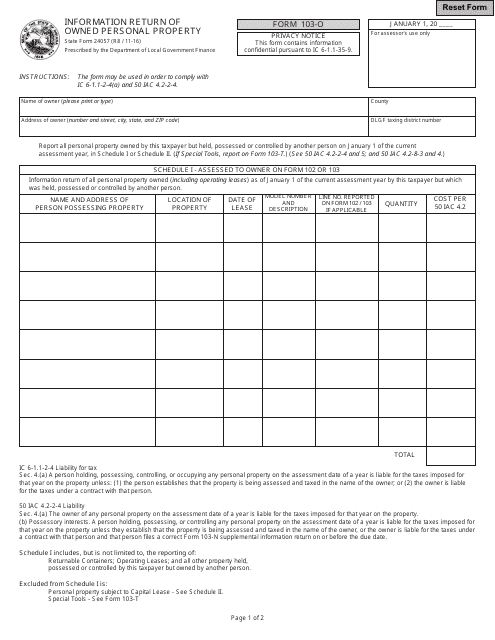

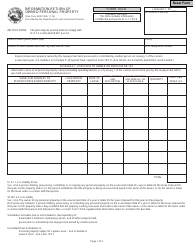

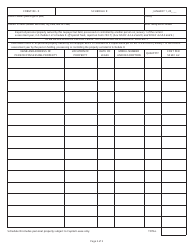

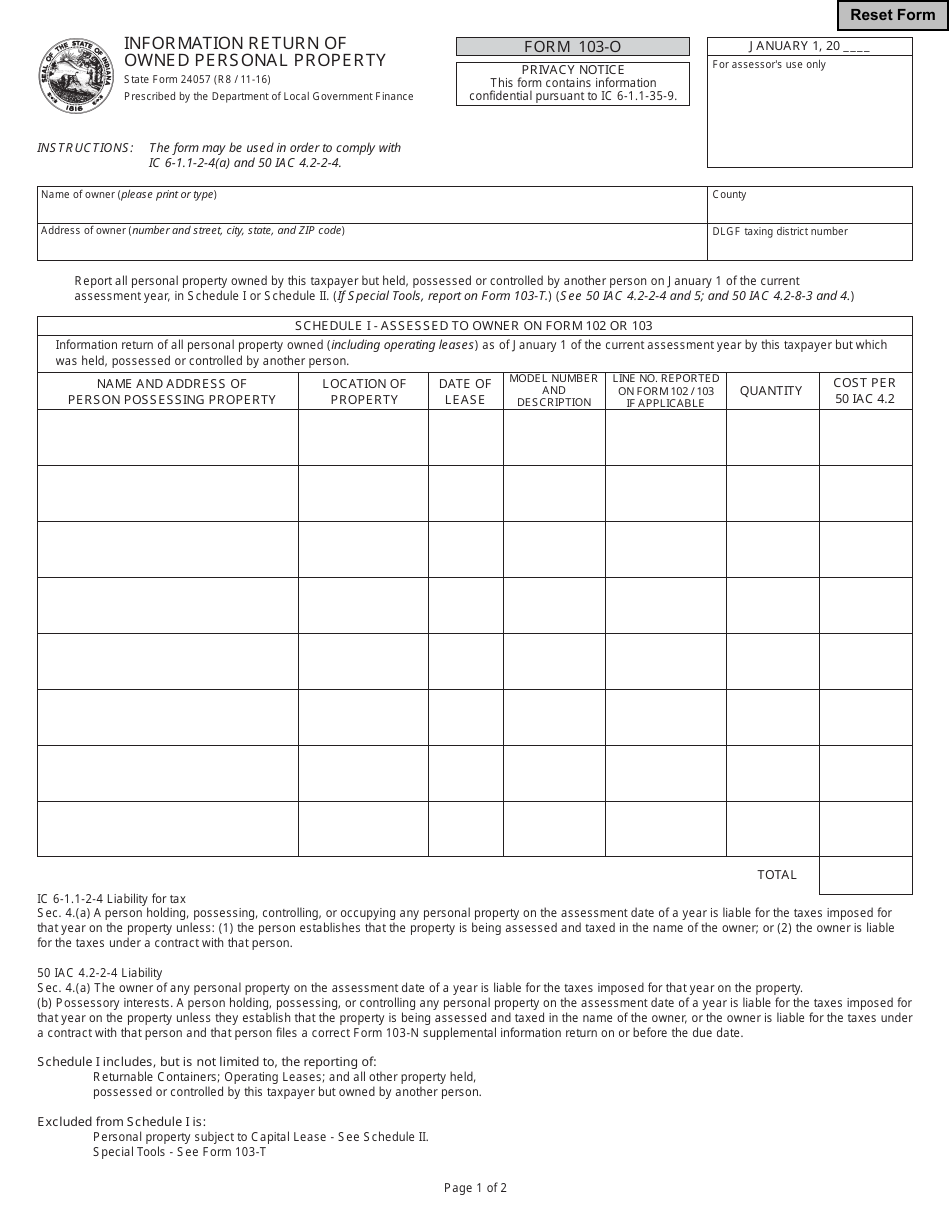

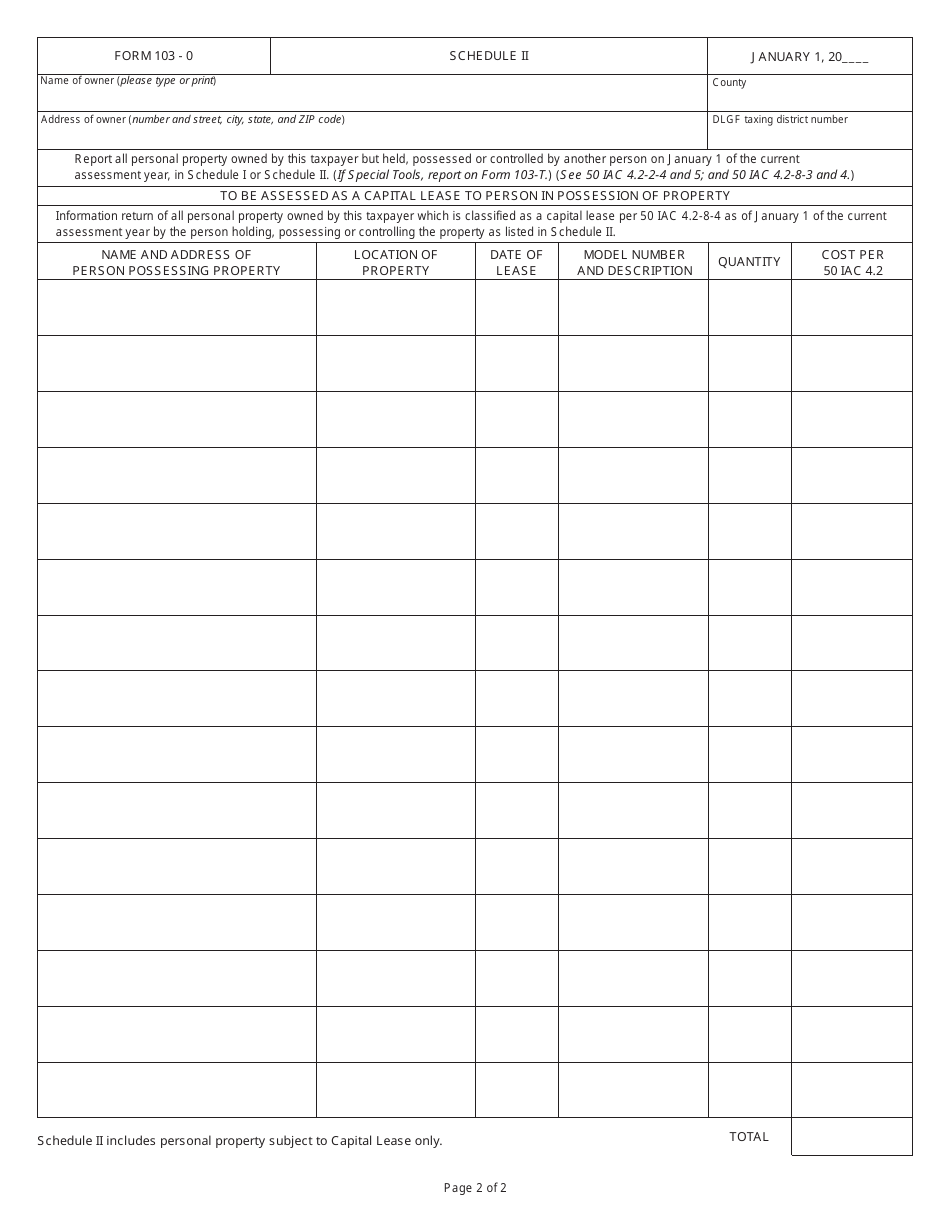

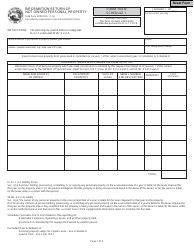

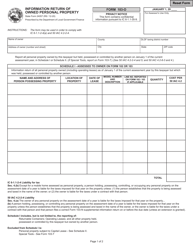

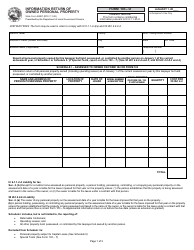

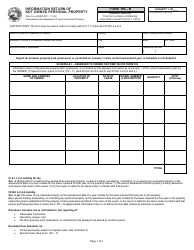

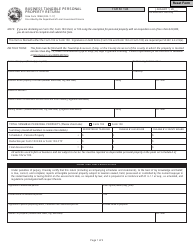

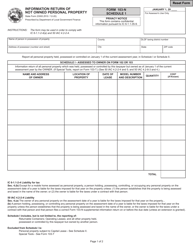

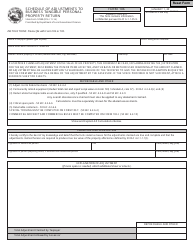

Form 103-O Information Return of Owned Personal Property - Indiana

What Is Form 103-O?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-O?

A: Form 103-O is the Information Return of Owned Personal Property in Indiana.

Q: Who needs to file Form 103-O?

A: Individuals, partnerships, corporations, or other entities who own personal property in Indiana need to file Form 103-O.

Q: What is considered personal property in Indiana?

A: Personal property in Indiana includes machinery, equipment, furniture, fixtures, and other tangible assets used in a business.

Q: When is Form 103-O due?

A: Form 103-O is due on or before May 15th of each year.

Q: Is there a fee for filing Form 103-O?

A: Yes, there is a filing fee for Form 103-O. The fee varies based on the assessed value of the property owned.

Q: What happens if I don't file Form 103-O?

A: Failure to file Form 103-O may result in penalties and interest assessed by the Indiana Department of Revenue.

Q: Can I amend my Form 103-O if I made a mistake?

A: Yes, you can amend your Form 103-O if you made a mistake. You will need to file an amended return with the Indiana Department of Revenue.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-O by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.