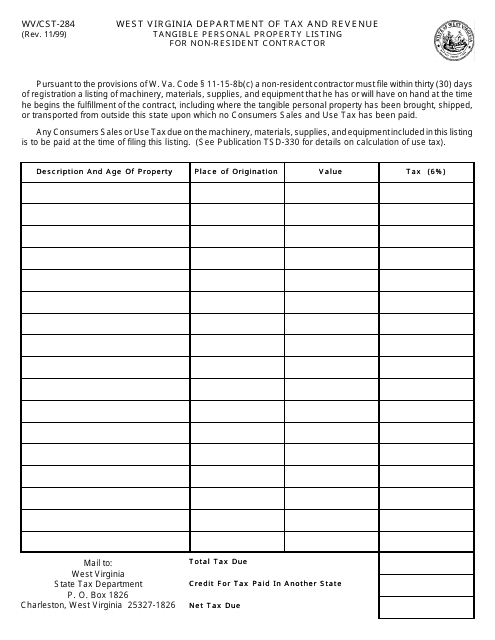

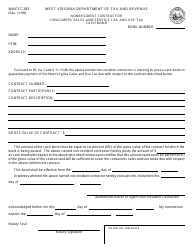

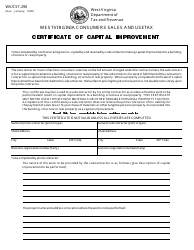

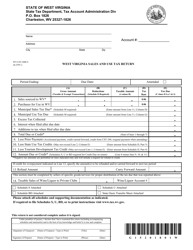

Form WV / CST-284 Tangible Personal Property Listing for Non-resident Contractor - West Virginia

What Is Form WV/CST-284?

This is a legal form that was released by the West Virginia Department of Revenue - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

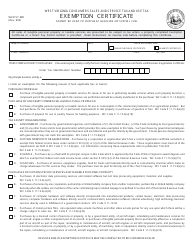

Q: What is the WV/CST-284 form?

A: The WV/CST-284 form is a Tangible Personal Property Listing form for Non-resident Contractors in West Virginia.

Q: Who needs to file the WV/CST-284 form?

A: Non-resident Contractors in West Virginia need to file the WV/CST-284 form.

Q: What is the purpose of the WV/CST-284 form?

A: The WV/CST-284 form is used to report tangible personal property used in connection with construction contracts in West Virginia.

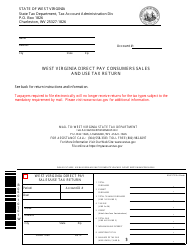

Q: When is the WV/CST-284 form due?

A: The WV/CST-284 form is due on or before June 30th each year.

Q: Are there any penalties for not filing the WV/CST-284 form?

A: Yes, there are penalties for not filing the WV/CST-284 form, including fines and interest charges.

Q: Is the WV/CST-284 form applicable to residents of Canada?

A: No, the WV/CST-284 form is applicable only to non-resident contractors in West Virginia.

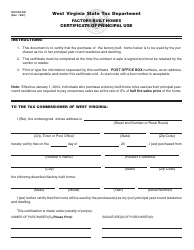

Q: What information do I need to complete the WV/CST-284 form?

A: You will need information about your tangible personal property used in connection with construction contracts, including descriptions, values, and acquisition dates.

Q: Is there a fee for filing the WV/CST-284 form?

A: No, there is no fee for filing the WV/CST-284 form.

Form Details:

- Released on November 1, 1999;

- The latest edition provided by the West Virginia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-284 by clicking the link below or browse more documents and templates provided by the West Virginia Department of Revenue.