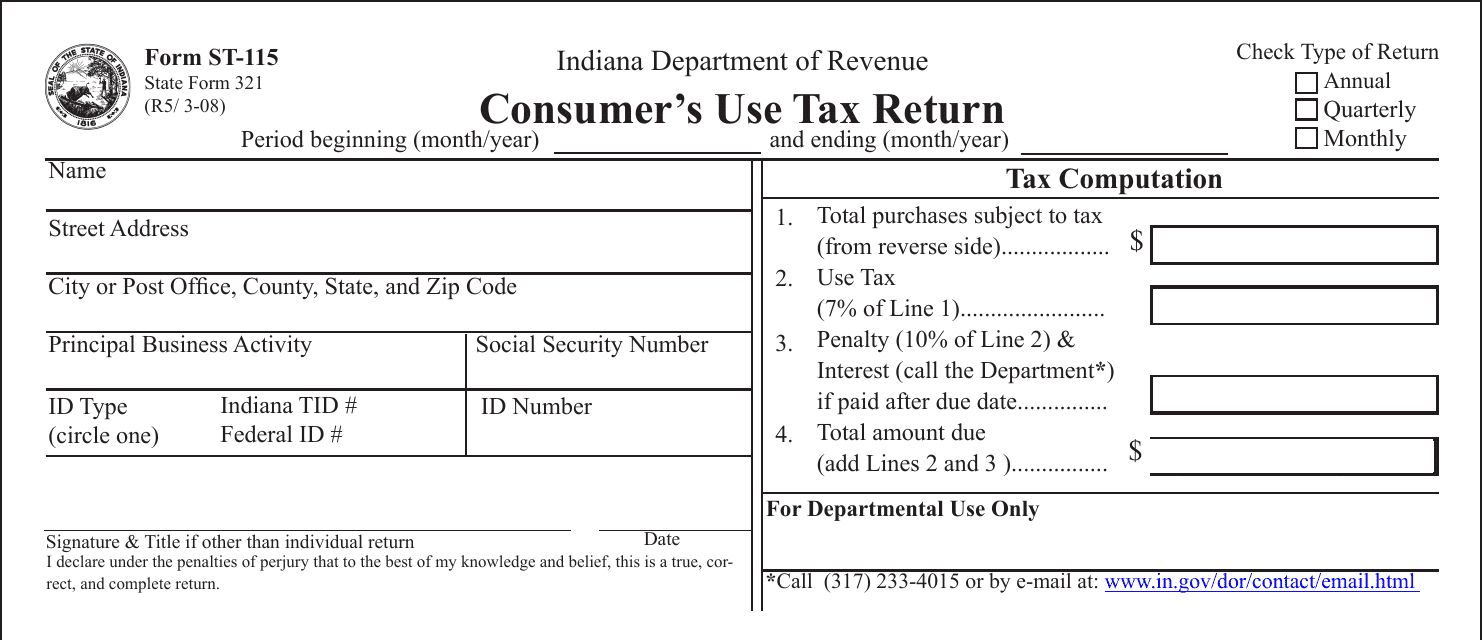

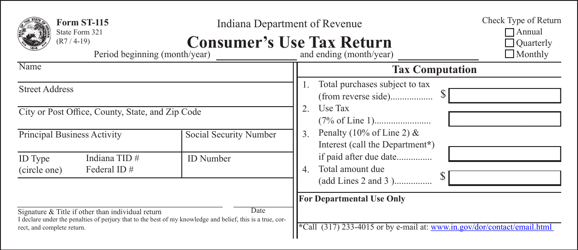

Form ST-115 Consumer's Use Tax Return - Indiana

What Is Form ST-115?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-115?

A: Form ST-115 is the Consumer's Use Tax Return for Indiana.

Q: Who needs to file Form ST-115?

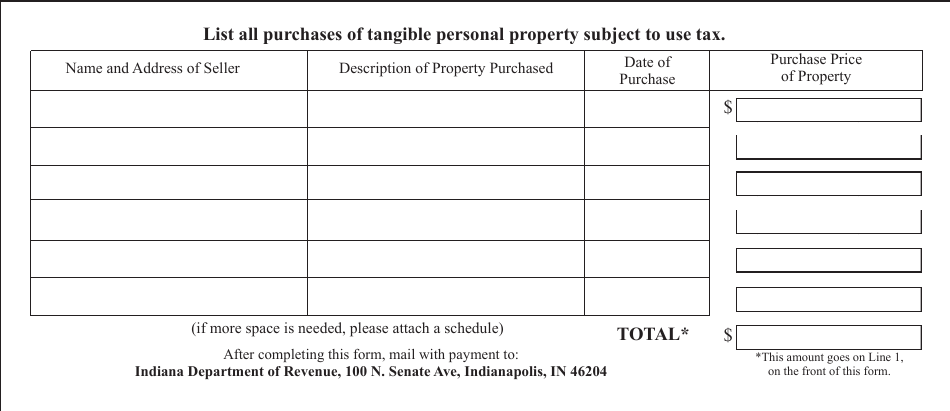

A: Individuals and businesses in Indiana who have made purchases without paying sales tax are required to file Form ST-115.

Q: What is the purpose of Form ST-115?

A: The purpose of Form ST-115 is to report and pay the consumer's use tax owed on purchases made without paying sales tax.

Q: How often should Form ST-115 be filed?

A: Form ST-115 should be filed on a quarterly basis.

Q: Are there any exemptions to the consumer's use tax?

A: Yes, there are certain exemptions to the consumer's use tax in Indiana. You should refer to the instructions of Form ST-115 or consult with the Indiana Department of Revenue for more information.

Q: What happens if I don't file Form ST-115?

A: Failing to file Form ST-115 and pay the consumer's use tax owed may result in penalties and interest being assessed by the Indiana Department of Revenue.

Q: Is there a deadline for filing Form ST-115?

A: Yes, Form ST-115 must be filed and the consumer's use tax owed must be paid by the 20th day of the month following the end of the quarter.

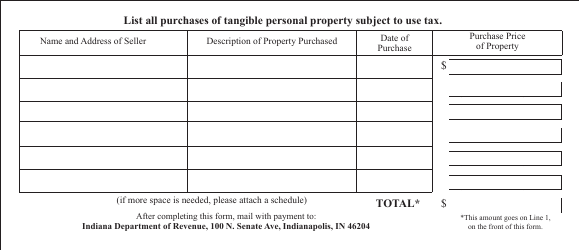

Q: How should I calculate the consumer's use tax owed?

A: You should refer to the instructions of Form ST-115 or consult with the Indiana Department of Revenue for guidance on calculating the consumer's use tax owed.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-115 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.