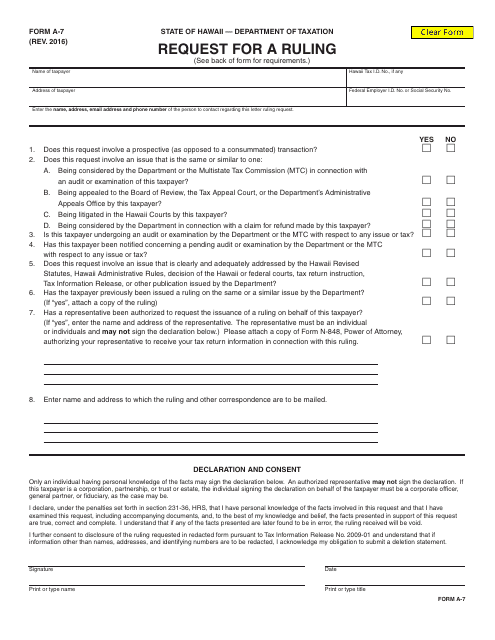

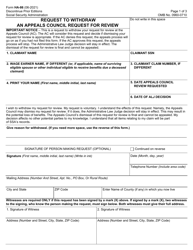

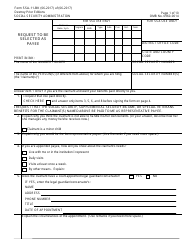

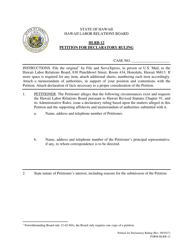

Form A-7 Request for a Ruling - Hawaii

What Is Form A-7?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-7?

A: Form A-7 is a Request for a Ruling form that is used in Hawaii.

Q: When should I use Form A-7?

A: You should use Form A-7 when you need to request a ruling in Hawaii.

Q: What is the purpose of Form A-7?

A: The purpose of Form A-7 is to request a ruling or determination from the State of Hawaii.

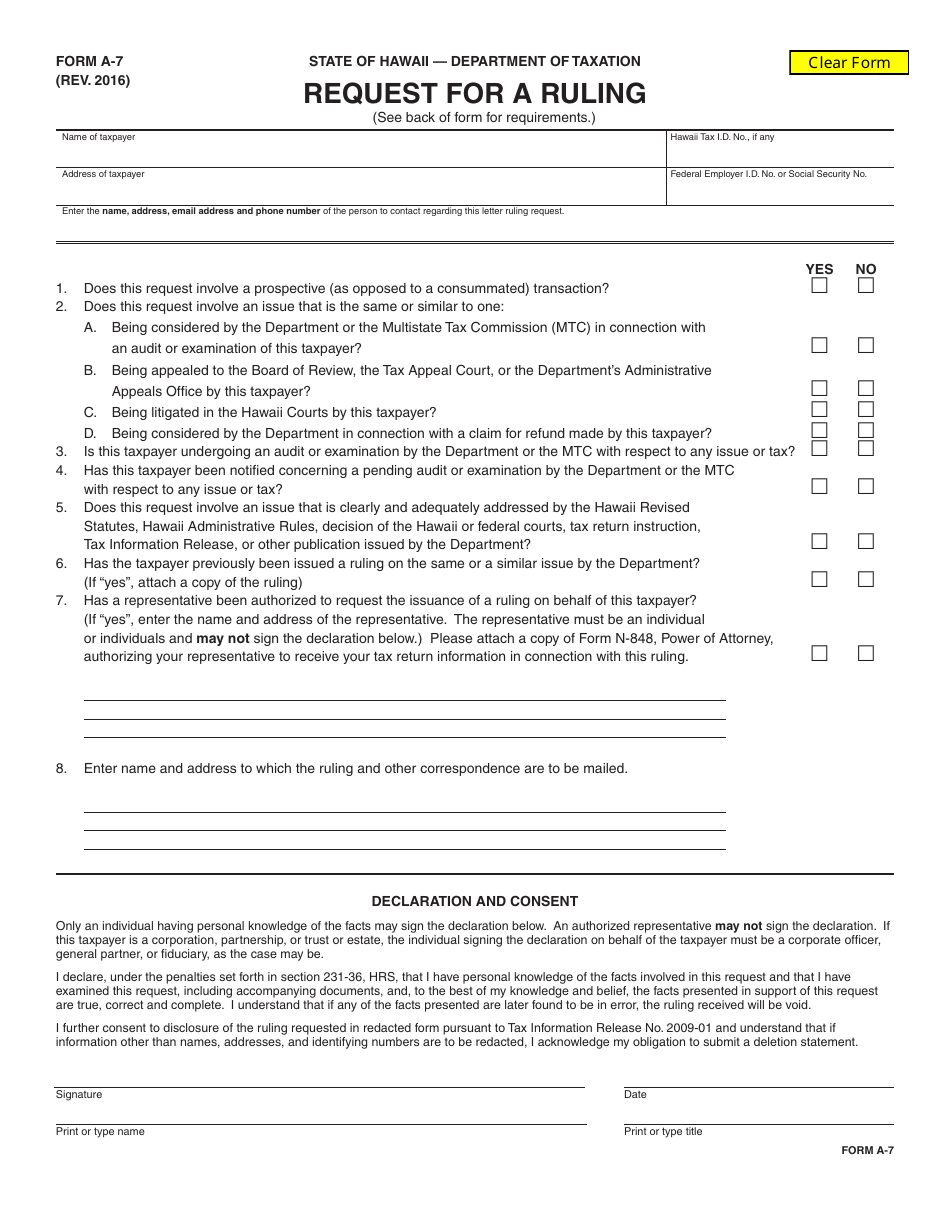

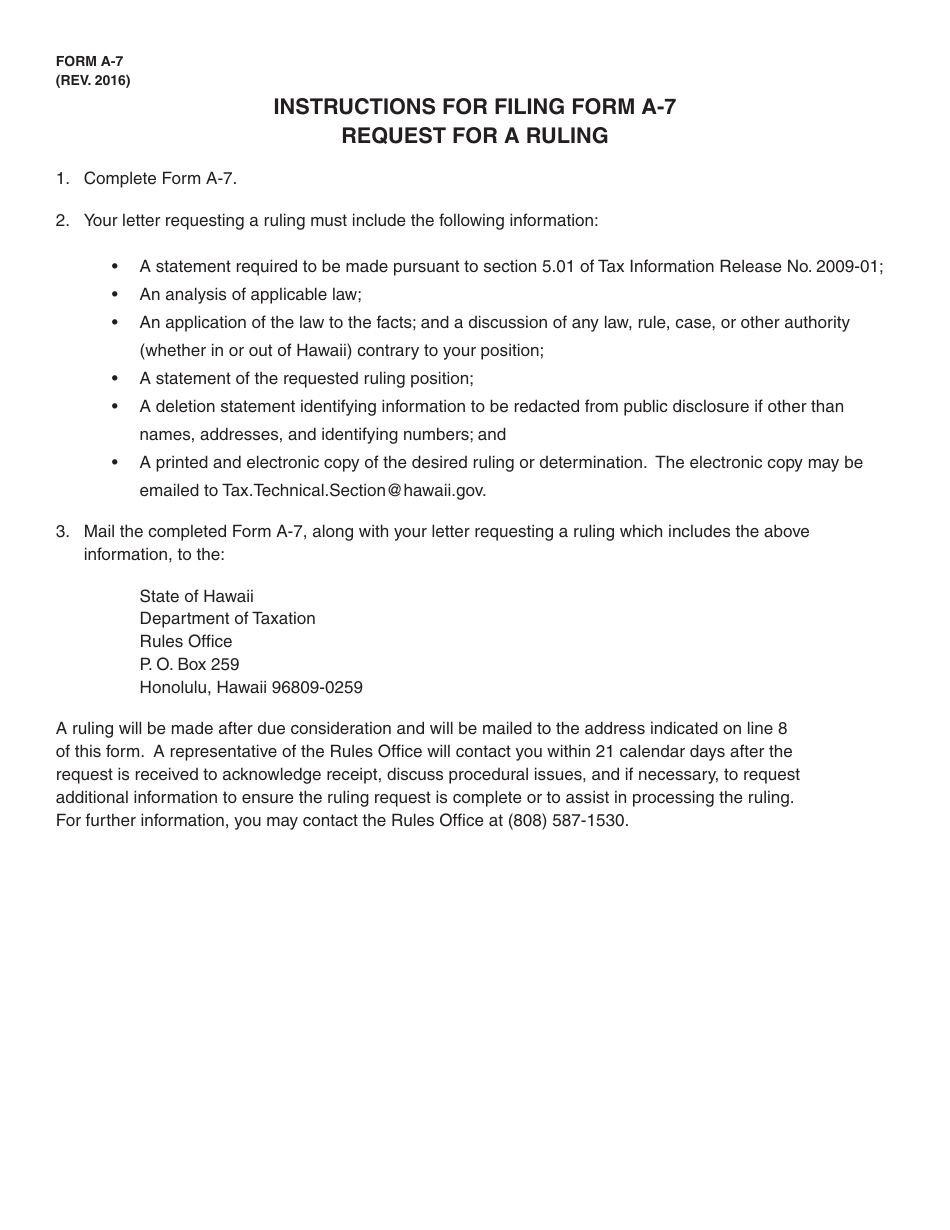

Q: Are there any specific requirements for completing Form A-7?

A: Yes, there are specific requirements for completing Form A-7. You should carefully read the instructions and provide all the necessary information.

Q: How long does it take to receive a ruling after submitting Form A-7?

A: The processing time for Form A-7 may vary. It is best to contact the relevant government office for an estimate.

Q: Can I appeal a ruling made based on Form A-7?

A: Yes, you may have the option to appeal a ruling made based on Form A-7. Consult the instructions or reach out to the relevant government office for more information.

Q: Who can help me with filling out Form A-7?

A: You can seek assistance from a tax professional or legal advisor to help you with filling out Form A-7.

Q: Is there a deadline for submitting Form A-7?

A: There may be a deadline for submitting Form A-7. Please refer to the instructions or contact the government office for specific information.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-7 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.