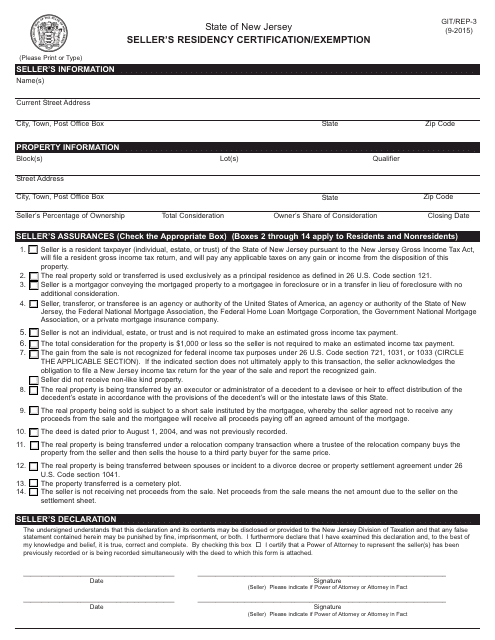

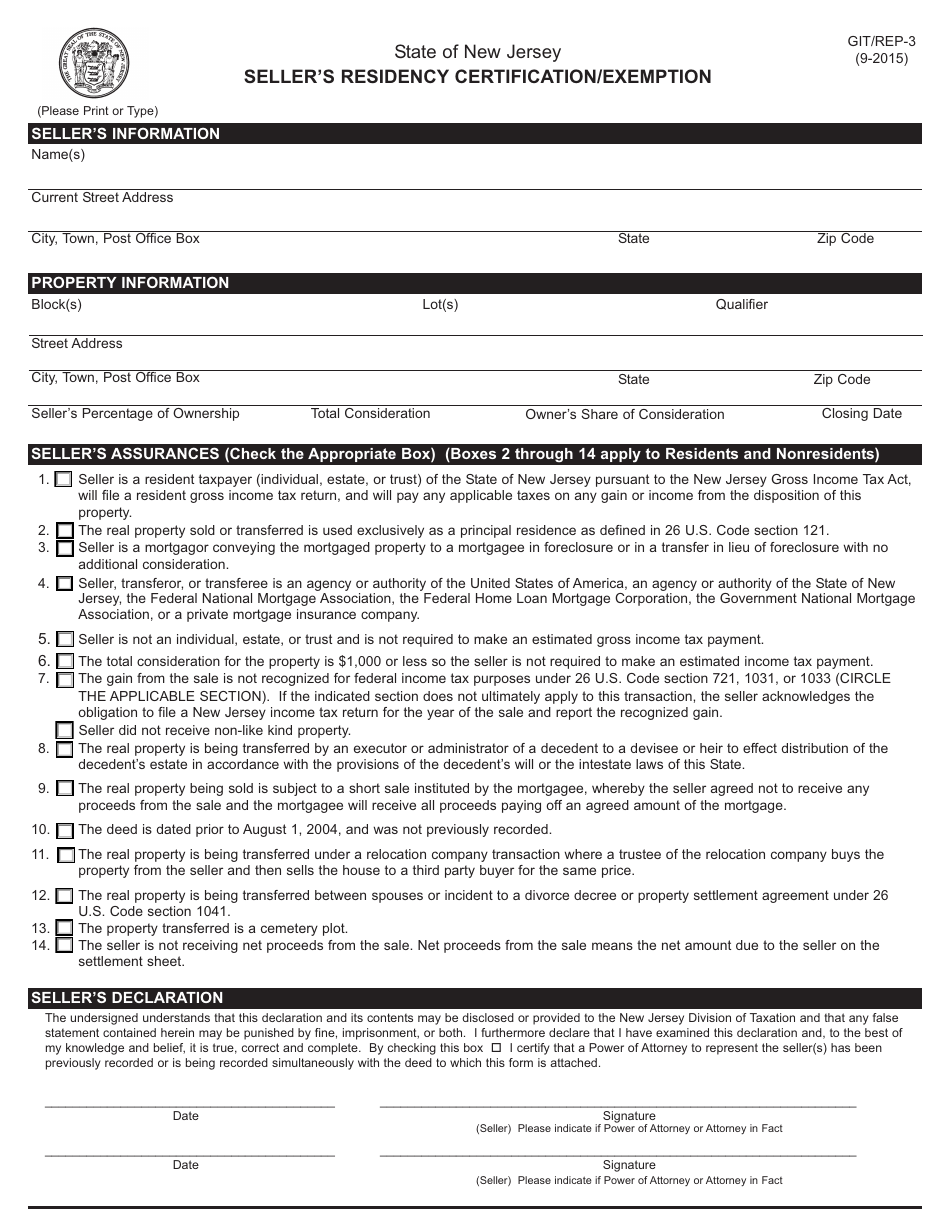

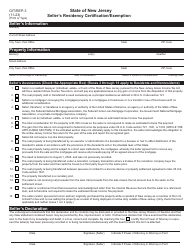

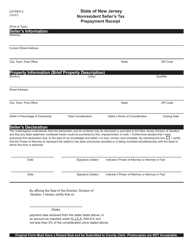

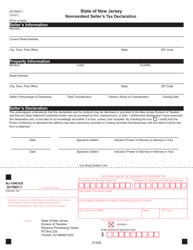

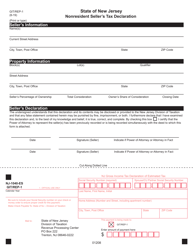

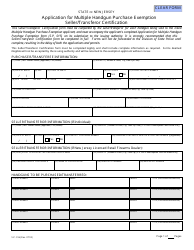

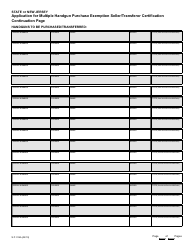

Form GIT-REP-3 Seller's Residency Certification / Exemption - New Jersey

What Is Form GIT-REP-3?

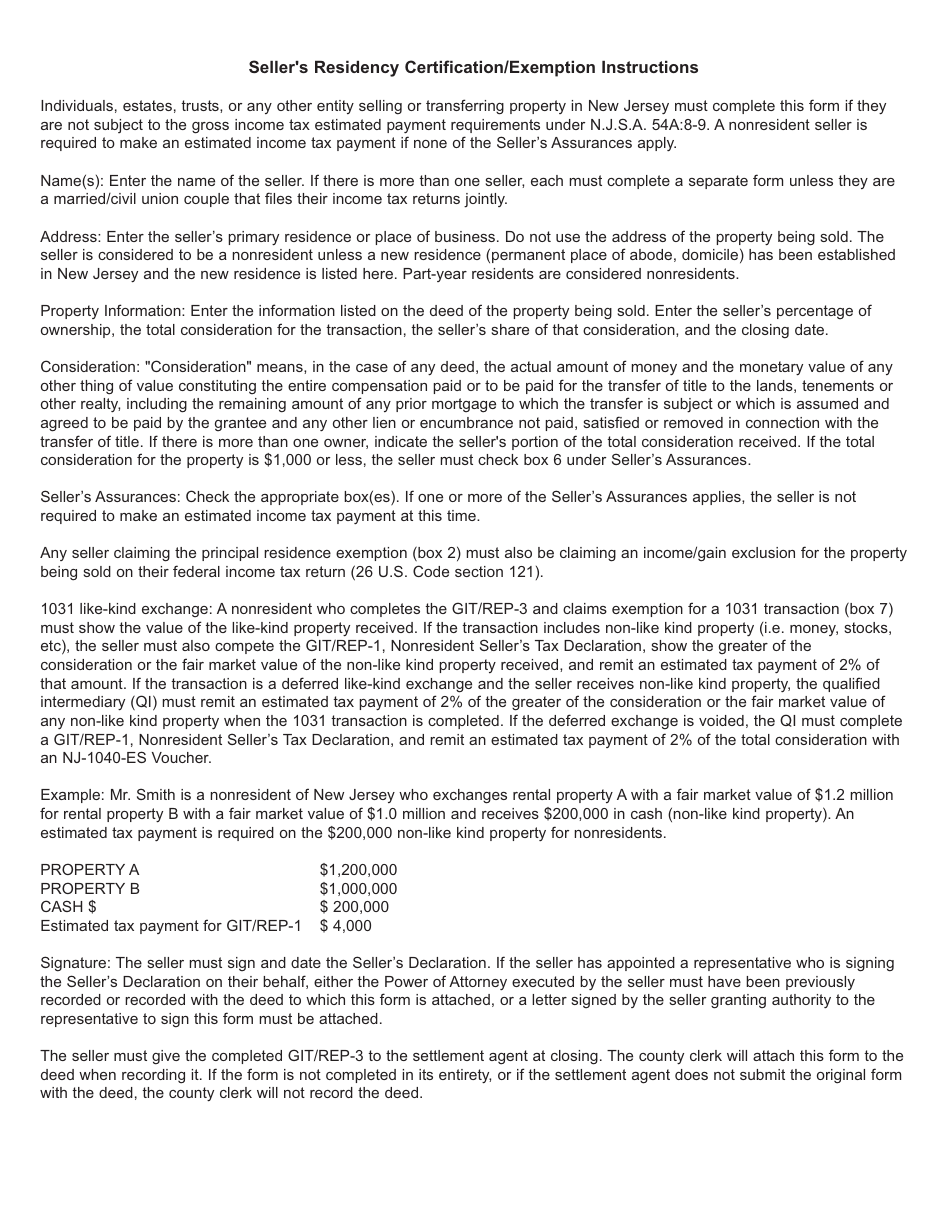

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT-REP-3 form?

A: The GIT-REP-3 form is the Seller's Residency Certification/Exemption form for New Jersey.

Q: Who needs to fill out the GIT-REP-3 form?

A: Sellers who are claiming a residency exemption for the state of New Jersey need to fill out the GIT-REP-3 form.

Q: What is the purpose of the GIT-REP-3 form?

A: The purpose of the GIT-REP-3 form is to certify or provide an exemption for the seller's residency status in New Jersey.

Q: Are there any specific requirements for filling out the GIT-REP-3 form?

A: Yes, there are specific requirements for filling out the GIT-REP-3 form, such as providing accurate information about the seller's residency status in New Jersey.

Q: Is the GIT-REP-3 form only applicable for sellers in New Jersey?

A: Yes, the GIT-REP-3 form is specifically for sellers who have a residency status or exemption in New Jersey.

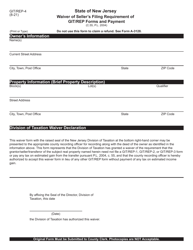

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-REP-3 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.