Form 3281 State of Michigan New Hire Reporting Form - Michigan

What Is Form 3281?

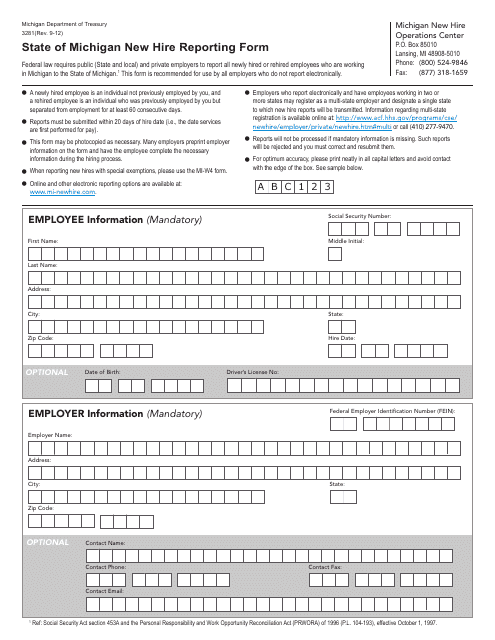

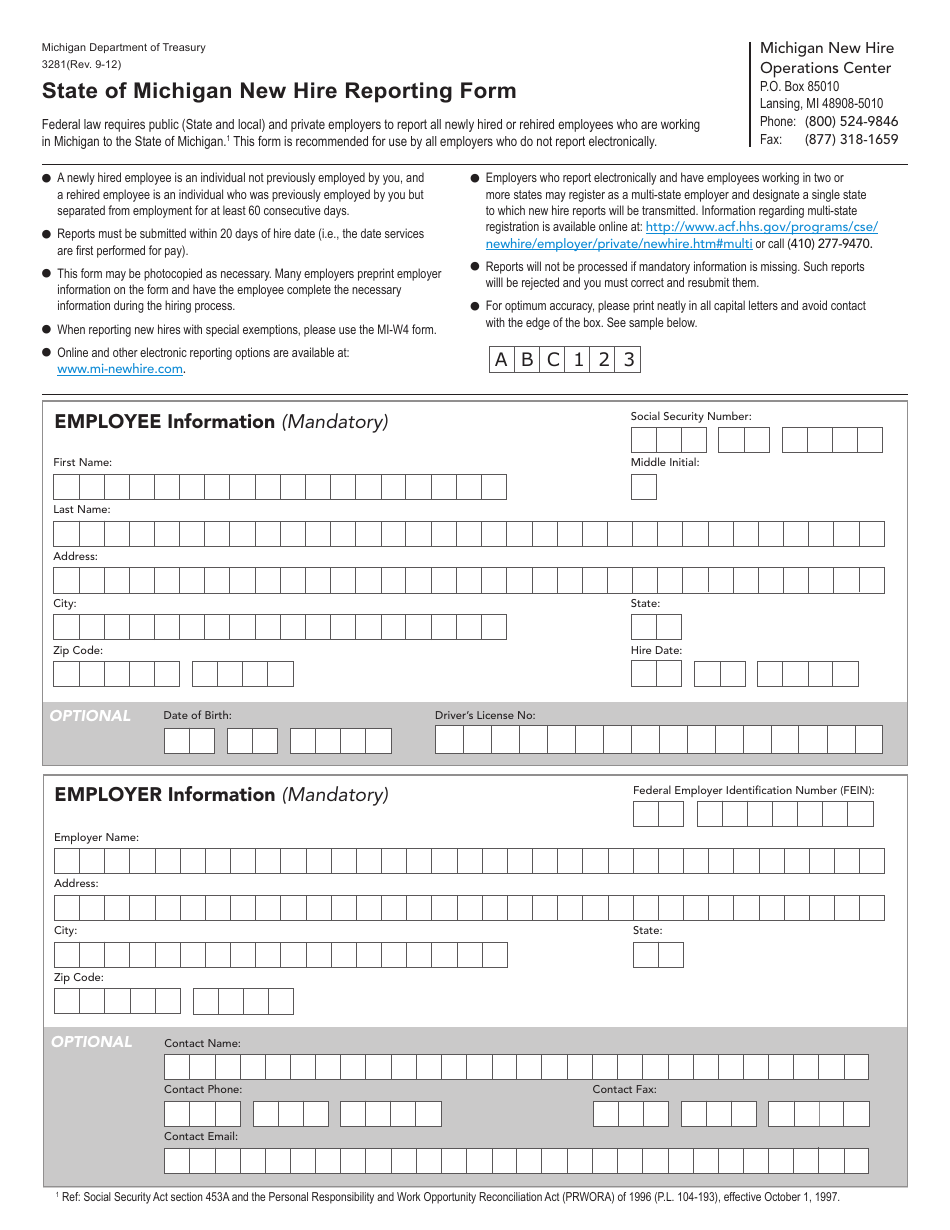

Form 3281, State of Michigan New Hire Reporting Form , is a legal document used by an employer to report information on newly hired employees to the Department of Treasury shortly after the date of hire in the state of Michigan. If you hire an individual who was not previously employed by you or was separated from employment for at least 60 consecutive days, fill out the State of Michigan New Hire Reporting Form

Separation from employment means an individual was laid off, furloughed, granted a leave without pay, or terminated from employment for more than 60 days. Form 3281 is recommended for use by all employers who choose not to file electronically and may be photocopied or reproduced as necessary.

This form was released by the Michigan Department of Treasury . The latest version of the Michigan New Hire form was issued on September 1, 2012 , with all previous editions obsolete. A fillable Form 3281 is available for download below.

Form 3281 Instructions

Each employer is required to report certain information about employees who have been newly hired or rehired. Document the following details in the Michigan New Hire Form:

- Provide the employee information. State the individual's full name, Social Security Number, valid address, and the date of hire - the date the employee first performs services for wages. If you need to report a rehire, use the date of return to work, not the original date of hire. The date of birth and driver's license number are optional; however, they are very helpful in the verification of employment;

- Record the employer information. Indicate the employer's name, Federal Employer Identification Number (FEIN), and address. You may add contact details - the name, phone number, fax, and email address. This is optional but highly recommended, particularly if there is missing required information and the authorities need to contact the employer. Generally, the employer details are preprinted by the employer and the employee only completes the necessary information when hired.

Once you have completed a Michigan New Hire form, you are required to send it to the Michigan New Hire Operations Center, PO Box 85010, Lansing, MI 48908-5010. You have 20 days from the hire date to submit a report. Failure to report may lead to a fine. The papers will not be processed if you fail to include mandatory information, so be careful and try not to miss any important details.