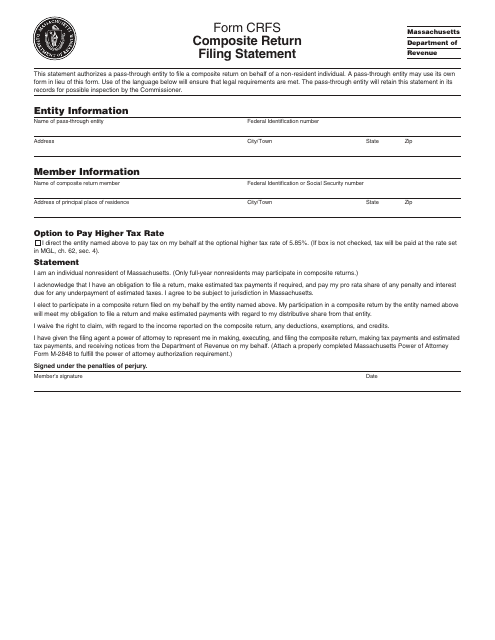

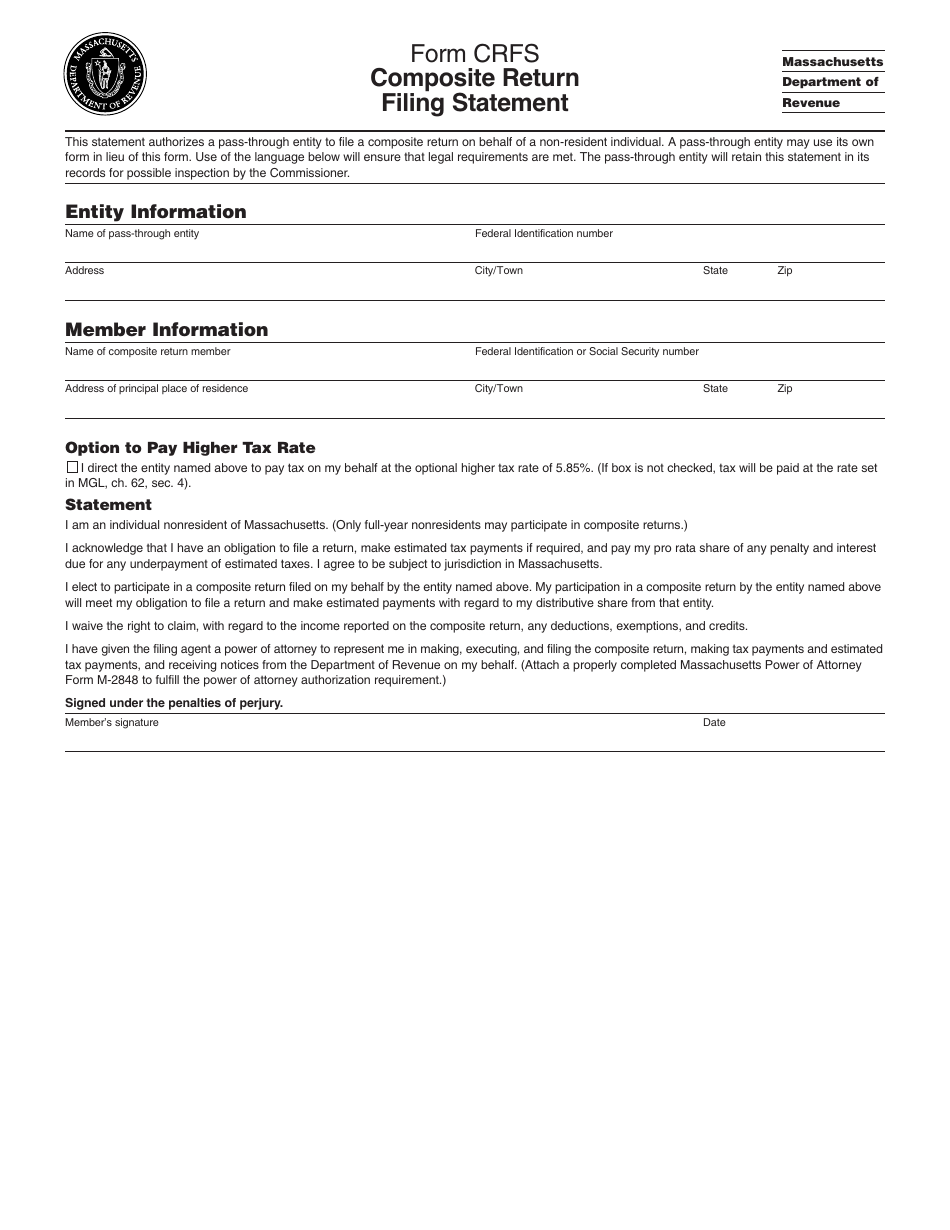

Form CRFS Composite Return Filing Statement - Massachusetts

What Is Form CRFS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CRFS Composite Return Filing Statement?

A: CRFS stands for Composite Return Filing Statement, which is a form used in Massachusetts for filing taxes.

Q: Who needs to file a CRFS Composite Return Filing Statement?

A: The CRFS form should be filed by composite non-resident taxpayers who have income from Massachusetts sources.

Q: What is considered Massachusetts source income?

A: Massachusetts source income includes income from Massachusetts businesses, rental properties, and certain investments.

Q: When is the deadline to file the CRFS form?

A: The deadline for filing the CRFS form is generally April 15th, the same as the federal tax deadline.

Q: Are there any penalties for late filing of the CRFS form?

A: Yes, if you fail to file the CRFS form by the deadline, you may be subject to penalties and interest on any unpaid taxes.

Q: What if I don't have any Massachusetts source income?

A: If you don't have any Massachusetts source income, you do not need to file the CRFS form.

Q: What supporting documents do I need to include with the CRFS form?

A: You may need to include copies of your federal tax return, W-2 forms, and any other relevant income documents.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRFS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.