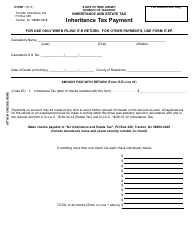

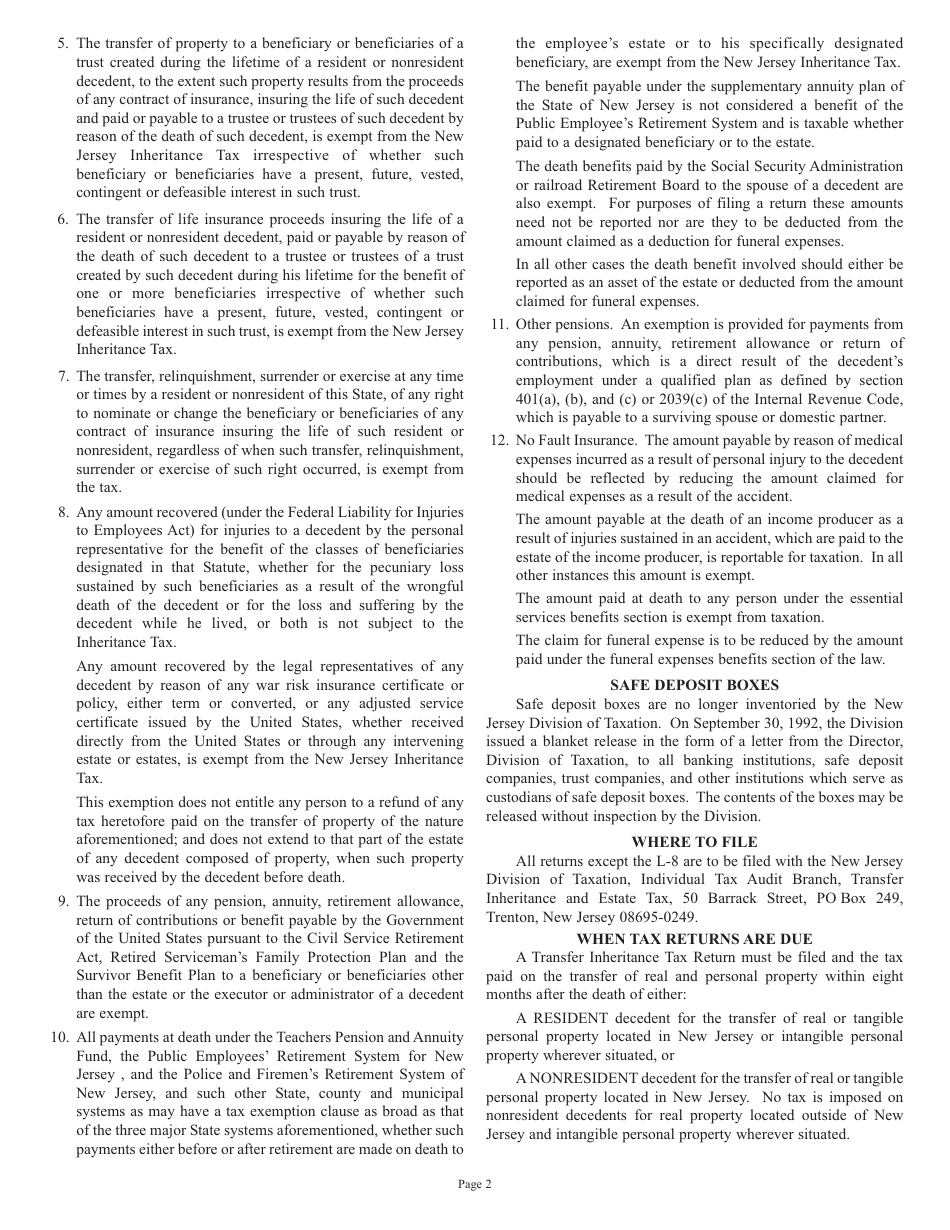

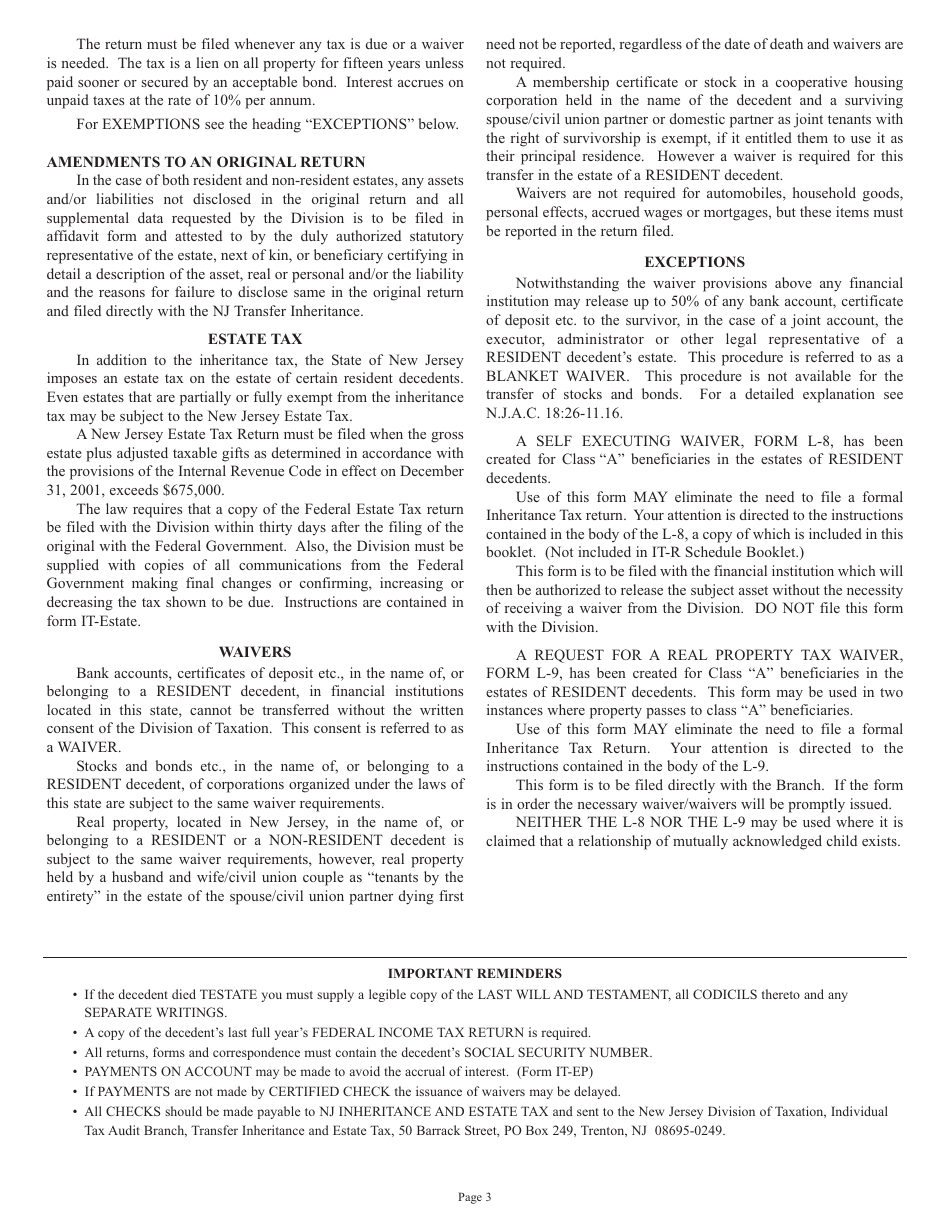

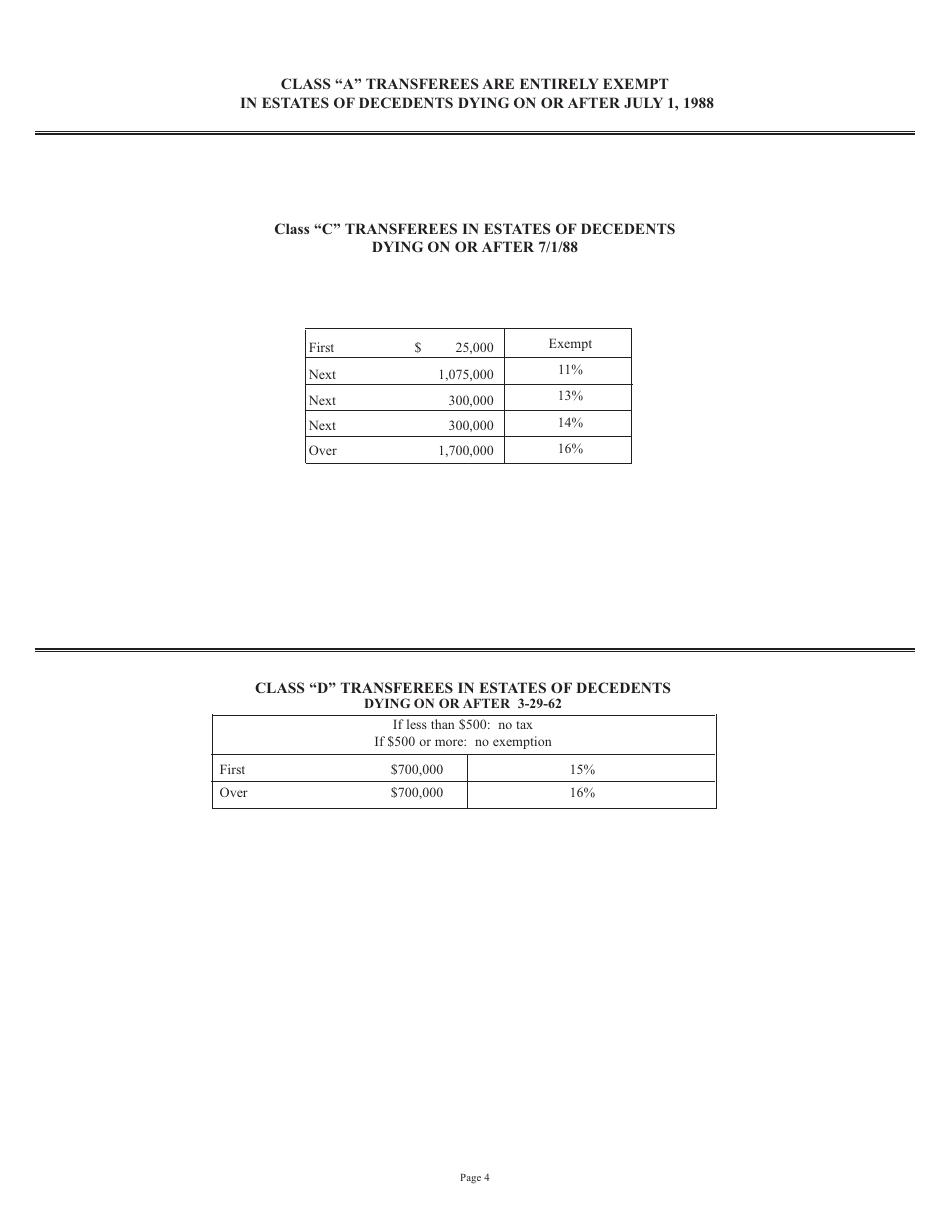

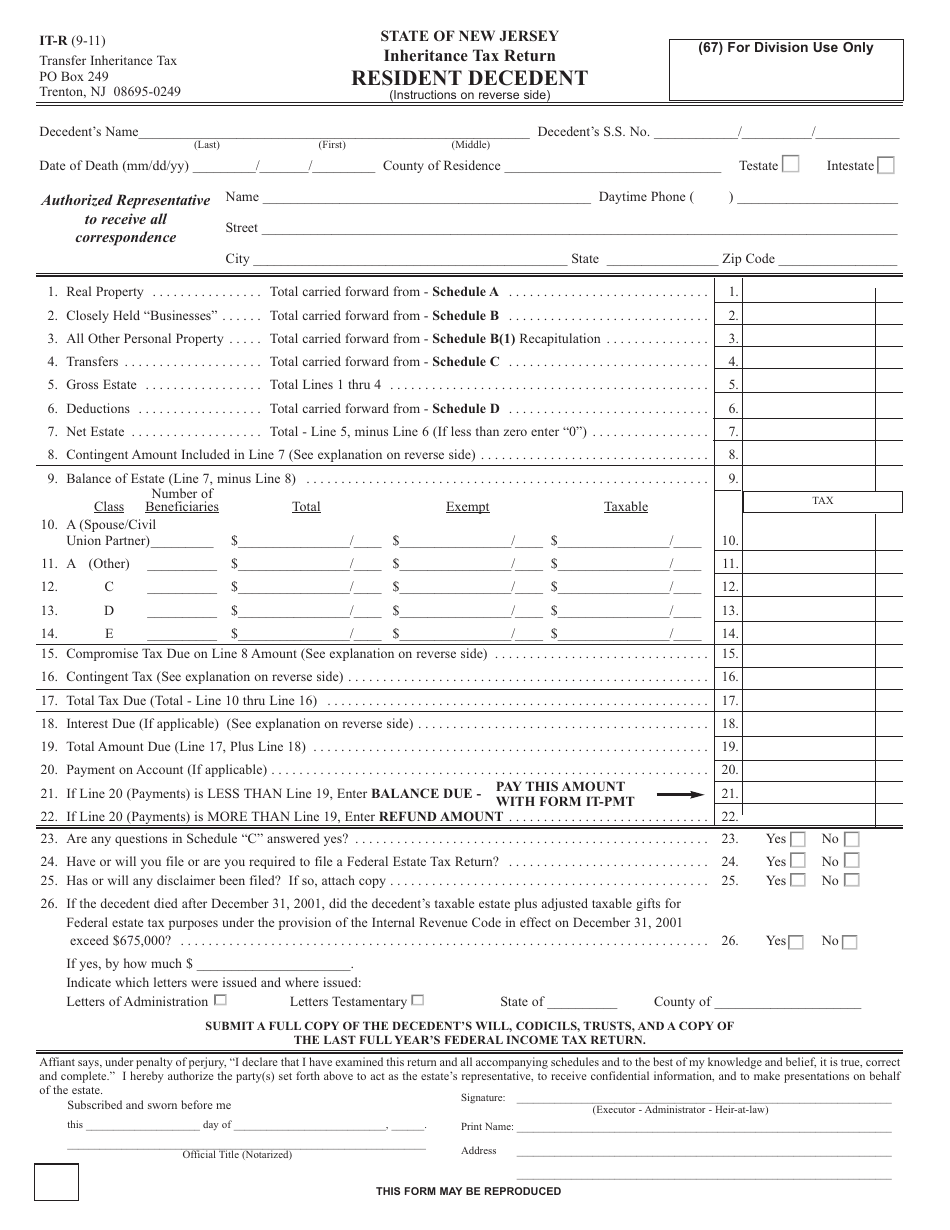

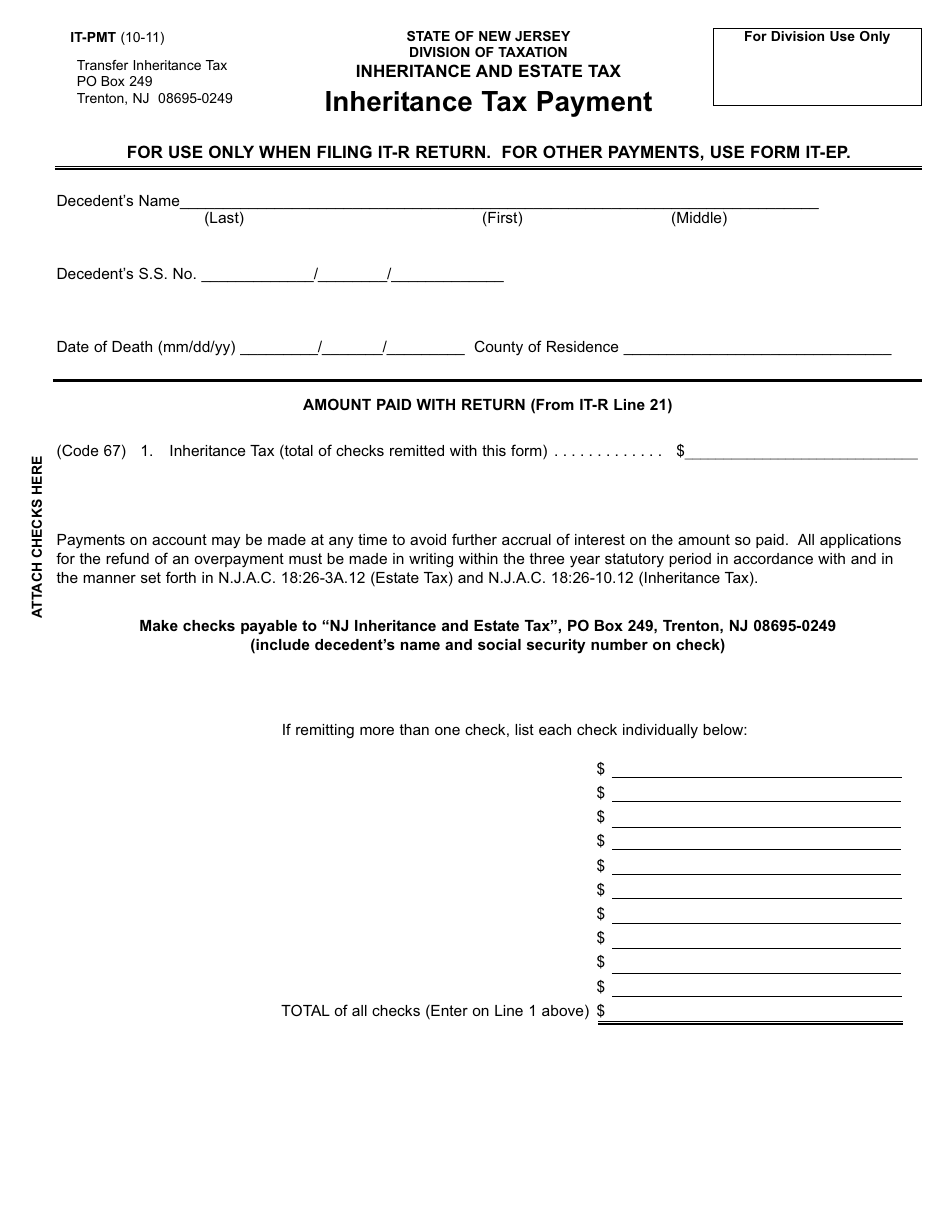

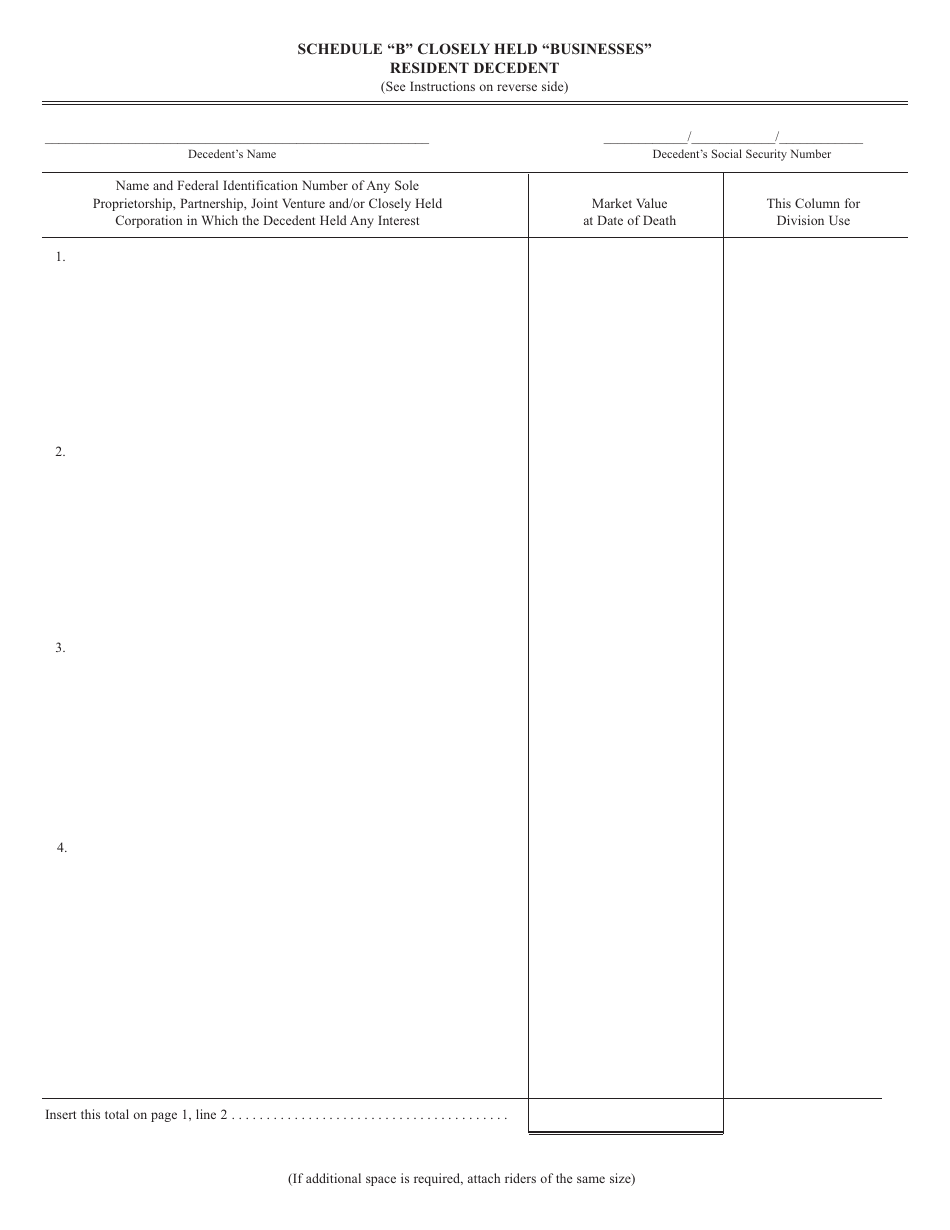

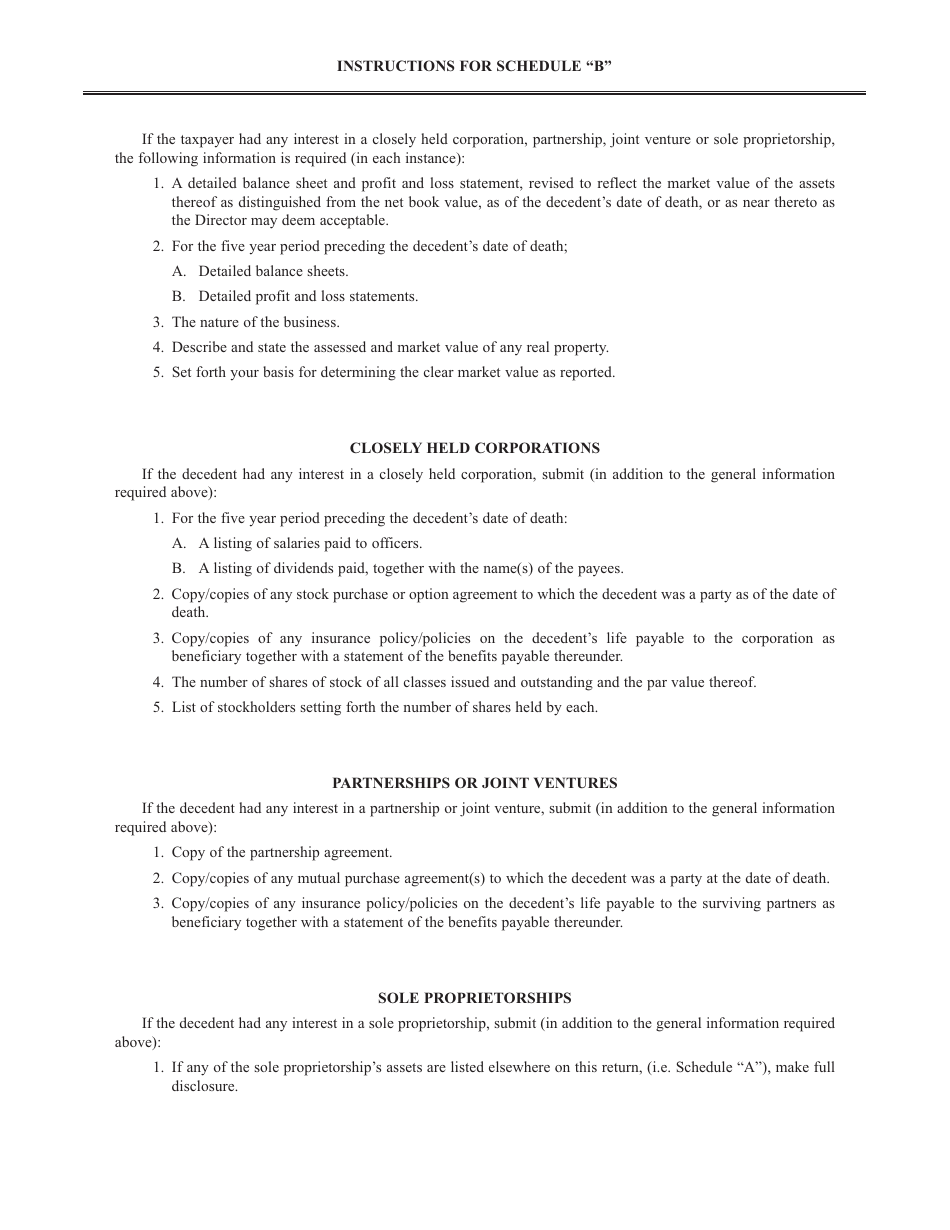

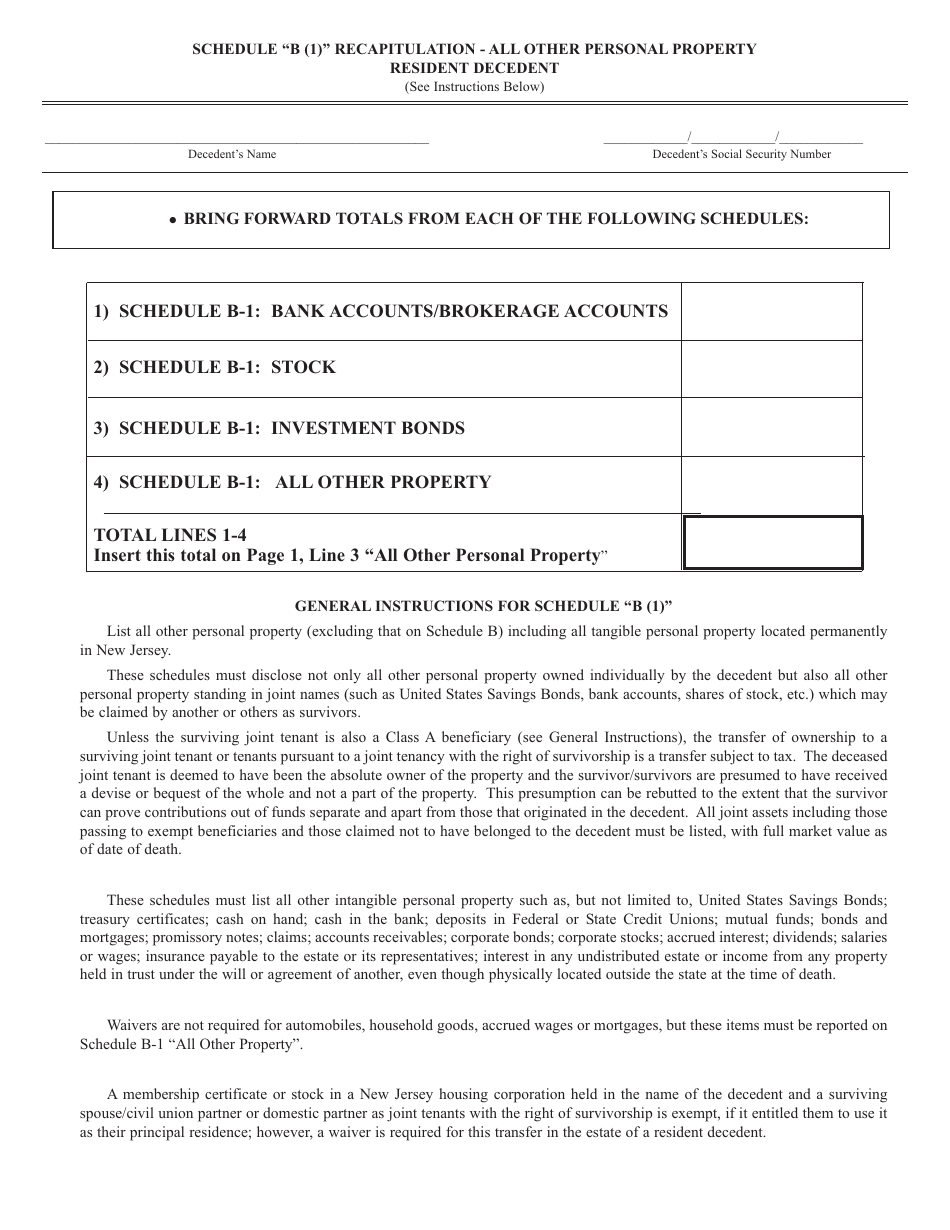

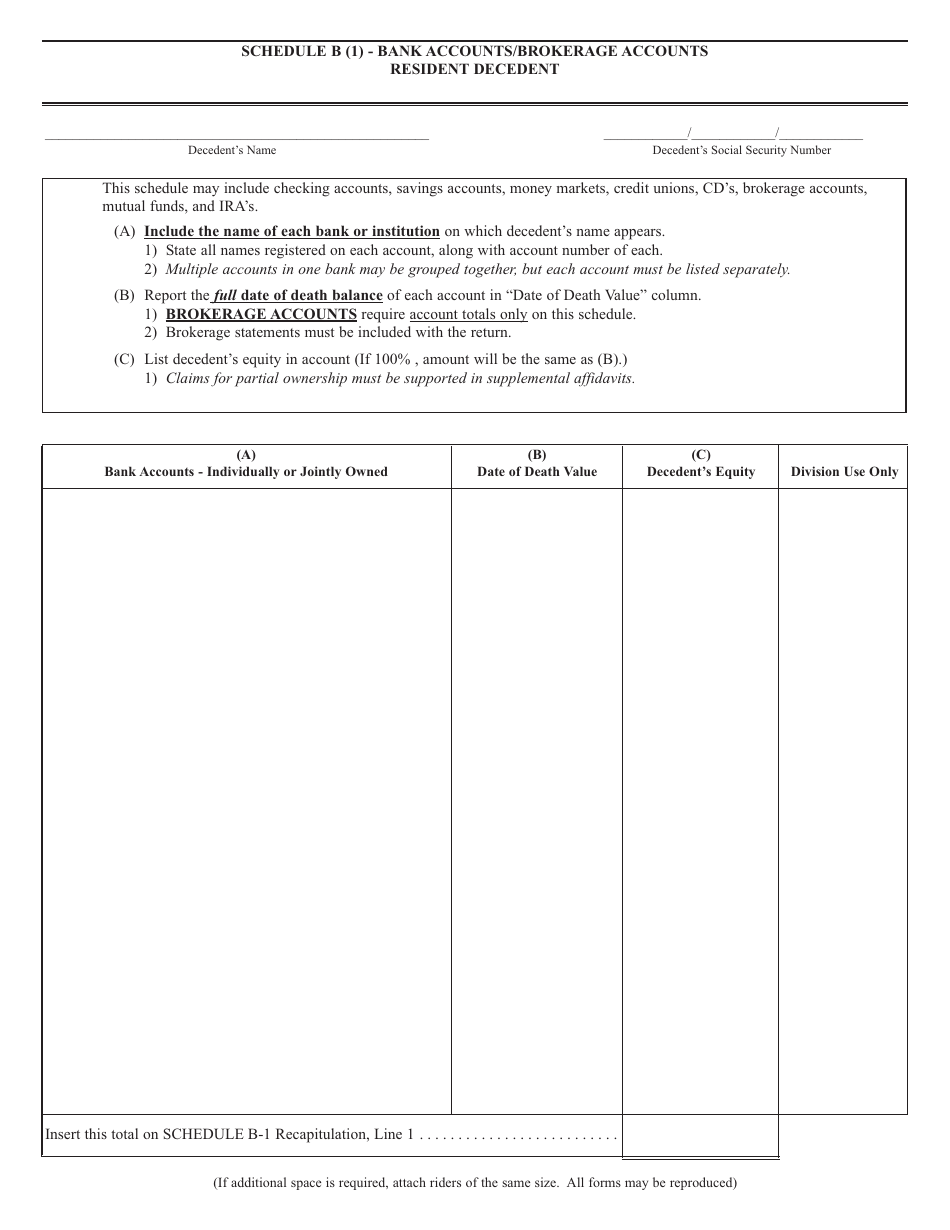

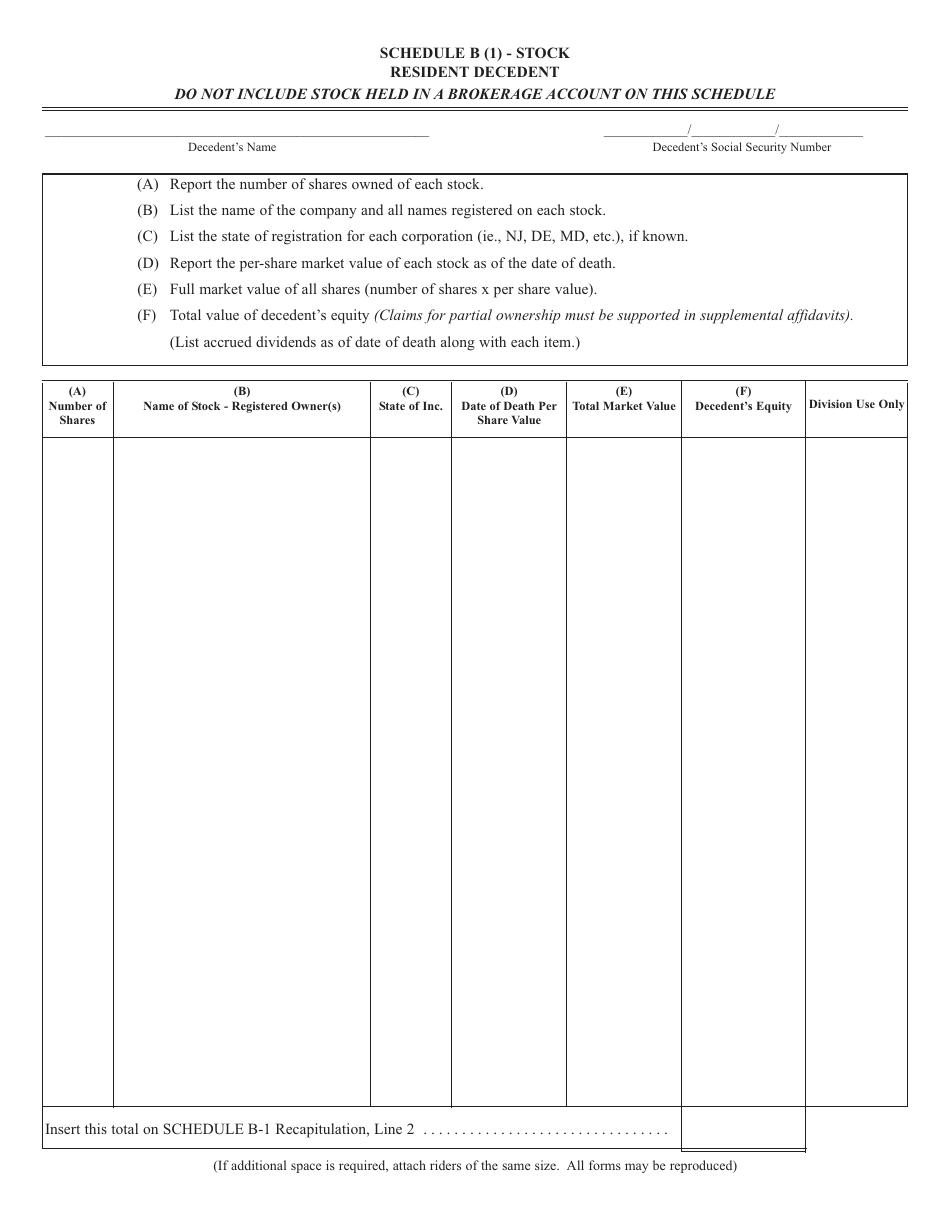

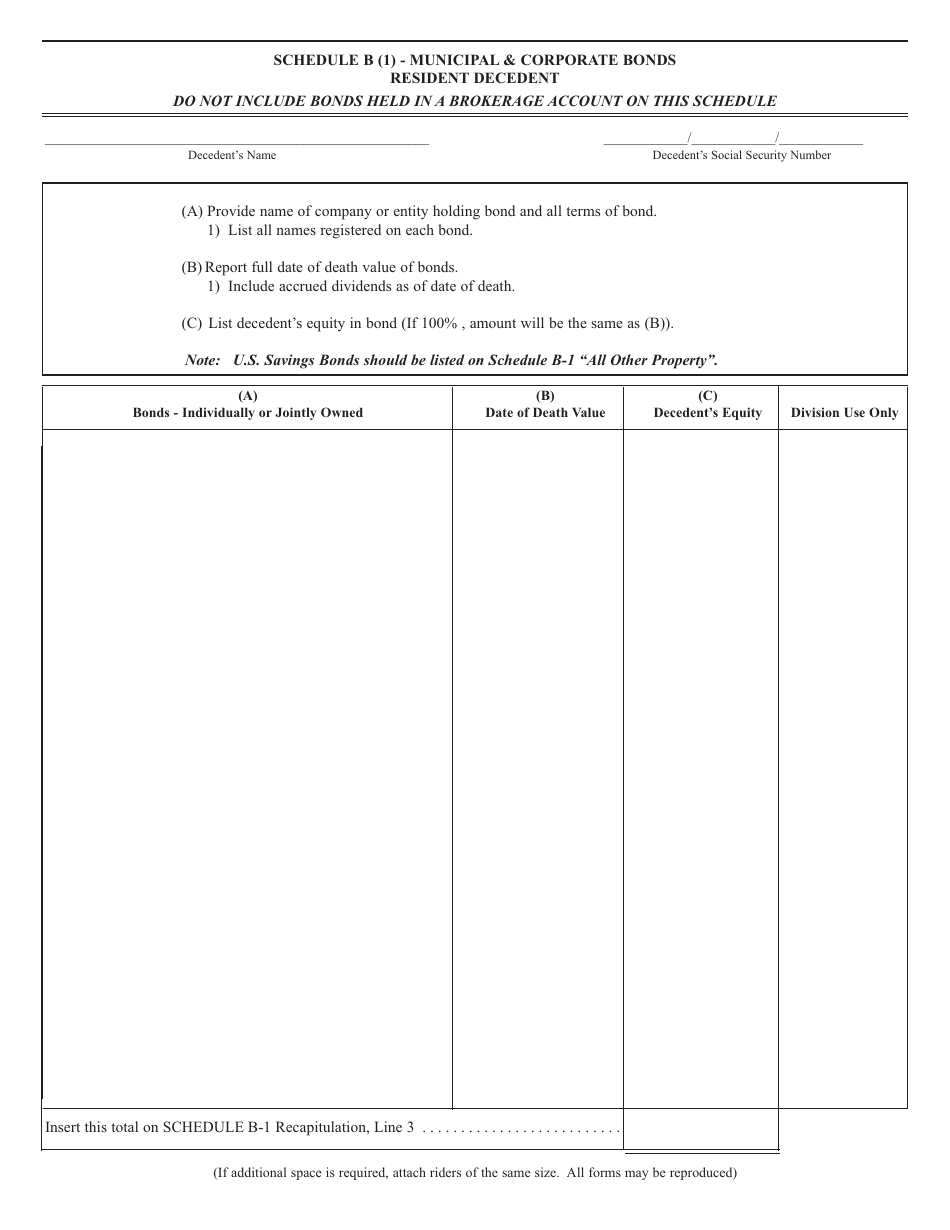

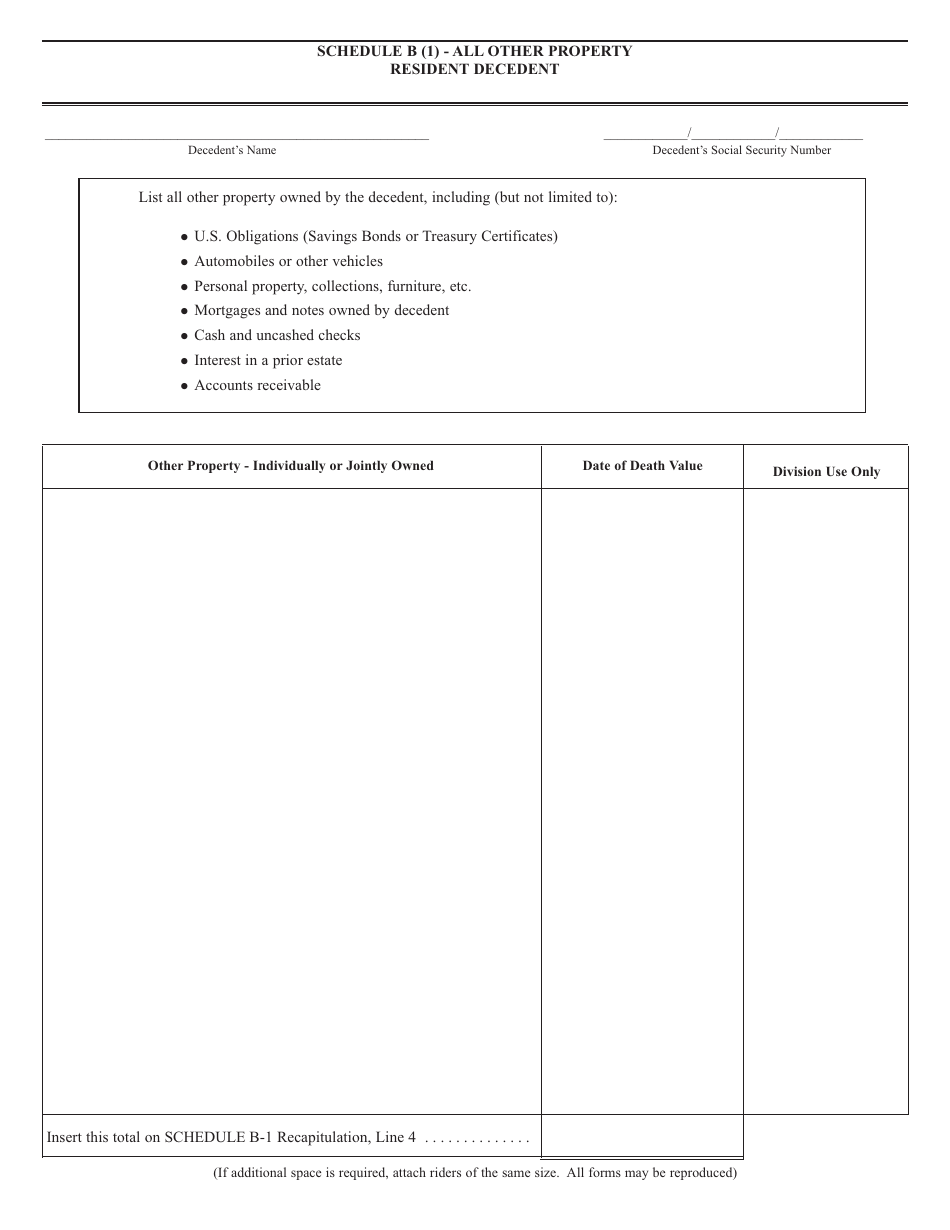

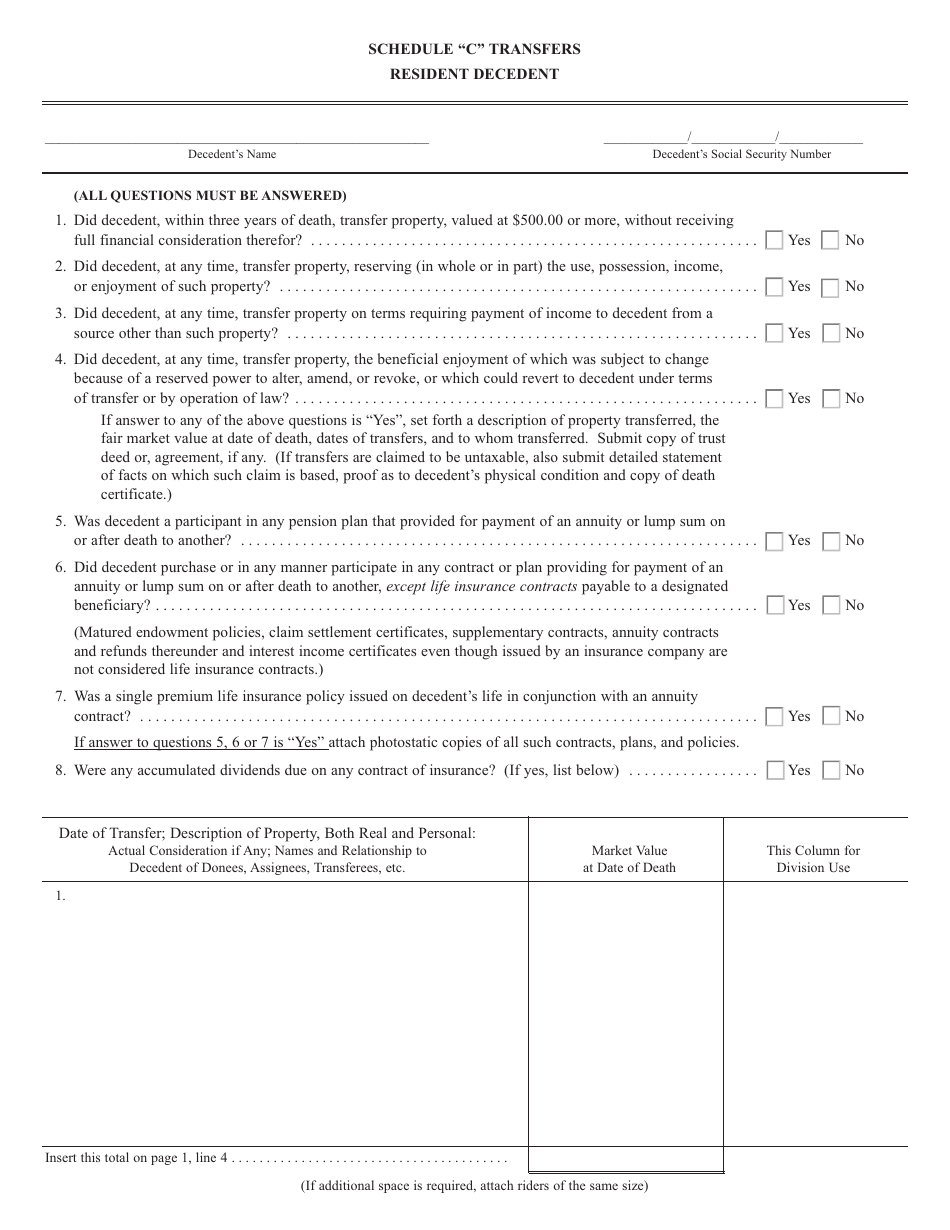

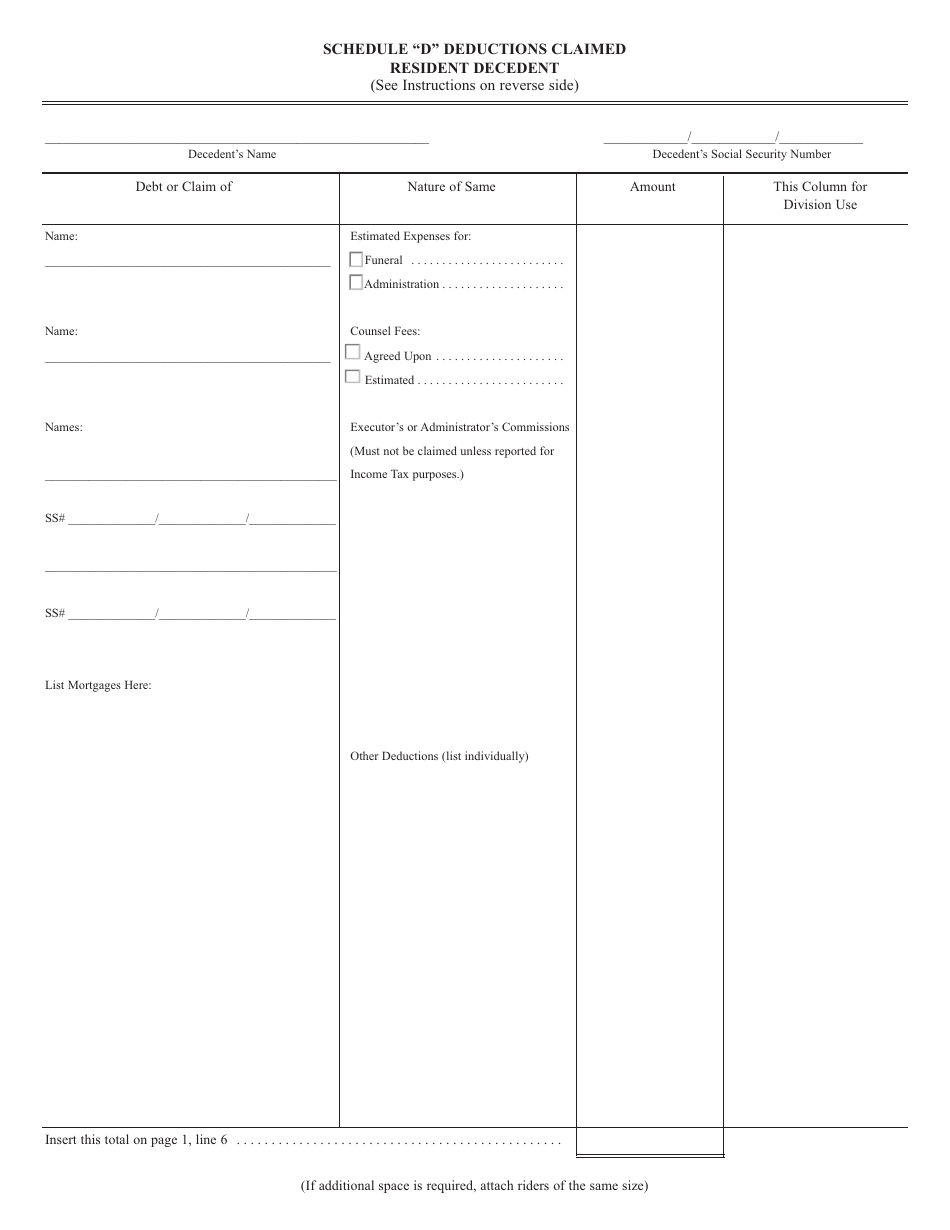

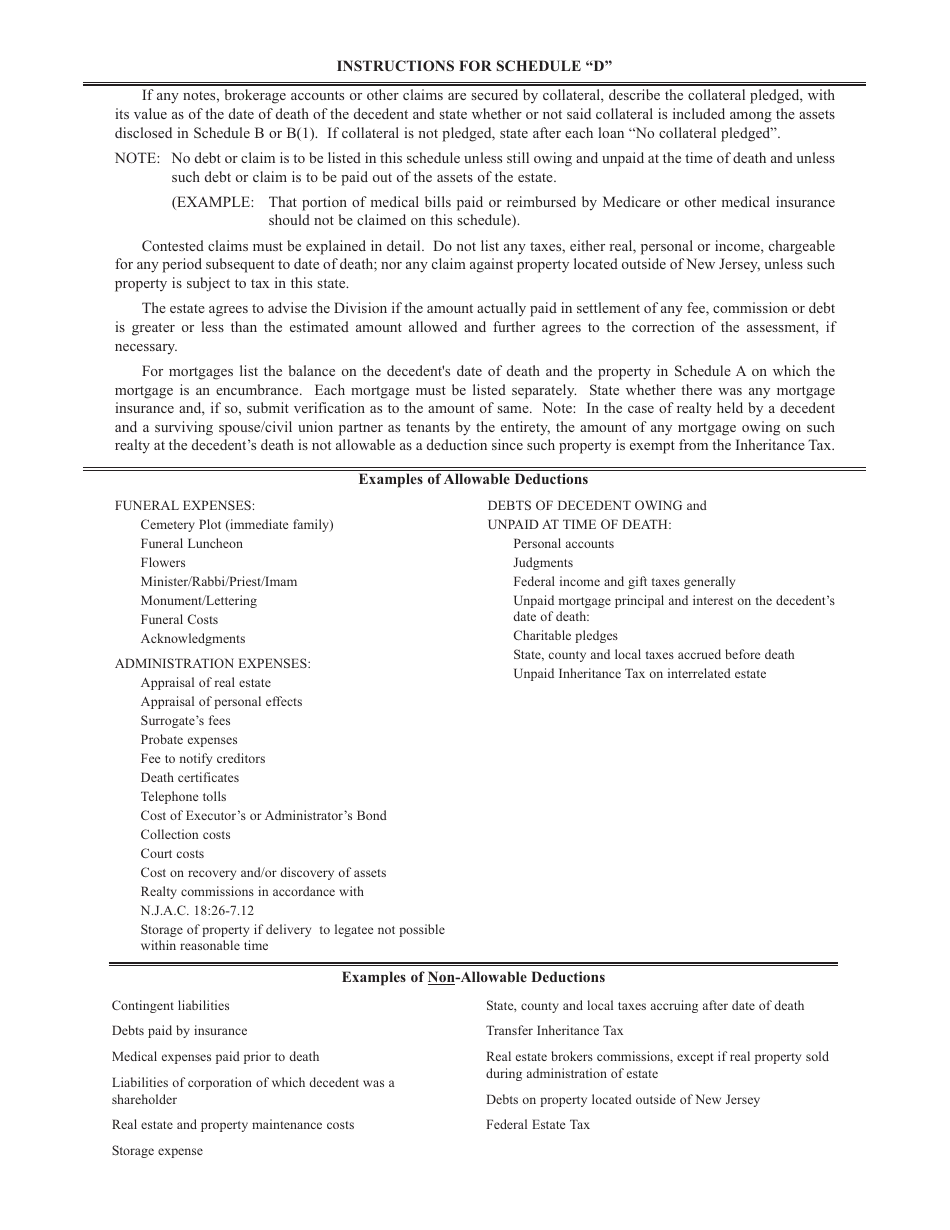

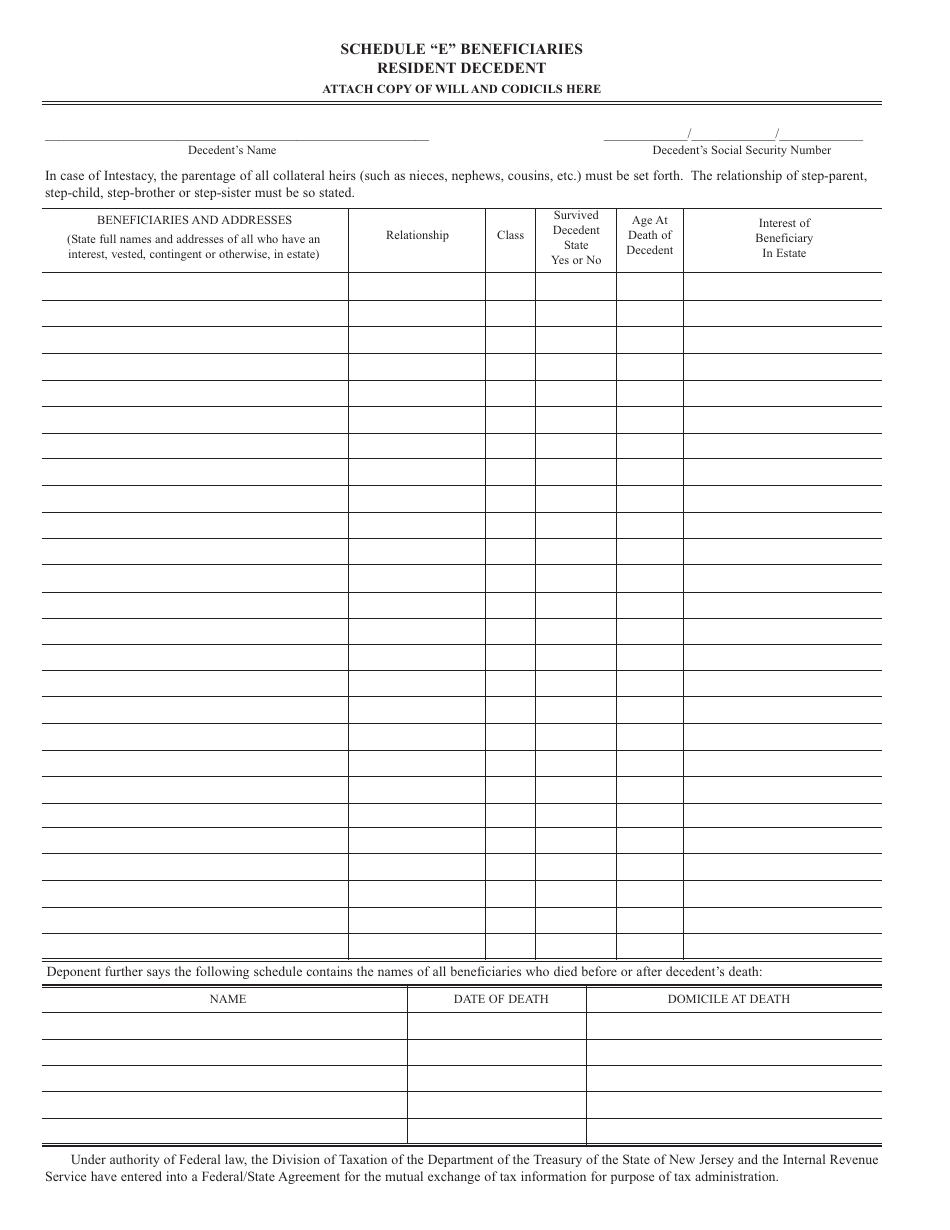

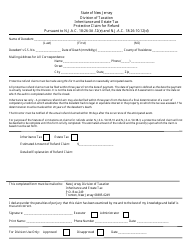

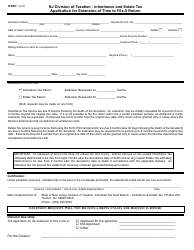

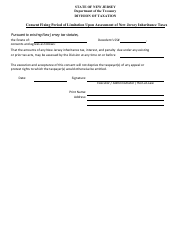

Form IT-R Inheritance Tax Resident Return - New Jersey

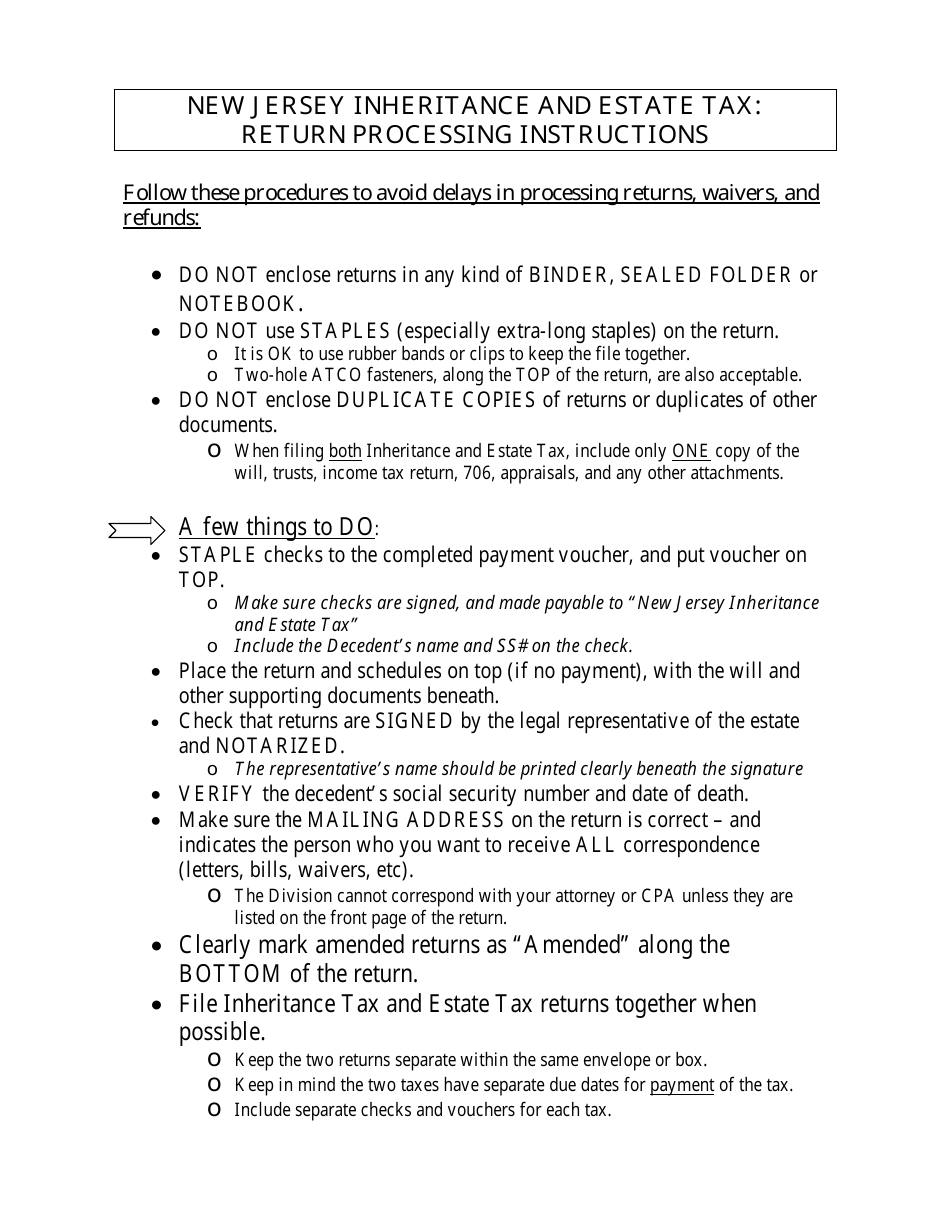

What Is Form IT-R?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

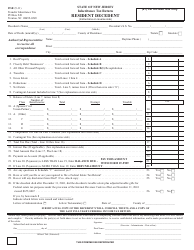

Q: What is Form IT-R?

A: Form IT-R is the Inheritance TaxResident Return for New Jersey.

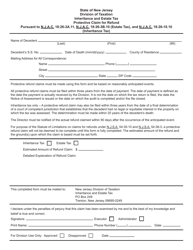

Q: Who needs to file Form IT-R?

A: Anyone who is a resident of New Jersey and is required to pay inheritance tax needs to file Form IT-R.

Q: What is the purpose of Form IT-R?

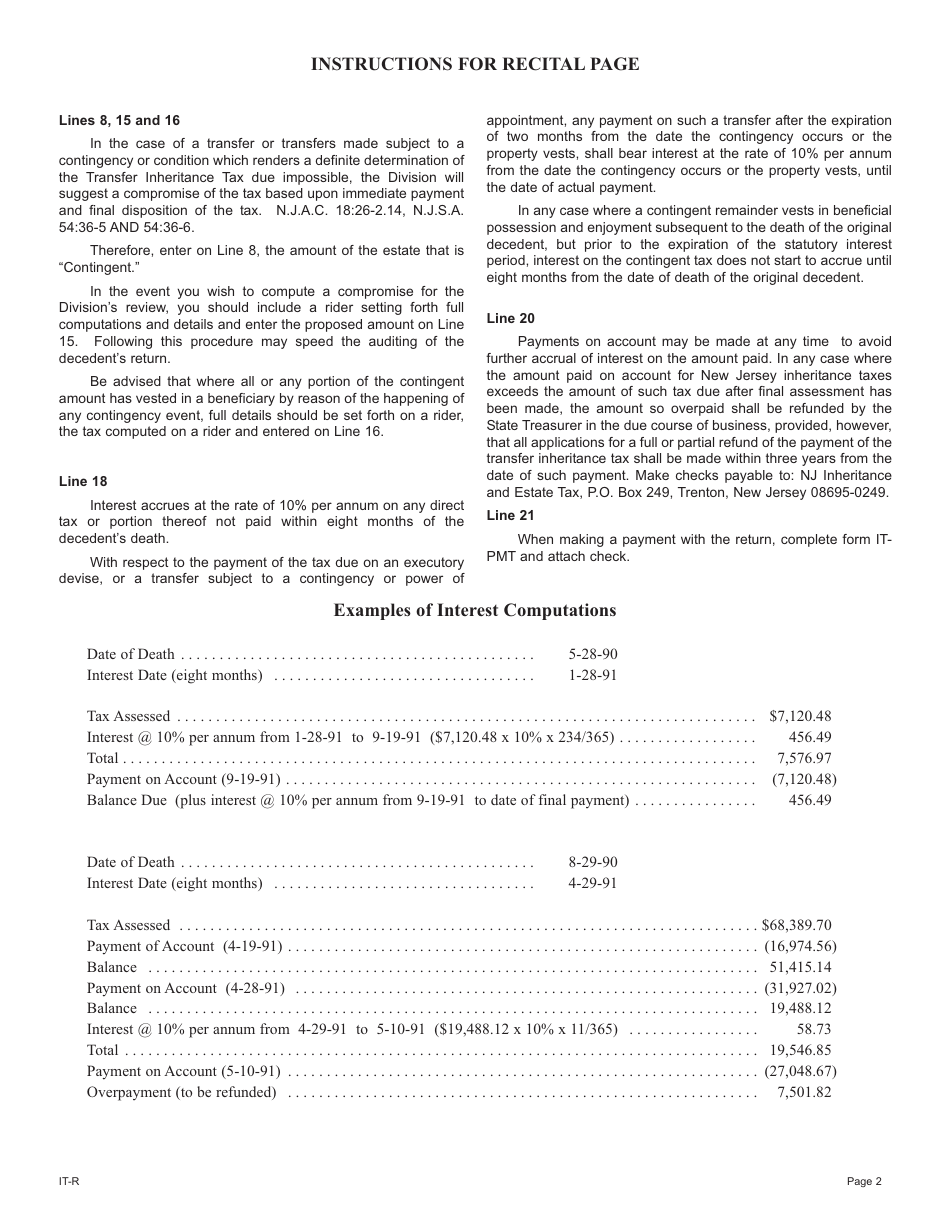

A: The purpose of Form IT-R is to report and calculate the amount of inheritance tax owed to the state of New Jersey.

Q: When is Form IT-R due?

A: The due date for Form IT-R is 8 months after the decedent's death.

Q: Is there a penalty for late filing of Form IT-R?

A: Yes, there is a penalty for late filing of Form IT-R. The penalty is 5% of the tax due for each month the return is late, up to a maximum of 25%.

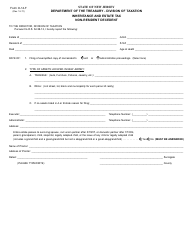

Form Details:

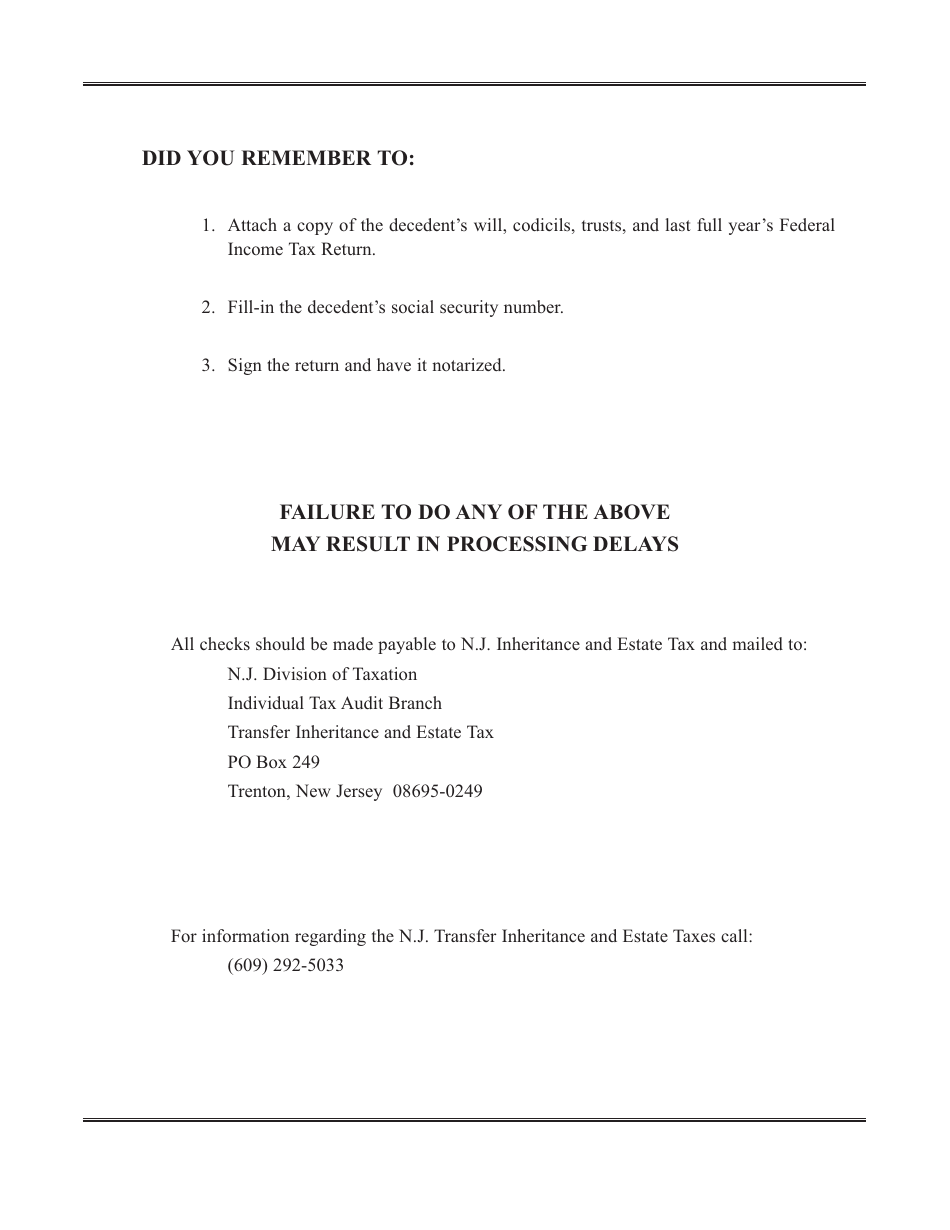

- Released on September 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-R by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.