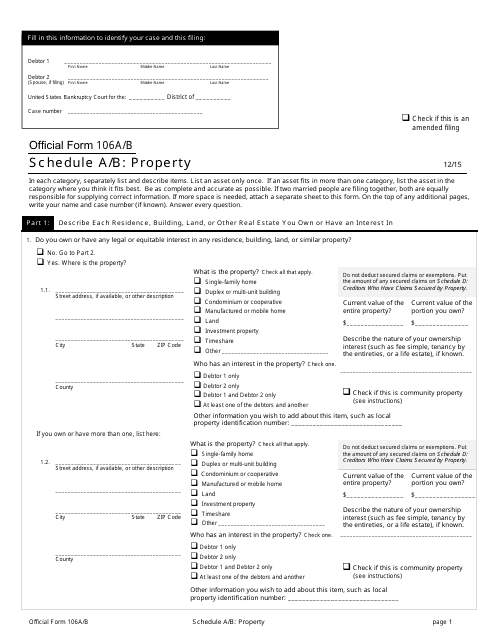

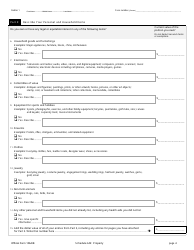

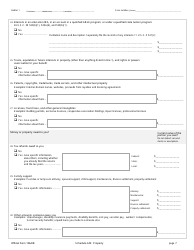

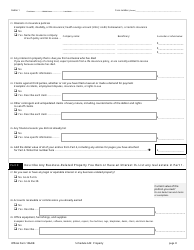

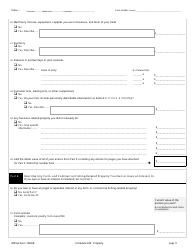

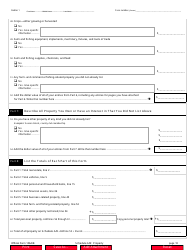

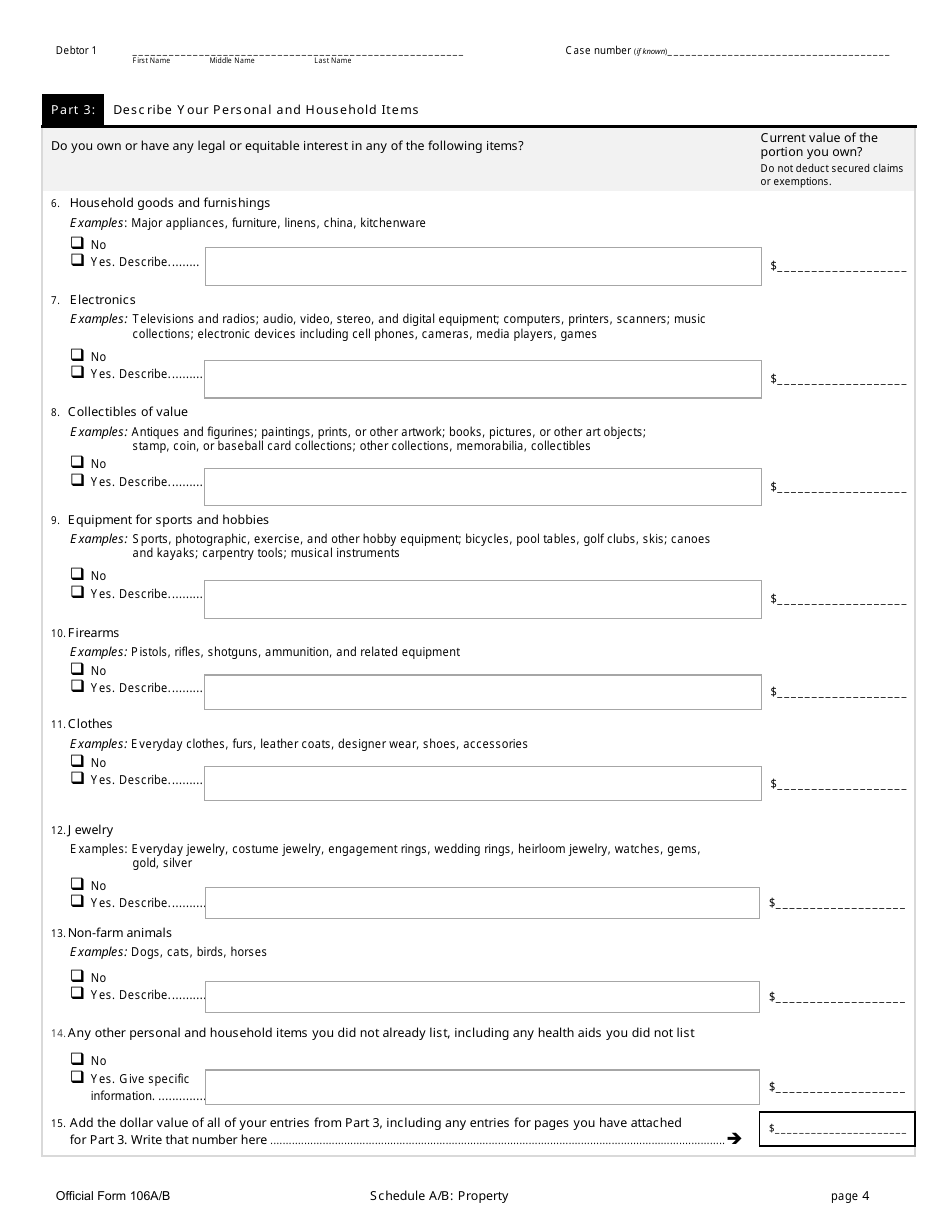

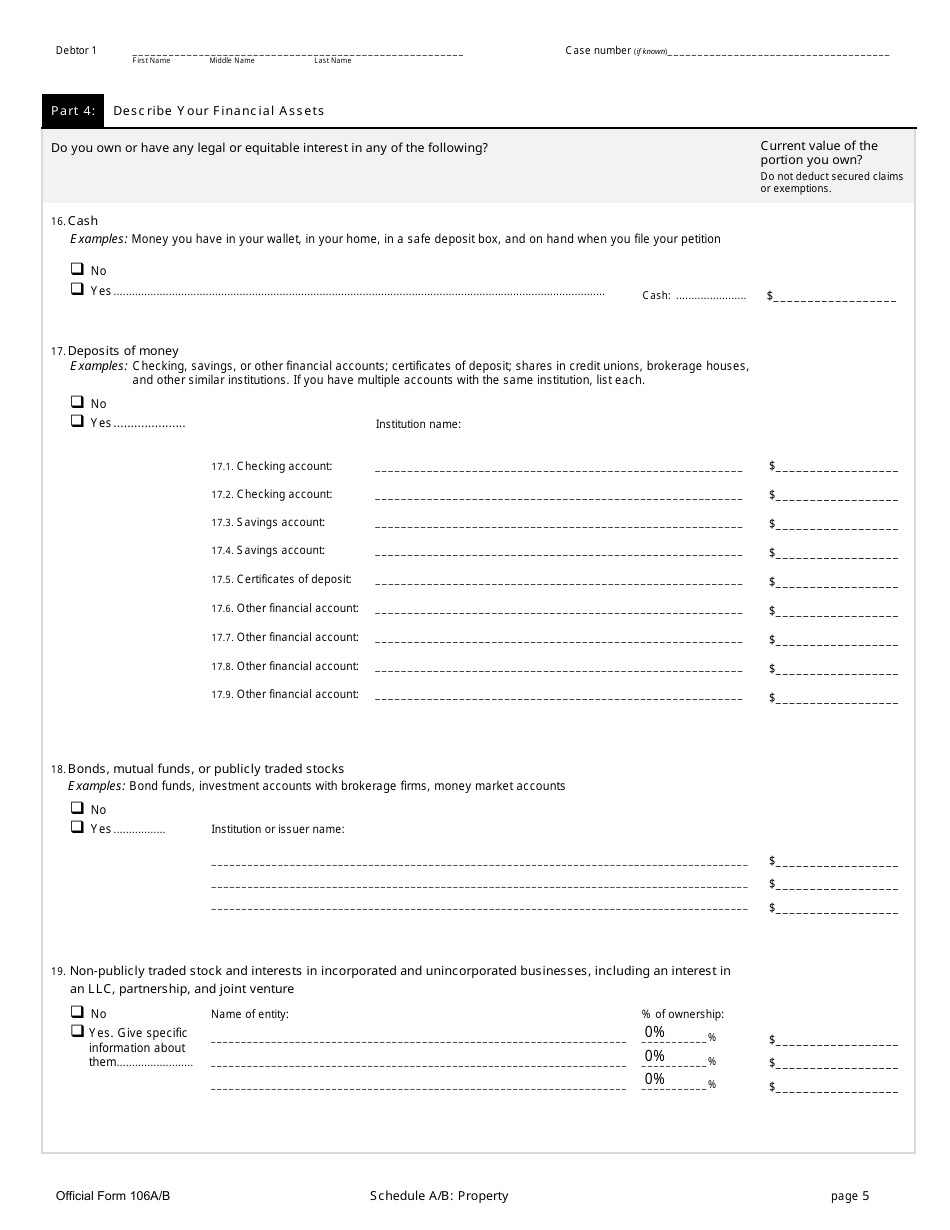

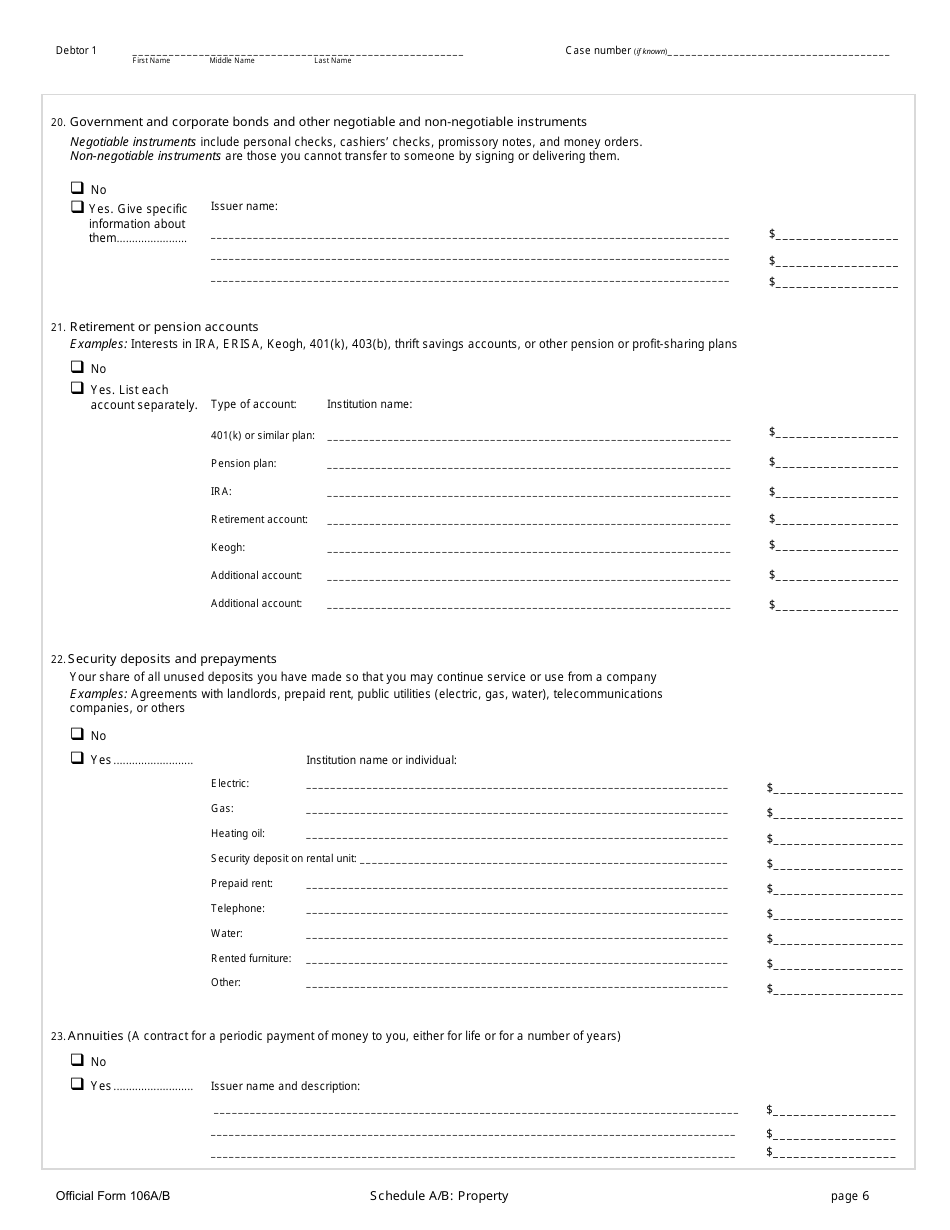

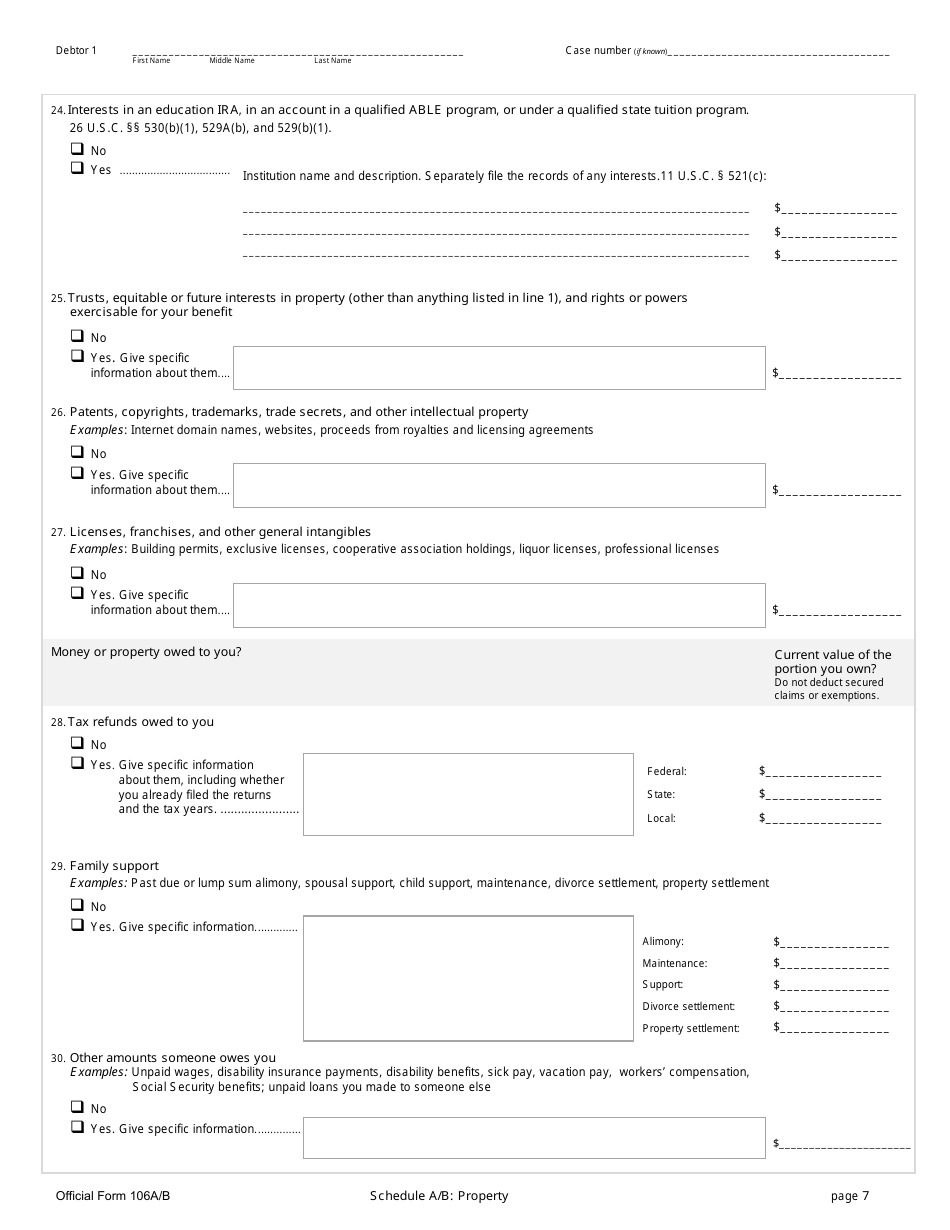

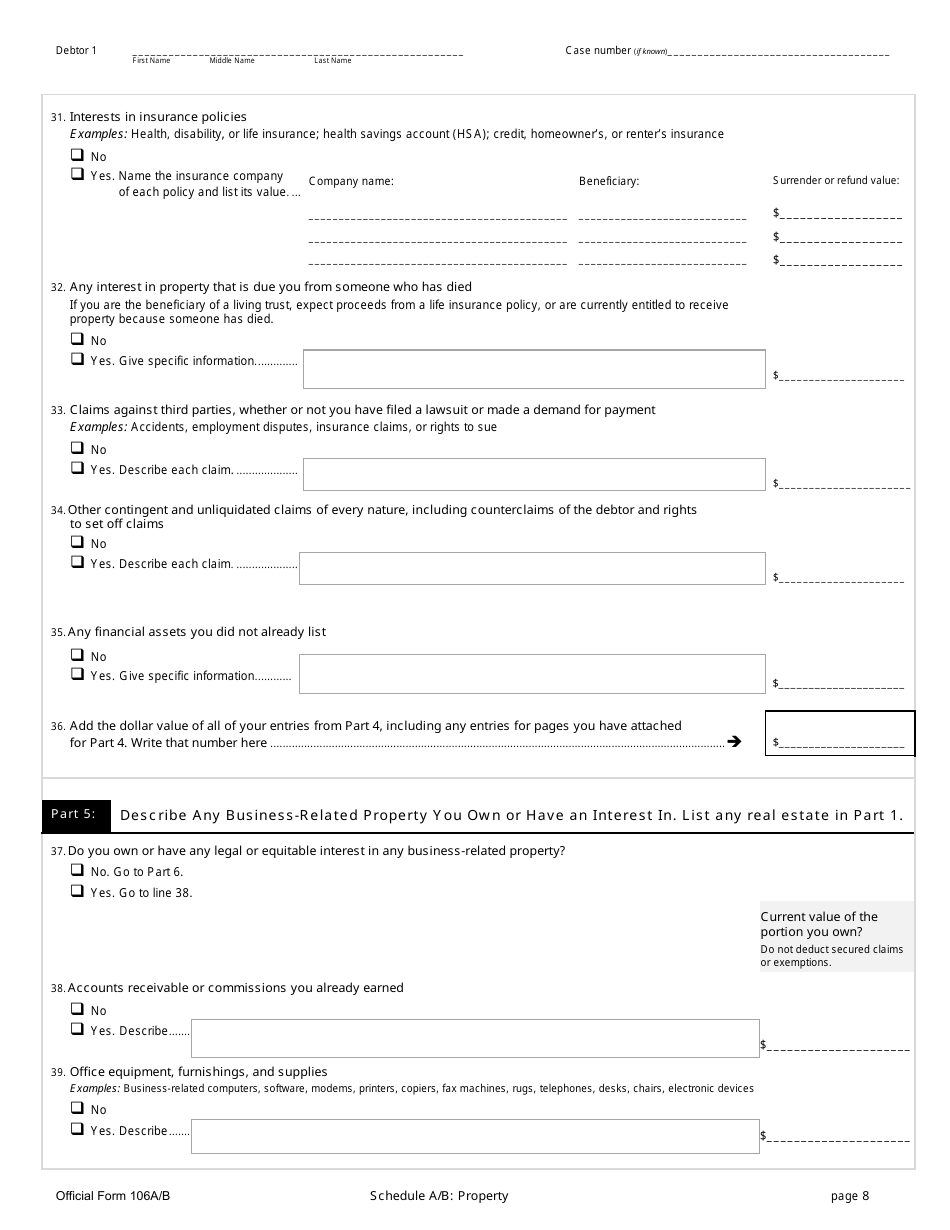

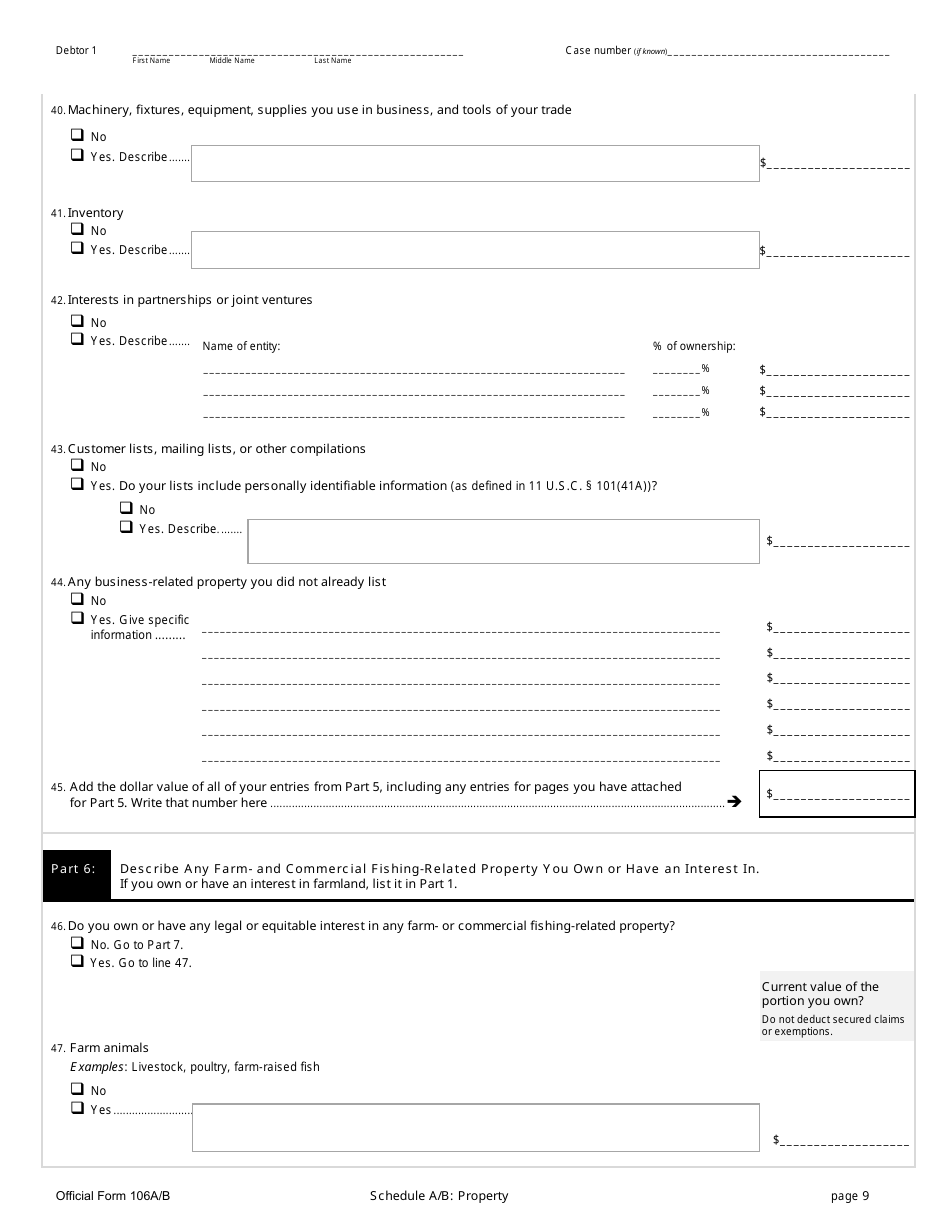

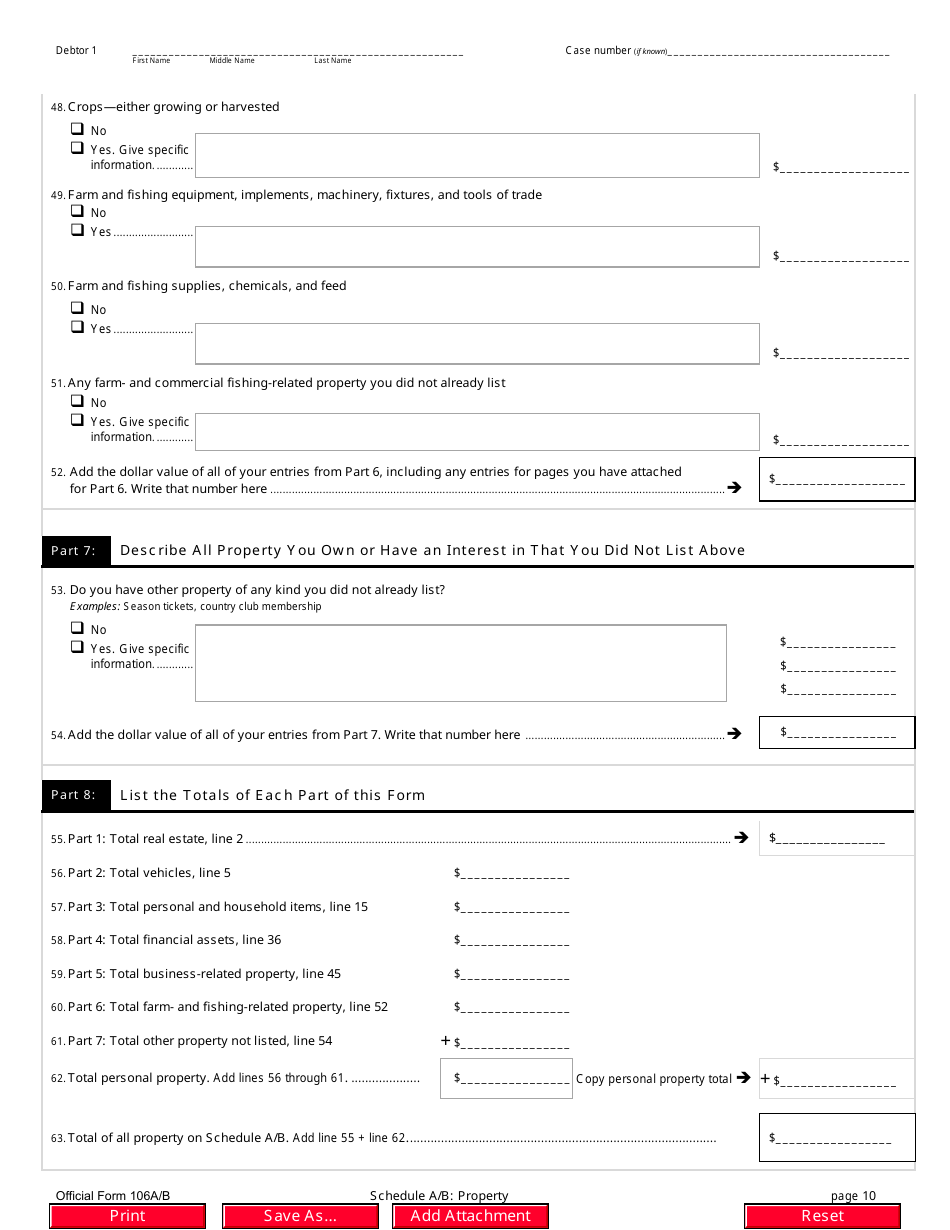

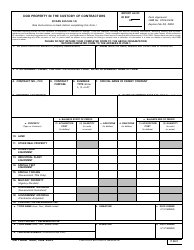

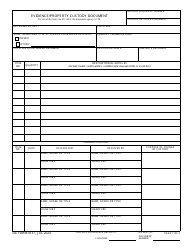

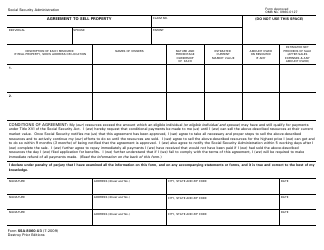

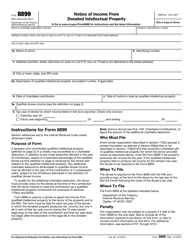

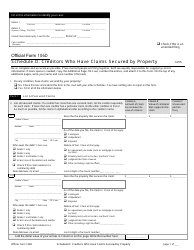

Official Form 106A / B Schedule A / B Property

What Is Official Form 106A/B Schedule A/B?

This is a legal form that was released by the United States Courts on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

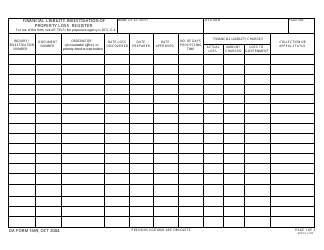

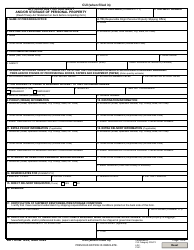

Q: What is Form 106A/B Schedule A/B Property?

A: Form 106A/B Schedule A/B Property is an official form used for listing assets and properties in a bankruptcy case.

Q: Why do I need to fill out Form 106A/B Schedule A/B Property?

A: You need to fill out Form 106A/B Schedule A/B Property to provide a detailed list of your assets and properties that may be subject to liquidation or repayment in a bankruptcy case.

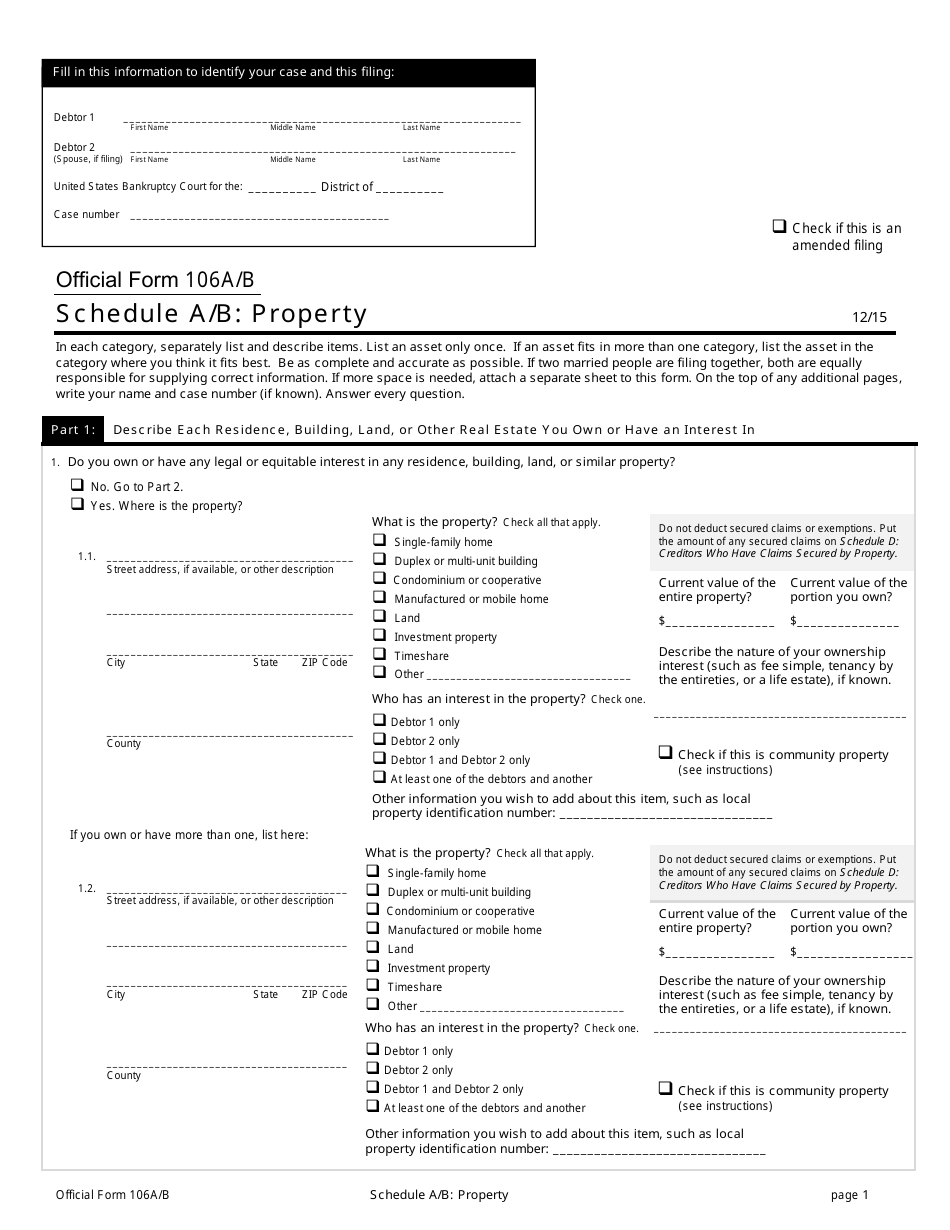

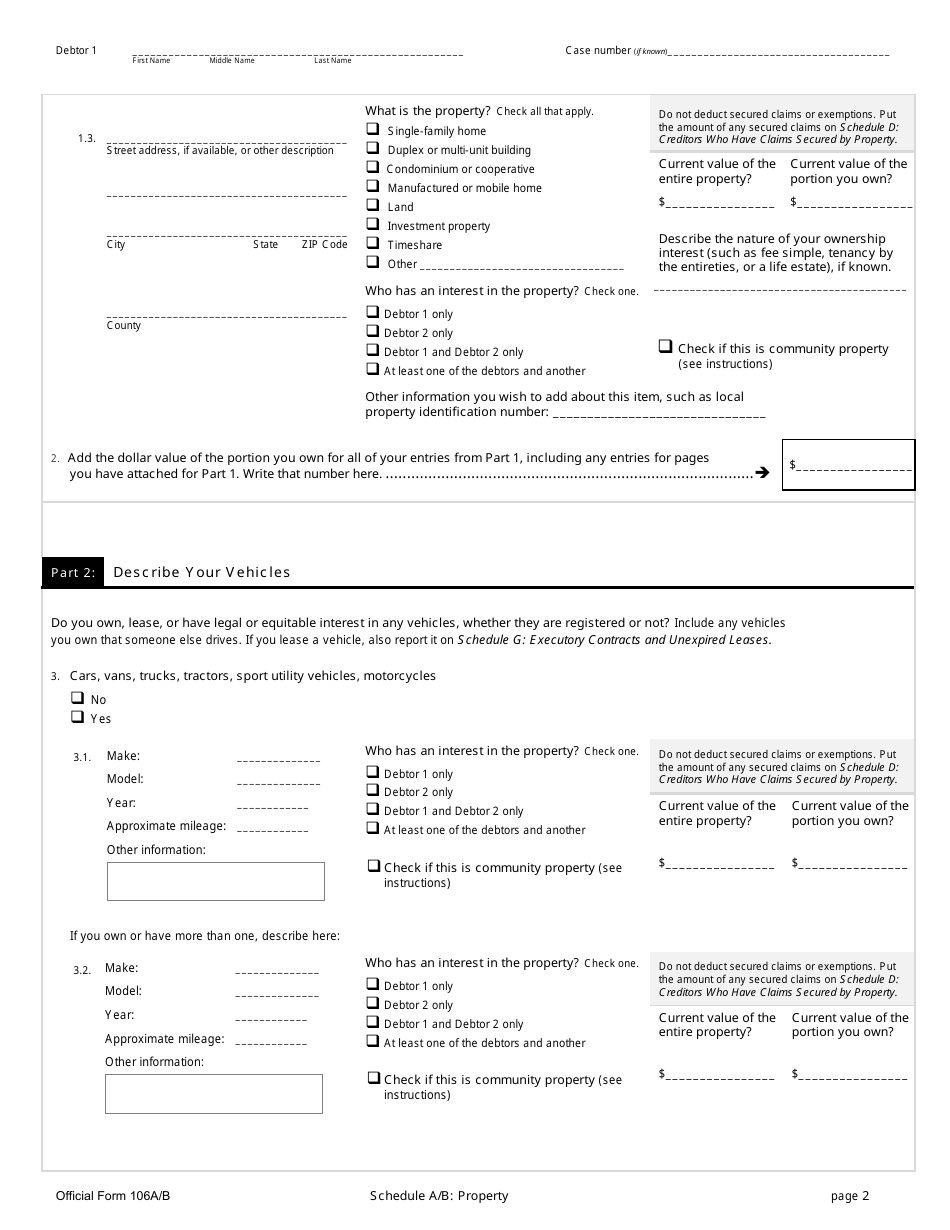

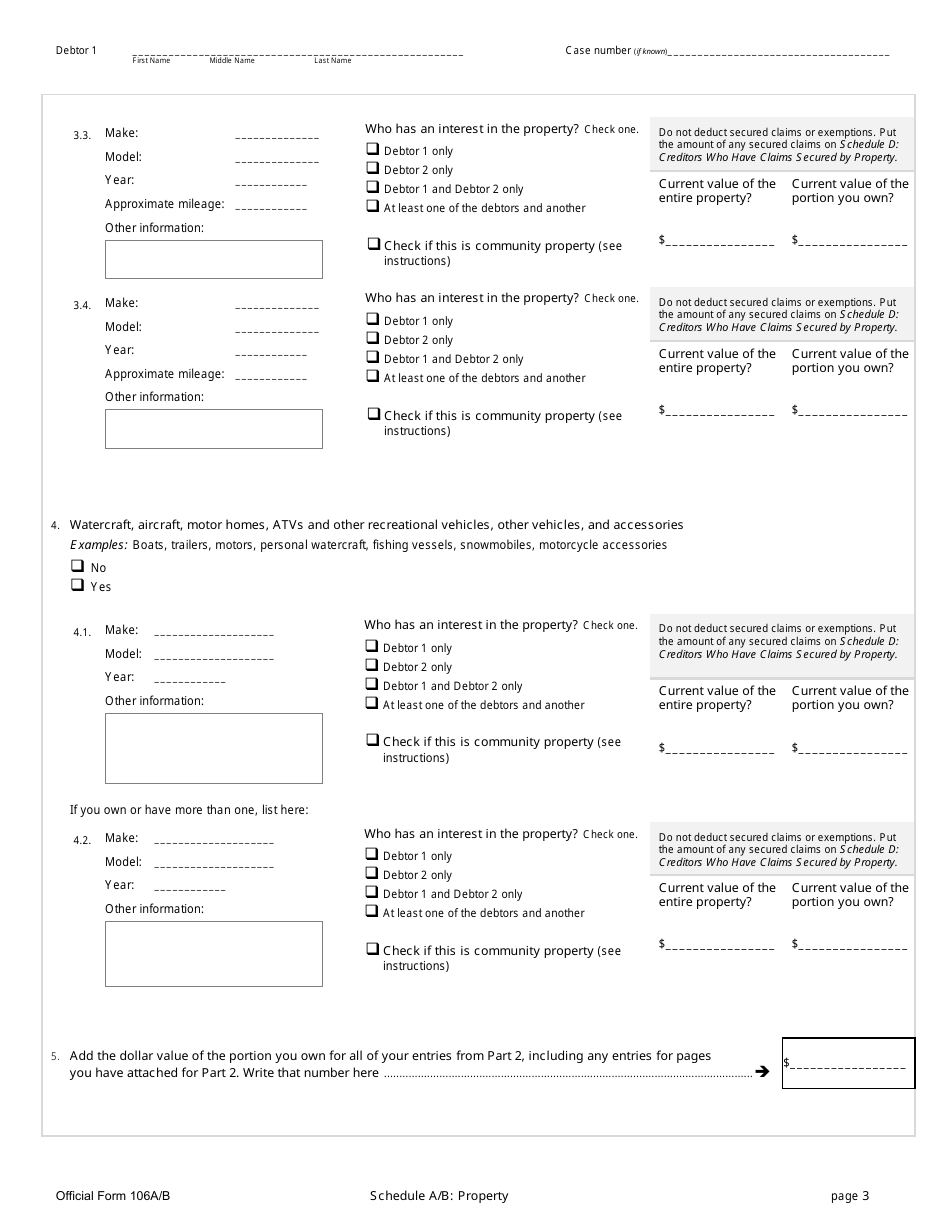

Q: What type of properties should be included in Form 106A/B Schedule A/B Property?

A: You should include all types of properties you own, such as real estate, vehicles, bank accounts, investments, and personal belongings, in Form 106A/B Schedule A/B Property.

Q: Do I need to list all my properties in Form 106A/B Schedule A/B Property?

A: Yes, you are required to list all your properties, regardless of their value, in Form 106A/B Schedule A/B Property.

Q: Can I exempt some properties from Form 106A/B Schedule A/B Property?

A: You may be able to exempt certain properties from being subject to liquidation or repayment by claiming exemptions allowed under bankruptcy laws. However, you still need to list those properties in Form 106A/B Schedule A/B Property.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Courts;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 106A/B Schedule A/B by clicking the link below or browse more documents and templates provided by the United States Courts.