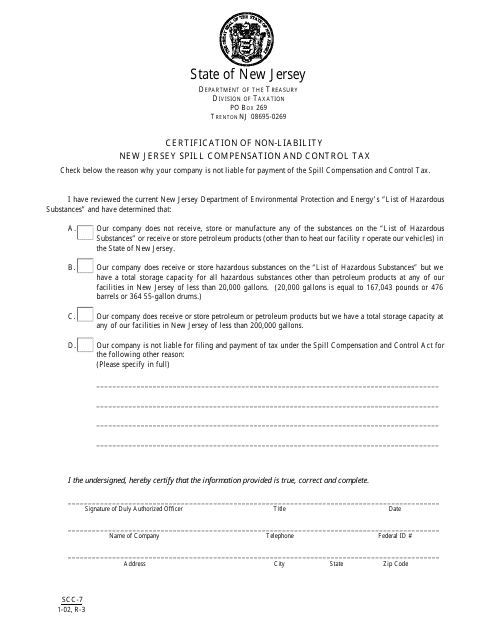

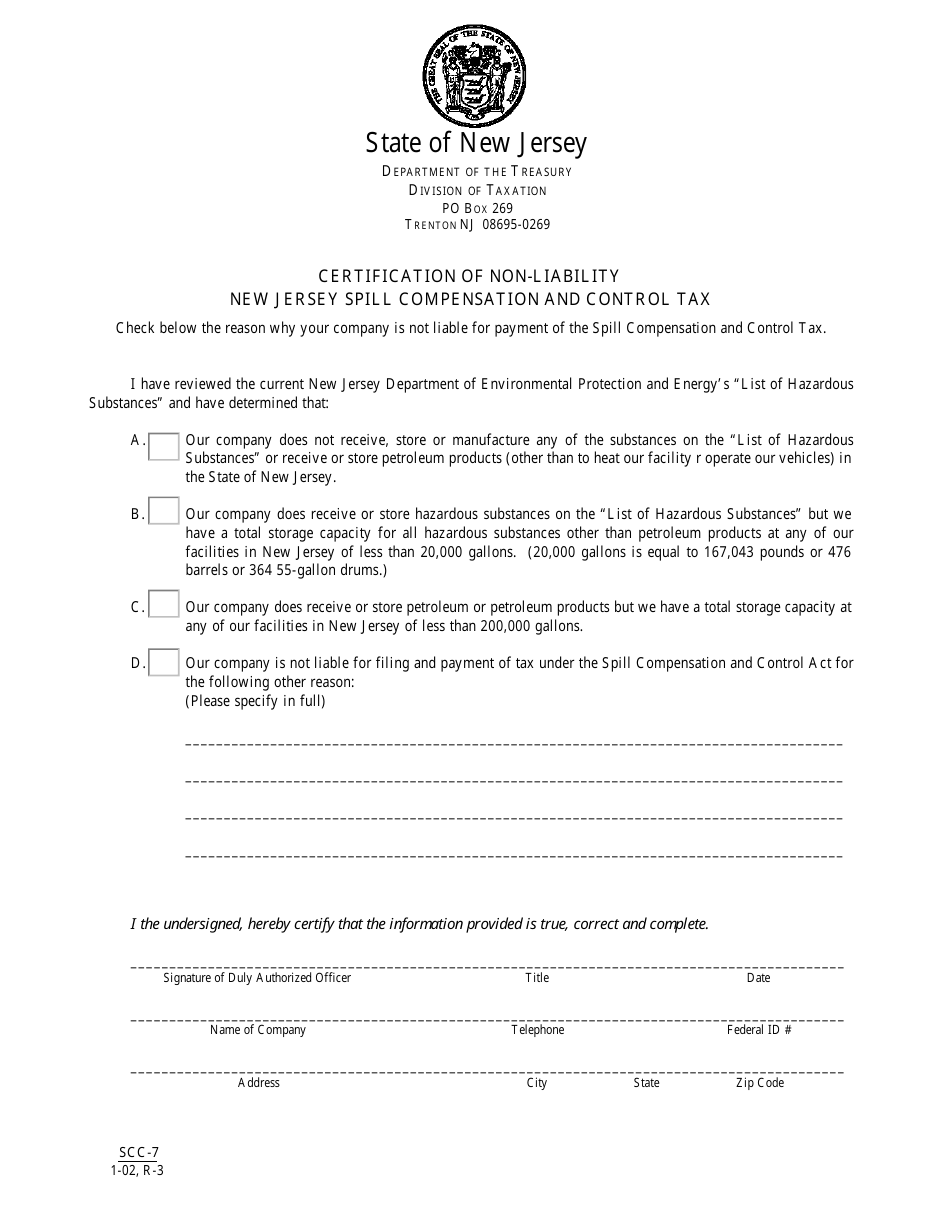

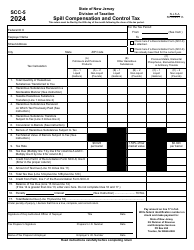

Form SCC-7 Certification of Non-liability New Jersey Spill Compensation and Control Tax - New Jersey

What Is Form SCC-7?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCC-7?

A: Form SCC-7 is the Certification of Non-liability for the New Jersey Spill Compensation and Control Tax.

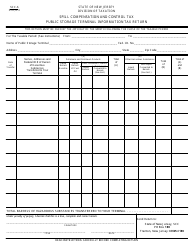

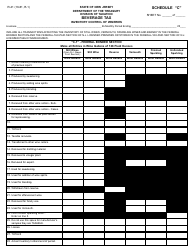

Q: What is the New Jersey Spill Compensation and Control Tax?

A: The New Jersey Spill Compensation and Control Tax is a tax imposed by the state of New Jersey on certain hazardous substances.

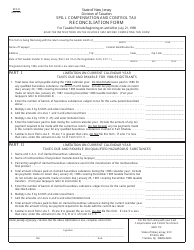

Q: Who needs to file Form SCC-7?

A: Any person who believes they are not liable for the New Jersey Spill Compensation and Control Tax needs to file Form SCC-7.

Q: What is the purpose of Form SCC-7?

A: The purpose of Form SCC-7 is to certify that the filer is not liable for the New Jersey Spill Compensation and Control Tax.

Q: What information is required on Form SCC-7?

A: Form SCC-7 requires information such as the filer's name, address, and explanation of why they believe they are not liable for the tax.

Q: Is there a deadline to file Form SCC-7?

A: Yes, Form SCC-7 must be filed within 90 days of receipt of a notice of liability for the New Jersey Spill Compensation and Control Tax.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-7 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.