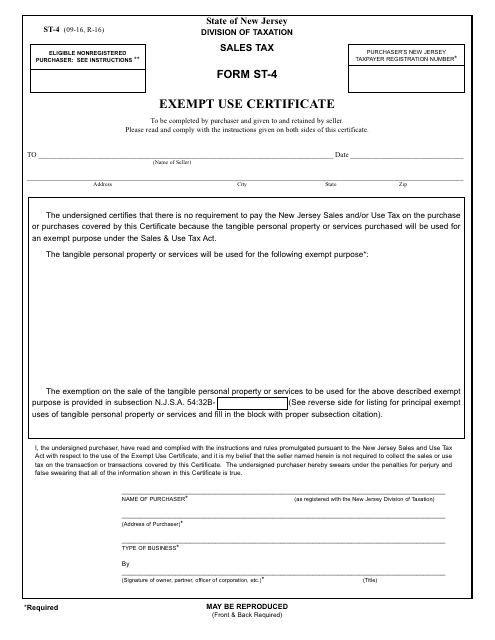

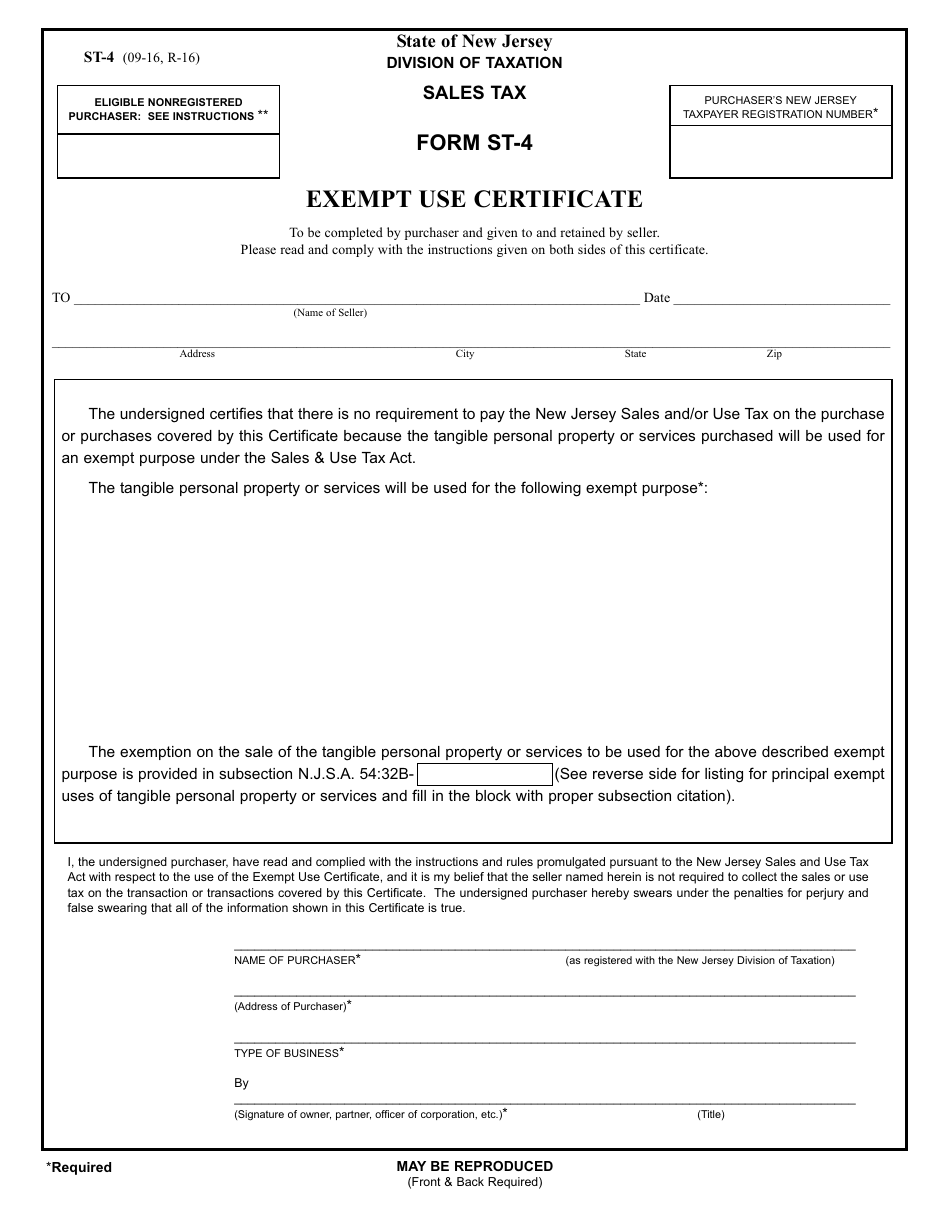

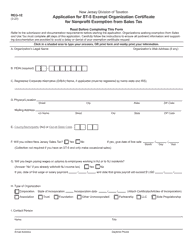

Form ST-4 Exempt Use Certificate - New Jersey

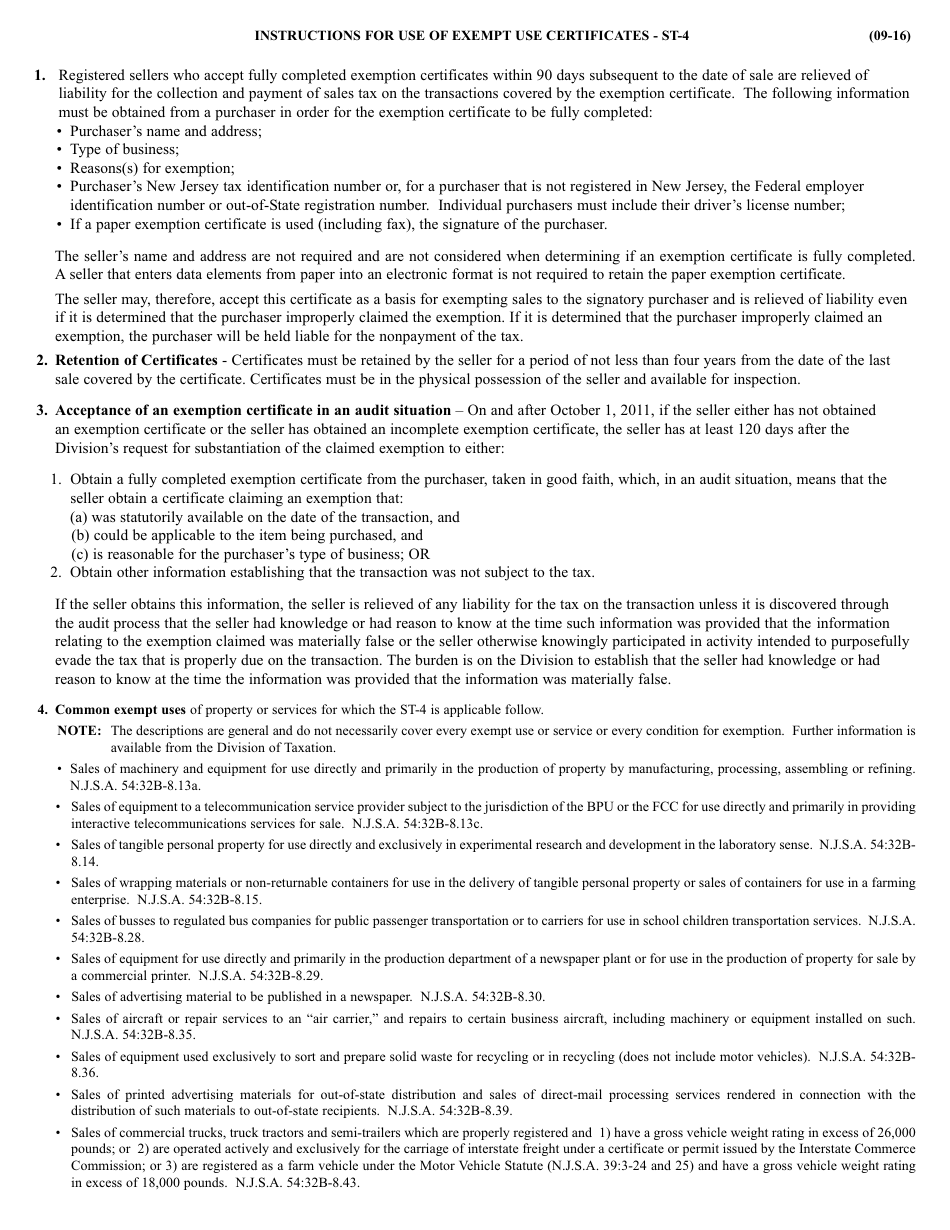

What Is Form ST-4?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ST-4?

A: Form ST-4 is an Exempt Use Certificate.

Q: What is the purpose of Form ST-4?

A: Form ST-4 is used to claim exemption from New Jersey sales tax on purchases that will be used for exempt purposes.

Q: Who can use Form ST-4?

A: Form ST-4 can be used by individuals and businesses who qualify for exemption from New Jersey sales tax.

Q: When should Form ST-4 be filled out?

A: Form ST-4 should be filled out at the time of purchase and given to the seller.

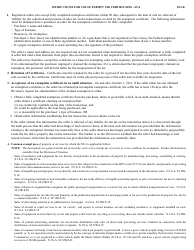

Q: What information should be included on Form ST-4?

A: Form ST-4 should include the purchaser's identification information, a description of the property being purchased, and the reason for the exemption.

Q: How long is Form ST-4 valid?

A: Form ST-4 is generally valid for four years from the date of issuance.

Q: Is Form ST-4 the same as a resale certificate?

A: No, Form ST-4 is specifically for claiming exemption from New Jersey sales tax on purchases for exempt use.

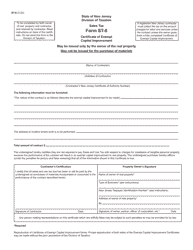

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-4 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.