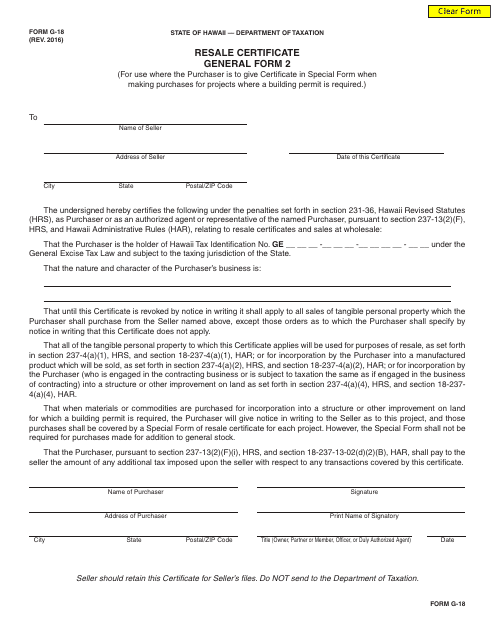

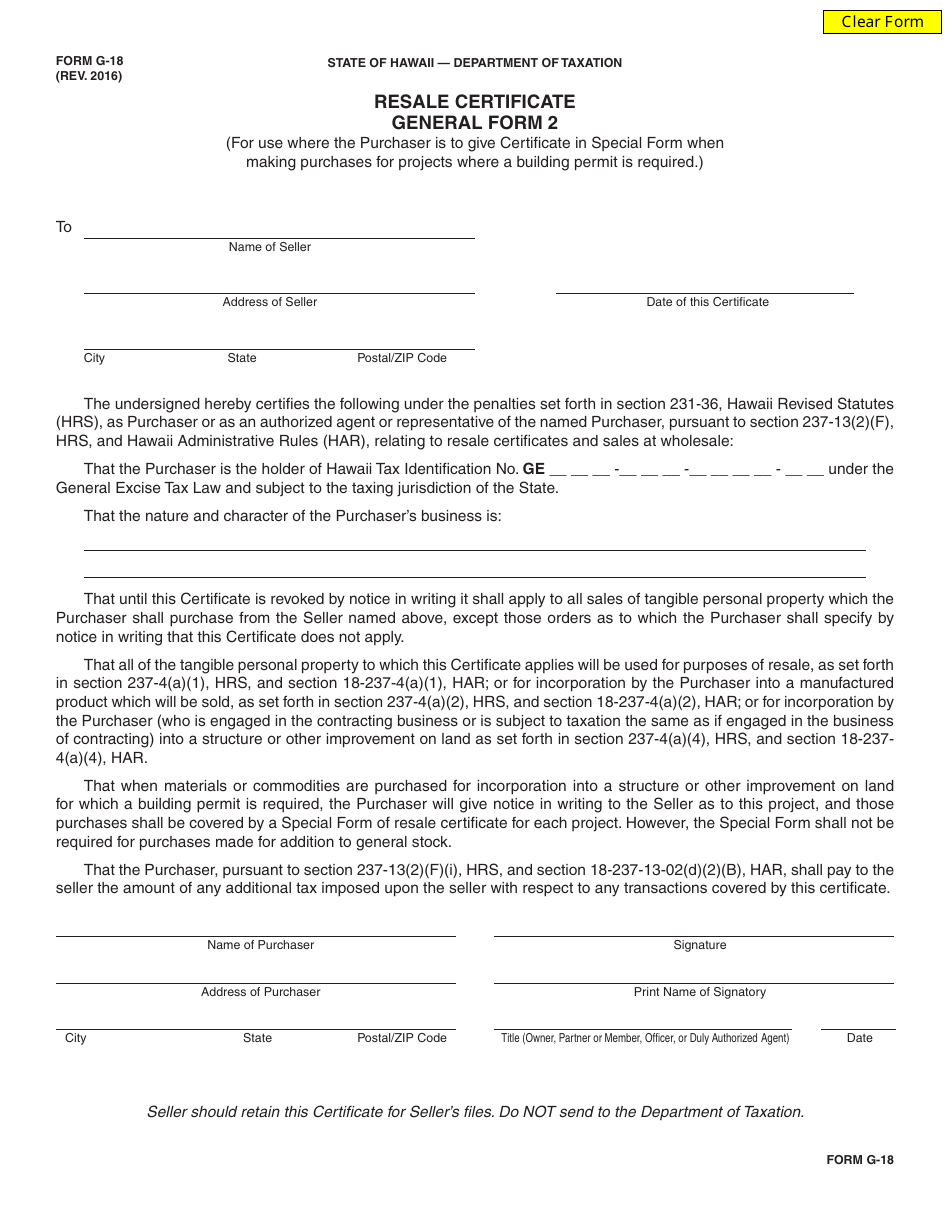

Form G-18 Resale Certificate General Form 2 - Hawaii

What Is Form G-18?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-18 Resale Certificate General Form 2?

A: Form G-18 Resale Certificate General Form 2 is a certificate used in Hawaii for claiming exemption from sales tax on items that will be resold.

Q: Who should use Form G-18 Resale Certificate General Form 2?

A: This form should be used by individuals and businesses in Hawaii who are registered for sales tax and wish to purchase items for resale.

Q: What is the purpose of Form G-18 Resale Certificate General Form 2?

A: The purpose of this form is to certify that the purchaser intends to resell the items and therefore qualifies for exemption from sales tax.

Q: What information is required on Form G-18 Resale Certificate General Form 2?

A: The form requires information such as the seller's name and address, the purchaser's name and address, and a description of the items being purchased.

Q: How often do I need to file Form G-18 Resale Certificate General Form 2?

A: This form should be provided to the seller at the time of purchase and a new form should be completed for each transaction.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-18 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.