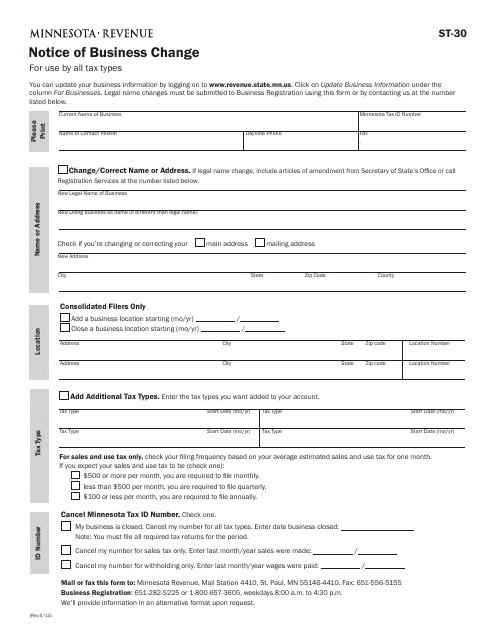

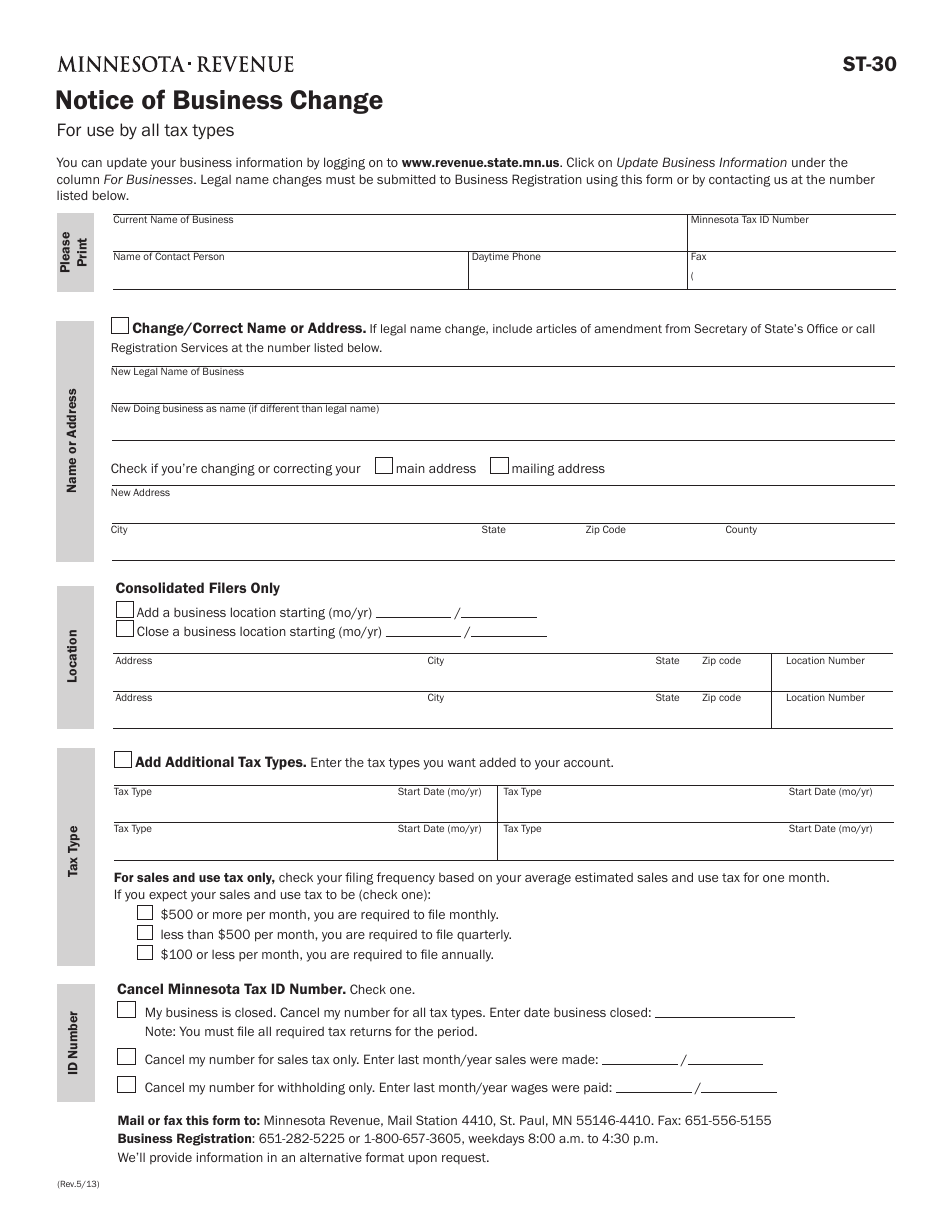

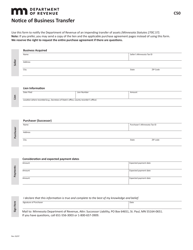

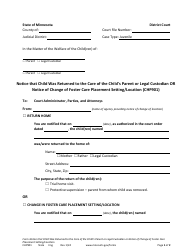

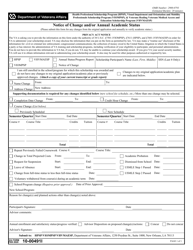

Form ST-30 Notice of Business Change - Minnesota

What Is Form ST-30?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-30?

A: Form ST-30 is a Notice of Business Change form in Minnesota.

Q: What is the purpose of Form ST-30?

A: The purpose of Form ST-30 is to notify the Minnesota Department of Revenue about changes in your business.

Q: When should I use Form ST-30?

A: You should use Form ST-30 whenever there are changes to your business, such as a change in ownership, address, or business activity.

Q: Do I need to submit Form ST-30 if there are no changes in my business?

A: No, you only need to submit Form ST-30 if there are changes in your business.

Q: What information do I need to provide on Form ST-30?

A: You will need to provide information about your business, such as the business name, tax identification number, and details of the changes being made.

Q: Is there a deadline for submitting Form ST-30?

A: Yes, you must submit Form ST-30 within 10 days of the change in your business.

Q: What happens after I submit Form ST-30?

A: The Minnesota Department of Revenue will update their records with the information you provide on Form ST-30.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-30 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.