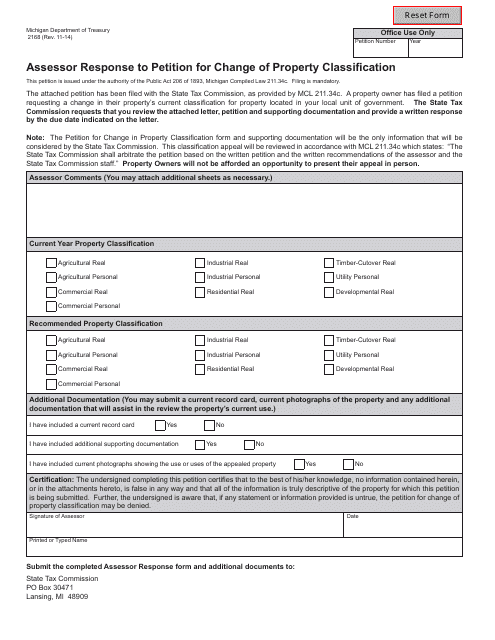

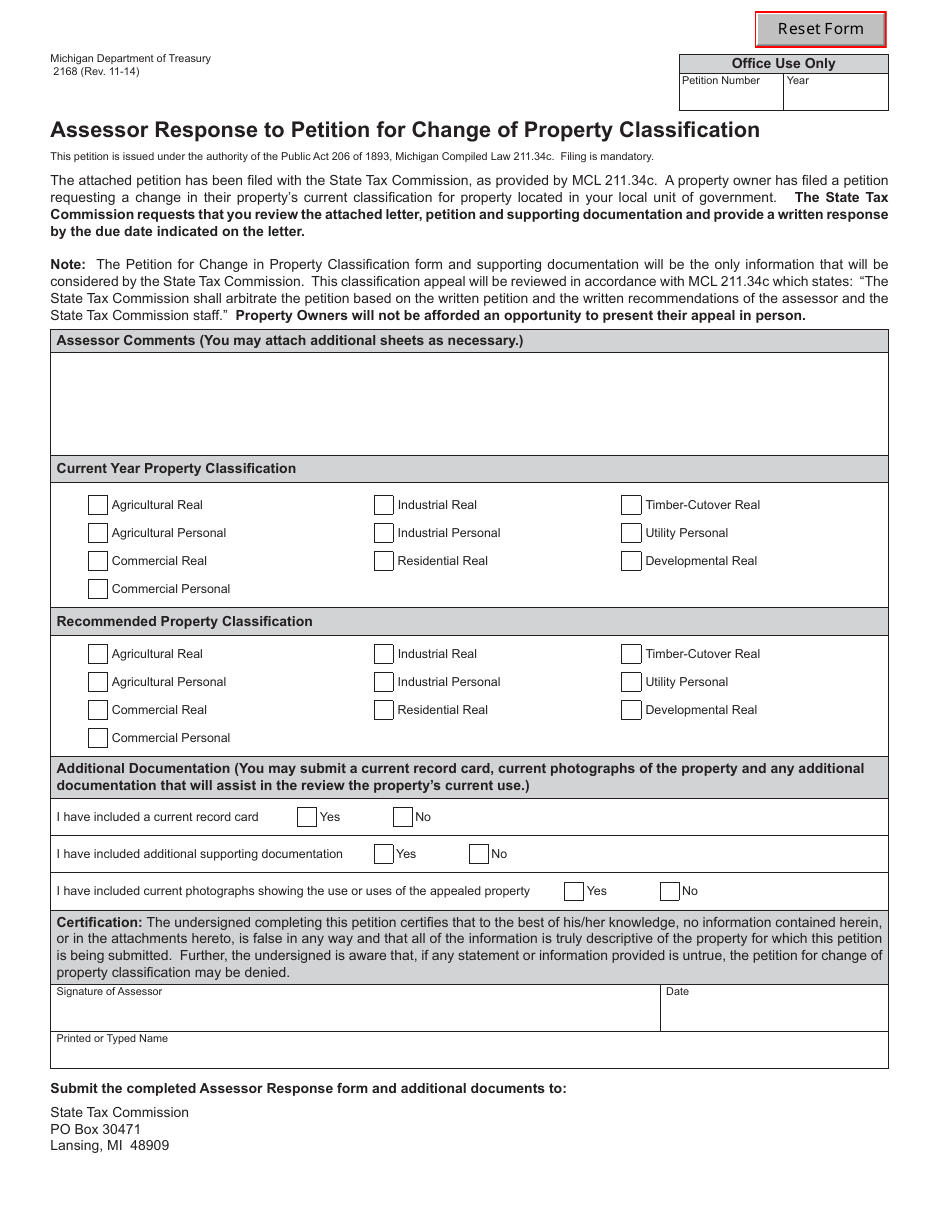

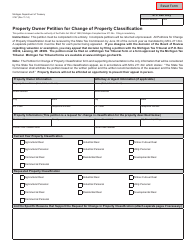

Form 2168 Assessor Response to Petition for Change of Property Classification - Michigan

What Is Form 2168?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

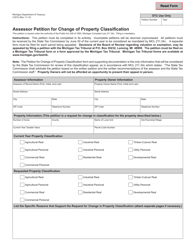

Q: What is Form 2168?

A: Form 2168 is the Assessor Response to Petition for Change of Property Classification in Michigan.

Q: What is the purpose of Form 2168?

A: The purpose of Form 2168 is for the assessor to respond to a petition for change of property classification.

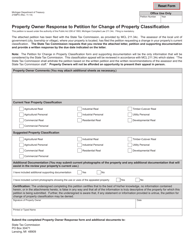

Q: Who uses Form 2168?

A: Form 2168 is used by assessors in Michigan.

Q: Can anyone file a petition for change of property classification?

A: Yes, any property owner can file a petition for change of property classification.

Q: What information is required on Form 2168?

A: Form 2168 requires the property owner's name, address, property identification number, and a description of the requested change in property classification.

Q: Is there a deadline to file Form 2168?

A: Yes, Form 2168 must be filed by May 1st of the assessment year for which the change is requested.

Q: What happens after Form 2168 is submitted?

A: After Form 2168 is submitted, the assessor will review the petition and provide a response.

Q: Can the assessor deny a petition for change of property classification?

A: Yes, the assessor can deny a petition for change of property classification if it does not meet the necessary criteria.

Q: Is there an appeals process if the petition is denied?

A: Yes, if the petition is denied, the property owner can appeal the decision to the Michigan Tax Tribunal.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2168 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.