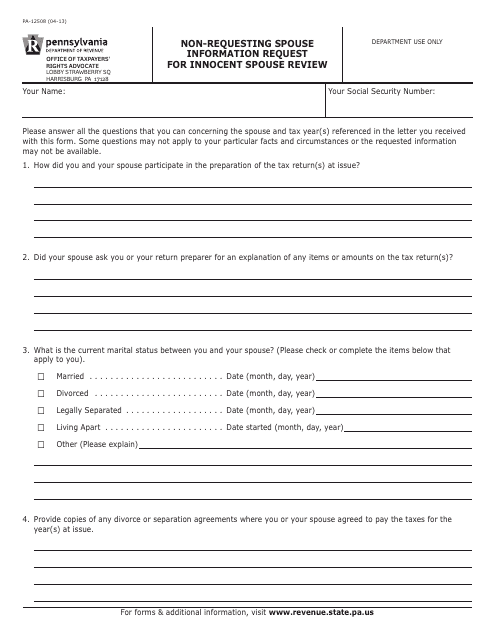

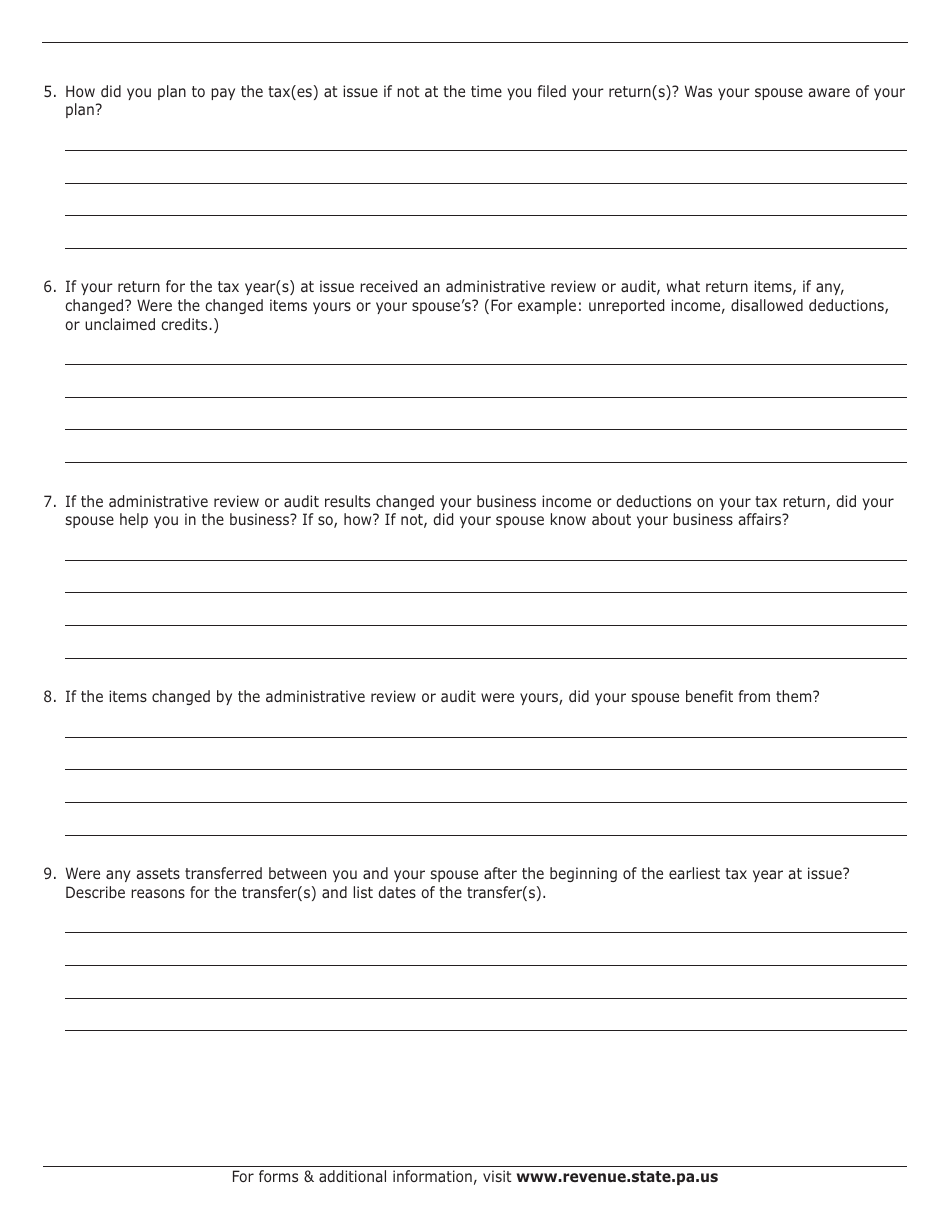

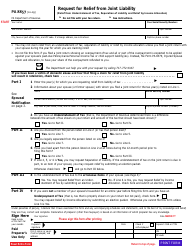

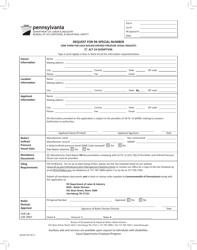

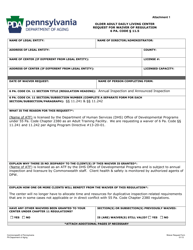

Form PA-12508 Non-requesting Spouse Information Request for Innocent Spouse Review - Pennsylvania

What Is Form PA-12508?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

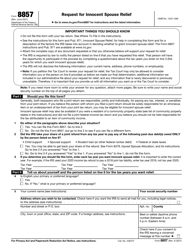

Q: What is Form PA-12508?

A: Form PA-12508 is the Non-requesting Spouse Information Request for Innocent Spouse Review specifically for residents of Pennsylvania.

Q: What is the purpose of Form PA-12508?

A: The purpose of Form PA-12508 is to provide information about the non-requesting spouse for the Innocent Spouse Review.

Q: Who is required to fill out Form PA-12508?

A: The non-requesting spouse is required to fill out Form PA-12508.

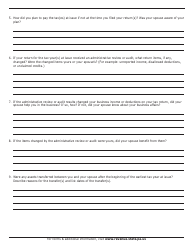

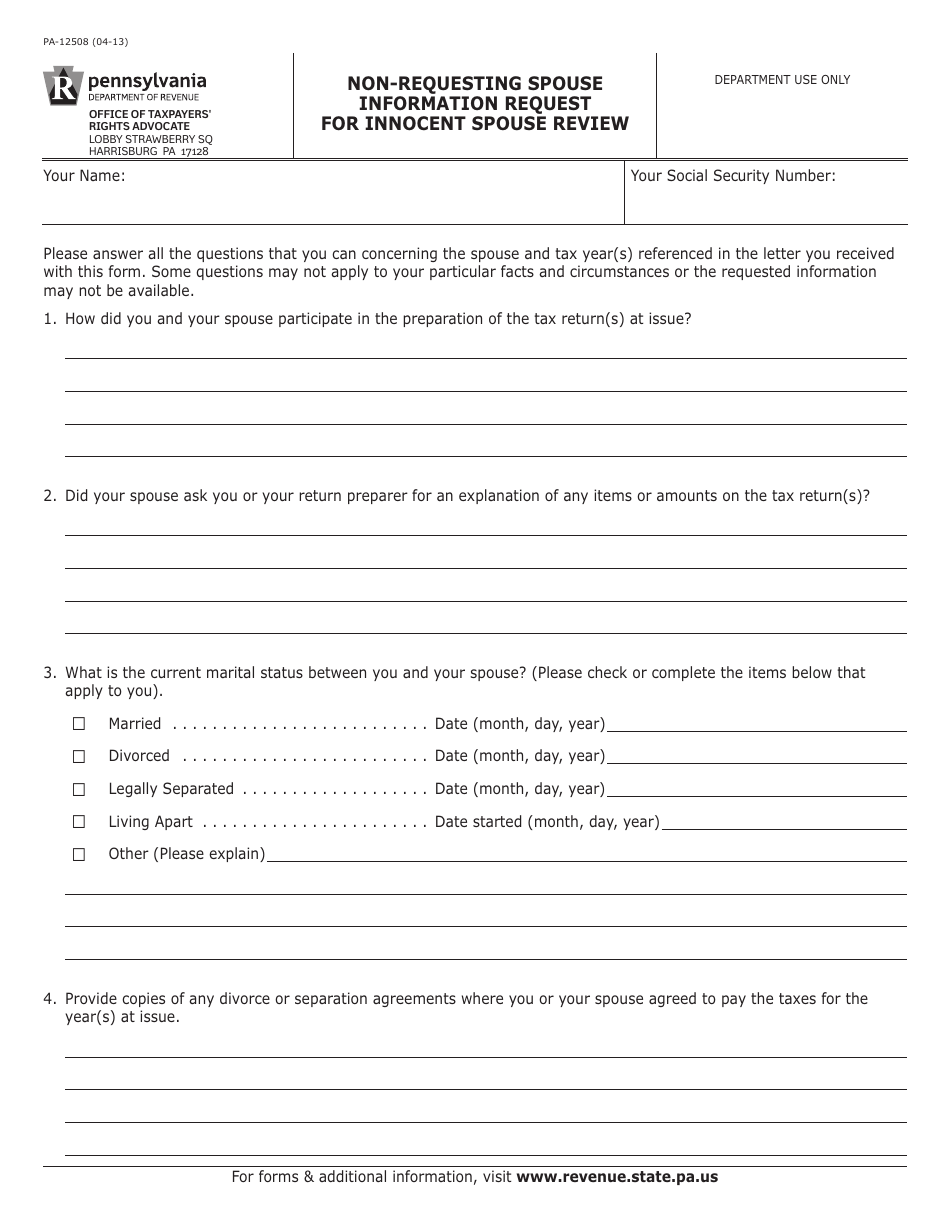

Q: What information is required in Form PA-12508?

A: Form PA-12508 requires information about the non-requesting spouse's income, assets, and liabilities, as well as any correspondence with the requesting spouse regarding the joint return.

Q: Is Form PA-12508 only applicable to innocent spouse review cases?

A: Yes, Form PA-12508 is specifically for innocent spouse review cases and is not applicable to other tax matters.

Q: Is Form PA-12508 specific to Pennsylvania residents?

A: Yes, Form PA-12508 is specific to residents of Pennsylvania and is not used in other states.

Q: Are there any filing fees for Form PA-12508?

A: There are no filing fees associated with Form PA-12508.

Q: How should I submit Form PA-12508?

A: Form PA-12508 should be submitted to the Pennsylvania Department of Revenue by mail or electronically, as instructed on the form.

Q: What should I do if I need assistance with Form PA-12508?

A: If you need assistance with Form PA-12508, you can contact the Pennsylvania Department of Revenue for guidance and support.

Form Details:

- Released on April 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-12508 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.