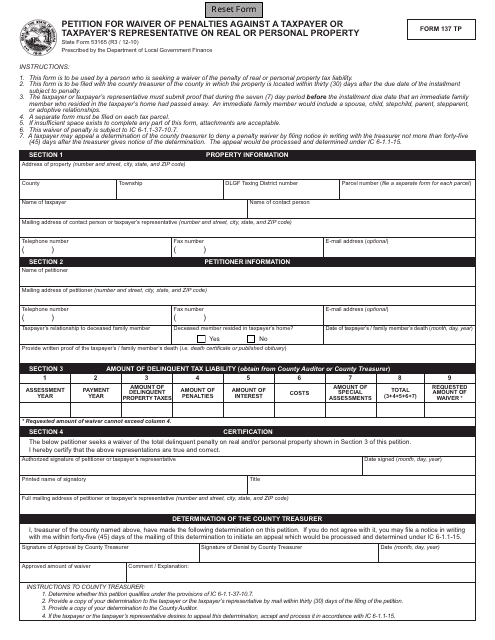

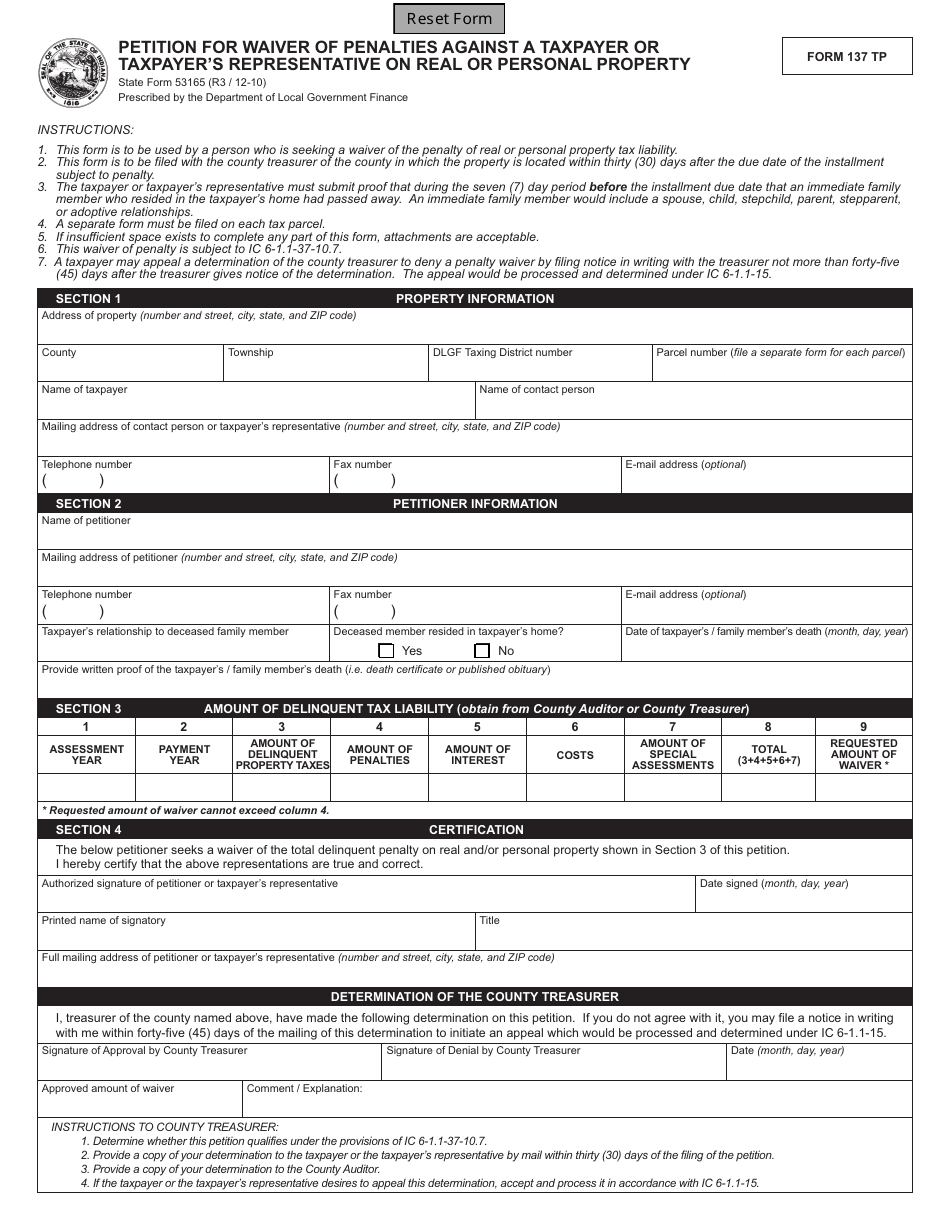

State Form 53165 (137 TP) Petition for Waiver of Penalties Against a Taxpayer or Taxpayer's Representative on Real or Personal Property - Indiana

What Is State Form 53165 (137 TP)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 53165?

A: State Form 53165 is a petition for waiver of penalties against a taxpayer or taxpayer's representative on real or personal property in Indiana.

Q: Who can use State Form 53165?

A: State Form 53165 can be used by taxpayers or their representatives in Indiana who want to request a waiver of penalties on real or personal property.

Q: What is the purpose of State Form 53165?

A: The purpose of State Form 53165 is to request a waiver of penalties imposed on taxpayers or their representatives for real or personal property in Indiana.

Q: Are there any fees associated with submitting State Form 53165?

A: No, there are no fees associated with submitting State Form 53165.

Q: Is there a deadline for submitting State Form 53165?

A: Yes, State Form 53165 must be submitted within 30 days from the date of the penalty notice.

Q: What information is required on State Form 53165?

A: State Form 53165 requires information such as the taxpayer's name, address, tax ID, description of the penalty, reason for the request, and supporting documentation.

Q: How long does it take to process State Form 53165?

A: The processing time for State Form 53165 varies, but it usually takes several weeks.

Q: Can I appeal if my request on State Form 53165 is denied?

A: Yes, if your request on State Form 53165 is denied, you can appeal the decision by following the instructions provided by the Indiana Department of Revenue.

Q: Who should I contact for more information about State Form 53165?

A: For more information about State Form 53165, you can contact the Indiana Department of Revenue or your local Indiana tax office.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53165 (137 TP) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.