This version of the form is not currently in use and is provided for reference only. Download this version of

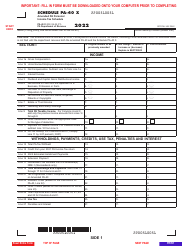

Form REV-459B

for the current year.

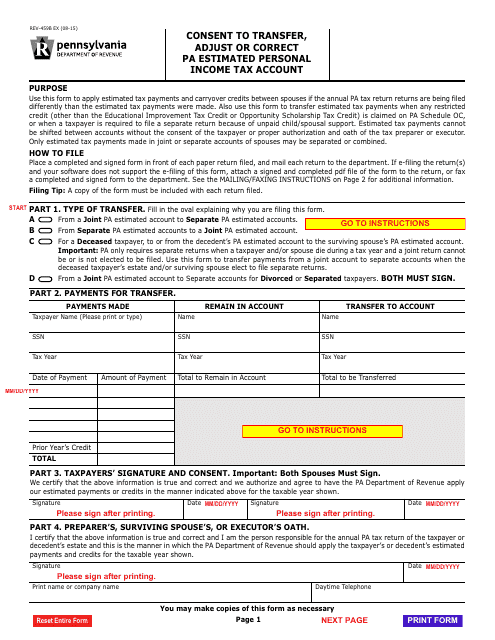

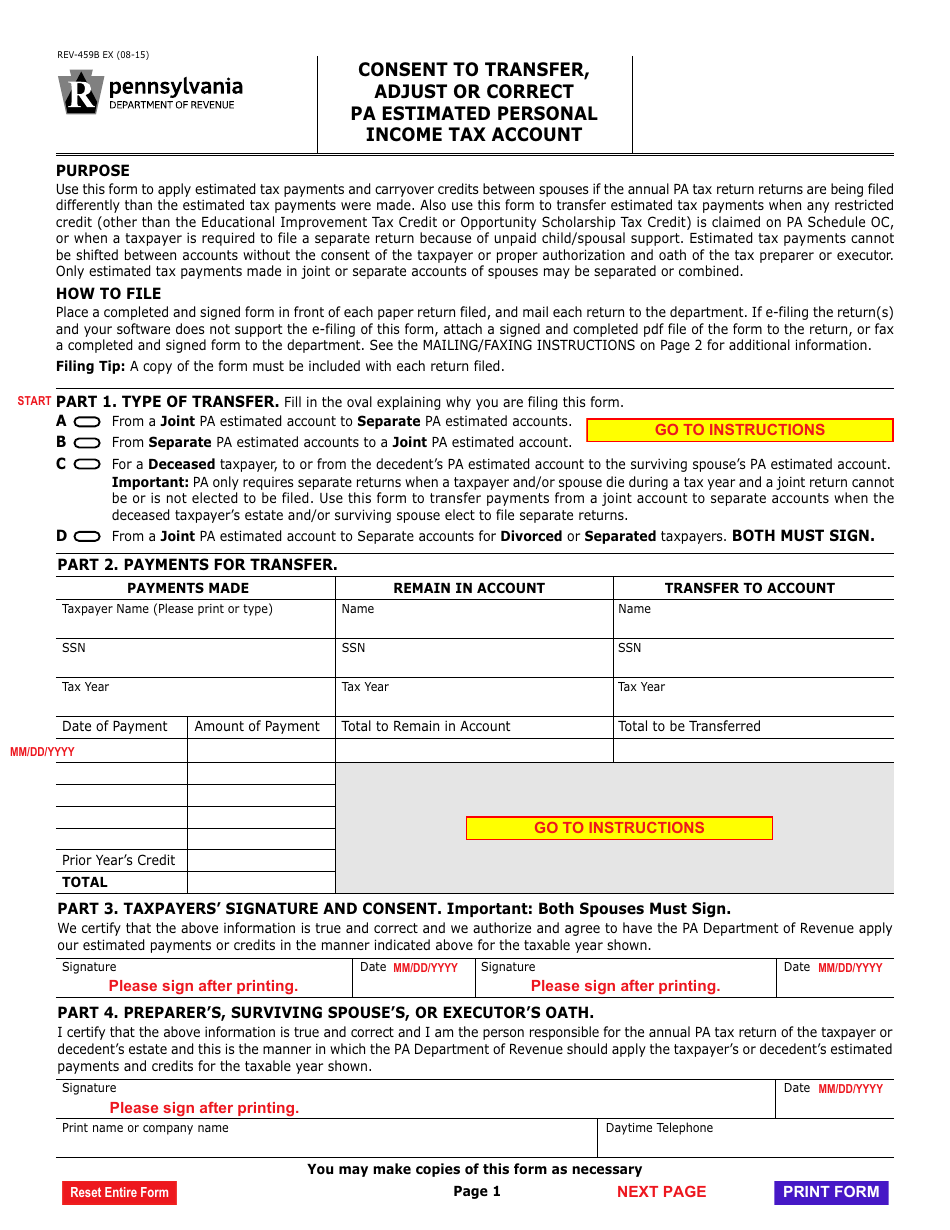

Form REV-459B Consent to Transfer, Adjust or Correct Pa Estimated Personal Income Tax Account - Pennsylvania

What Is Form REV-459B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-459B?

A: Form REV-459B is a consent form used to transfer, adjust, or correct a Pennsylvania estimated personal income tax account.

Q: What is the purpose of Form REV-459B?

A: The purpose of Form REV-459B is to obtain consent from a taxpayer to transfer, adjust, or correct their Pennsylvania estimated personal income tax account.

Q: Who needs to file Form REV-459B?

A: Taxpayers who need to transfer, adjust, or correct their Pennsylvania estimated personal income tax account need to file Form REV-459B.

Q: Are there any fees associated with filing Form REV-459B?

A: No, there are no fees associated with filing Form REV-459B.

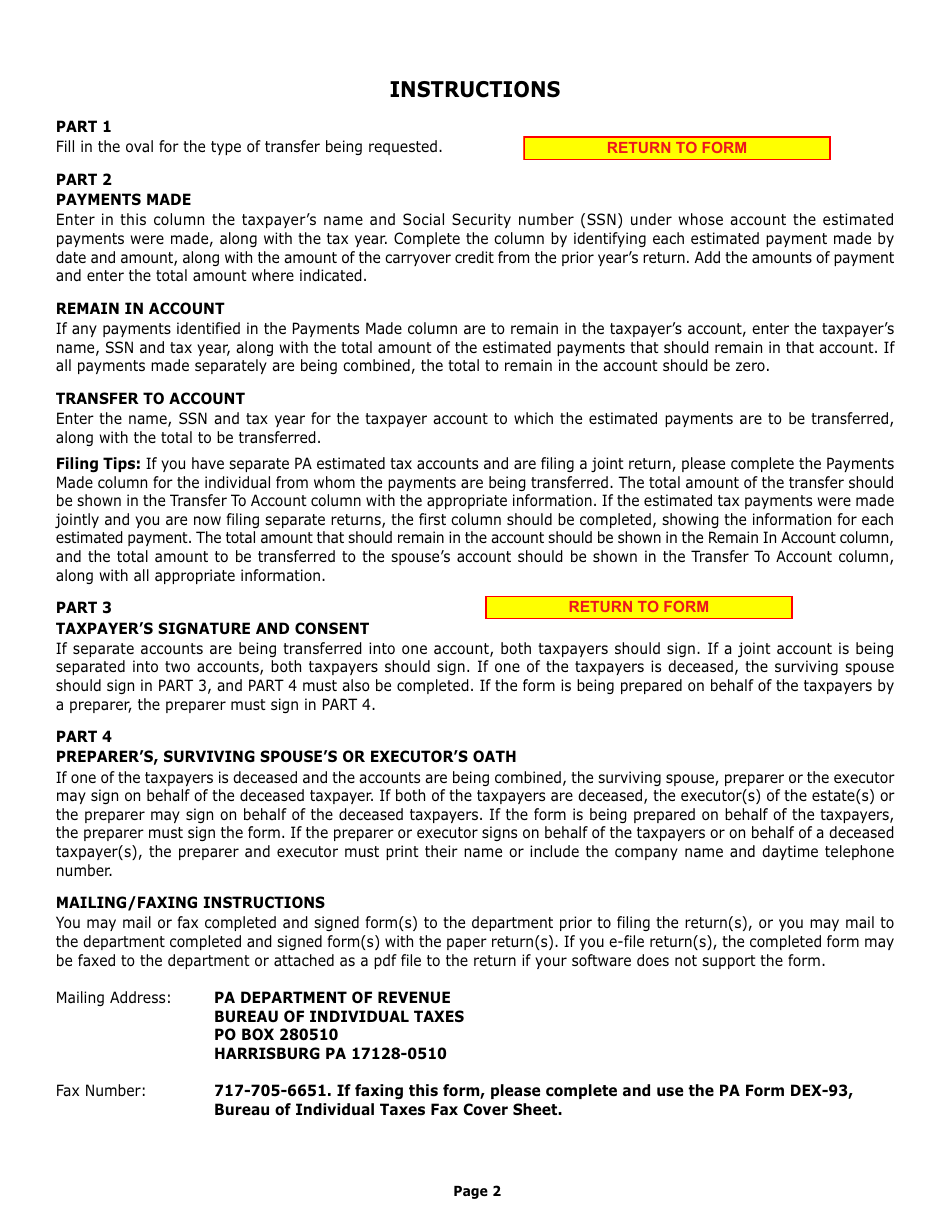

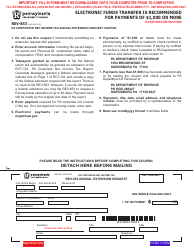

Q: Can I electronically file Form REV-459B?

A: No, Form REV-459B cannot be filed electronically. It must be mailed or faxed to the Pennsylvania Department of Revenue.

Q: What should I do if I have questions about Form REV-459B?

A: If you have questions about Form REV-459B, you can contact the Pennsylvania Department of Revenue for assistance.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-459B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.