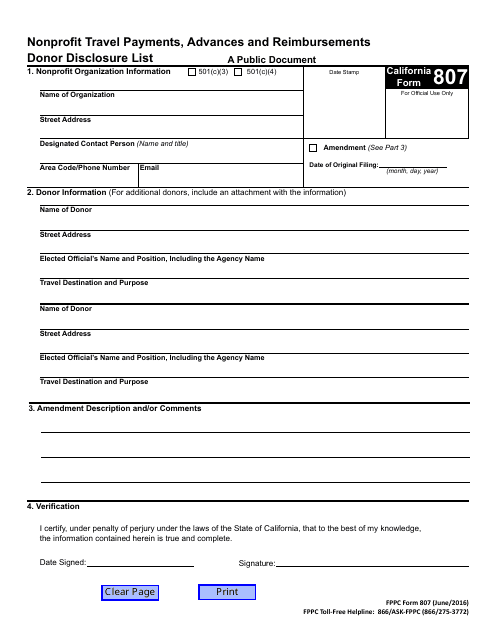

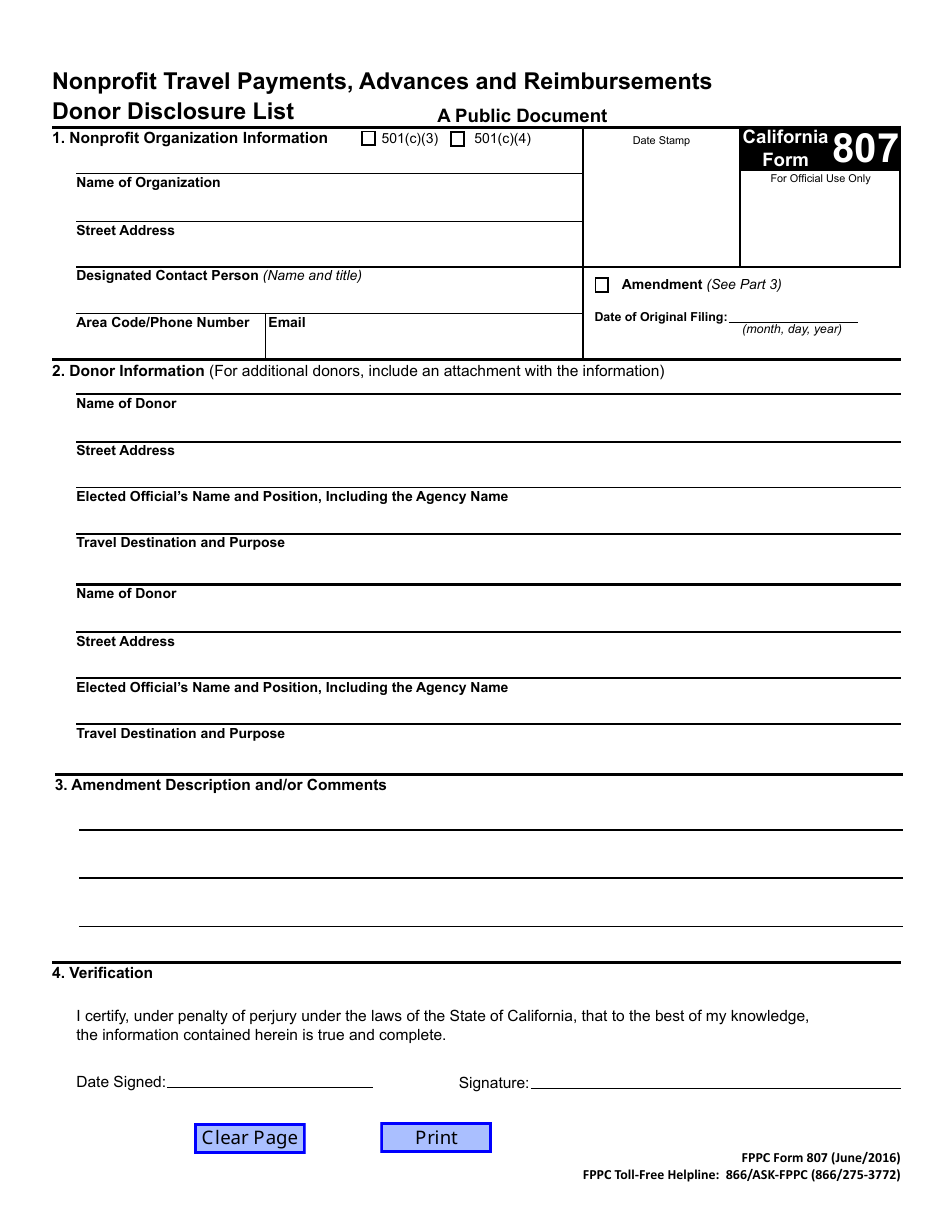

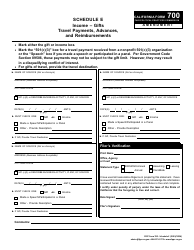

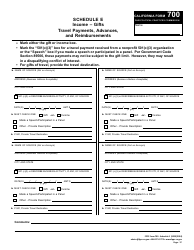

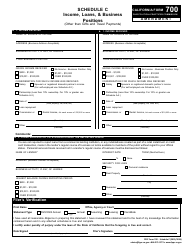

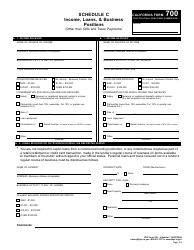

FPPC Form 807 Nonprofit Travel Payments, Advances and Reimbursements Donor Disclosure List - California

What Is FPPC Form 807?

This is a legal form that was released by the California Fair Political Practices Commission - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FPPC Form 807?

A: FPPC Form 807 is a form used in California to disclose nonprofit travel payments, advances, and reimbursements.

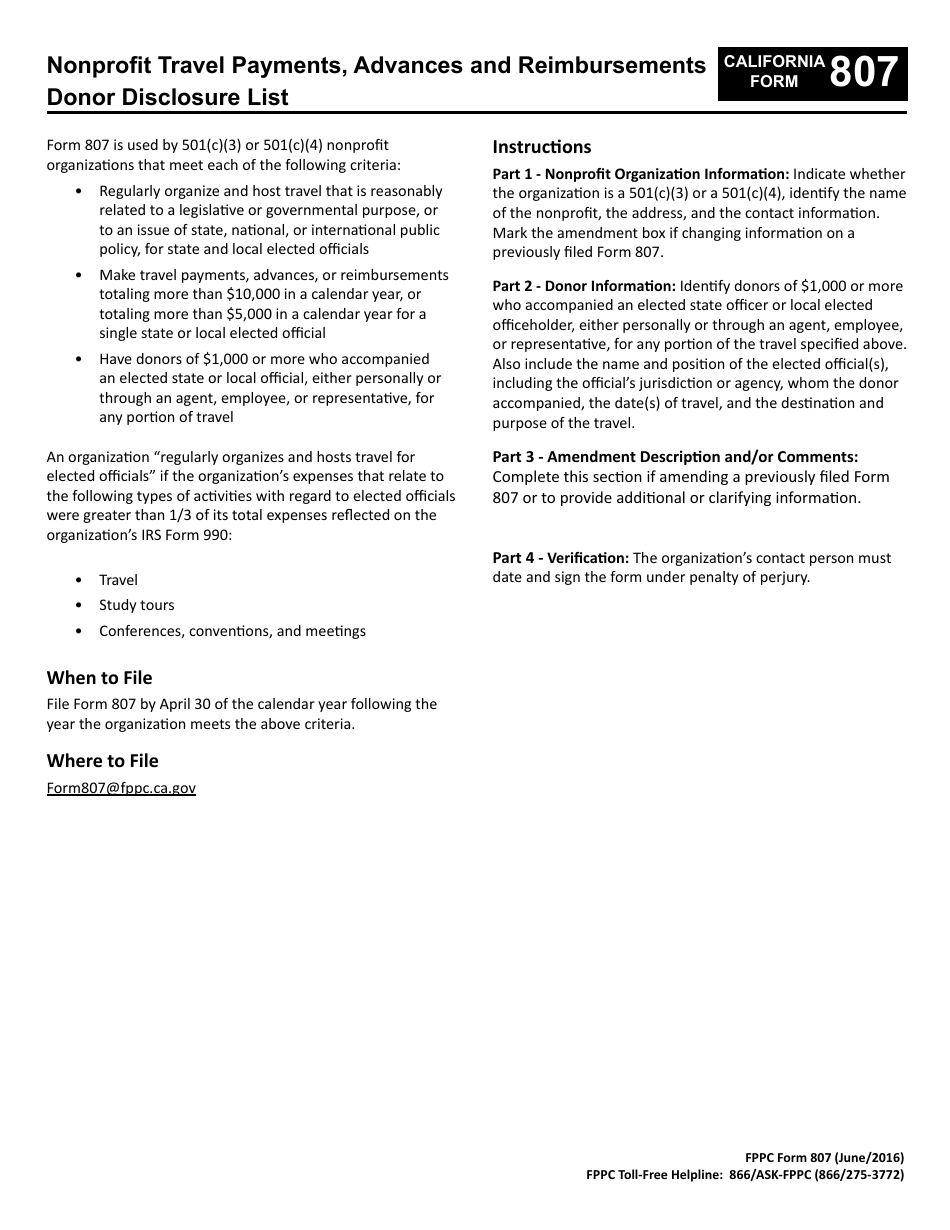

Q: Who uses FPPC Form 807?

A: Nonprofit organizations in California use FPPC Form 807 to disclose travel payments, advances, and reimbursements.

Q: What is the purpose of FPPC Form 807?

A: The purpose of FPPC Form 807 is to provide transparency and disclose travel payments, advances, and reimbursements made by nonprofit organizations.

Q: What information is required on FPPC Form 807?

A: FPPC Form 807 requires the disclosure of the name, address, and employer of each donor who provides travel payments, advances, or reimbursements.

Q: When should FPPC Form 807 be filed?

A: FPPC Form 807 should be filed within 30 days of the receipt of each travel payment, advance, or reimbursement.

Q: Is FPPC Form 807 publicly available?

A: Yes, FPPC Form 807 is a publicly available document that can be viewed by the public.

Q: Are there any penalties for not filing FPPC Form 807?

A: Yes, there may be penalties for failing to timely file FPPC Form 807 or for providing false or incomplete information.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the California Fair Political Practices Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of FPPC Form 807 by clicking the link below or browse more documents and templates provided by the California Fair Political Practices Commission.