This version of the form is not currently in use and is provided for reference only. Download this version of

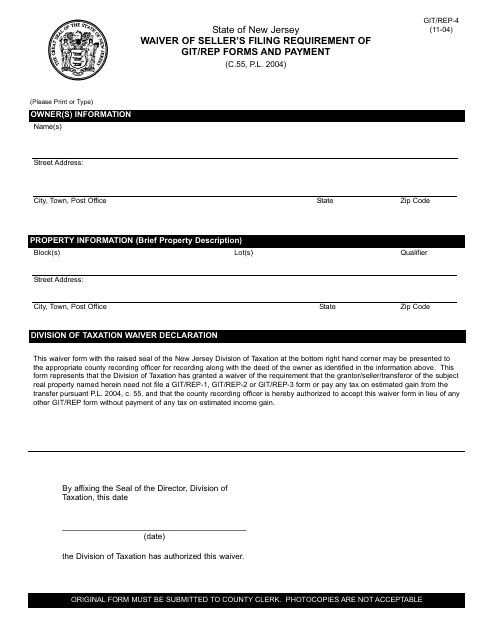

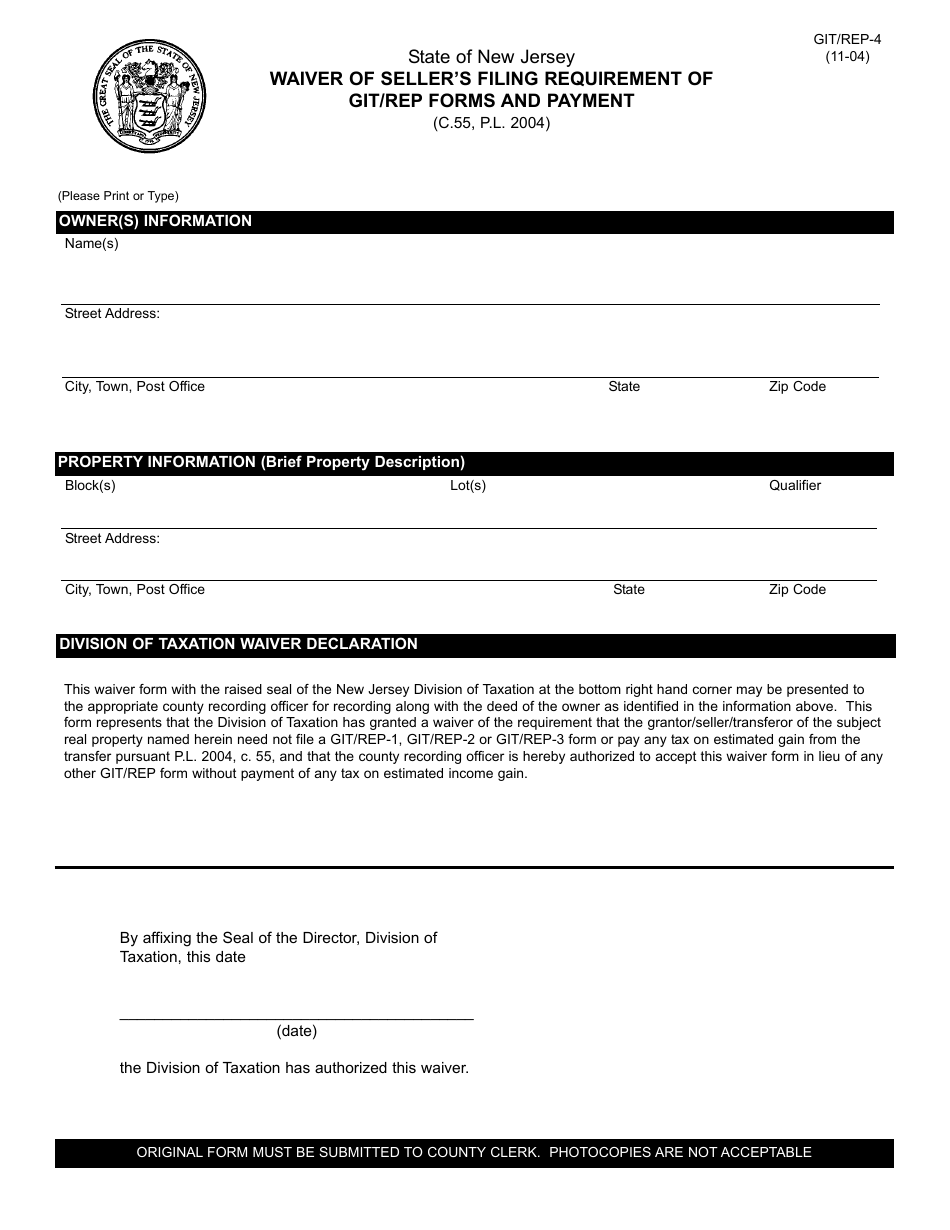

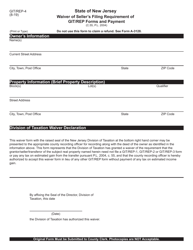

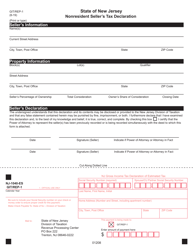

Form GIT/REP-4

for the current year.

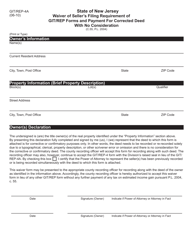

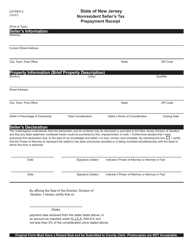

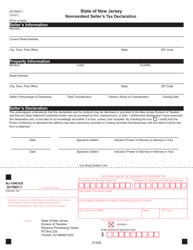

Form GIT / REP-4 Waiver of Seller's Filing Requirement of Git / Rep Forms and Payment - New Jersey

What Is Form GIT/REP-4?

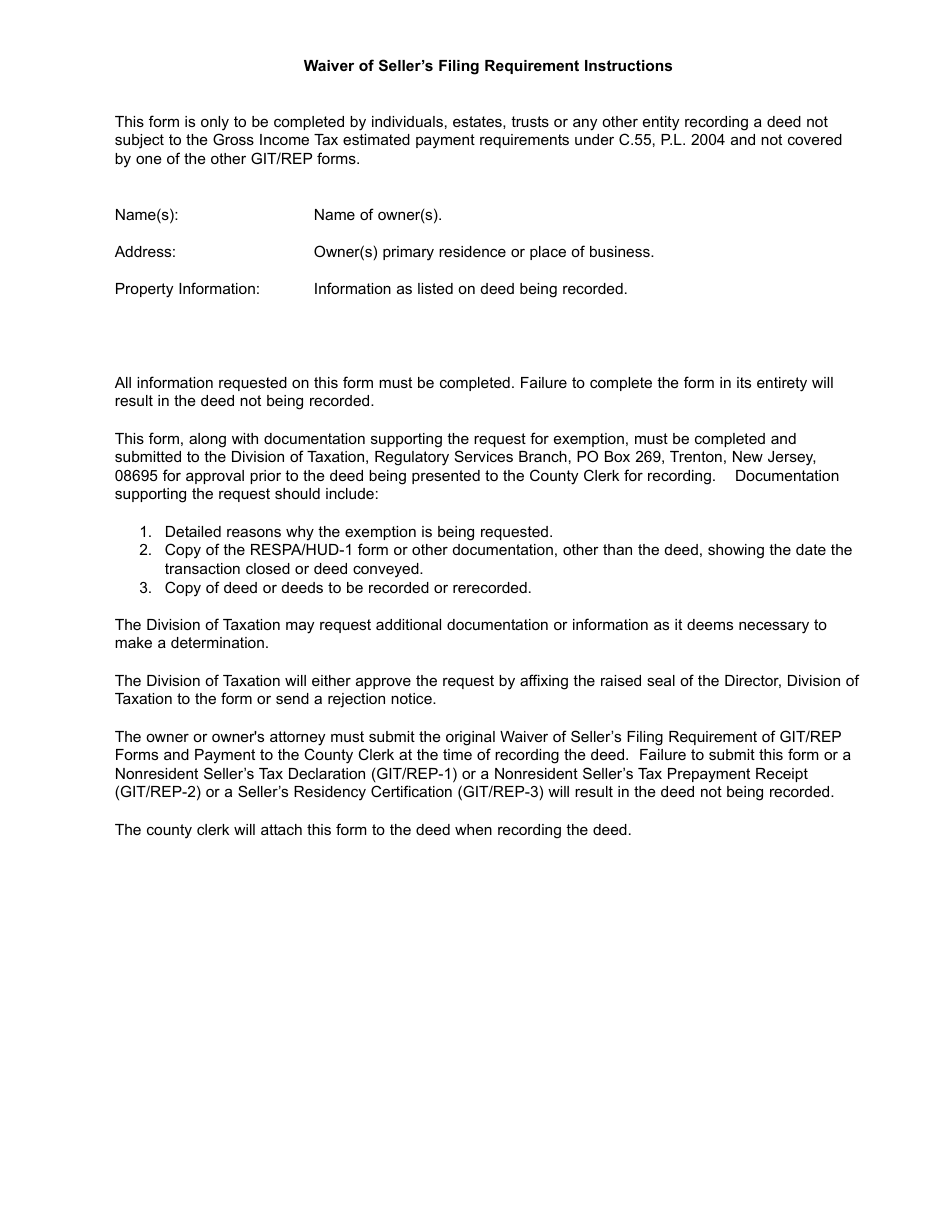

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

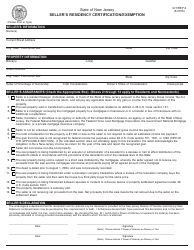

Q: What is a GIT/REP-4 form?

A: The GIT/REP-4 form is a waiver form for sellers in New Jersey to request an exemption from filing GIT/REP forms and making payments.

Q: When is the GIT/REP-4 form used?

A: The GIT/REP-4 form is used when a seller wants to waive their requirement to file GIT/REP forms and make payment for certain transactions in New Jersey.

Q: Who can use the GIT/REP-4 form?

A: Any seller in New Jersey who qualifies for the waiver can use the GIT/REP-4 form to request the exemption.

Q: What does the GIT/REP-4 form waive?

A: The GIT/REP-4 form waives the requirement for sellers to file GIT or REP forms and make payment for transactions that meet the qualifications for the waiver.

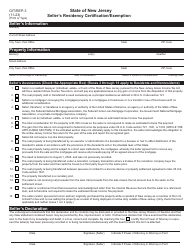

Q: Are there any fees associated with the GIT/REP-4 form?

A: There are no fees associated with submitting the GIT/REP-4 form or obtaining the waiver.

Q: What should I do if I have questions about the GIT/REP-4 form?

A: If you have questions about the GIT/REP-4 form or the waiver process, you should contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on November 1, 2004;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT/REP-4 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.