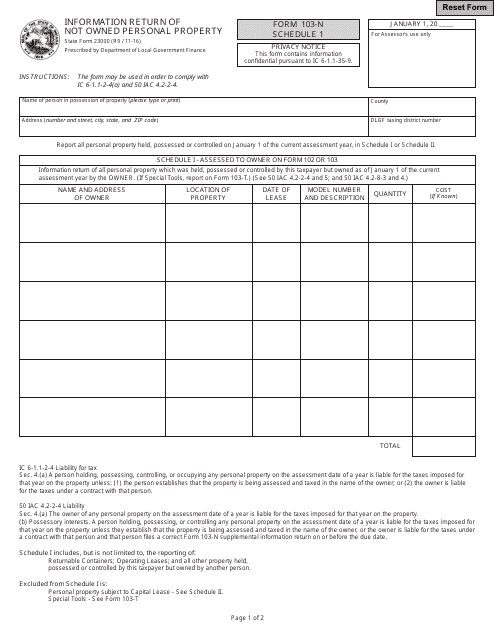

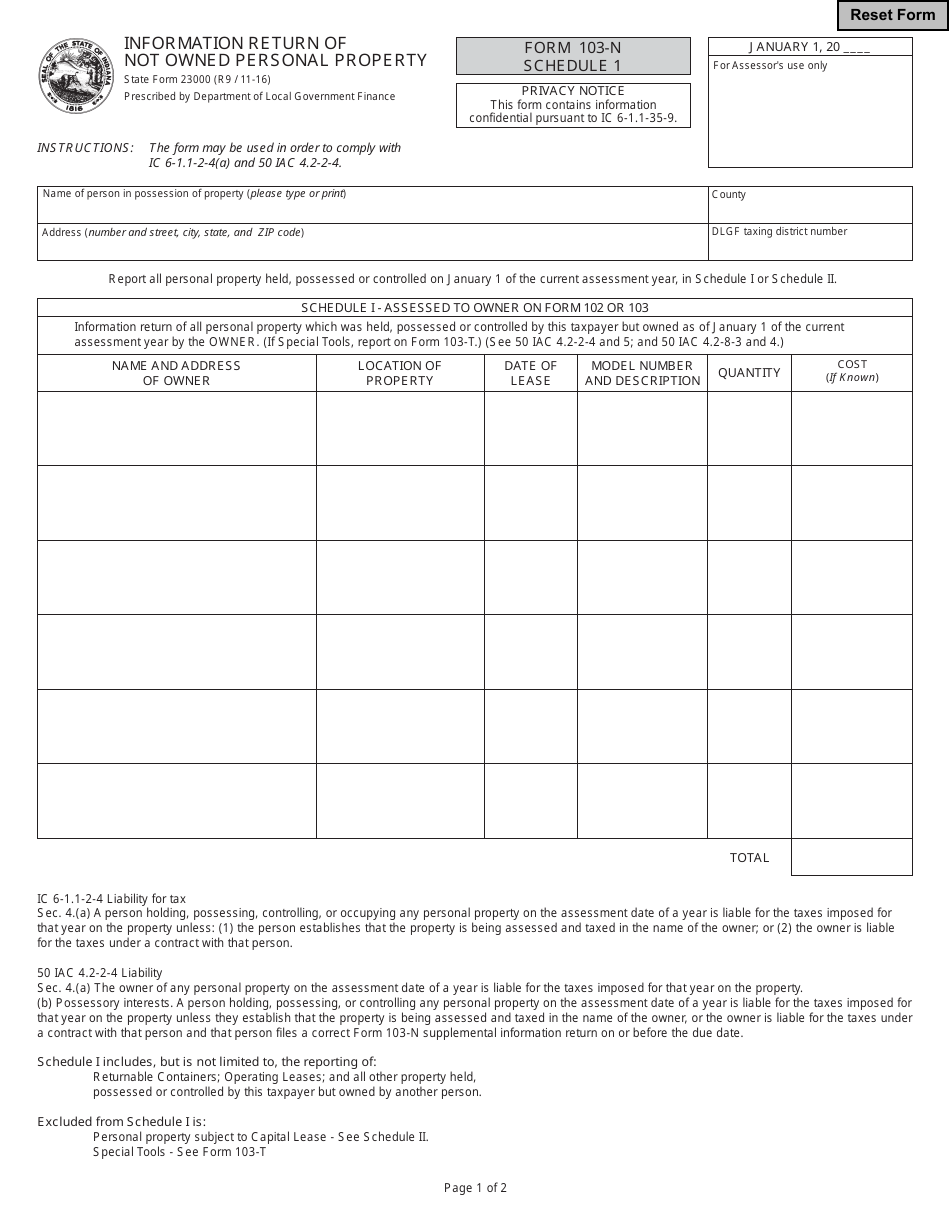

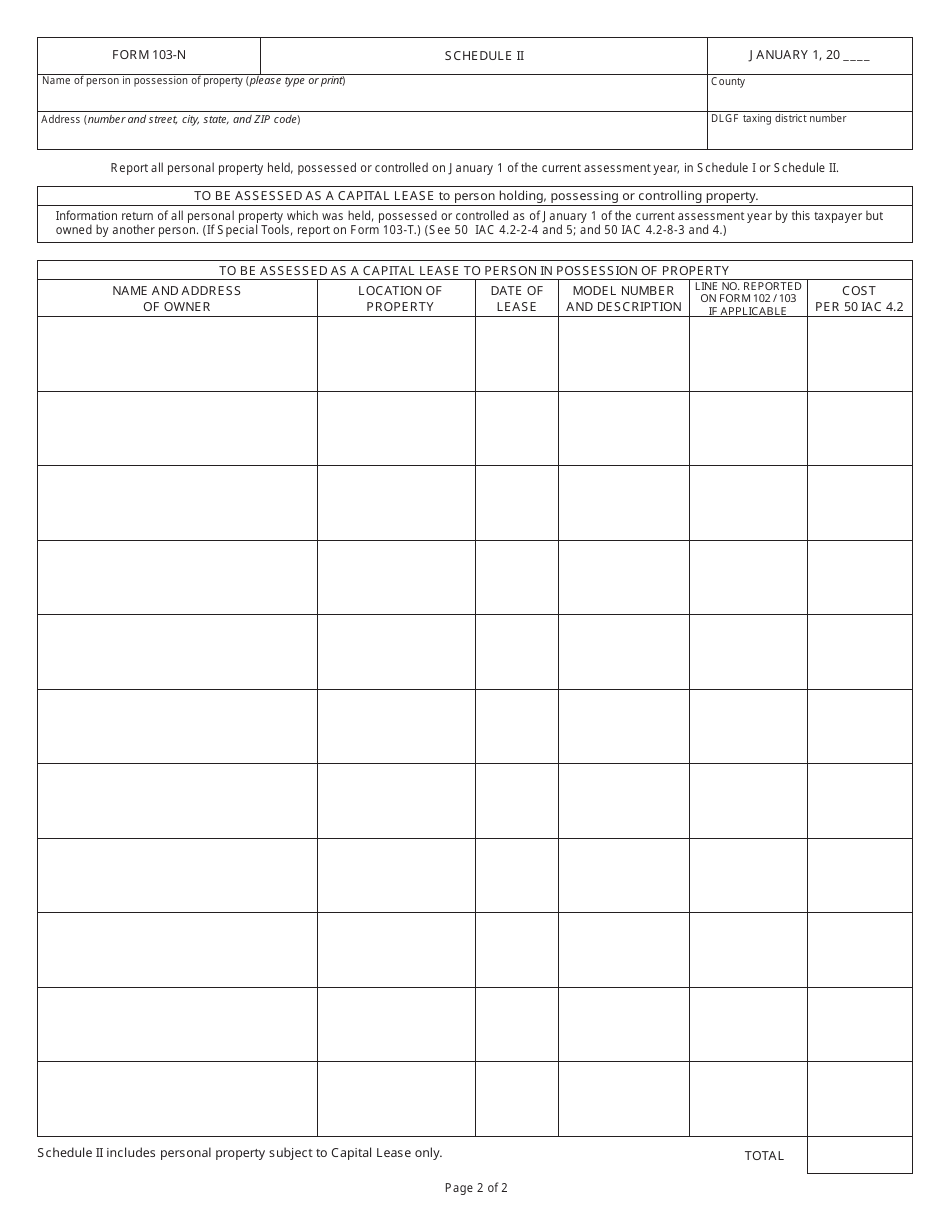

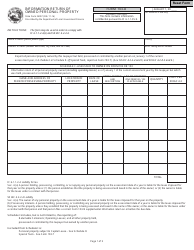

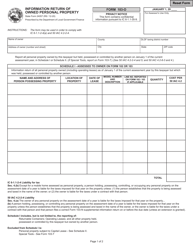

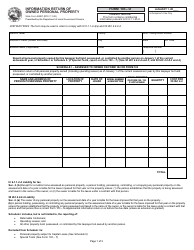

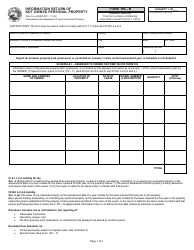

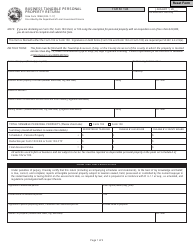

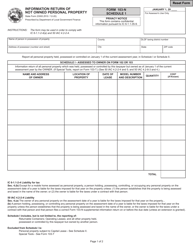

Form 103-N Schedule 1 Information Return of Not Owned Personal Property - Indiana

What Is Form 103-N Schedule 1?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-N Schedule 1?

A: Form 103-N Schedule 1 is an information return for reporting not owned personal property in Indiana.

Q: Who needs to file Form 103-N Schedule 1?

A: Individuals and businesses who have not owned personal property in Indiana during the tax year need to file Form 103-N Schedule 1.

Q: What is the purpose of filing Form 103-N Schedule 1?

A: The purpose of filing Form 103-N Schedule 1 is to report information about not owned personal property in Indiana for tax purposes.

Q: When is the deadline to file Form 103-N Schedule 1?

A: The deadline to file Form 103-N Schedule 1 is usually April 15th of the following year.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-N Schedule 1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.