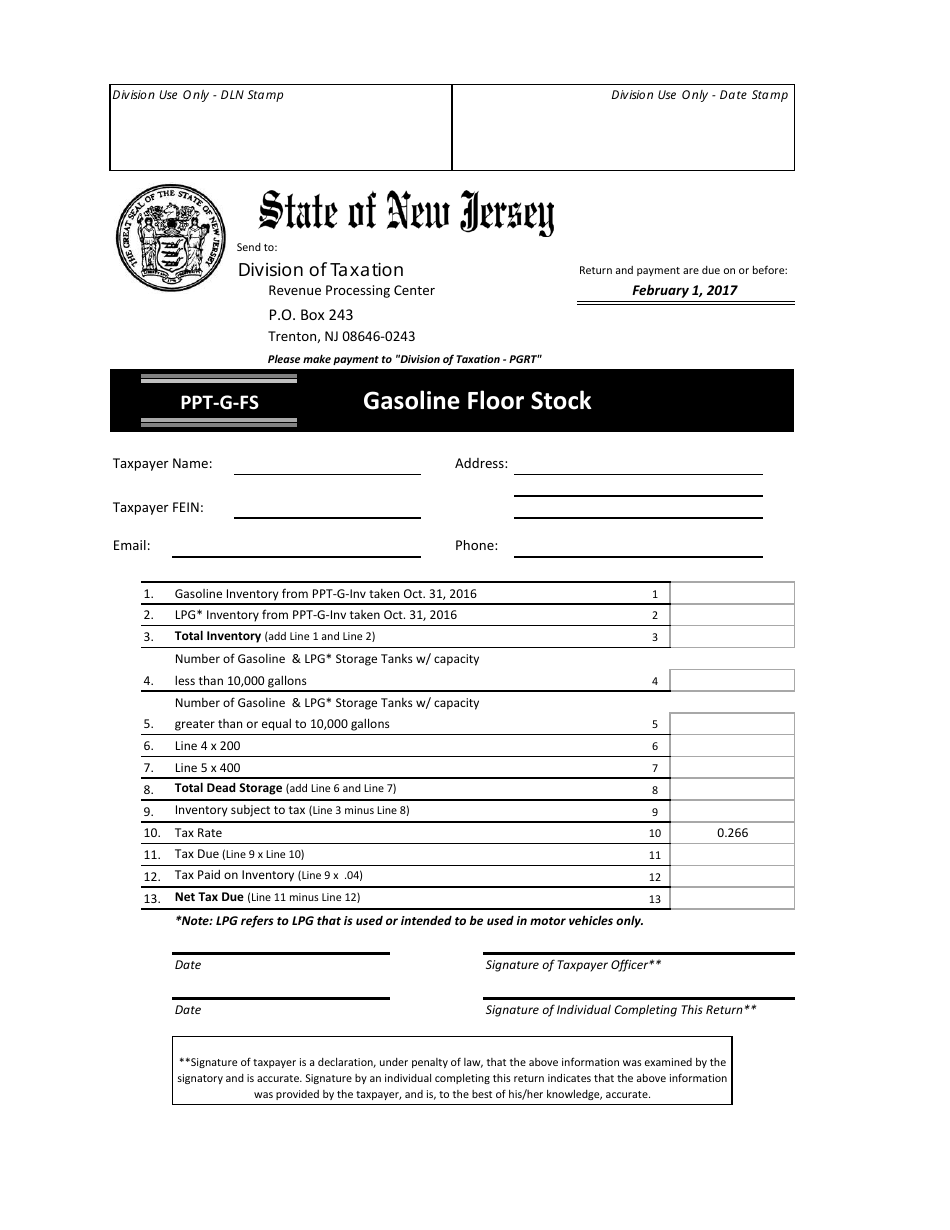

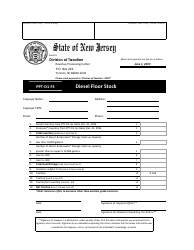

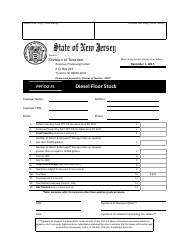

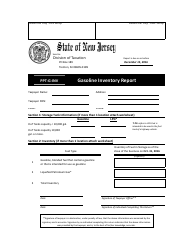

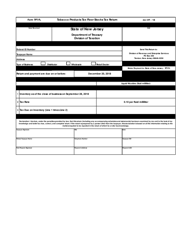

Form PPT-G-FS Gasoline Floor Stock - New Jersey

What Is Form PPT-G-FS?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-G-FS?

A: Form PPT-G-FS is a form used for reporting gasoline floor stock in New Jersey.

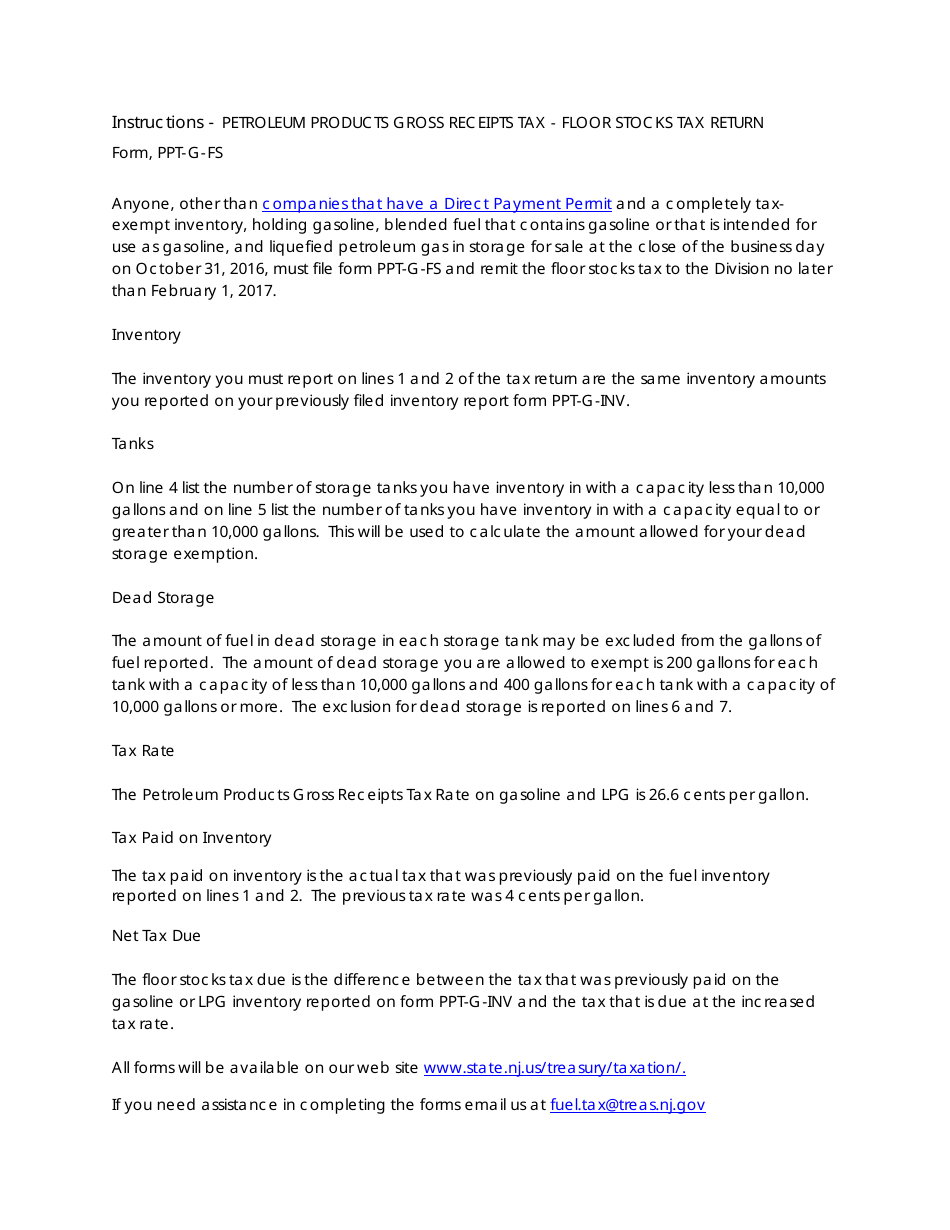

Q: Who needs to file Form PPT-G-FS?

A: Gasoline retailers in New Jersey need to file Form PPT-G-FS.

Q: What is gasoline floor stock?

A: Gasoline floor stock refers to the gasoline that a retailer has in their storage tanks or dispensing equipment.

Q: When is Form PPT-G-FS due?

A: Form PPT-G-FS is due on a quarterly basis, typically on the 20th day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form PPT-G-FS?

A: Yes, late filing of Form PPT-G-FS can result in penalties and interest.

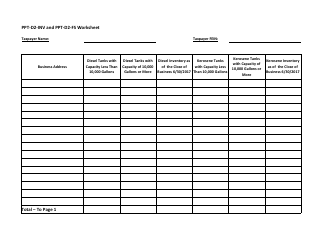

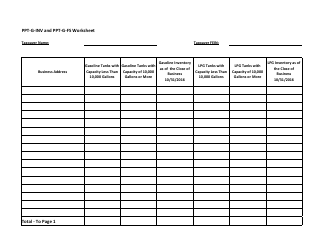

Q: What information is required on Form PPT-G-FS?

A: Form PPT-G-FS requires information such as the beginning and ending inventory levels, purchases, and sales of gasoline.

Q: Can I amend a filed Form PPT-G-FS?

A: Yes, if you need to make changes or corrections to a filed Form PPT-G-FS, you can file an amended return.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-G-FS by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.