This version of the form is not currently in use and is provided for reference only. Download this version of

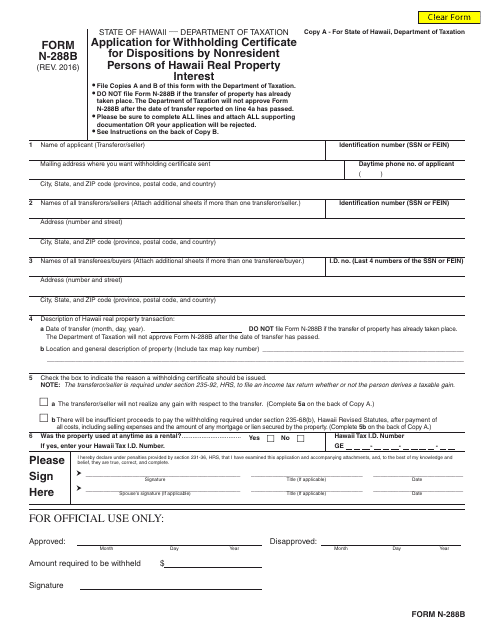

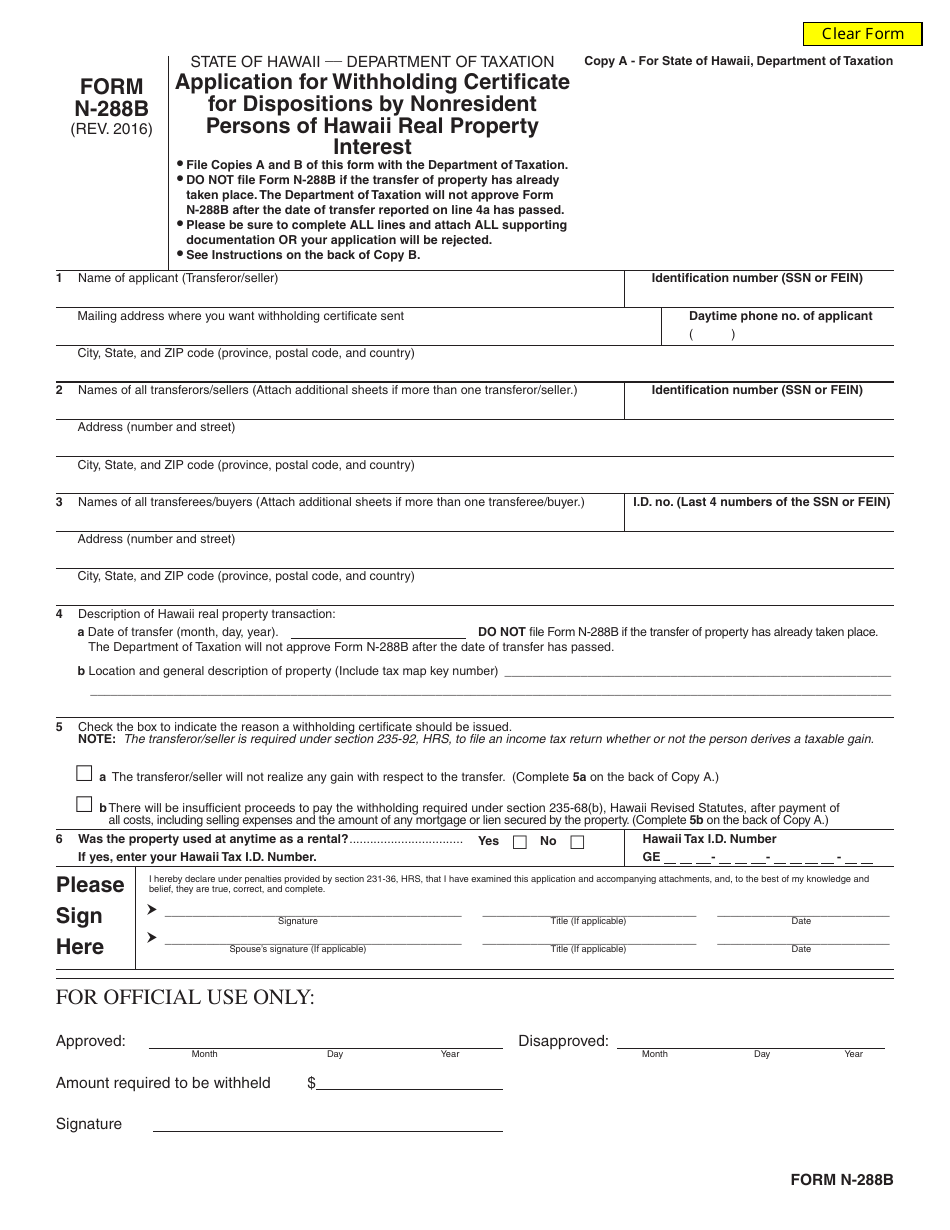

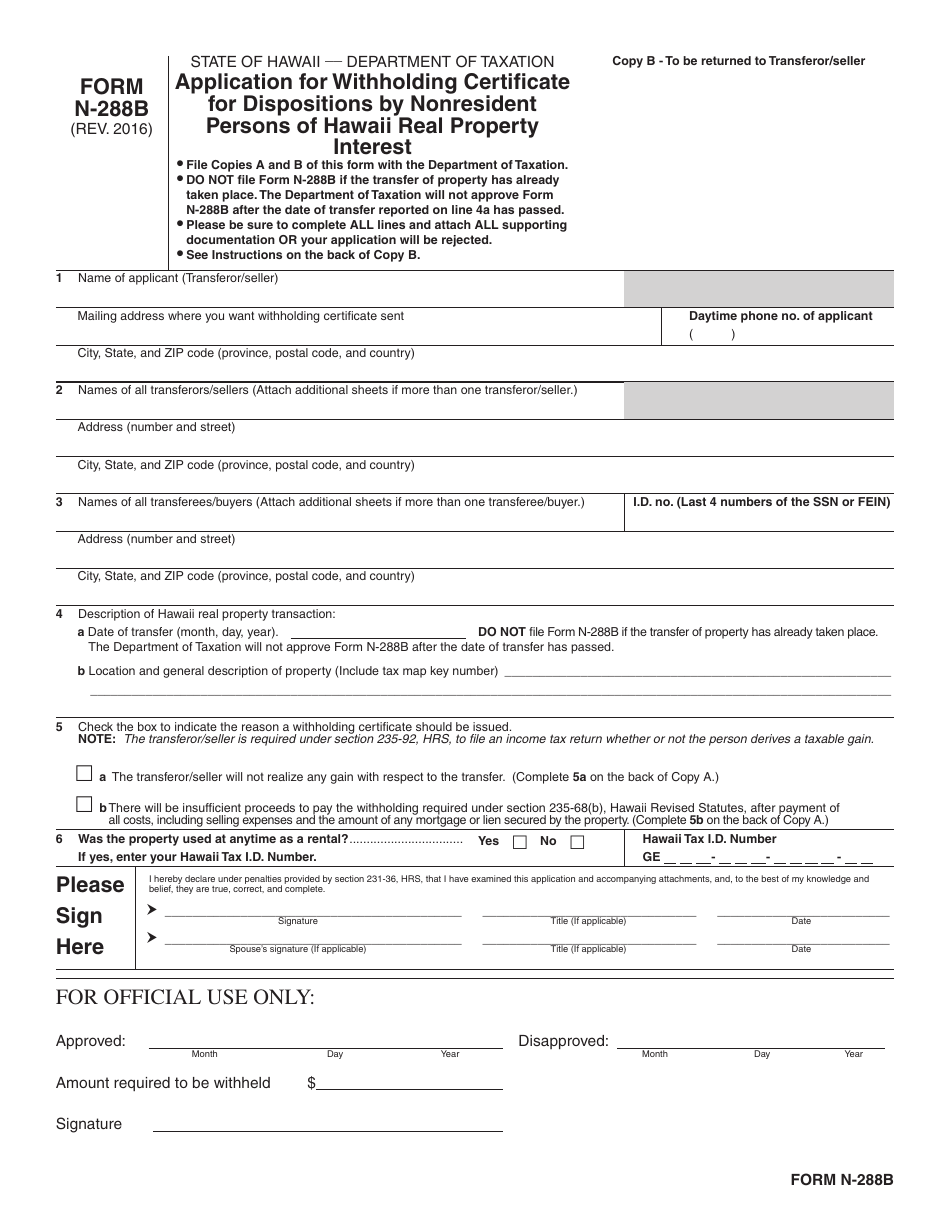

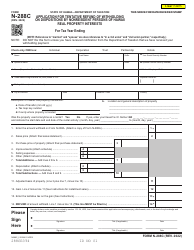

Form N-288B

for the current year.

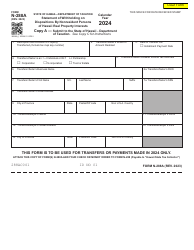

Form N-288B Application for Withholding Certificate for Dispositions by Nonresident Persons of Hawaii Real Property Interest - Hawaii

What Is Form N-288B?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288B?

A: Form N-288B is the Application for Withholding Certificate for Dispositions by Nonresident Persons of Hawaii Real Property Interest in Hawaii.

Q: Who needs to file Form N-288B?

A: Nonresident persons who are disposing of a Hawaii real property interest need to file Form N-288B.

Q: What is the purpose of Form N-288B?

A: The purpose of Form N-288B is to request a withholding certificate to reduce or eliminate the requirement to withhold tax on the sale or transfer of a Hawaii real property interest.

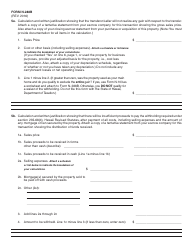

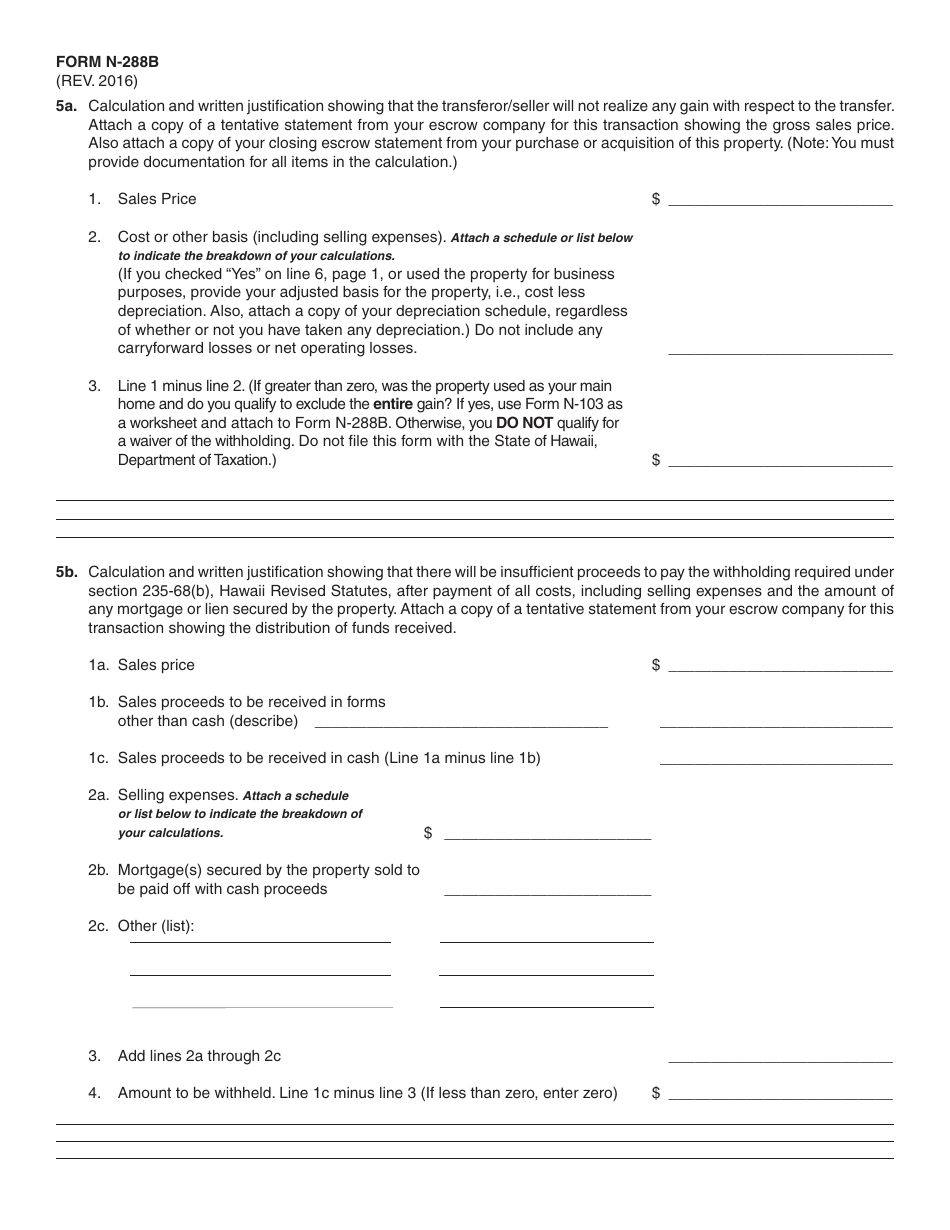

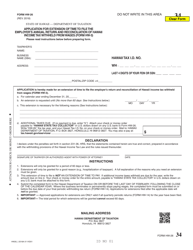

Q: What information is required on Form N-288B?

A: Form N-288B requires information such as the seller's personal information, the property details, the terms of the sale, and the desired withholding amount.

Q: Is there a deadline for filing Form N-288B?

A: Yes, Form N-288B must be filed at least 21 days before the date of closing or transfer of the property.

Q: Are there any fees associated with filing Form N-288B?

A: No, there are no fees associated with filing Form N-288B.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288B by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.