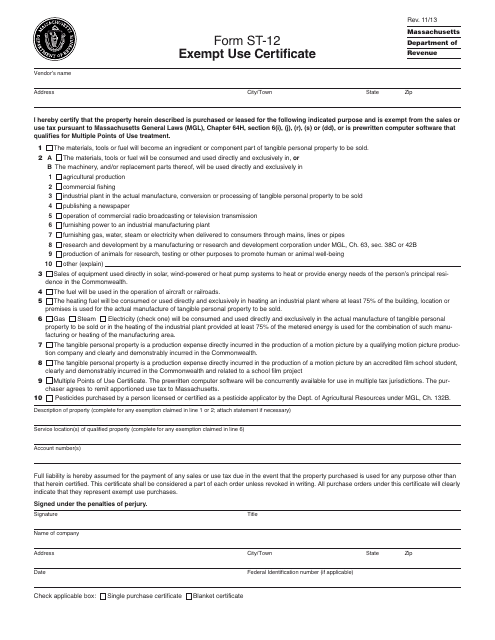

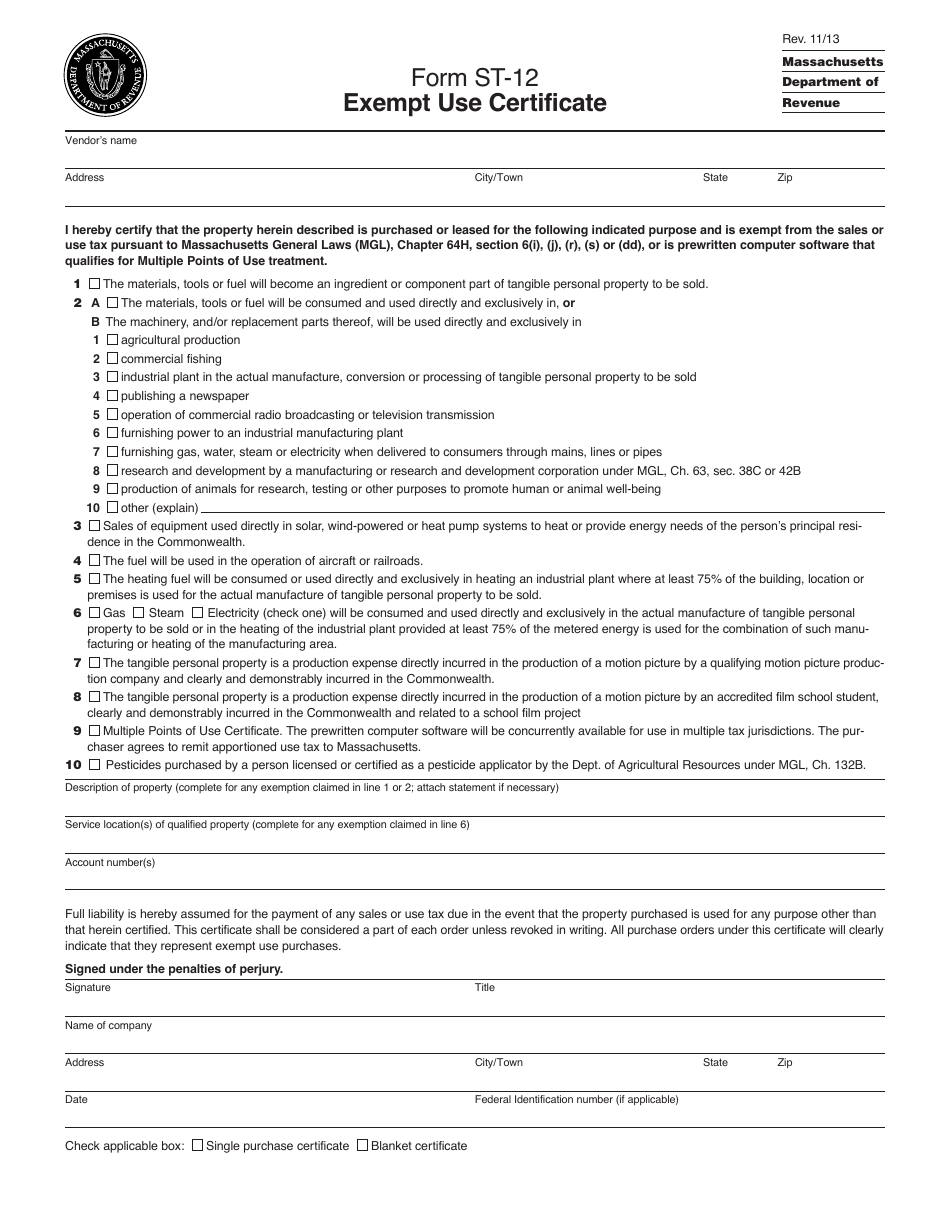

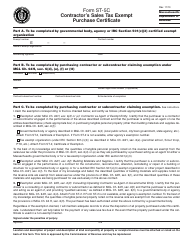

Form ST-12 Exempt Use Certificate - Massachusetts

What Is Form ST-12?

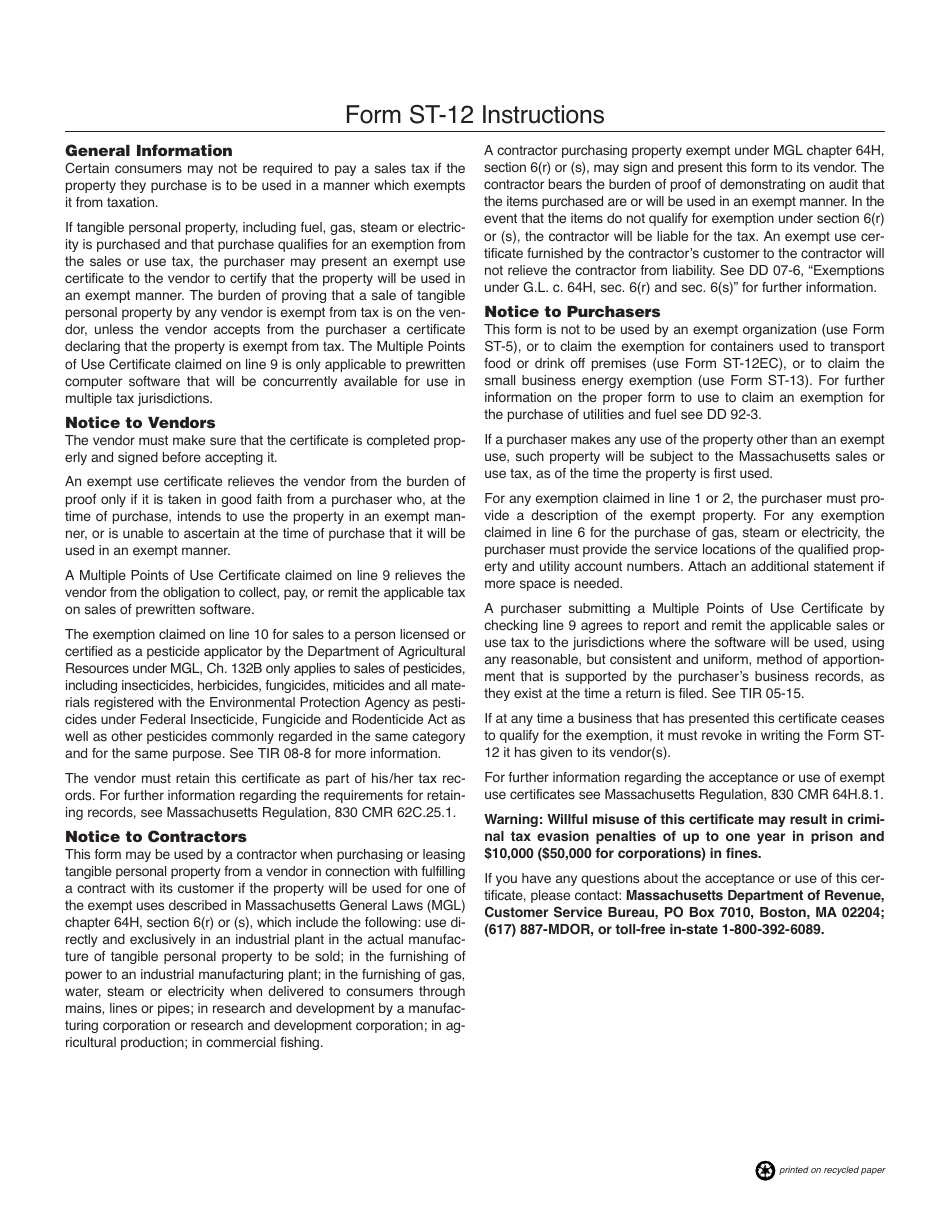

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-12?

A: Form ST-12 is an Exempt Use Certificate used in Massachusetts.

Q: Who uses Form ST-12?

A: Form ST-12 is used by businesses or organizations in Massachusetts to claim exemptions from certain sales and use taxes.

Q: What is the purpose of Form ST-12?

A: The purpose of Form ST-12 is to provide documentation for exempt transactions, such as purchases for resale or purchases by tax-exempt entities.

Q: What information is required on Form ST-12?

A: Form ST-12 requires information such as the buyer's name, address, and tax identification number, as well as details about the transaction and the exemption being claimed.

Q: When should Form ST-12 be submitted?

A: Form ST-12 should be submitted to the seller at the time of purchase, or within a reasonable time after the purchase, to claim the exemption.

Q: Does Form ST-12 expire?

A: No, Form ST-12 does not expire. However, it is recommended to review and update the form periodically to ensure accuracy.

Q: Can Form ST-12 be used for all exempt transactions?

A: Form ST-12 can be used for most exempt transactions, but there are some specific exemptions that require other forms or documentation.

Q: What should I do if my Form ST-12 is rejected?

A: If your Form ST-12 is rejected, you should contact the seller or the Massachusetts Department of Revenue for assistance in resolving the issue.

Q: Are there any penalties for incorrectly claiming exemptions on Form ST-12?

A: Yes, there can be penalties for incorrectly claiming exemptions on Form ST-12, including interest charges and possible audits by the Massachusetts Department of Revenue.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-12 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.