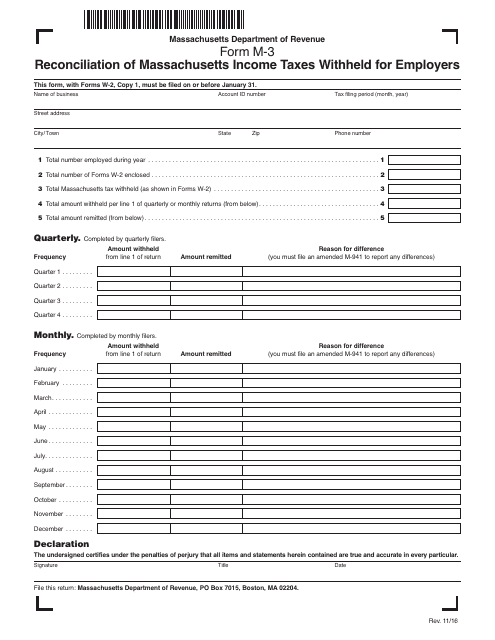

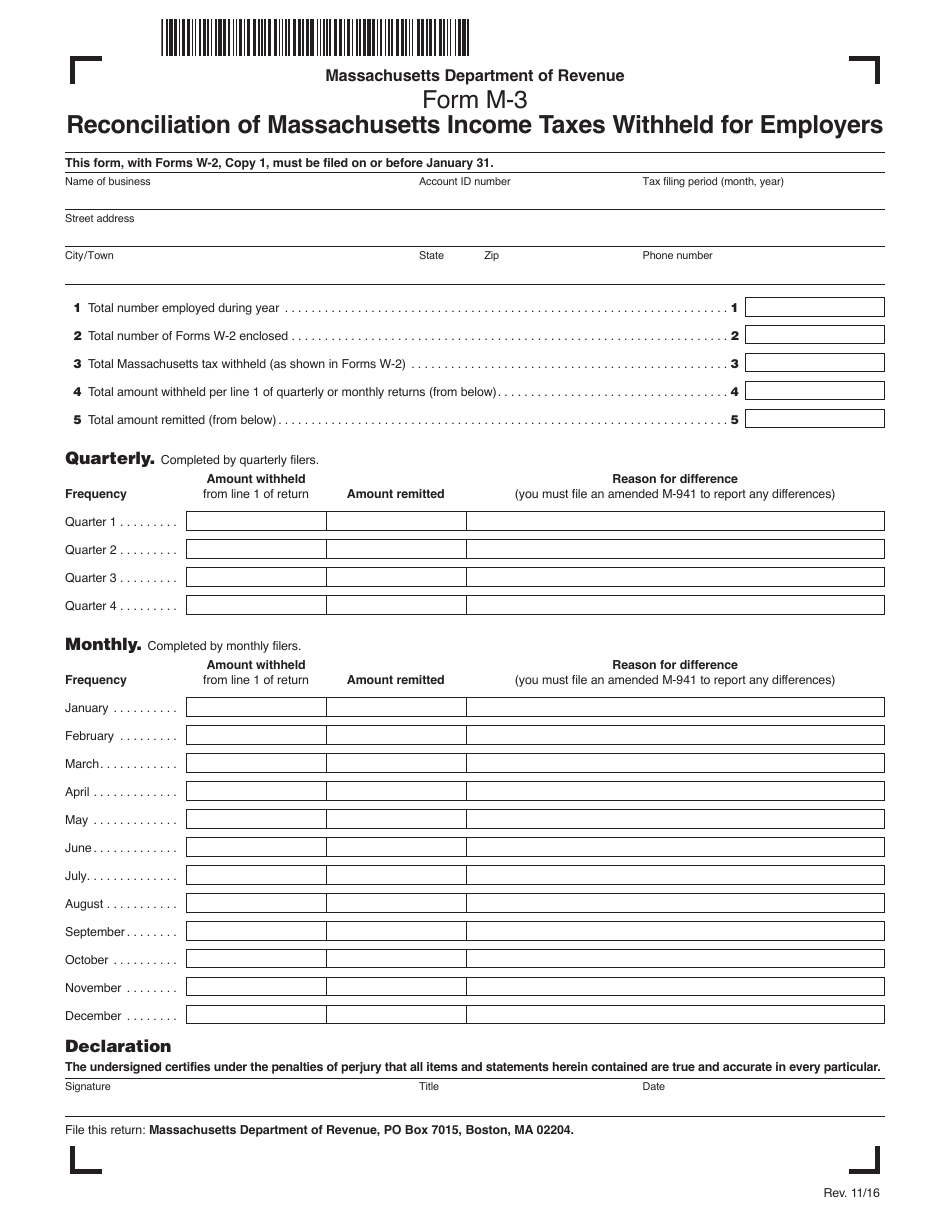

Form M-3 Reconciliation of Massachusetts Income Taxes Withheld for Employers - Massachusetts

What Is Form M-3?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-3?

A: Form M-3 is the Reconciliation of Massachusetts Income Taxes Withheld for Employers.

Q: Who is required to file Form M-3?

A: Employers in Massachusetts who withhold income taxes from their employees' wages are required to file Form M-3.

Q: What is the purpose of Form M-3?

A: The purpose of Form M-3 is to reconcile the amount of income taxes withheld from employees' wages with the total amount of income taxes paid to the Massachusetts Department of Revenue.

Q: When is Form M-3 due?

A: Form M-3 is due on or before January 31st of the following year.

Q: Are there any penalties for not filing Form M-3?

A: Yes, if an employer fails to file Form M-3 or files it late, they may be subject to penalties and interest charges.

Q: Are there any special instructions or requirements for completing Form M-3?

A: Yes, employers must carefully follow the instructions provided on the official Form M-3 document to ensure accurate completion.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-3 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.