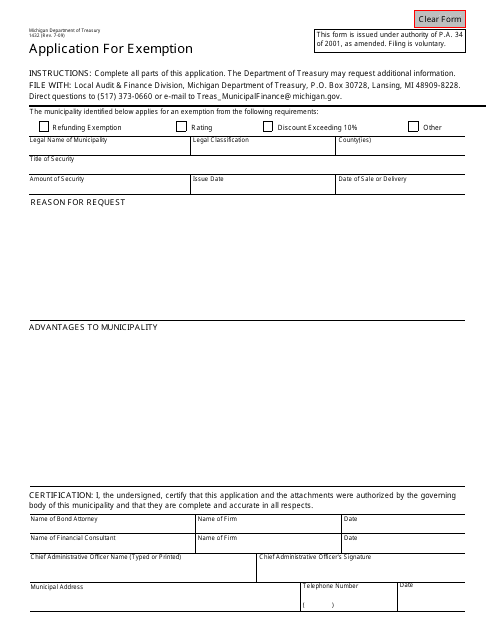

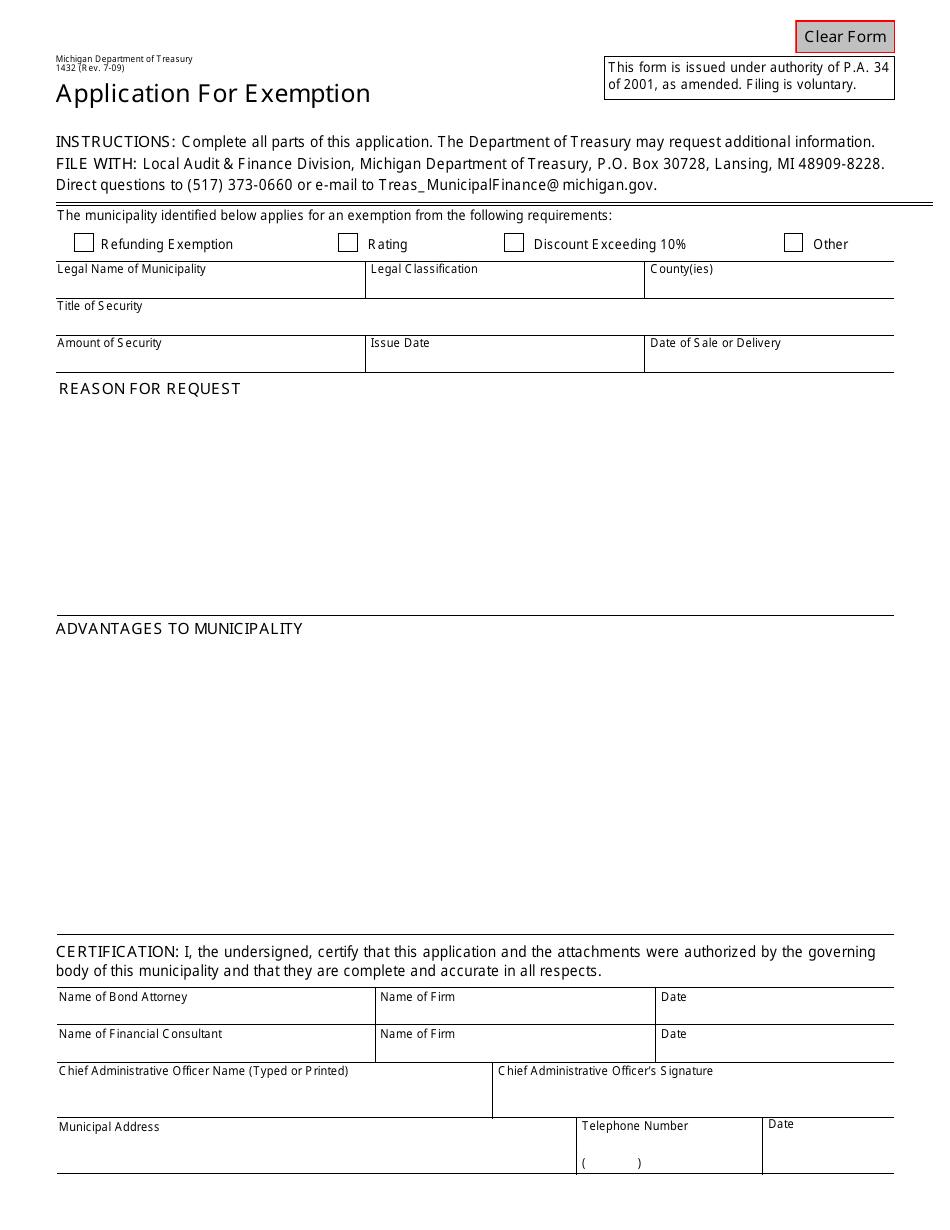

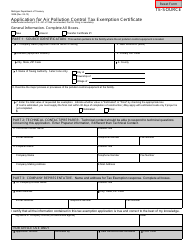

Form 1432 Application for Exemption - Michigan

What Is Form 1432?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1432?

A: Form 1432 is the Application for Exemption in Michigan.

Q: Who can use Form 1432?

A: Form 1432 can be used by individuals or organizations seeking exemption from certain taxes in Michigan.

Q: What taxes can be exempted using Form 1432?

A: Form 1432 can be used to request exemption from sales tax, use tax, and/or other taxes in Michigan.

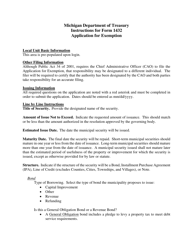

Q: What information is required on Form 1432?

A: Form 1432 requires information about the applicant's identity, tax type, reason for exemption, and supporting documentation.

Q: How do I submit Form 1432?

A: Form 1432 can be submitted electronically or by mail to the Michigan Department of Treasury.

Q: When should I submit Form 1432?

A: Form 1432 should be submitted at least 30 days before the planned exempt activity or transaction.

Q: How long does it take to process Form 1432?

A: The processing time for Form 1432 varies, but it may take several weeks to months to receive a decision.

Q: Can I appeal if my Form 1432 is denied?

A: Yes, you can appeal a denial of exemption by following the instructions provided in the denial notice.

Q: Are there any fees associated with Form 1432?

A: There are no fees associated with submitting Form 1432.

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1432 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.