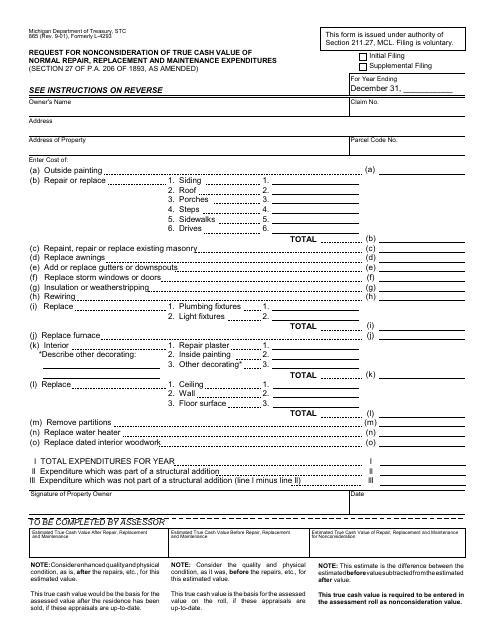

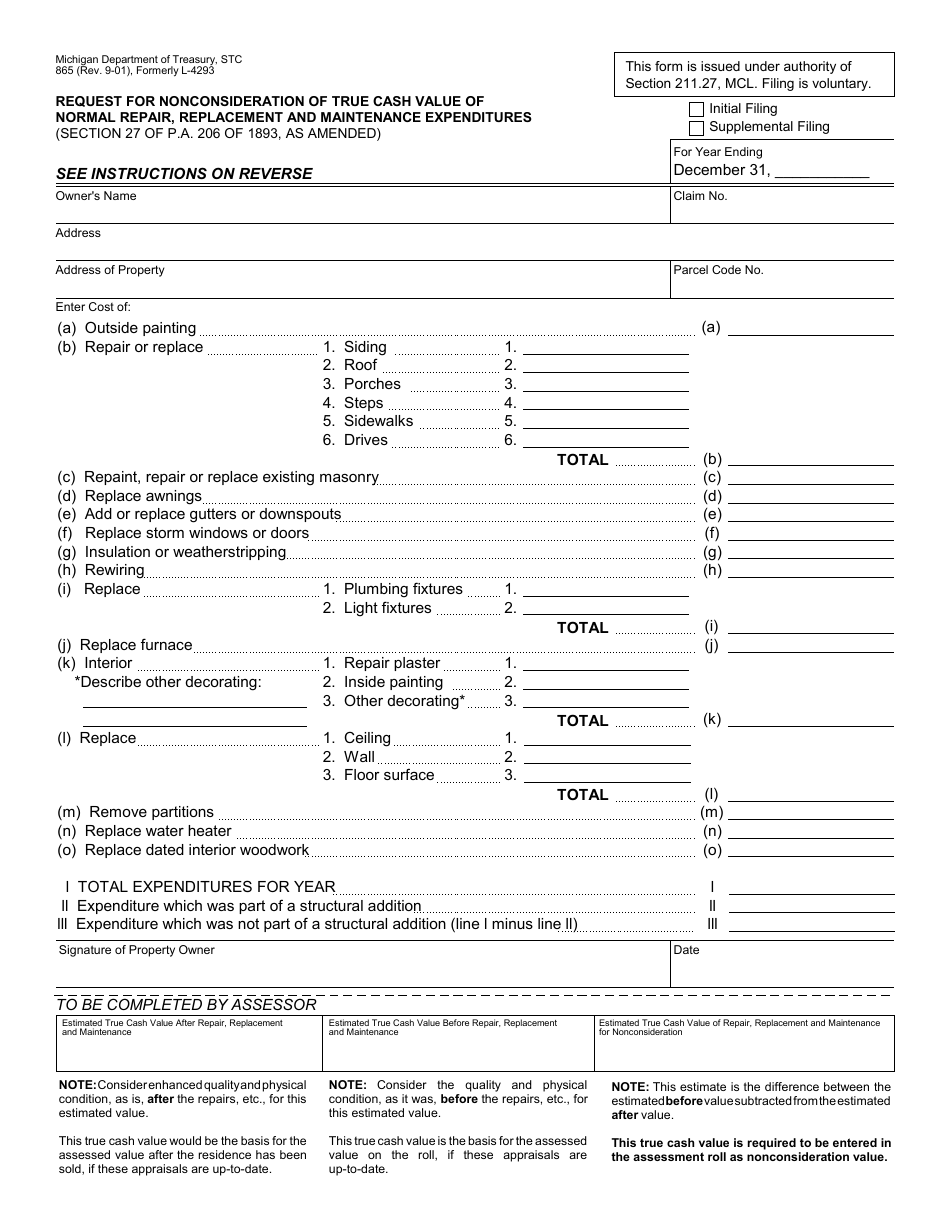

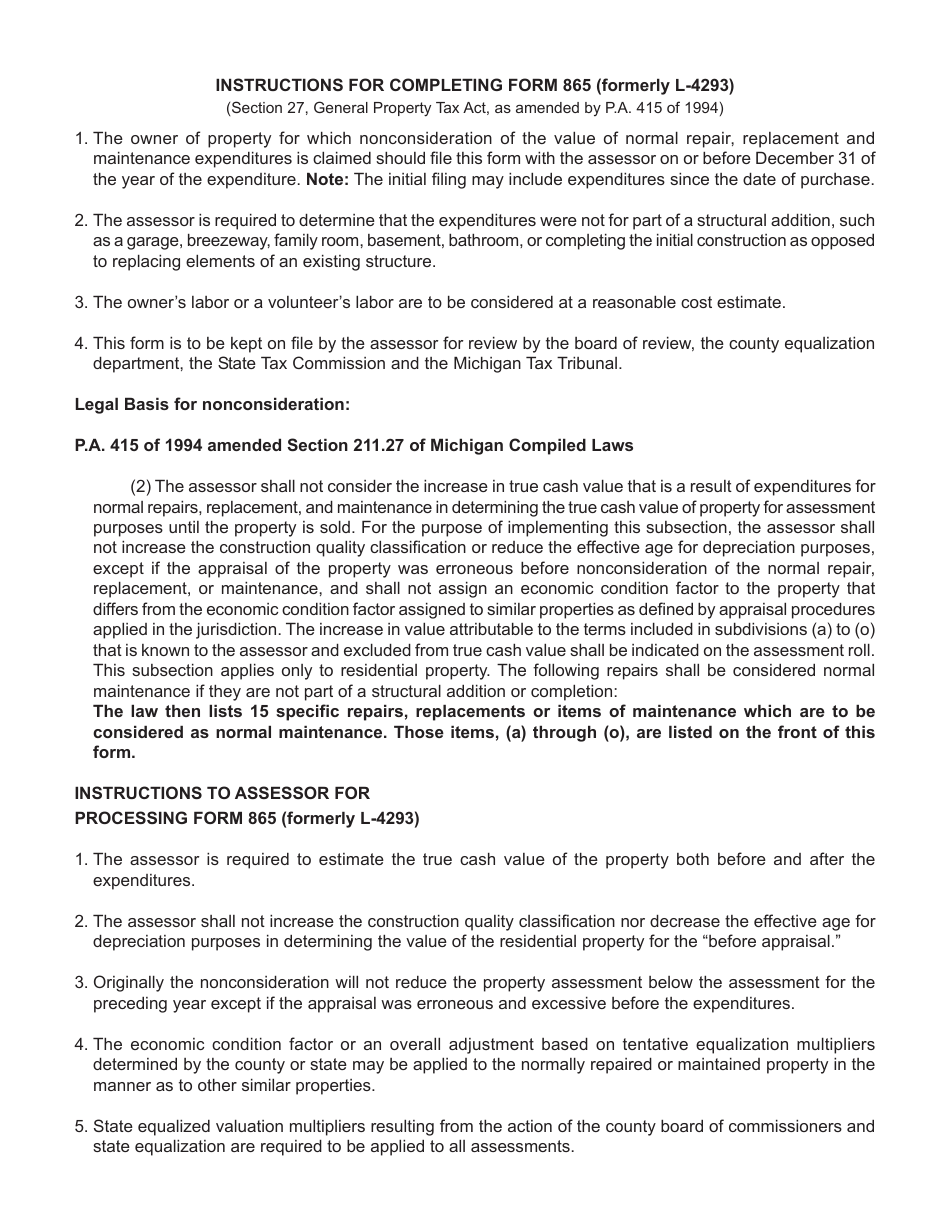

Form 865 Request for Nonconsideration of True Cash Value of Normal Repair, Replacement and Maintenance Expenditures - Michigan

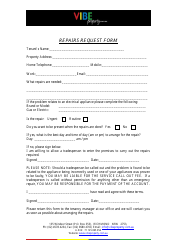

What Is Form 865?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 865?

A: Form 865 is a request for nonconsideration of true cash value of normal repair, replacement, and maintenance expenditures in Michigan.

Q: What is the purpose of Form 865?

A: The purpose of Form 865 is to request that certain repair, replacement, and maintenance expenditures not be considered in determining the true cash value of property.

Q: Who needs to fill out Form 865?

A: Property owners in Michigan who have incurred normal repair, replacement, or maintenance expenditures and want those expenditures excluded from the determination of the property's true cash value.

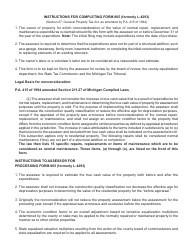

Q: Are there any deadlines for submitting Form 865?

A: Yes, Form 865 must be filed with the local assessor's office on or before Tax Day, which is typically April 30th in Michigan.

Q: Is there a fee for filing Form 865?

A: No, there is no fee for filing Form 865 in Michigan.

Q: What happens after I submit Form 865?

A: The assessor will review the form and determine whether the requested expenditures can be excluded from the property's true cash value. You will be notified of their decision in writing.

Q: Can I appeal the assessor's decision regarding Form 865?

A: Yes, if you disagree with the assessor's decision, you have the right to appeal. Instructions for appealing will be included in the assessor's written decision.

Q: Are there any penalties for submitting false information on Form 865?

A: Yes, knowingly providing false information on Form 865 can result in penalties, including fines and potential criminal charges.

Q: Is Form 865 only applicable in Michigan?

A: Yes, Form 865 is specific to the state of Michigan and is used for property tax purposes in that state.

Form Details:

- Released on September 1, 2001;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 865 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.