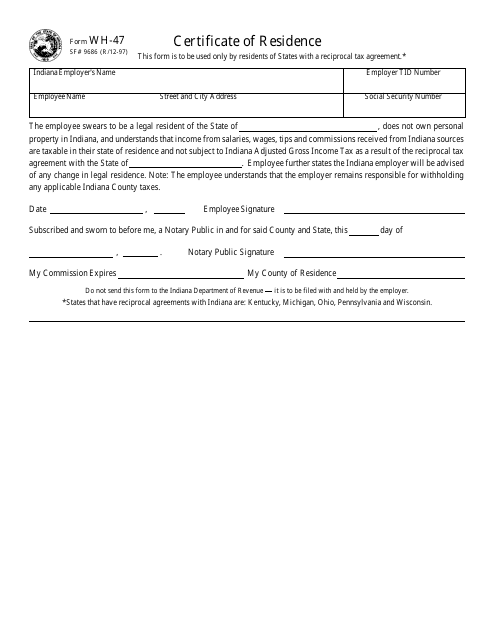

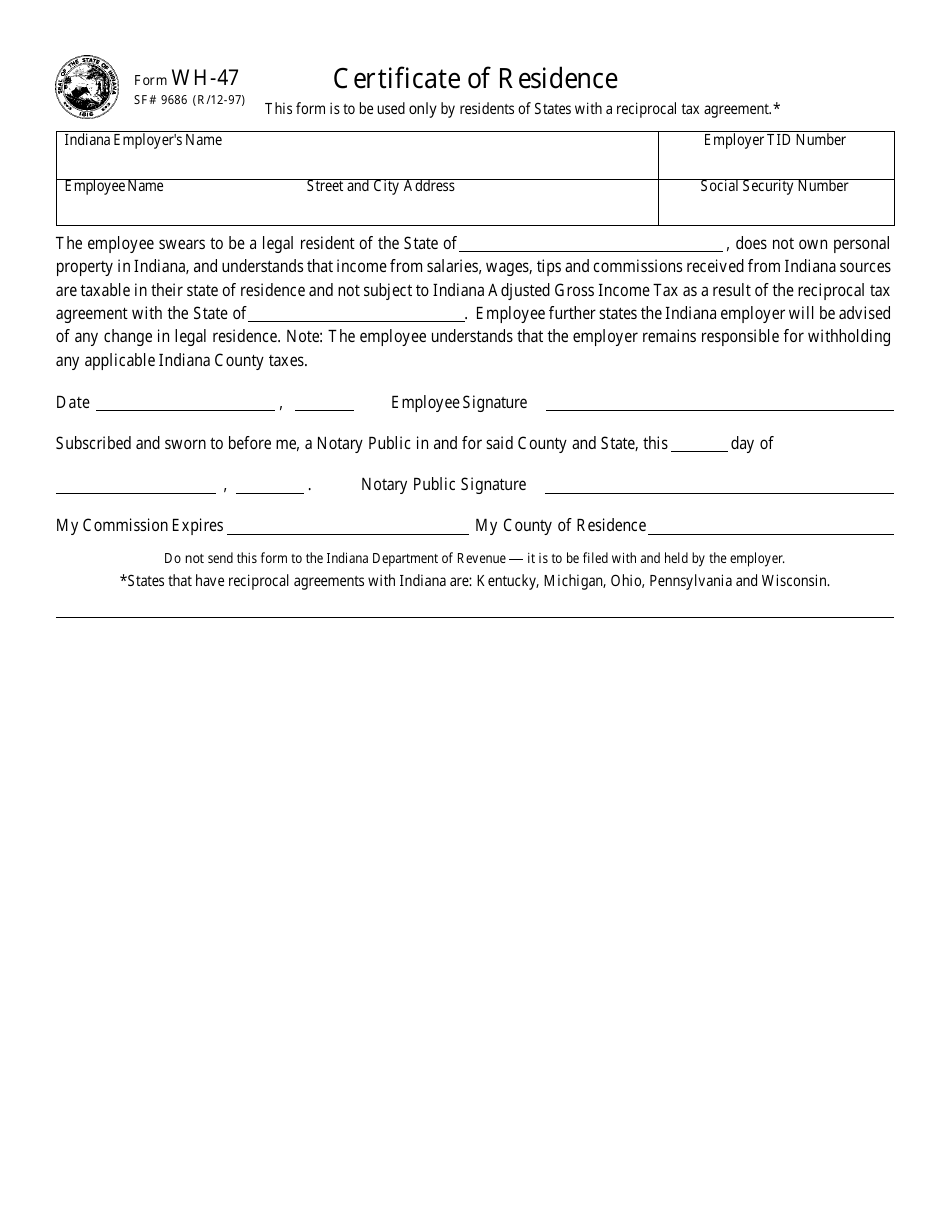

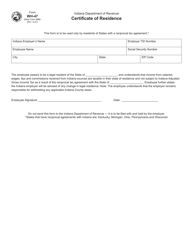

Form SF9686 (WH-47) Certificate of Residence - Indiana

What Is Form SF9686 (WH-47)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF9686 (WH-47)?

A: Form SF9686 (WH-47) is a Certificate of Residence for the state of Indiana.

Q: Who needs to fill out and submit Form SF9686 (WH-47)?

A: Residents of Indiana who need to prove their residency for tax purposes may need to fill out and submit Form SF9686 (WH-47).

Q: What information do I need to provide on Form SF9686 (WH-47)?

A: You will need to provide your personal information, such as your name, address, social security number, and the tax year for which the certificate is valid.

Q: Can I electronically submit Form SF9686 (WH-47)?

A: No, Form SF9686 (WH-47) must be completed and submitted in paper format.

Q: What is the purpose of Form SF9686 (WH-47)?

A: The purpose of Form SF9686 (WH-47) is to certify your residency in Indiana for tax purposes.

Q: Do I need to attach any documents to Form SF9686 (WH-47)?

A: No, you do not need to attach any documents to Form SF9686 (WH-47). However, you may be required to provide supporting documentation if requested by the Indiana Department of Revenue.

Q: Is there any fee associated with submitting Form SF9686 (WH-47)?

A: No, there is no fee associated with submitting Form SF9686 (WH-47).

Q: Is Form SF9686 (WH-47) only for Indiana residents?

A: Yes, Form SF9686 (WH-47) is specifically for residents of Indiana.

Q: What happens after I submit Form SF9686 (WH-47)?

A: After you submit Form SF9686 (WH-47), the Indiana Department of Revenue will review your application and determine your residency status for tax purposes.

Form Details:

- Released on December 1, 1997;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SF9686 (WH-47) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.