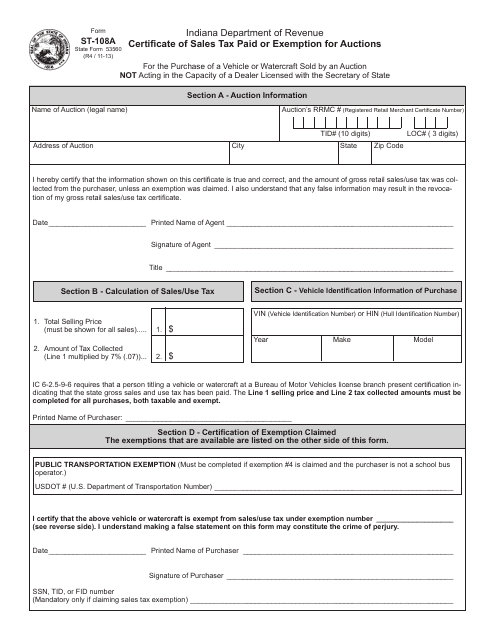

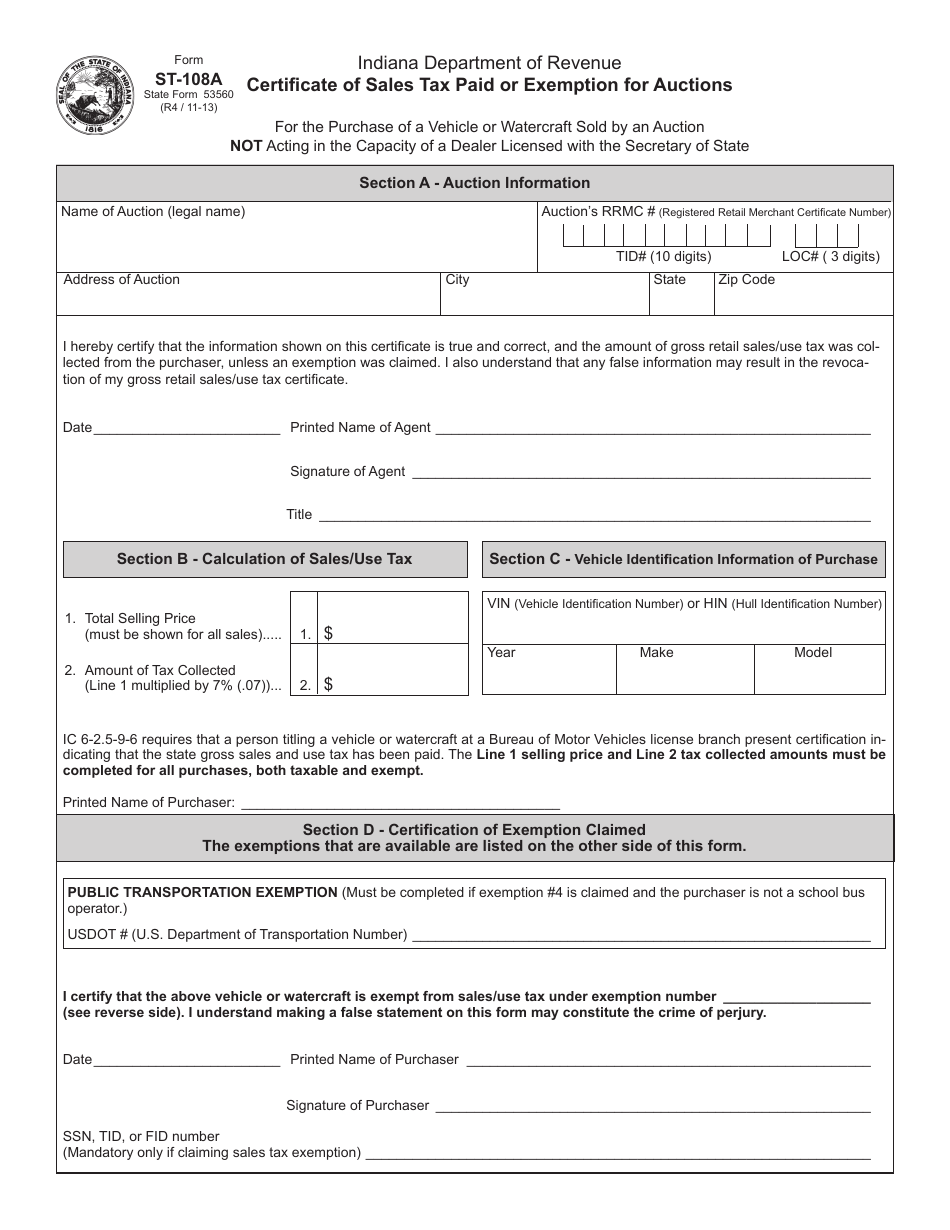

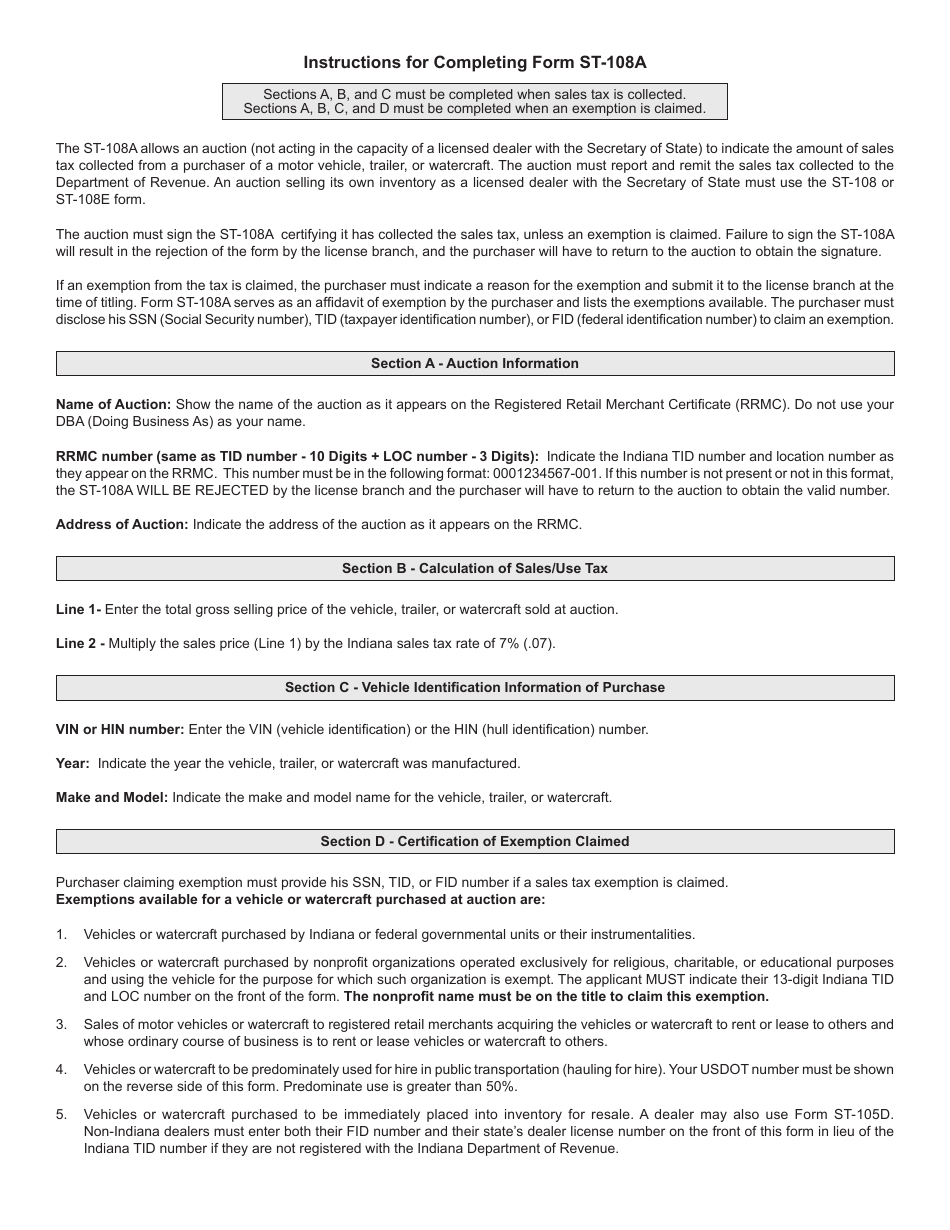

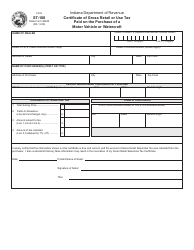

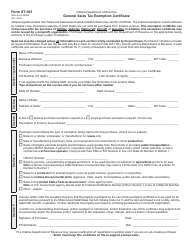

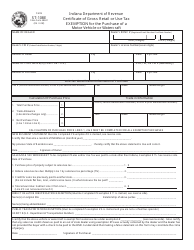

Form ST-108A Certificate of Sales Tax Paid or Exemption for Auctions - Indiana

What Is Form ST-108A?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

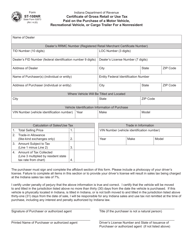

Q: What is Form ST-108A?

A: Form ST-108A is a certificate used for reporting sales tax paid or claiming exemption for auctions in Indiana.

Q: What is the purpose of Form ST-108A?

A: The purpose of Form ST-108A is to document sales tax paid or exemption claimed for auctions in Indiana.

Q: Who is required to use Form ST-108A?

A: Auctioneers and auction businesses in Indiana are required to use Form ST-108A.

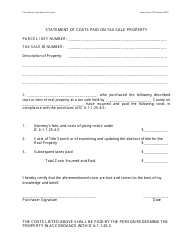

Q: When should Form ST-108A be filed?

A: Form ST-108A should be filed within 20 days after the end of the month in which the auction took place.

Q: Are there any penalties for not filing Form ST-108A?

A: Yes, failure to file Form ST-108A or filing incorrect information may result in penalties and interest.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Indiana Department of Revenue;

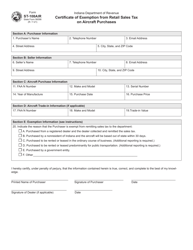

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-108A by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.