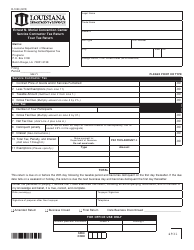

Form R-3302 (LA709) Gift Tax Return of Donor - Louisiana

What Is Form R-3302 (LA709)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

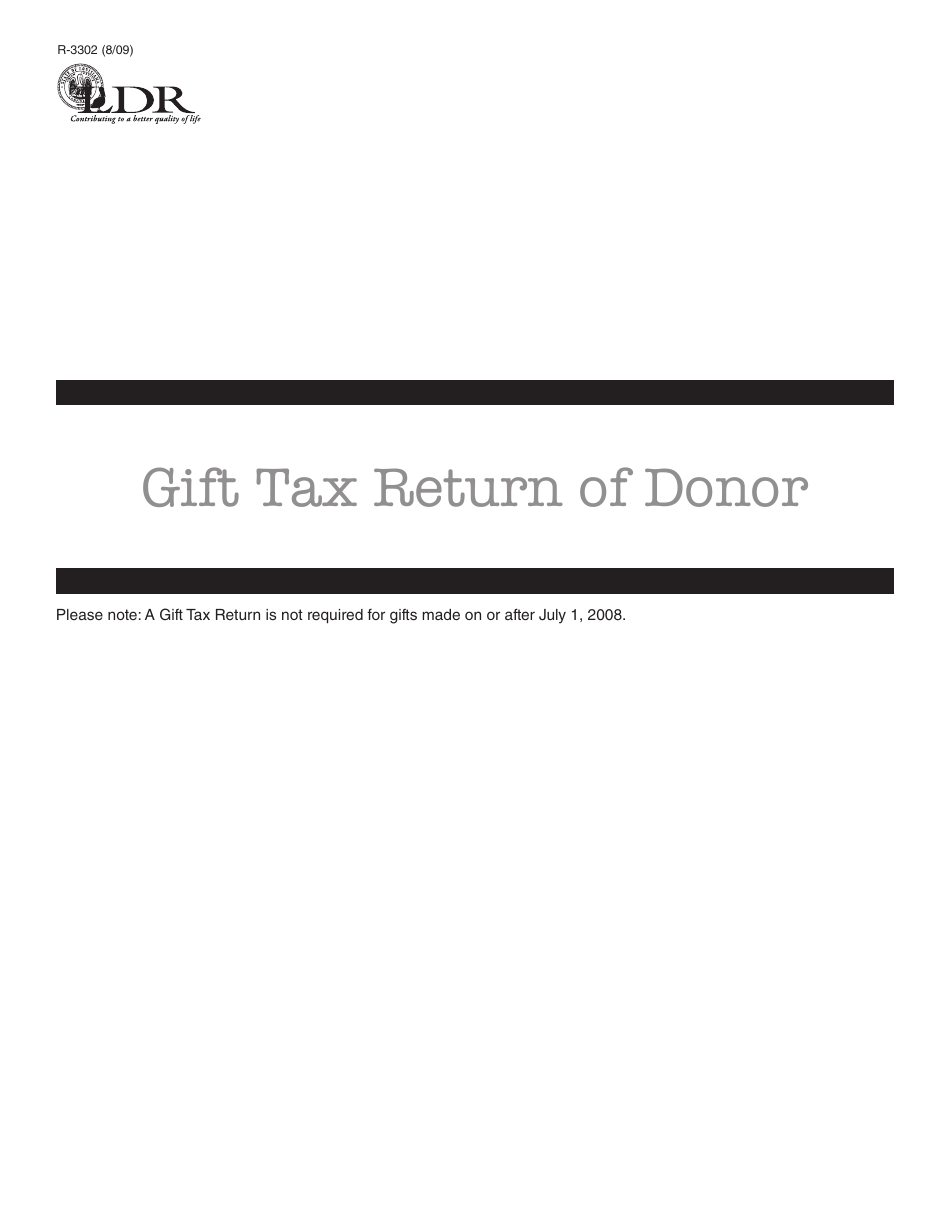

Q: What is Form R-3302 (LA709)?

A: Form R-3302 (LA709) is the Gift Tax Return of Donor for the state of Louisiana.

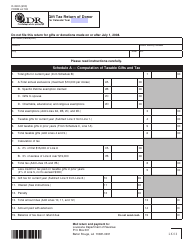

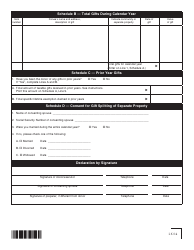

Q: Who needs to file Form R-3302 (LA709)?

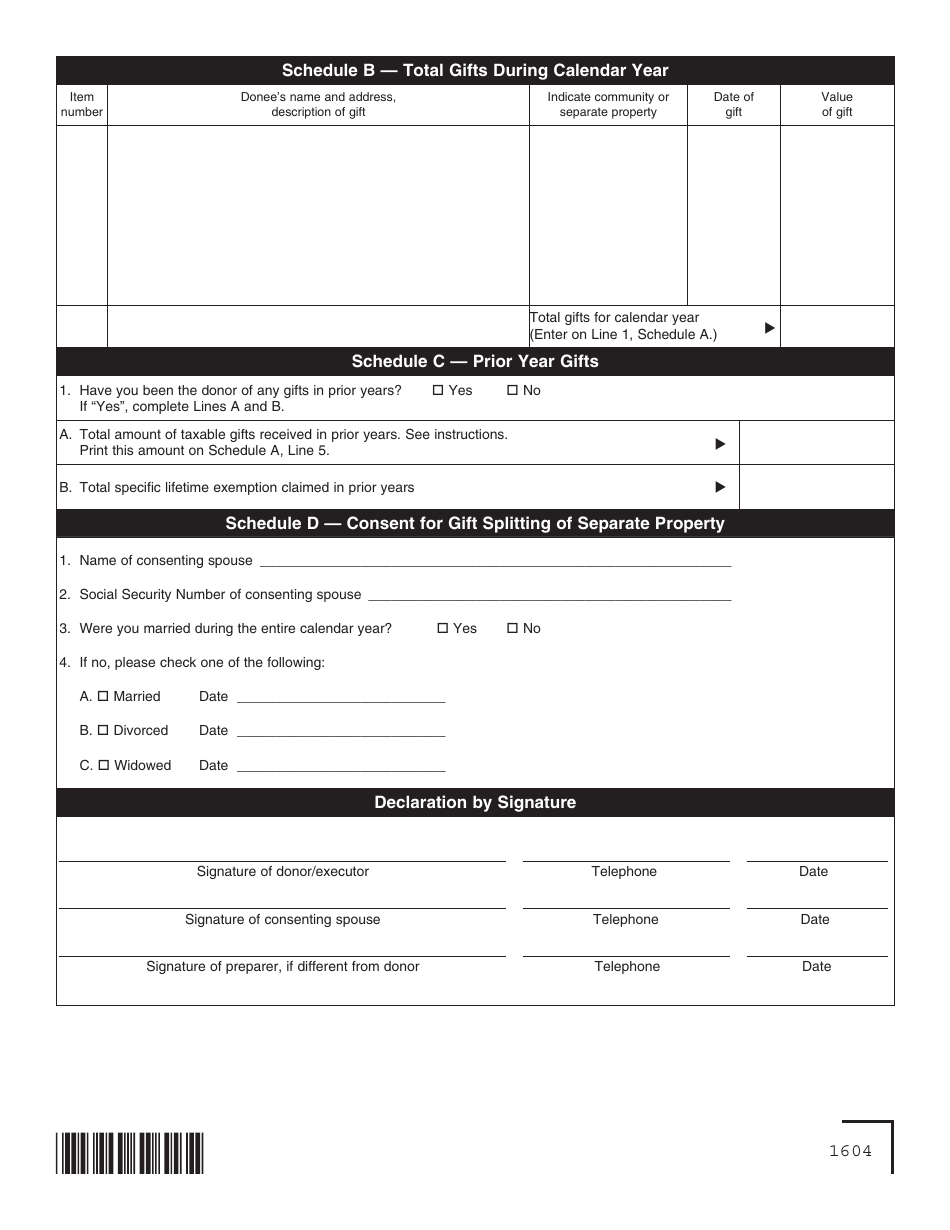

A: Any donor who has made gifts subject to Louisiana gift tax needs to file Form R-3302 (LA709).

Q: What is the purpose of Form R-3302 (LA709)?

A: The purpose of Form R-3302 (LA709) is to report gifts made by a donor and calculate any gift tax owed to the state of Louisiana.

Q: When is Form R-3302 (LA709) due?

A: Form R-3302 (LA709) is due on or before the 15th day of the 4th month following the close of the calendar year in which the gifts were made.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-3302 (LA709) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.