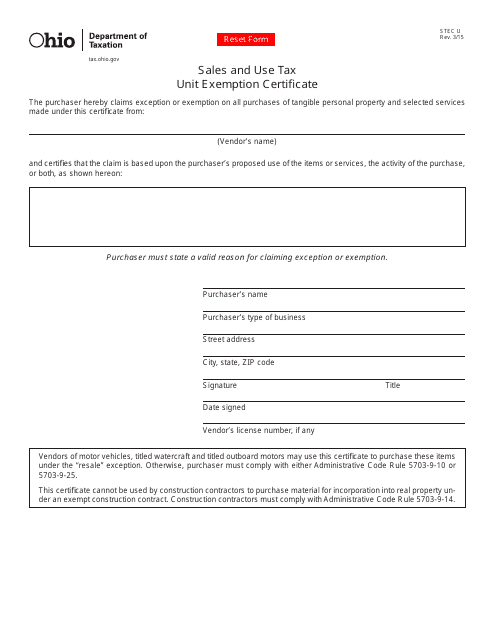

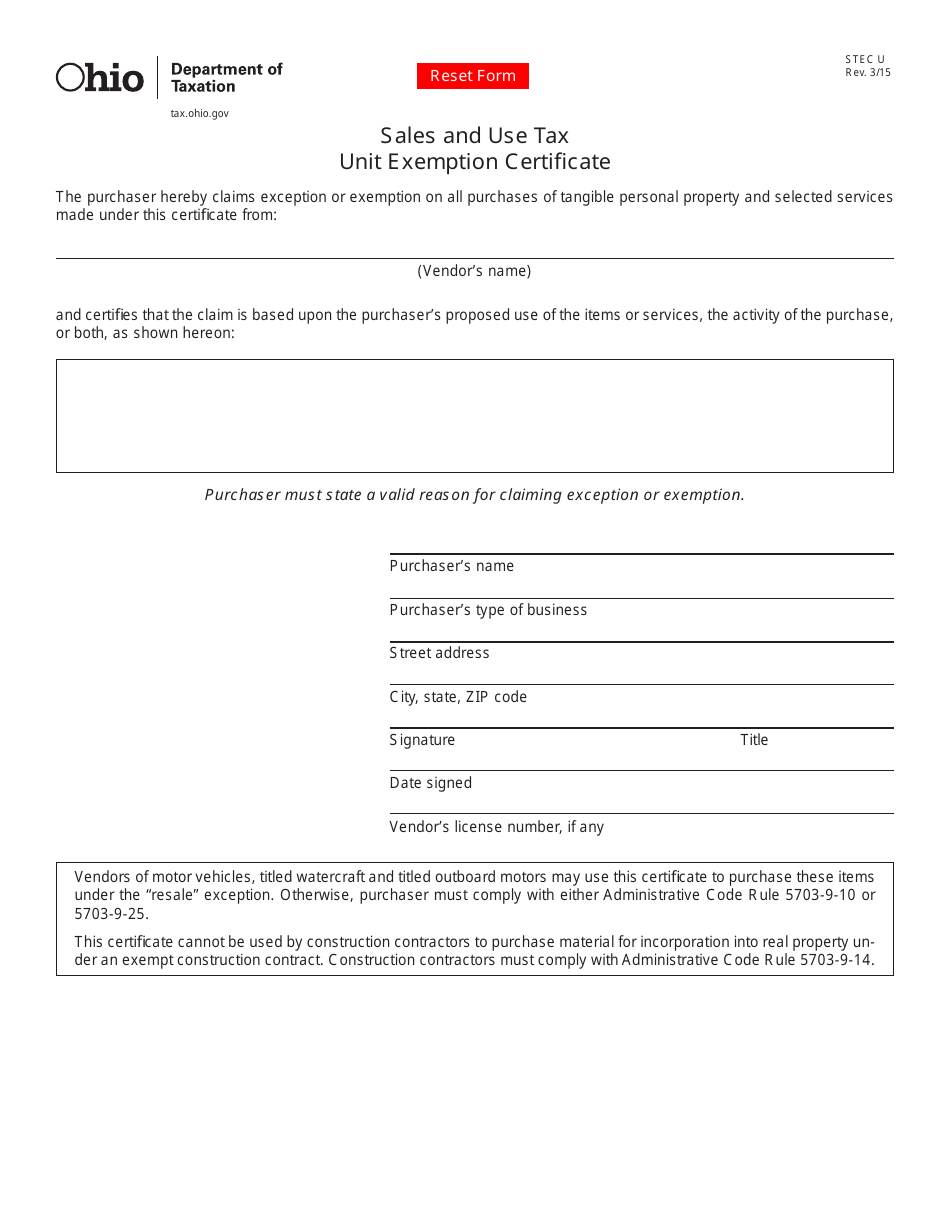

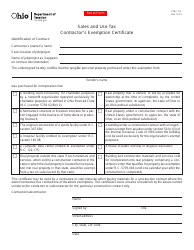

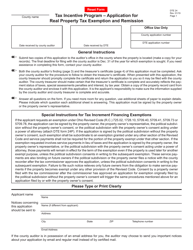

Form STEC U Sales and Use Tax Unit Exemption Certificate - Ohio

What Is Form STEC U?

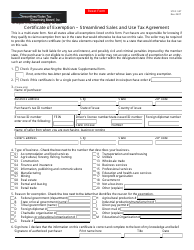

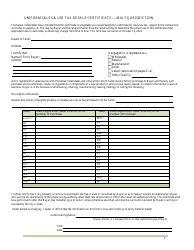

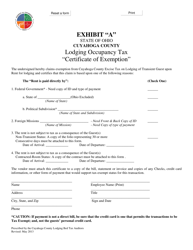

Form STEC U, Sales and Use Tax Unit Exemption Certificate , is a legal document you need to complete to gain tax exemption when buying merchandise to later resell in the state of Ohio. This form will be useful for you if you are a retailer who purchases various products to resell. There is no need to pay sales tax on the purchase because later you will charge sales tax to your customers on the final value of the merchandise and send the collected sales tax to the Department of Taxation. To avoid paying taxes twice, you need to have evidence to prove why sales tax was not collected on a transaction. Only use this document for the inventory that will be resold later.

This form was released by the Ohio Department of Taxation . The latest version of the form was issued on March 1, 2015 , with all previous editions obsolete. A fillable Ohio STEC U Form is available for download below.

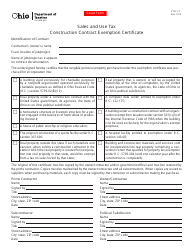

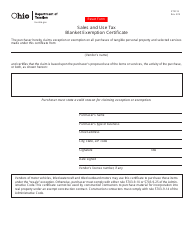

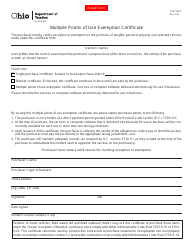

If you want to keep making multiple purchases from the vendor, use Form STEC B, Sales and Use Tax Blanket Exemption Certificate, to avoid having to draft additional forms. Contractors who lead construction projects are required to complete Form STEC CC, Sales and Use Tax Construction Contract Exemption Certificate, or Form STEC CO, Sales and Use Tax Contractor's Exemption Certificate instead.

How to Fill Out Ohio Sales and Use Tax Unit Exemption Certificate?

Before you may sell and collect sales tax from taxable products and services in Ohio, you need to obtain an Ohio Vendor's License from the Department of Taxation. Then, to prove your intention to resell the property or services, you must fill out and provide a valid resale certificate to the seller of the merchandise. The STEC U Form instructions are as follows:

- Name the vendor who sells tangible personal property and services under this certificate;

- Indicate the proposed use of the goods or services, the activity of the purchase, or both. It is required to state a valid reason to explain how your transaction legally allows you to claim exemption;

- Provide the purchaser's personal details - name, type of business, address. Sign the form, adding your title, and write down the actual date of signing;

- If the vendor has a license, record the license number in writing.

Once you complete the form, give it to a retailer who accepts the certificate in good faith and makes sure the document has been signed. An Ohio STEC U Form does not expire and will be valid as long as sales continue. Then, the seller verifies the validity of the resale certificate and keeps it in case of a future audit. The retailer is responsible for examining the certificate and evaluating whether the merchandise sold is reasonably consistent with the buyer's type of business. For instance, if the purchaser's business is a car wash but the form is presented with the purpose of purchasing office supplies tax-free, the matter requires further investigation.